Nomad Medical Insurance

Protecting Your Health: A Comprehensive Guide to Nomad Medical Insurance

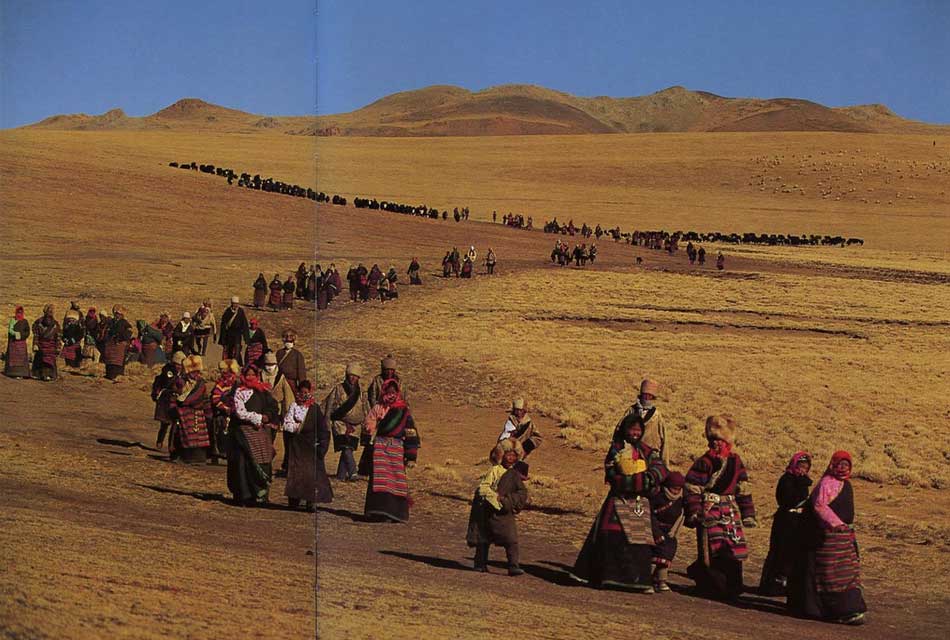

In today's globalized world, more and more individuals are embracing the nomadic lifestyle, whether it's for work, travel, or personal pursuits. However, one crucial aspect that often gets overlooked in the excitement of exploration is healthcare. Nomad medical insurance is an essential tool to ensure that your adventures are not hindered by unexpected health issues or accidents.

This guide aims to provide an in-depth analysis of nomad medical insurance, covering everything from the types of policies available to the key considerations when choosing a plan. By understanding the intricacies of this insurance, you can make informed decisions to safeguard your health and peace of mind during your nomadic journey.

Understanding Nomad Medical Insurance

Nomad medical insurance, also known as travel medical insurance or international health insurance, is specifically designed to cater to the unique needs of individuals who are frequently on the move, often spending extended periods abroad. Unlike traditional health insurance plans that are tied to a specific country or region, nomad medical insurance offers flexible coverage that can adapt to your changing locations and circumstances.

Key Features of Nomad Medical Insurance

- Worldwide Coverage: One of the standout features of nomad medical insurance is its global coverage. Whether you're hiking in the Swiss Alps, surfing in Australia, or exploring the Amazon rainforest, your insurance policy will provide coverage for medical emergencies and unforeseen illnesses.

- Flexible Durations: Nomad insurance plans often offer flexible term lengths, allowing you to choose coverage that aligns with the duration of your travels. Whether you're planning a year-long adventure or a shorter trip, there's a policy to suit your needs.

- Comprehensive Benefits: These policies typically offer a wide range of benefits, including coverage for medical emergencies, hospitalization, specialist consultations, prescription medications, and even dental and optical care. Some plans may also include coverage for pre-existing conditions, which is a critical consideration for long-term nomads.

- Evacuation and Repatriation: In the event of a severe medical emergency, nomad insurance policies often provide coverage for medical evacuation and repatriation. This ensures that you can receive the necessary treatment, even if it requires transportation to a specialized facility in your home country.

It's important to note that the specific features and benefits of nomad medical insurance can vary significantly between providers. Therefore, it's crucial to thoroughly review the policy documents and understand the fine print to ensure the plan aligns with your needs.

Choosing the Right Nomad Medical Insurance

With a myriad of options available in the market, selecting the right nomad medical insurance can be a daunting task. Here are some key considerations to help you make an informed decision:

Assess Your Needs

Before diving into policy comparisons, take the time to assess your specific healthcare needs. Consider factors such as your age, pre-existing medical conditions, the nature of your travels (adventure sports, city exploring, etc.), and the regions you plan to visit. Understanding your unique requirements will help narrow down the options and ensure you choose a plan that provides adequate coverage.

Compare Providers and Policies

Research and compare different insurance providers and their respective policies. Look beyond the headline benefits and dig into the details. Pay attention to factors like coverage limits, deductibles, co-pays, and any exclusions. Additionally, check if the policy provides coverage for the countries you plan to visit, as some providers may have geographical restrictions.

| Policy Category | Key Features |

|---|---|

| Basic Coverage | Covers essential medical expenses, including hospitalization, doctor visits, and prescription medications. |

| Enhanced Coverage | Offers additional benefits like dental and optical care, emergency medical evacuation, and coverage for adventure sports. |

| Comprehensive Coverage | Provides extensive coverage, including pre-existing condition coverage, specialized treatment options, and high coverage limits. |

Check Reputation and Reliability

It's essential to choose a reputable and reliable insurance provider. Look for providers with a strong track record of honoring claims and providing excellent customer service. Check online reviews and seek recommendations from fellow nomads or travel experts to gauge the reliability of different providers.

Understand the Fine Print

Don't be tempted to rush through the policy documents. Take the time to thoroughly understand the terms and conditions, including any exclusions and limitations. Be aware of potential loopholes or restrictions that could impact your coverage. If any part of the policy is unclear, reach out to the provider for clarification.

Consider Additional Benefits

Beyond the standard medical coverage, some nomad insurance policies offer additional benefits that can enhance your travel experience. These may include travel assistance services, trip interruption coverage, or even lost luggage reimbursement. While these benefits may not be essential, they can provide added peace of mind during your travels.

Real-World Examples: Nomad Medical Insurance in Action

To illustrate the importance and effectiveness of nomad medical insurance, let's explore a few real-world scenarios:

Emergency Medical Evacuation

Imagine you're hiking in a remote region of Nepal when you suffer a severe injury. Without insurance, the cost of medical evacuation to a specialized facility in Kathmandu, let alone your home country, could be financially devastating. However, with a comprehensive nomad medical insurance policy, you can rest assured that the necessary transportation and medical care will be covered, ensuring you receive the best possible treatment.

Coverage for Pre-Existing Conditions

As a long-term nomad with a pre-existing medical condition, finding insurance coverage can be challenging. However, some nomad medical insurance policies offer coverage for pre-existing conditions, provided certain criteria are met. This can provide much-needed peace of mind, ensuring that your condition is managed effectively while you're on the move.

Specialized Treatment

During your travels, you may require specialized medical treatment that is not readily available in your current location. Nomad medical insurance can provide coverage for such treatments, ensuring you have access to the care you need, even if it requires transportation to a different country.

Future Implications and Industry Insights

The rise of digital nomadism and remote work has led to an increased demand for nomad medical insurance. Insurance providers are recognizing this trend and are continually evolving their policies to better cater to the needs of this growing demographic. As a result, we can expect to see more specialized plans and improved coverage options in the future.

Additionally, the ongoing COVID-19 pandemic has highlighted the importance of travel insurance, including medical coverage. Many providers are now offering policies that provide coverage for COVID-related expenses, such as testing, treatment, and even cancellation due to a positive diagnosis. This evolution in coverage demonstrates the industry's adaptability and commitment to protecting travelers' health and well-being.

FAQ

Can I purchase nomad medical insurance after my trip has started?

+In most cases, it is recommended to purchase nomad medical insurance before your trip begins. Some providers may offer coverage for ongoing trips, but it is best to check the specific terms and conditions of the policy.

What happens if I need to make a claim while abroad?

+The claims process can vary depending on the insurance provider. Typically, you will need to contact the provider’s emergency assistance line and provide the necessary details. They will guide you through the steps to obtain the required treatment and ensure your claim is processed efficiently.

Are there any limitations on the number of trips I can take with one policy?

+This can depend on the specific policy. Some providers offer annual policies with unlimited trips, while others may have a limit on the number of days or trips covered within a certain period. It’s important to review the policy terms to understand the trip limits and plan your travels accordingly.