Edu

Cal Insurance

<section>

<h2>Understanding the Basics: What is Insurance and Why is it Important?</h2>

<p>Insurance is a fundamental tool for managing financial risk. It provides a sense of security and stability by

offering protection against potential losses or damages. In simple terms, insurance is a contract between an

individual (the policyholder) and an insurance company (the insurer), where the insurer agrees to compensate the

policyholder for specific losses in exchange for regular premium payments.</p>

<p>The importance of insurance cannot be overstated. It acts as a financial safety net, ensuring that individuals,

families, and businesses can recover from unexpected events such as accidents, illnesses, natural disasters, or

business interruptions. Insurance provides peace of mind, knowing that you have a backup plan to handle

unexpected financial burdens.</p>

</section>

<section>

<h2>The Diverse Landscape of Insurance: Exploring Types and Policies</h2>

<p>The insurance industry is vast and diverse, offering a wide range of products to cater to various needs. Here's a

glimpse into the different types of insurance and the policies they encompass:</p>

<ul>

<li>

<h3>Life Insurance</h3>

<p>Life insurance policies provide financial protection to your loved ones in the event of your untimely

death. There are two primary types:</p>

<ul>

<li><strong>Term Life Insurance:</strong> Offers coverage for a specified term, providing a death

benefit to your beneficiaries. It is ideal for covering short-term needs like mortgage payments or

children's education.</li>

<li><strong>Permanent Life Insurance:</strong> Offers lifelong coverage and includes a cash value

component that grows over time. It can be used for long-term financial planning and wealth

accumulation.</li>

</ul>

</li>

<li>

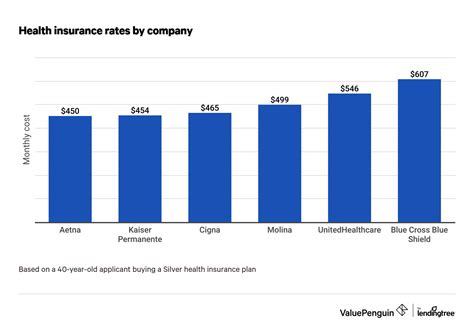

<h3>Health Insurance</h3>

<p>Health insurance is crucial for covering medical expenses. It can include:</p>

<ul>

<li><strong>Major Medical Insurance:</strong> Provides coverage for a wide range of medical services,

including hospitalization, doctor visits, and prescription drugs.</li>

<li><strong>Dental and Vision Insurance:</strong> These policies offer coverage for dental and eye care,

which are often not covered by major medical plans.</li>

</ul>

</li>

<li>

<h3>Auto Insurance</h3>

<p>Auto insurance is mandatory in most states and provides financial protection in the event of an

automobile accident. It typically includes liability coverage, collision coverage, and comprehensive

coverage.</p>

</li>

<li>

<h3>Homeowners Insurance</h3>

<p>Homeowners insurance is essential for protecting your home and personal property against damages or

losses. It covers a wide range of perils, including fire, theft, and natural disasters.</p>

</li>

<li>

<h3>Business Insurance</h3>

<p>Business insurance is tailored to the needs of businesses, providing coverage for various risks,

including property damage, liability, and business interruption.</p>

</li>

<li>

<h3>Travel Insurance</h3>

<p>Travel insurance offers protection while you're away from home, covering trip cancellations, medical

emergencies, and lost luggage.</p>

</li>

</ul>

</section>

<section>

<h2>The Role of Cal Insurance: A Trusted Partner for Your Insurance Needs</h2>

<p>In the vast landscape of insurance providers, Cal Insurance stands out as a trusted and reliable partner. With a

rich history spanning decades, Cal Insurance has established itself as a leading insurance provider, offering

comprehensive coverage and exceptional customer service.</p>

<p>Cal Insurance understands that every individual and business has unique insurance needs. That's why they offer a

wide range of insurance products, tailored to provide the right level of protection for every situation. Whether

you're seeking life insurance to secure your family's future, health insurance to cover medical expenses, or

property insurance to safeguard your assets, Cal Insurance has a policy that fits your needs perfectly.</p>

<p>One of the key strengths of Cal Insurance is their commitment to customer satisfaction. Their team of expert

insurance advisors is dedicated to helping you navigate the complex world of insurance, ensuring you make

informed decisions. They take the time to understand your specific circumstances and provide personalized

advice, guiding you towards the most suitable insurance solutions.</p>

</section>

<section>

<h2>The Benefits of Choosing Cal Insurance</h2>

<p>There are numerous reasons why Cal Insurance should be your go-to insurance provider:</p>

<ul>

<li><strong>Comprehensive Coverage:</strong> Cal Insurance offers a comprehensive range of insurance products,

ensuring you can find the right policy for your needs, whether it's life, health, auto, or property

insurance.</li>

<li><strong>Competitive Pricing:</strong> Cal Insurance is committed to providing competitive rates without

compromising on the quality of coverage. They offer affordable insurance solutions without hidden fees or

unexpected costs.</li>

<li><strong>Personalized Service:</strong> At Cal Insurance, you're more than just a policy number. Their team

takes the time to understand your unique circumstances and provides personalized advice, ensuring you

receive the best possible insurance solution.</li>

<li><strong>Expertise and Experience:</strong> With years of experience in the insurance industry, Cal Insurance

has the expertise to handle any insurance-related query or concern. Their team is highly knowledgeable and

stays up-to-date with the latest industry developments, ensuring you receive accurate and reliable advice.

</li>

<li><strong>Exceptional Customer Service:</strong> Cal Insurance prides itself on its exceptional customer

service. Their dedicated team is always ready to assist, providing prompt responses and efficient

resolution of any issues or claims.</li>

</ul>

</section>

<section>

<h2>The Process of Obtaining Insurance with Cal Insurance</h2>

<p>Obtaining insurance with Cal Insurance is a straightforward and hassle-free process. Here's a step-by-step guide to

help you navigate the process:</p>

<ol>

<li><strong>Assess Your Insurance Needs:</strong> Begin by evaluating your specific insurance requirements.

Consider factors such as your age, health status, financial goals, and assets to determine the type of

insurance you need.</li>

<li><strong>Research and Compare:</strong> Take the time to research and compare different insurance providers,

including Cal Insurance. Look for reviews, ratings, and testimonials to gain insights into their reputation

and customer satisfaction.</li>

<li><strong>Contact Cal Insurance:</strong> Reach out to Cal Insurance through their website, by phone, or in

person. Their team of insurance advisors will be happy to discuss your insurance needs and provide

personalized recommendations.</li>

<li><strong>Obtain a Quote:</strong> Provide Cal Insurance with the necessary information to obtain a quote for

the insurance policy that best suits your needs. This may include details such as your age, health status,

and the value of your assets.</li>

<li><strong>Review the Policy:</strong> Carefully review the insurance policy provided by Cal Insurance. Ensure

you understand the coverage, exclusions, and any limitations. Don't hesitate to ask questions or seek

clarification if needed.</li>

<li><strong>Purchase the Policy:</strong> Once you're satisfied with the policy and its terms, you can proceed

with purchasing the insurance. Cal Insurance offers flexible payment options, including monthly, quarterly,

or annual payments.</li>

<li><strong>Maintain Open Communication:</strong> Throughout the insurance process and beyond, maintain open

communication with Cal Insurance. Keep them informed of any changes in your circumstances that may impact

your insurance needs. Regularly review your policy to ensure it aligns with your current situation.</li>

</ol>

</section>

<section>

<h2>Real-Life Success Stories: How Cal Insurance Made a Difference</h2>

<p>At Cal Insurance, we take pride in the impact we've had on the lives of our policyholders. Here are a few real-life

success stories that highlight the importance of insurance and the role Cal Insurance has played:</p>

<ul>

<li><strong>John's Peace of Mind:</strong> John, a young professional, invested in a term life insurance policy

with Cal Insurance. Unfortunately, he was diagnosed with a critical illness. Thanks to his insurance

coverage, John was able to focus on his health without worrying about the financial burden of medical

expenses. Cal Insurance provided the financial support he needed during a challenging time.</li>

<li><strong>Sarah's Business Resilience:</strong> Sarah, a small business owner, experienced a devastating fire

at her place of business. With Cal Insurance's comprehensive business insurance policy, she was able to

rebuild her business and get back on her feet quickly. The insurance coverage provided the necessary funds

to cover the cost of repairs, replacement of equipment, and even helped with temporary relocation during

the reconstruction process.</li>

<li><strong>Michael's Travel Protection:</strong> Michael, an avid traveler, purchased travel insurance from Cal

Insurance before embarking on a trip to Europe. During his journey, he suffered a sudden illness and had to

be hospitalized. The travel insurance policy covered his medical expenses, ensuring he received the

necessary treatment without incurring significant financial strain.</li>

</ul>

</section>

<section>

<h2>The Future of Insurance: Innovations and Trends</h2>

<p>The insurance industry is constantly evolving, and Cal Insurance is at the forefront of these advancements. Here

are some key trends and innovations shaping the future of insurance:</p>

<ul>

<li><strong>Digital Transformation:</strong> The insurance industry is embracing digital technologies to enhance

the customer experience. Cal Insurance has invested in digital platforms and mobile apps, making it

convenient for policyholders to manage their insurance policies, file claims, and receive real-time

updates.</li>

<li><strong>Personalized Insurance:</strong> With advancements in data analytics, insurance providers like Cal

Insurance are able to offer more personalized insurance solutions. By analyzing individual risk profiles,

they can tailor policies to meet specific needs, providing optimal coverage at competitive rates.</li>

<li><strong>Telematics and Usage-Based Insurance:</strong> Telematics technology is revolutionizing auto

insurance. Cal Insurance is exploring usage-based insurance policies that offer discounts to safe drivers

based on real-time driving data. This innovative approach promotes safer driving habits and rewards

responsible drivers.</li>

<li><strong>Blockchain Technology:</strong> Blockchain technology is transforming the insurance industry by

enhancing security, transparency, and efficiency. Cal Insurance is exploring blockchain-based solutions to

streamline insurance processes, reduce fraud, and improve claim settlements.</li>

</ul>

</section>

<section>

<h2>FAQs: Common Questions about Insurance and Cal Insurance</h2>

<div class="faq-section">

<div class="faq-container">

<div class="faq-item">

<div class="faq-question">

<h3>What types of insurance does Cal Insurance offer?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Cal Insurance offers a comprehensive range of insurance products, including life insurance,

health insurance, auto insurance, homeowners insurance, business insurance, and travel

insurance. They aim to provide tailored solutions for every insurance need.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How do I choose the right insurance policy for my needs?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Choosing the right insurance policy involves assessing your unique circumstances and needs.

Consider factors such as your age, health status, financial goals, and assets. Reach out to Cal

Insurance's expert advisors for personalized guidance in selecting the most suitable policy.

</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What sets Cal Insurance apart from other insurance providers?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Cal Insurance stands out for its commitment to providing comprehensive coverage, competitive

pricing, and exceptional customer service. Their team of expert advisors is dedicated to

helping you find the right insurance solution, ensuring you receive the best possible

protection for your needs.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How can I file a claim with Cal Insurance?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Filing a claim with Cal Insurance is a straightforward process. You can initiate the claim

process through their website, by phone, or in person. Their dedicated claims team will guide

you through the process, ensuring a smooth and efficient resolution.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any discounts or special offers available with Cal Insurance?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, Cal Insurance offers various discounts and special offers to its policyholders. These may

include discounts for multiple policies, safe driving practices, and loyalty rewards. Stay

updated with their latest promotions to take advantage of these benefits.</p>

</div>

</div>

</div>

</div>

</section>

<footer>

<p>Disclaimer: The information provided in this guide is for educational purposes only and should not be construed

as professional financial or legal advice. Always consult with qualified professionals for personalized advice

tailored to your specific circumstances.</p>

<p>© 2024 Cal Insurance. All rights reserved.</p>

</footer>