California Life Insurance License Lookup

The California Department of Insurance (CDI) is responsible for regulating and overseeing the insurance industry within the state. As part of its regulatory duties, the CDI maintains a comprehensive database of licensed insurance professionals, including those specializing in life insurance. This article will delve into the process of conducting a California life insurance license lookup, providing a step-by-step guide, and offering insights into the importance of verifying insurance credentials.

The Significance of a Life Insurance License Lookup

Ensuring that your life insurance policies are in the hands of licensed and reputable professionals is of utmost importance. By conducting a license lookup, you can verify the legitimacy of your insurance agent or broker and ensure that they are authorized to offer life insurance products in California. This process empowers consumers to make informed decisions and protect their financial interests.

The CDI's online license verification system is designed to be user-friendly and accessible to the public. It provides a wealth of information about licensed insurance professionals, allowing individuals to confirm an agent's credentials, check for any disciplinary actions, and assess their overall reputation.

Step-by-Step Guide to Conducting a California Life Insurance License Lookup

Follow these steps to perform a comprehensive license lookup for life insurance professionals in California:

Step 1: Access the California Department of Insurance Website

Begin by visiting the official website of the California Department of Insurance at https://www.insurance.ca.gov. This is the primary gateway to all insurance-related information and services offered by the state.

Step 2: Navigate to the License Search Tool

Once on the CDI website, locate the "License Search" tool. This tool is typically found in the "Consumers" section or under "Resources." It allows you to search for licensed insurance professionals by name, license number, or other specific criteria.

Step 3: Enter the Agent's Information

In the search field, enter the name of the life insurance agent or broker you wish to verify. You can also search by license number if you have that information. The CDI's database is extensive and includes detailed information about licensed individuals.

Step 4: Review the Search Results

After submitting your search query, the CDI's system will generate a list of results based on the information provided. Review the search results carefully to identify the specific agent you are looking for. The results will include details such as the agent's name, license number, and the types of insurance they are licensed to sell.

Step 5: Click on the Agent's Profile

Once you have identified the correct agent, click on their name or license number to access their detailed profile. This profile contains crucial information about the agent's license status, the insurance companies they are affiliated with, and any disciplinary actions taken against them.

Step 6: Verify License Status and Details

On the agent's profile page, carefully examine the license status. Ensure that the license is active and current. Pay attention to the license expiration date and any restrictions or conditions associated with the license. This information helps you confirm that the agent is authorized to sell life insurance in California.

Step 7: Check for Disciplinary Actions

The CDI maintains a record of any disciplinary actions taken against licensed insurance professionals. Review this section of the agent's profile to ensure they have a clean disciplinary record. Disciplinary actions may include fines, suspensions, or revocations of their license.

Step 8: Evaluate Additional Information

The agent's profile may also provide additional information, such as their years of experience, education, and any professional designations they hold. This information can help you assess their expertise and reputation in the industry.

Understanding the Information Provided by the CDI

The California Department of Insurance provides a wealth of information about licensed insurance professionals. Here's a breakdown of some key details you can expect to find:

| License Status | Description |

|---|---|

| Active | The license is currently valid and the agent is authorized to conduct insurance business. |

| Expired | The license has reached its expiration date and is no longer valid. |

| Suspended | The license has been temporarily revoked due to disciplinary action or non-compliance with regulations. |

| Revoked | The license has been permanently canceled due to serious violations or misconduct. |

| Surrendered | The license holder voluntarily relinquished their license. |

Additionally, the CDI's license lookup tool may provide information about the agent's:

- License number and type (e.g., life insurance, health insurance)

- Date of birth and age

- Insurance companies they are appointed with

- Address and contact information

- Any complaints or inquiries made against them

- Education and professional designations

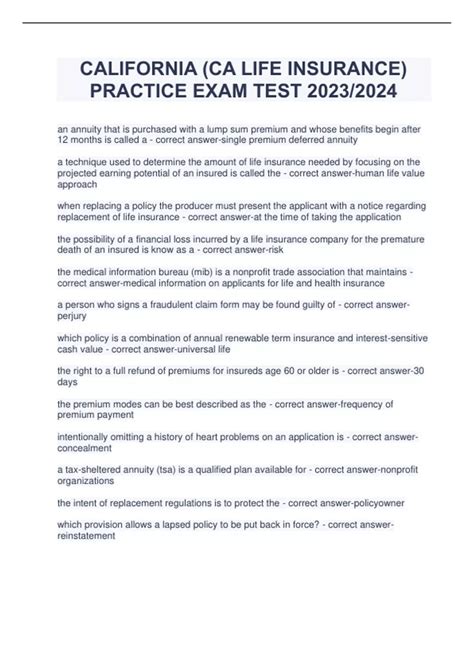

Frequently Asked Questions

Can I trust the information provided by the CDI's license lookup tool?

+Yes, the California Department of Insurance takes great care to ensure the accuracy and reliability of the information provided in its license lookup tool. The data is regularly updated and maintained to reflect the current status of licensed insurance professionals. However, it's always a good idea to cross-reference information with other reputable sources to ensure comprehensive due diligence.

What should I do if I find disciplinary actions against an agent during the license lookup?

+If you discover disciplinary actions against an agent, it's crucial to exercise caution. While a single disciplinary action may not necessarily disqualify an agent, it's important to understand the nature and severity of the violation. Consider seeking alternative insurance professionals or consulting with an insurance expert to assess the situation further.

Are there any additional steps I can take to verify an agent's credibility beyond the CDI's license lookup?

+Absolutely! Beyond the CDI's license lookup, you can take additional steps to verify an agent's credibility. Consider checking their professional references, reviewing online reviews and testimonials, and inquiring about their experience and expertise in the specific type of insurance you require. Building a trusted relationship with your insurance agent is crucial for your financial well-being.

How often should I conduct a license lookup for my insurance agent or broker?

+It's recommended to conduct a license lookup for your insurance agent or broker at least once a year, especially if you have an ongoing relationship with them. Regular license lookups help ensure that your agent remains licensed and reputable. Additionally, it's a good practice to verify their license status before making any significant insurance decisions or transactions.

In conclusion, conducting a California life insurance license lookup is a vital step in ensuring that you are working with licensed and reputable professionals. The CDI’s license verification system provides a comprehensive and user-friendly platform to access this critical information. By following the step-by-step guide and understanding the data provided, you can make informed decisions about your life insurance coverage and protect your financial interests.