How Does Fdic Insurance Work

FDIC insurance, officially known as Federal Deposit Insurance Corporation insurance, is a vital component of the US banking system, offering crucial protection to depositors. This insurance safeguards funds held in eligible bank accounts against the risk of bank failure, providing a critical safety net for millions of Americans.

In this comprehensive article, we will delve into the intricacies of FDIC insurance, exploring its history, the benefits it provides, how it works, and the impact it has on the financial stability of the nation. By understanding FDIC insurance, individuals can make more informed decisions about where to keep their hard-earned money and ensure its security in the event of unforeseen banking crises.

A Historical Perspective on FDIC Insurance

The concept of deposit insurance was born out of the devastating impact of the Great Depression on the US banking system. In the early 1930s, a significant number of banks failed, leading to a widespread loss of public confidence in the banking sector. This crisis resulted in a run on banks, with panicked depositors withdrawing their funds en masse, further exacerbating the financial turmoil.

To restore stability and rebuild public trust, the US government established the Federal Deposit Insurance Corporation (FDIC) on January 1, 1934. This agency was tasked with insuring bank deposits and promoting public confidence in the banking system. The initial deposit insurance coverage was set at $2,500 per depositor, a significant increase from the previous maximum of $2,500 per bank.

Since its inception, the FDIC has played a pivotal role in maintaining the integrity of the banking system, ensuring that depositors' funds are protected even in times of economic hardship. Over the years, the coverage limit has been increased to keep pace with inflation and changing economic conditions. Today, the standard insurance amount stands at $250,000 per depositor, per insured bank, for each ownership category.

Understanding FDIC Insurance Coverage

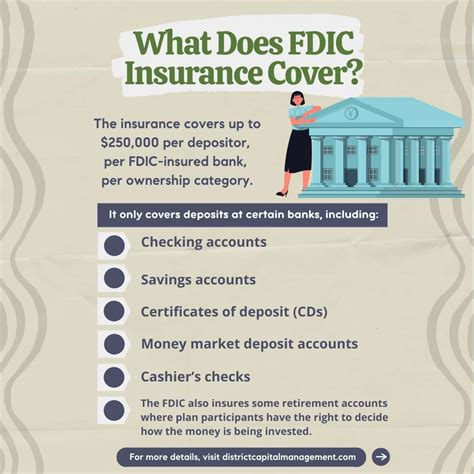

FDIC insurance provides critical protection for depositors by guaranteeing the safety of their funds up to the specified coverage limit. This insurance covers various types of deposits, including checking and savings accounts, money market deposit accounts (MMDAs), and certificates of deposit (CDs). It also covers certain retirement accounts, such as individual retirement accounts (IRAs) and Keogh plans.

However, it's essential to note that not all financial products are insured by the FDIC. Investments like stocks, bonds, mutual funds, and life insurance policies are not covered. Additionally, certain bank products, such as safe deposit boxes and certain types of repurchase agreements, are also excluded from FDIC insurance.

The FDIC maintains a comprehensive online guide that provides detailed information on what is and isn't covered by FDIC insurance. This resource helps depositors understand their coverage limits and make informed decisions about their financial holdings.

How Much Coverage Do You Have?

The FDIC provides standard insurance coverage of 250,000 per depositor, per insured bank, for each ownership category. This means that individuals can have up to 250,000 in deposits insured at a single bank, and if they have accounts at multiple branches of the same bank, their deposits at each branch are also covered up to this limit.

Furthermore, the FDIC insurance coverage applies to different ownership categories. For instance, if you have a single account in your name, it is insured up to $250,000. If you have a joint account with another individual, each of you is insured up to $250,000 for your respective ownership shares in the account. This means that a joint account can have a combined coverage of $500,000.

| Ownership Category | Coverage Limit |

|---|---|

| Single Account | $250,000 |

| Joint Account | $250,000 per co-owner |

| Trust Accounts | Varies based on beneficiary |

| Business Accounts | $250,000 per ownership category |

It's important to note that the FDIC insurance coverage limit applies to the combined balance of all deposit accounts in a single ownership category at a single bank. If your deposits exceed this limit, you may consider spreading your funds across multiple banks or utilizing FDIC-insured retirement accounts to maximize your coverage.

How FDIC Insurance Works

FDIC insurance operates through a comprehensive system designed to safeguard depositors’ funds and maintain the stability of the banking sector. Here’s an in-depth look at how this system works:

Premiums and Funding

FDIC insurance is funded through premiums paid by member banks. These premiums are based on the bank’s assessment rate category, which is determined by its risk profile and the amount of deposits it holds. The FDIC assesses banks quarterly, and the assessment rate is adjusted accordingly to ensure the fund remains well-capitalized.

The FDIC maintains a Deposit Insurance Fund (DIF), which is used to cover the costs of insuring deposits. This fund is funded by the premiums paid by member banks and any interest earned on its investments. The DIF is designed to be a self-sustaining fund, ensuring that the FDIC can fulfill its insurance obligations even in the event of widespread bank failures.

Insurance Coverage and Eligibility

FDIC insurance covers a wide range of deposit accounts, including checking and savings accounts, money market deposit accounts (MMDAs), and certificates of deposit (CDs). It also covers certain retirement accounts, such as individual retirement accounts (IRAs) and Keogh plans. However, as mentioned earlier, not all financial products are insured.

To be eligible for FDIC insurance, a bank must be a member of the FDIC and comply with its regulations. The FDIC regularly examines member banks to ensure they maintain sound financial practices and meet the required standards. This ongoing supervision helps identify potential risks and ensures the safety and soundness of the banking system.

Claim Process

In the event of a bank failure, the FDIC steps in to ensure that depositors’ funds are protected. The agency takes control of the failed bank’s assets and liabilities, including its insured deposits. The FDIC then works to transfer the insured deposits to a healthy bank or pays depositors directly, ensuring they receive their insured funds promptly.

The FDIC has a well-established process for handling bank failures. It typically notifies depositors within a few days of a bank's failure, providing information on how they can access their insured funds. In most cases, depositors can access their insured funds within a short period, often within a week or two. The FDIC's goal is to minimize disruption and ensure a smooth transition for depositors during such challenging times.

The Impact of FDIC Insurance

FDIC insurance has had a profound impact on the US banking system and the financial well-being of Americans. By providing a safety net for depositors, FDIC insurance has helped restore and maintain public confidence in the banking sector. This confidence is crucial for the stability and growth of the economy, as it encourages individuals to keep their funds in banks rather than hoarding cash or investing in riskier alternatives.

The presence of FDIC insurance has also contributed to the overall stability of the banking system. By ensuring that depositors' funds are protected, the FDIC reduces the likelihood of bank runs and systemic failures. This stability is essential for maintaining a healthy financial system, as it allows banks to continue lending and supporting economic activity even during times of economic stress.

Furthermore, FDIC insurance has played a critical role in mitigating the impact of financial crises. During the Great Recession of 2008, for instance, the FDIC's insurance program helped prevent widespread panic and the potential collapse of the banking system. By providing depositors with assurance that their funds were safe, the FDIC helped maintain financial stability and limit the damage caused by the crisis.

FAQs about FDIC Insurance

How often is the FDIC insurance coverage limit reviewed and adjusted?

+

The FDIC reviews and adjusts the insurance coverage limit periodically to keep pace with inflation and changing economic conditions. The last increase occurred in 2010, when the coverage limit was raised from 100,000 to the current 250,000 per depositor, per insured bank, for each ownership category.

Are all banks required to be members of the FDIC and offer FDIC insurance?

+

No, membership in the FDIC is voluntary for banks. However, most banks choose to join the FDIC to gain access to the deposit insurance coverage and the associated benefits. Banks that are not members of the FDIC are not eligible to offer FDIC insurance and must clearly disclose this fact to their customers.

Can I increase my FDIC insurance coverage by opening accounts at different branches of the same bank?

+

Yes, if you open accounts at different branches of the same bank, your deposits at each branch are insured up to the standard coverage limit of 250,000. This means you can potentially have a combined coverage of up to 500,000 if you have accounts at two different branches of the same bank.

What happens if my bank fails, and I have deposits exceeding the FDIC insurance coverage limit?

+

In the event of a bank failure, the FDIC steps in to protect insured deposits up to the coverage limit. Any deposits exceeding this limit may be at risk. However, the FDIC works to find a healthy bank to assume the insured deposits and may also pursue legal action against the failed bank’s assets to recover funds for uninsured depositors.

Are there any fees or charges associated with FDIC insurance for depositors?

+

No, depositors do not pay any fees or charges for FDIC insurance. The cost of insurance is borne by member banks through the premiums they pay based on their assessment rate category. Depositors benefit from the protection of FDIC insurance without any direct financial burden.

FDIC insurance is a cornerstone of the US banking system, providing essential protection for depositors and contributing to the overall stability of the financial sector. By understanding how FDIC insurance works and the coverage it provides, individuals can make informed decisions about where to keep their money and have confidence in the safety of their hard-earned savings.