Car Insurance Price Comparisons

Car insurance is a crucial aspect of vehicle ownership, providing financial protection and peace of mind to drivers worldwide. With numerous insurance providers offering a range of policies, finding the best deal and understanding the factors that influence prices can be a complex task. In this comprehensive guide, we delve into the world of car insurance price comparisons, exploring the key elements that impact costs and empowering you to make informed choices.

Understanding Car Insurance Premiums

The price of car insurance, often referred to as the premium, is influenced by a multitude of factors, each playing a unique role in determining the overall cost. These factors are carefully considered by insurance companies to assess the risk associated with insuring a particular vehicle and driver.

Driver Profile: A Personalized Approach

Insurance providers evaluate a driver’s personal characteristics and history to assess their risk level. Factors such as age, gender, driving experience, and even marital status can influence premiums. Younger, less experienced drivers, for instance, often face higher insurance costs due to their perceived higher risk on the road.

| Driver Profile | Impact on Premium |

|---|---|

| Age | Younger drivers typically pay more. |

| Gender | Some insurers consider gender, though regulations vary. |

| Driving Experience | Inexperienced drivers may face higher rates. |

| Marital Status | Being married can lead to lower premiums. |

Additionally, your driving record plays a significant role. A clean record with no accidents or traffic violations is generally rewarded with lower premiums, while a history of claims or infractions can result in higher costs.

Vehicle Characteristics: Beyond the Make and Model

The make, model, and year of your vehicle are key considerations for insurers. Vehicles with higher repair costs, those prone to theft, or those with powerful engines that may encourage speeding are often associated with higher insurance rates.

Furthermore, the purpose of your vehicle usage can impact premiums. Insurance companies may offer lower rates for vehicles primarily used for commuting or pleasure, while commercial vehicles or those used for ride-sharing services might incur higher costs due to increased mileage and potential exposure to risk.

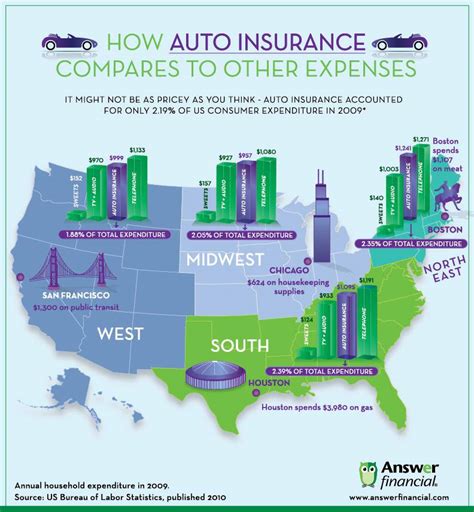

Location Matters: Geographical Risk Assessment

Your geographical location is a critical factor in car insurance pricing. Insurance companies analyze data on accident rates, crime levels, and even weather conditions in different areas to assess the risk of insuring vehicles in specific regions.

For instance, areas with high traffic congestion or a history of severe weather events may have higher insurance rates. Similarly, regions with a higher incidence of car theft or vandalism can lead to increased premiums.

Coverage Options: Customizing Your Policy

The level of coverage you choose significantly impacts your insurance premium. Basic liability coverage, which protects you from lawsuits arising from accidents you cause, is typically the most affordable option. However, comprehensive coverage, which provides protection for a wide range of incidents including theft, vandalism, and natural disasters, can be more costly.

Additionally, optional add-ons such as roadside assistance, rental car coverage, or personal injury protection can increase your premium, but they may provide valuable benefits in certain situations.

Comparing Quotes: The Power of Information

With a better understanding of the factors influencing car insurance premiums, you can now embark on the process of comparing quotes to find the best deal. Here’s a step-by-step guide to help you navigate the world of insurance comparisons.

Gathering Quotes: Online vs. Offline

The convenience of the internet makes it easy to obtain multiple car insurance quotes online. Many insurance providers offer online quote tools that allow you to input your information and receive an estimate within minutes. These quotes often provide a good starting point for comparison.

However, it's essential to remember that online quotes may not always be accurate. They are typically based on limited information and may not consider all the factors that could impact your premium. Therefore, it's beneficial to follow up with insurance providers directly to obtain more precise quotes.

Consider Bundling and Loyalty Discounts

Insurance companies often offer discounts for bundling multiple policies, such as combining car insurance with home or renters insurance. Additionally, loyalty discounts are common, rewarding customers who have been with the same insurer for an extended period.

When comparing quotes, inquire about these potential discounts to ensure you're considering the full range of options available. Bundling policies or maintaining loyalty to a single insurer can often result in significant savings.

Understanding Deductibles and Limits

When reviewing insurance quotes, pay close attention to deductibles and coverage limits. A deductible is the amount you must pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premium, but it also means you’ll be responsible for a larger portion of any claims.

Coverage limits refer to the maximum amount your insurance provider will pay out for a covered incident. It's crucial to ensure that your coverage limits are adequate to protect your financial interests. Consider your assets and the potential risks you face when selecting appropriate limits.

Read the Fine Print: Policy Details Matter

Beyond the price, it’s essential to understand the specific terms and conditions of each insurance policy. Different policies may offer varying levels of coverage for specific situations, and some may have exclusions or limitations that could impact your protection.

Review the policy documents carefully, paying attention to details such as the types of coverage included, the conditions under which coverage applies, and any potential exclusions. This step is crucial to ensure you're not only getting a good deal but also the right coverage for your needs.

Optimizing Your Insurance Strategy

Now that you have a comprehensive understanding of car insurance pricing and the process of comparing quotes, it’s time to explore strategies to optimize your insurance strategy and potentially reduce your premiums.

Safe Driving Habits: A Key to Lower Premiums

Maintaining a clean driving record is one of the most effective ways to keep your insurance premiums low. Safe driving habits, such as avoiding aggressive maneuvers, adhering to speed limits, and practicing defensive driving, can help prevent accidents and traffic violations. Over time, a consistent record of safe driving can lead to significant savings on your insurance.

Exploring Discounts: Maximizing Savings

Insurance providers offer a variety of discounts to attract and retain customers. These discounts can significantly reduce your insurance premiums, so it’s worth exploring all available options.

- Safe Driver Discounts: Many insurers offer discounts to drivers with clean records or those who complete defensive driving courses.

- Multi-Policy Discounts: Bundling your car insurance with other policies, such as home or life insurance, can result in substantial savings.

- Loyalty Discounts: Staying with the same insurer for an extended period often leads to loyalty discounts.

- Payment Method Discounts: Some insurers offer discounts for setting up automatic payments or paying your premium in full.

- Vehicle Safety Features: Having advanced safety features in your car, such as anti-lock brakes or collision avoidance systems, can qualify you for discounts.

Shopping Around: The Benefits of Regular Reviews

Insurance premiums can fluctuate over time, and it’s beneficial to regularly review your policy and compare quotes from different providers. This practice, known as “shopping around,” allows you to stay informed about the latest rates and ensure you’re not overpaying for your insurance.

By consistently comparing quotes and staying aware of market trends, you can make informed decisions about your insurance coverage. If you find a better deal elsewhere, you can switch providers without penalty, ensuring you always have the most competitive rate available.

Conclusion: Empowered Decision-Making

Understanding the factors that influence car insurance premiums and the process of comparing quotes empowers you to make informed decisions about your insurance coverage. By considering your unique circumstances, exploring available discounts, and regularly reviewing your options, you can find the best deal that provides adequate protection at a competitive price.

Remember, car insurance is a crucial investment that provides financial security and peace of mind. Take the time to research, compare, and choose the policy that best fits your needs and budget. With the right strategy, you can navigate the world of car insurance with confidence and ensure you're always adequately protected.

How often should I compare car insurance quotes?

+It’s beneficial to compare quotes annually, especially during your policy renewal period. However, if you experience significant life changes such as a move to a new location, a major accident, or the purchase of a new vehicle, it’s advisable to compare quotes sooner to ensure your coverage and premiums remain competitive.

Can I switch car insurance providers mid-policy term?

+Yes, you can typically switch providers at any time. However, be aware of any cancellation fees or penalties that may apply. Some providers may also offer a prorated refund for unused coverage if you cancel your policy before its renewal date.

What factors can I control to lower my car insurance premiums?

+You can influence your insurance premiums by maintaining a clean driving record, choosing a vehicle with lower repair and replacement costs, and exploring discounts for safety features or defensive driving courses. Additionally, consider increasing your deductible to lower your premium, but ensure you can afford the increased out-of-pocket expense in the event of a claim.