Progressive Commercial Insurance Quote

Obtaining a Progressive commercial insurance quote is an essential step for businesses looking to safeguard their operations and assets. Commercial insurance, often referred to as business insurance, is designed to protect companies from various risks, including property damage, liability claims, and potential losses due to unexpected events. Progressive, a leading name in the insurance industry, offers comprehensive coverage options tailored to the unique needs of businesses across diverse industries.

In this comprehensive guide, we will delve into the process of securing a Progressive commercial insurance quote, exploring the key considerations, coverage options, and benefits. By understanding the nuances of commercial insurance and leveraging the expertise of Progressive, businesses can make informed decisions to secure their future and mitigate potential financial risks.

Understanding Progressive’s Commercial Insurance Solutions

Progressive’s commercial insurance division is renowned for its innovative approach to risk management and coverage. The company offers a wide array of policies designed to address the diverse needs of modern businesses. From small startups to established enterprises, Progressive provides tailored solutions to ensure businesses are adequately protected.

Progressive's commercial insurance offerings typically include coverage for:

- Property Insurance: Protecting physical assets such as buildings, equipment, and inventory from damage or loss due to fire, theft, or natural disasters.

- Liability Insurance: Safeguarding businesses against claims arising from bodily injury or property damage caused by business operations.

- Business Interruption Insurance: Providing coverage for lost income and additional expenses incurred when business operations are disrupted due to covered perils.

- Commercial Auto Insurance: Covering vehicles used for business purposes, including trucks, vans, and other commercial vehicles.

- Workers' Compensation Insurance: Ensuring medical care and wage replacement for employees injured on the job, while also protecting businesses from related lawsuits.

The Progressive Commercial Insurance Quote Process

Securing a Progressive commercial insurance quote is a straightforward process that begins with an assessment of your business's unique needs. Progressive's experienced agents work closely with businesses to understand their operations, risks, and coverage requirements. Here's a step-by-step guide to obtaining a Progressive commercial insurance quote:

Step 1: Gather Essential Information

Before initiating the quote process, it’s crucial to have certain information readily available. This includes details about your business’s operations, such as the nature of your industry, the number of employees, and the types of assets and vehicles you own or lease.

Additionally, it's beneficial to have a clear understanding of the specific risks your business faces. This may involve conducting a thorough risk assessment to identify potential hazards and vulnerabilities. By gathering this information, you can provide Progressive's agents with the necessary insights to tailor a quote to your business's unique circumstances.

Step 2: Connect with Progressive’s Commercial Insurance Team

Progressive offers multiple channels for businesses to connect with their commercial insurance experts. You can reach out via phone, email, or even schedule a virtual consultation. The Progressive team is known for their responsiveness and commitment to providing personalized service.

During your initial consultation, be prepared to discuss your business's operations, coverage needs, and any specific concerns or questions you may have. Progressive's agents will guide you through the quote process, ensuring you understand the various coverage options available.

Step 3: Receive Your Personalized Quote

Based on the information you provide and Progressive’s assessment of your business’s risks, you’ll receive a tailored commercial insurance quote. This quote will outline the recommended coverage options, the associated premiums, and any additional details or exclusions. It’s important to carefully review the quote to ensure it aligns with your business’s needs and expectations.

Step 4: Discuss Coverage Options and Customization

Progressive understands that every business is unique, and their agents are dedicated to ensuring your coverage is precisely tailored to your requirements. During this step, you’ll have the opportunity to discuss any concerns or requests for customization. Progressive’s flexibility allows for adjustments to be made to the quote, ensuring you receive the coverage that best suits your business.

Step 5: Secure Your Commercial Insurance Policy

Once you’re satisfied with the quote and have made any necessary adjustments, it’s time to secure your commercial insurance policy with Progressive. This involves finalizing the policy details, paying the initial premium, and receiving your policy documents. Progressive’s efficient onboarding process ensures a smooth transition, allowing you to focus on running your business with the peace of mind that comes with comprehensive coverage.

Benefits of Choosing Progressive for Commercial Insurance

Progressive’s commercial insurance division stands out for several key reasons, making it an attractive choice for businesses seeking reliable coverage.

Comprehensive Coverage Options

Progressive offers a wide range of coverage options, ensuring businesses can secure the protection they need. From standard policies to highly specialized coverage, Progressive’s expertise allows them to cater to the unique requirements of diverse industries.

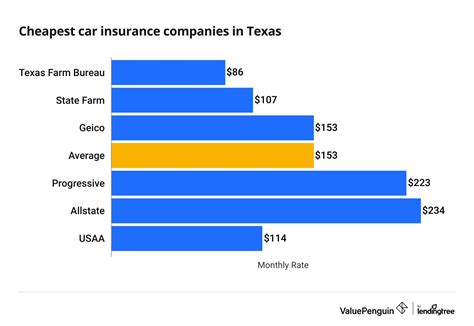

Competitive Pricing

Progressive is committed to providing competitive pricing for its commercial insurance policies. By leveraging their extensive network and innovative risk management strategies, they are able to offer businesses affordable coverage without compromising on quality.

Personalized Service and Expertise

Progressive’s commercial insurance team is comprised of experienced professionals who understand the nuances of business risk. Their dedication to providing personalized service ensures businesses receive tailored advice and guidance throughout the quote and policy process. This level of expertise and attention to detail sets Progressive apart, providing businesses with the confidence and peace of mind they deserve.

Innovative Technology and Resources

Progressive leverages cutting-edge technology and resources to enhance the commercial insurance experience. Their online platforms and mobile apps provide businesses with convenient access to policy information, claims management, and other essential services. Additionally, Progressive’s commitment to innovation ensures businesses can benefit from the latest advancements in risk management and coverage.

Conclusion: Empowering Your Business with Progressive Commercial Insurance

Securing a Progressive commercial insurance quote is a pivotal step in safeguarding your business’s future. By understanding your unique risks and leveraging Progressive’s expertise and comprehensive coverage options, you can make informed decisions to protect your operations and assets. Progressive’s dedication to providing personalized service, competitive pricing, and innovative solutions ensures your business receives the coverage it needs to thrive.

As you embark on the journey of securing commercial insurance, remember that Progressive is committed to being your trusted partner. With their expertise and dedication, you can focus on growing your business with the assurance that you're protected against potential risks and liabilities.

How much does Progressive commercial insurance cost?

+The cost of Progressive commercial insurance varies based on factors such as your business’s size, industry, and specific coverage needs. Progressive offers competitive pricing, and their agents can provide a personalized quote based on your unique circumstances.

What types of businesses does Progressive insure?

+Progressive insures a wide range of businesses, from small startups to large enterprises. Their coverage options are tailored to meet the diverse needs of industries such as retail, manufacturing, healthcare, and more.

Can I customize my Progressive commercial insurance policy?

+Absolutely! Progressive understands that every business is unique, and their agents work closely with you to customize your policy. You can choose the coverage options that best fit your business’s specific needs and budget.

What happens if I need to file a claim with Progressive commercial insurance?

+In the event of a claim, Progressive’s dedicated claims team is ready to assist. They provide prompt and efficient service, guiding you through the claims process and ensuring a smooth resolution. Their goal is to minimize disruptions to your business and help you get back on track quickly.

Are there any discounts available for Progressive commercial insurance policies?

+Yes, Progressive offers a variety of discounts to help businesses save on their commercial insurance premiums. These discounts may be based on factors such as safety features, loss prevention measures, and multi-policy bundles. Be sure to inquire about available discounts when obtaining your quote.