Cheapest Life Insurance

When it comes to financial planning and securing the future for your loved ones, life insurance is an essential consideration. The cost of life insurance can vary significantly, and finding the cheapest option that meets your needs is a priority for many. In this comprehensive guide, we will delve into the world of life insurance, exploring the factors that influence its cost, the different types available, and strategies to obtain the most affordable coverage.

Understanding the Factors That Impact Life Insurance Costs

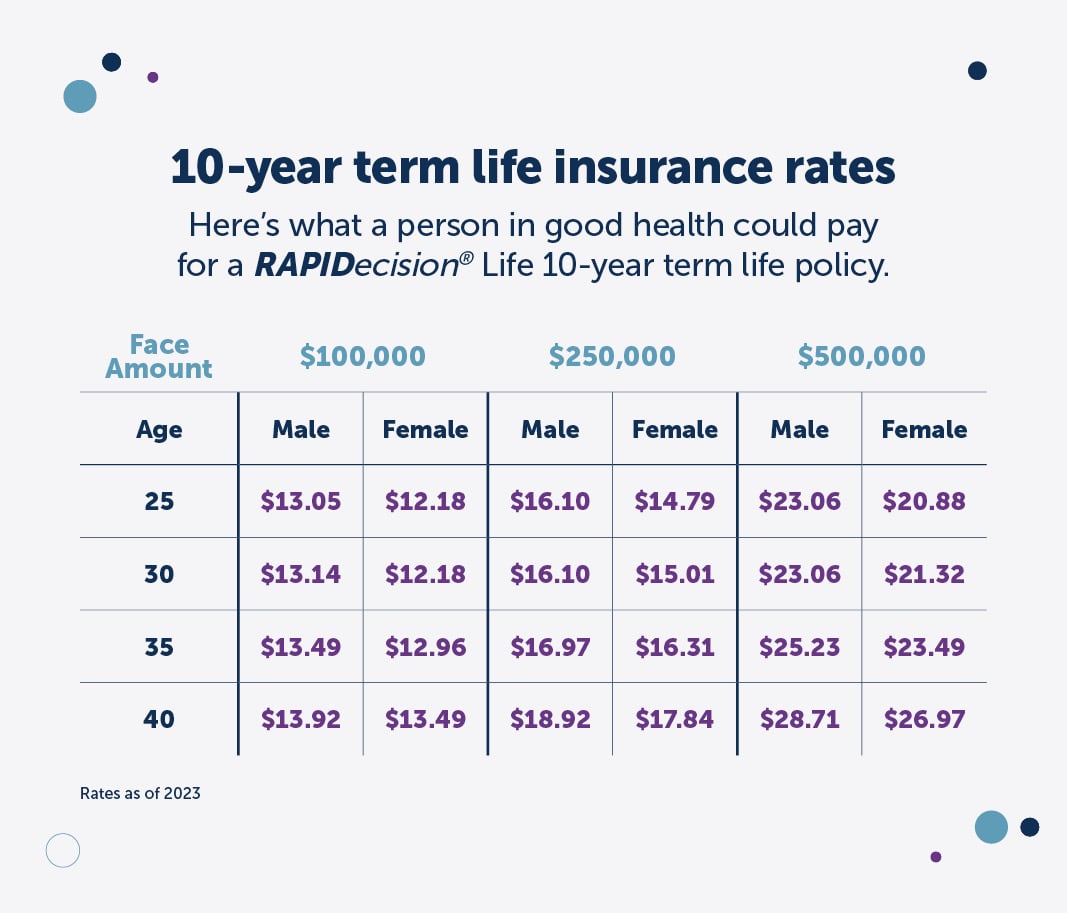

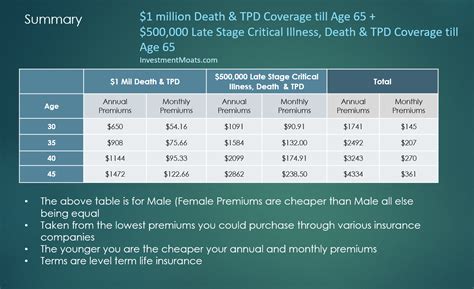

The price of life insurance is influenced by several key factors. Firstly, your age plays a significant role. Generally, younger individuals are offered lower premiums as they are considered less of a risk. Starting early can lead to substantial savings over time. Secondly, your health and lifestyle are crucial. Insurance providers evaluate your medical history, current health status, and habits such as smoking or extreme sports participation. The healthier you are, the more likely you are to qualify for lower rates.

Additionally, the amount of coverage you require is a determining factor. The higher the death benefit, the higher the premium. It's essential to find a balance between sufficient coverage and affordability. Lastly, the type of policy you choose impacts the cost. Term life insurance, which provides coverage for a specific period, is often more affordable than permanent life insurance, which offers lifelong coverage and additional benefits.

Age and Life Insurance Premiums

Age is a primary factor in determining life insurance premiums. The younger you are when you purchase a policy, the lower your rates are likely to be. This is because younger individuals are considered to have a longer life expectancy and are less likely to make claims. For instance, a 30-year-old non-smoker with no health issues can expect to pay significantly less for a term life insurance policy compared to someone who is 50 years old.

| Age | Average Annual Premium for a $500,000 Term Life Insurance Policy |

|---|---|

| 30 years | $300 - $400 |

| 40 years | $400 - $600 |

| 50 years | $600 - $1,000 |

Health and Lifestyle Considerations

Your health and lifestyle are significant factors in life insurance pricing. Insurance providers conduct thorough medical examinations and assess your health history to determine your risk level. Conditions such as high blood pressure, diabetes, or a history of heart disease can lead to higher premiums or even denial of coverage.

Additionally, habits like smoking or engaging in high-risk activities can impact your rates. Smokers, for example, often pay significantly higher premiums than non-smokers due to the increased health risks associated with smoking. Similarly, individuals who participate in extreme sports or have hazardous occupations may face higher costs or exclusions.

Types of Life Insurance and Their Costs

There are two primary types of life insurance: term life insurance and permanent life insurance. Each type has distinct features and pricing structures.

Term Life Insurance

Term life insurance is the most straightforward and affordable option. It provides coverage for a specified period, typically ranging from 10 to 30 years. During this term, your beneficiaries receive a death benefit if you pass away. However, if you outlive the term, the coverage ends, and you’ll need to either renew the policy or purchase a new one.

The cost of term life insurance is highly competitive, making it an excellent choice for individuals seeking affordable coverage. The premiums remain level throughout the term, providing budget predictability. Moreover, term life insurance is flexible, allowing you to adjust the coverage amount or term as your needs change.

| Term Length | Average Annual Premium for a $500,000 Policy |

|---|---|

| 10 years | $300 - $500 |

| 20 years | $400 - $700 |

| 30 years | $500 - $1,000 |

Permanent Life Insurance

Permanent life insurance, on the other hand, offers lifelong coverage and additional benefits. There are several types of permanent life insurance, including whole life, universal life, and variable life insurance.

Whole life insurance provides coverage for your entire life, and the premiums remain level throughout. It also includes a cash value component that grows over time and can be accessed through loans or withdrawals. However, the cost of whole life insurance is significantly higher than term life, making it a less affordable option for many.

| Type | Average Annual Premium for a $500,000 Policy |

|---|---|

| Whole Life | $3,000 - $5,000 |

| Universal Life | $2,000 - $3,500 |

| Variable Life | $1,500 - $2,500 |

Strategies to Find the Cheapest Life Insurance

Finding the cheapest life insurance that suits your needs requires a strategic approach. Here are some key strategies to consider:

- Shop Around: Compare quotes from multiple insurance providers. Online quote comparison tools can be a great starting point.

- Consider Term Length: Evaluate the length of the term that best suits your needs. Shorter terms may be more affordable, but longer terms provide more extended coverage.

- Assess Coverage Amount: Determine the appropriate death benefit amount based on your financial responsibilities and goals. Overinsuring can lead to unnecessary costs.

- Maintain a Healthy Lifestyle: Improve your health and quit unhealthy habits like smoking. This can lead to lower premiums and better overall health.

- Bundle Policies: Some insurance companies offer discounts when you bundle multiple policies, such as life insurance with auto or home insurance.

- Review Regularly: Periodically review your life insurance policy to ensure it still meets your needs. Life circumstances can change, and your coverage should reflect those changes.

The Future of Affordable Life Insurance

The life insurance industry is evolving, and advancements in technology are driving changes in how policies are priced and purchased. Insurtech, the intersection of insurance and technology, is revolutionizing the industry. Insurtech companies are leveraging data analytics and machine learning to offer more accurate and affordable life insurance policies.

These companies often use innovative underwriting methods, such as biometric data analysis and wearable device integration, to assess an individual's health and lifestyle. This data-driven approach allows for more precise risk assessment, which can lead to lower premiums for policyholders. Additionally, the convenience and efficiency of online applications and policy management are enhancing the overall customer experience.

The future of affordable life insurance looks promising, with technology playing a pivotal role in making coverage more accessible and tailored to individual needs. As the industry continues to innovate, consumers can expect even more options for obtaining life insurance at competitive rates.

How does life insurance work, and why is it important?

+Life insurance provides financial protection for your loved ones in the event of your death. It pays out a specified sum, known as the death benefit, to your beneficiaries. This benefit can help cover expenses such as funeral costs, outstanding debts, and ongoing living expenses, ensuring your family’s financial stability.

What factors determine the cost of life insurance premiums?

+Several factors influence life insurance premiums, including age, health, lifestyle, and the amount of coverage needed. Younger individuals and those with healthier lifestyles tend to pay lower premiums. The type of policy, whether term or permanent, also affects the cost.

Is term life insurance always the cheapest option?

+Term life insurance is often the most affordable option due to its simplicity and focused coverage. However, permanent life insurance may be more cost-effective for individuals seeking lifelong coverage and additional benefits, such as cash value accumulation.