Medical Insurance Premiums

The world of medical insurance is a complex landscape, with various factors influencing the cost of premiums. Understanding these factors is crucial for individuals and businesses alike as they navigate the healthcare system. This comprehensive guide delves into the intricacies of medical insurance premiums, shedding light on the variables that impact them and offering insights into ways to optimize coverage.

Understanding Medical Insurance Premiums

Medical insurance premiums are the regular payments made by individuals or businesses to maintain their health coverage. These premiums are determined by a multitude of factors, each playing a significant role in the overall cost of healthcare. Let’s explore these factors in detail.

Key Factors Influencing Medical Insurance Premiums

Age is a critical factor in determining insurance premiums. Generally, younger individuals tend to have lower premiums as they are less likely to require extensive medical care. On the other hand, older individuals, particularly those over 60, often face higher premiums due to increased healthcare needs. This age-based differentiation is a common practice among insurance providers.

The geographic location of the insured individual or business can also significantly impact insurance premiums. Healthcare costs can vary widely between different regions, influenced by factors such as the cost of living, local healthcare infrastructure, and the prevalence of certain medical conditions. For instance, urban areas with advanced medical facilities often command higher premiums compared to rural areas.

The type of health plan chosen is another crucial determinant of insurance premiums. Different plans offer varying levels of coverage, from basic plans that cover essential care to comprehensive plans that provide extensive coverage for a wide range of medical services. Plans with more extensive coverage typically come with higher premiums.

The family size of the insured person or business can also affect insurance premiums. Family plans often offer cost-saving benefits, especially for larger families. These plans are designed to provide coverage for multiple individuals under one policy, which can result in lower premiums per person compared to individual plans.

| Plan Type | Premium Range |

|---|---|

| Basic Health Plan | $150 - $250 per month |

| Comprehensive Health Plan | $300 - $500 per month |

| Family Health Plan | $200 - $400 per month (per family) |

The Impact of Medical History

An individual’s medical history is a significant factor in determining insurance premiums. Pre-existing medical conditions can lead to higher premiums or even denial of coverage. Insurance providers carefully assess an applicant’s medical history to evaluate the potential risk and cost of providing coverage. This practice, known as medical underwriting, ensures that premiums are fair and accurately reflect the risk involved.

For example, an individual with a history of chronic illness, such as diabetes, may face higher premiums due to the increased likelihood of requiring ongoing medical treatment. In some cases, specific conditions may result in exclusion from certain types of coverage.

However, it's important to note that in certain jurisdictions, there are regulations in place to protect individuals with pre-existing conditions. For instance, the Affordable Care Act (ACA) in the United States prohibits insurance providers from denying coverage or charging higher premiums based solely on pre-existing conditions.

The Role of Lifestyle Factors

Lifestyle choices can also influence insurance premiums. Engaging in risky behaviors such as smoking, excessive alcohol consumption, or participating in extreme sports can lead to higher premiums. Insurance providers often consider these factors as they directly impact an individual’s health and the likelihood of requiring medical care.

For instance, smokers often face higher premiums due to the increased risk of developing smoking-related health issues. Similarly, individuals who regularly engage in extreme sports may be charged higher premiums due to the potential for accidents and injuries.

However, it's not all bad news. Many insurance providers offer incentives and discounts to individuals who adopt healthy lifestyles. For example, some plans provide reduced premiums for non-smokers or individuals who maintain a healthy weight and exercise regularly. These incentives encourage healthier behaviors and can lead to significant savings over time.

Employer-Provided Insurance Plans

Many individuals and families obtain medical insurance through their employers. These employer-sponsored health plans often provide comprehensive coverage and can be more affordable due to the collective bargaining power of the employer. The employer typically covers a portion of the premium, making insurance more accessible to employees.

Additionally, employer-provided insurance plans often offer a range of coverage options, allowing employees to choose a plan that best suits their needs. This flexibility ensures that individuals can find a plan that aligns with their healthcare requirements and budget.

However, it's important to note that employer-sponsored plans may have certain limitations. For instance, coverage may be tied to employment, and individuals may face challenges if they change jobs or retire. In such cases, understanding the options for continuing coverage or individual insurance plans becomes crucial.

Individual Insurance Plans

For those not covered by employer-sponsored plans, individual insurance plans are an option. These plans are purchased directly from insurance providers and can be tailored to an individual’s specific needs. While individual plans offer flexibility, they often come with higher premiums compared to group plans.

When selecting an individual plan, it's essential to carefully review the coverage details. Different plans may have varying levels of coverage for specific services, such as prescription drugs, mental health services, or specialty care. Understanding these nuances is crucial to ensure that the plan aligns with one's healthcare requirements.

Additionally, individual plans may have certain restrictions or limitations, such as waiting periods for specific services or pre-authorization requirements. Being aware of these details can help individuals make informed decisions and avoid unexpected out-of-pocket costs.

Optimizing Medical Insurance Coverage

While understanding the factors that influence medical insurance premiums is crucial, it’s equally important to explore ways to optimize coverage. By making informed choices and taking advantage of available options, individuals and businesses can find a balance between affordable premiums and adequate healthcare coverage.

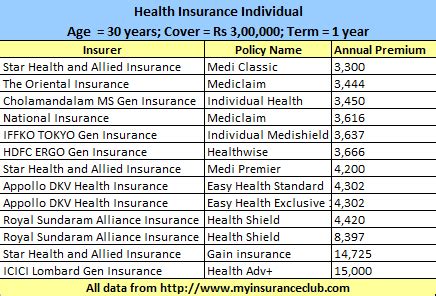

Comparing Multiple Insurance Providers

One of the most effective ways to optimize insurance coverage is by comparing offers from multiple insurance providers. Different providers may have varying premium structures, coverage options, and additional benefits. By exploring these options, individuals can find a plan that best suits their needs while keeping premiums within a manageable range.

For instance, some providers may offer discounts for bundling multiple types of insurance, such as medical, dental, and vision coverage. Others may provide incentives for maintaining a healthy lifestyle or participating in wellness programs. By researching and comparing these offerings, individuals can make informed choices and potentially save on premiums.

Understanding Deductibles and Co-Payments

Deductibles and co-payments are integral components of insurance plans that can significantly impact overall healthcare costs. A deductible is the amount an insured individual must pay out of pocket before the insurance coverage kicks in. Co-payments, on the other hand, are fixed amounts paid by the insured for covered services, often after the deductible has been met.

For example, if an individual has a $500 deductible and a $20 co-payment for doctor visits, they would need to pay the full $500 deductible before their insurance coverage begins. After that, they would pay $20 for each doctor visit, with the insurance provider covering the remaining costs.

Understanding these terms and their implications is crucial. Higher deductibles and co-payments often result in lower premiums, but they can also lead to higher out-of-pocket costs during healthcare utilization. On the other hand, lower deductibles and co-payments may result in higher premiums but provide more financial protection during medical treatment.

Exploring Government-Sponsored Programs

In many countries, government-sponsored health insurance programs offer affordable coverage options, particularly for individuals and families with low to moderate incomes. These programs, such as Medicaid in the United States or National Health Service in the United Kingdom, provide essential healthcare services at reduced or no cost.

For instance, Medicaid in the United States offers comprehensive healthcare coverage to eligible individuals and families, including children, pregnant women, elderly adults, and individuals with disabilities. The program covers a wide range of services, including doctor visits, hospital stays, prescription drugs, and mental health services.

Exploring these government-sponsored programs can be a viable option for individuals seeking affordable healthcare coverage. It's important to research the eligibility criteria and understand the coverage details to determine if these programs align with one's healthcare needs.

Utilizing Health Savings Accounts (HSAs)

Health Savings Accounts (HSAs) are tax-advantaged savings accounts specifically designed for healthcare expenses. These accounts allow individuals to set aside pre-tax dollars to pay for qualified medical expenses, providing a way to save for healthcare costs while potentially reducing tax liability.

HSAs are often paired with high-deductible health plans, where the savings from the lower premiums can be used to fund the HSA. This strategy can lead to significant savings, especially for individuals who have minimal healthcare needs and can accumulate funds in their HSA over time.

For example, an individual with a high-deductible health plan may choose to contribute a portion of their income to their HSA. If they encounter minimal healthcare expenses in a given year, the funds in their HSA can accumulate and be used to cover future medical costs, including deductibles and co-payments.

However, it's important to note that HSAs have certain eligibility requirements and contribution limits. Understanding these details and consulting with a financial advisor can help individuals make informed decisions about utilizing HSAs effectively.

The Importance of Preventive Care

Preventive care plays a crucial role in optimizing insurance coverage and maintaining overall health. Many insurance plans, particularly those complying with the Affordable Care Act (ACA), offer coverage for a range of preventive services at no additional cost.

These preventive services include regular check-ups, immunizations, cancer screenings, and counseling for various health conditions. By taking advantage of these services, individuals can identify potential health issues early on, potentially preventing more serious and costly health problems down the line.

For instance, regular cancer screenings can help detect potential issues at an early stage, increasing the chances of successful treatment. Similarly, counseling for conditions like diabetes or high blood pressure can help individuals manage their health and potentially avoid more severe complications.

Exploring Alternative Therapies

Alternative therapies, such as acupuncture, chiropractic care, or massage therapy, can provide additional health benefits and potentially reduce the need for more invasive medical treatments. While these therapies may not be covered by traditional insurance plans, exploring options for coverage or out-of-pocket payment can be worthwhile.

For example, some insurance providers offer supplemental plans that cover alternative therapies. These plans often have specific coverage limits and may require pre-authorization for certain treatments. Understanding the coverage details and exploring these options can provide individuals with access to a broader range of healthcare services.

Future Implications and Industry Trends

The landscape of medical insurance is constantly evolving, influenced by advancements in healthcare, changes in regulations, and shifting consumer demands. Understanding these future implications and industry trends is crucial for individuals and businesses to make informed decisions about their healthcare coverage.

The Rise of Telehealth Services

Telehealth services, which involve the use of digital technologies to provide healthcare remotely, have gained significant traction in recent years. This trend is expected to continue, with an increasing number of insurance providers offering coverage for telehealth consultations.

Telehealth services offer numerous benefits, including increased convenience, reduced travel time and costs, and improved access to healthcare for individuals in remote areas. Additionally, telehealth consultations can often be more cost-effective compared to in-person visits, potentially leading to lower healthcare costs.

For instance, an individual with a non-emergency medical issue, such as a minor illness or injury, can consult with a healthcare provider via video call or phone, eliminating the need for an in-person visit and associated costs.

The Impact of Technology on Insurance

Advancements in technology are transforming the insurance industry, leading to more efficient processes and improved customer experiences. Digital platforms and mobile applications are increasingly being used for insurance enrollment, claim submissions, and policy management.

These technological innovations offer several advantages, including streamlined processes, real-time updates, and enhanced data security. Additionally, insurance providers are leveraging data analytics to gain insights into customer needs and preferences, allowing for more tailored insurance offerings.

For example, some insurance providers now offer digital tools that allow customers to easily compare plans, calculate premiums, and enroll in coverage. These tools provide a seamless experience, making it more convenient for individuals to navigate the insurance landscape.

The Role of Artificial Intelligence (AI)

Artificial Intelligence (AI) is playing an increasingly significant role in the insurance industry, particularly in the area of claims processing. AI-powered systems can analyze large volumes of data quickly and accurately, leading to more efficient and effective claims handling.

For instance, AI algorithms can be used to detect patterns in claim submissions, identify potential fraud, and streamline the approval process. This technology can significantly reduce the time and resources required for claims processing, ultimately leading to cost savings for both insurance providers and customers.

The Growing Focus on Wellness and Prevention

There is a growing trend towards focusing on wellness and prevention in the healthcare industry. This shift is driven by the recognition that investing in preventive care and promoting healthy lifestyles can lead to improved health outcomes and reduced healthcare costs in the long term.

Insurance providers are increasingly offering incentives and rewards for individuals who adopt healthy behaviors. For example, some plans provide discounts or waivers for gym memberships, while others offer reduced premiums for individuals who maintain a healthy weight or participate in wellness programs.

Additionally, there is a growing emphasis on providing coverage for a broader range of preventive services, including mental health support, nutrition counseling, and lifestyle coaching. These services aim to address the root causes of health issues, rather than just treating the symptoms.

The Future of Medical Insurance

Looking ahead, the future of medical insurance is likely to be shaped by continued advancements in technology, evolving healthcare needs, and changing regulatory landscapes. While challenges and uncertainties exist, the industry is poised for innovation and adaptation.

As we navigate the complexities of the healthcare system, understanding the factors that influence medical insurance premiums and exploring ways to optimize coverage remains essential. By staying informed and making informed choices, individuals and businesses can ensure they have the coverage they need while managing costs effectively.

How often should I review my medical insurance plan?

+

It’s generally recommended to review your medical insurance plan annually to ensure it aligns with your current needs and circumstances. Life events such as marriage, the birth of a child, or a change in employment can impact your insurance requirements. Regular reviews allow you to stay informed about your coverage and make necessary adjustments.

Can I switch insurance providers if I’m unhappy with my current plan?

+

Yes, you have the option to switch insurance providers if you’re dissatisfied with your current plan. However, it’s important to carefully review the coverage details and terms of the new plan to ensure it meets your needs. Consider factors such as premium costs, coverage limits, and any waiting periods before making a switch.

What are some common mistakes to avoid when choosing a medical insurance plan?

+

Some common mistakes to avoid include selecting a plan solely based on the lowest premium without considering coverage limits, failing to understand the differences between in-network and out-of-network providers, and not reviewing the plan’s prescription drug coverage. It’s crucial to carefully review the plan details and ensure it aligns with your healthcare needs and budget.