Multiple Car Insurance Quotes

When it comes to insuring your vehicles, getting multiple car insurance quotes is a wise move. It allows you to compare coverage options, understand the market, and ultimately make an informed decision. This process ensures you find the best policy for your needs and budget. In this comprehensive guide, we will delve into the world of car insurance, offering expert insights and a detailed analysis to help you navigate the quote-gathering process seamlessly.

Understanding the Importance of Multiple Quotes

In the realm of car insurance, prices can vary significantly between providers, and even for the same provider, quotes can differ based on various factors. By obtaining multiple quotes, you gain a comprehensive view of the market, allowing you to identify the most competitive rates and the best coverage for your unique situation.

Factors Influencing Car Insurance Quotes

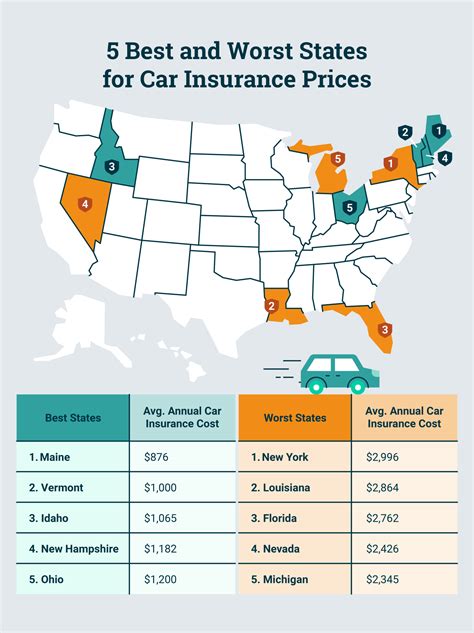

Numerous factors come into play when insurance companies calculate your premium. These include your driving record, the make and model of your vehicle, your age and gender, the location where your car is primarily garaged, and even your credit score. Each insurer has its own methodology for assessing these factors, which is why quotes can vary so widely.

For instance, consider the impact of driving history. A clean record with no accidents or traffic violations may result in lower premiums, while a history of accidents or moving violations could significantly increase your insurance costs. Similarly, the value and safety features of your vehicle can influence quotes. High-end cars or those with advanced safety systems might be deemed less risky by insurers, leading to more favorable rates.

The Process of Obtaining Quotes

The process of gathering car insurance quotes has become increasingly convenient, thanks to online platforms and comparison websites. These tools allow you to input your details once and receive multiple quotes from different insurers, saving you time and effort. However, it’s essential to provide accurate information to ensure the quotes you receive are as precise as possible.

When obtaining quotes, be mindful of the coverage options you're selecting. Car insurance typically comes in various forms, such as liability-only, comprehensive, or collision coverage. Each type offers different levels of protection, and the cost will vary accordingly. Make sure you understand the distinctions and choose the coverage that aligns with your needs.

Comparing Quotes: What to Look For

Once you’ve gathered a selection of quotes, it’s time to compare them. This step is crucial to ensuring you make an informed decision. Here are some key aspects to consider when evaluating car insurance quotes.

Coverage and Policy Details

The first thing to examine is the level of coverage each quote offers. Compare the liability limits, deductibles, and additional coverage options such as rental car reimbursement or towing and labor. Ensure that the quotes provide the level of protection you desire, and don’t be afraid to ask for clarifications if needed.

| Coverage Aspect | Important Considerations |

|---|---|

| Liability Coverage | Check the bodily injury and property damage limits. Higher limits offer more protection but cost more. |

| Comprehensive and Collision Coverage | Consider your vehicle's age and value. Older cars might not need full coverage. |

| Deductibles | Higher deductibles lower premiums, but ensure you can afford them in case of a claim. |

| Additional Coverages | Evaluate the need for rental car reimbursement, roadside assistance, or other add-ons. |

Cost and Payment Options

Of course, the cost of the policy is a significant factor. Compare the annual premiums and consider any discounts or payment plans offered. Some insurers may provide discounts for bundling multiple policies or for certain safety features in your vehicle. Additionally, inquire about payment flexibility and whether there are any fees associated with different payment methods.

Company Reputation and Customer Service

While cost and coverage are crucial, it’s also essential to consider the reputation and reliability of the insurance company. Look for companies with a history of strong financial stability and positive customer reviews. You want to ensure that the insurer will be there to assist you in the event of a claim and that they have a good track record for prompt and fair payouts.

Maximizing Your Savings: Tips and Strategies

Obtaining multiple car insurance quotes is an excellent start, but there are additional steps you can take to potentially reduce your insurance costs further.

Improving Your Driving Record

A clean driving record is a significant factor in determining your insurance premium. If you have had accidents or violations in the past, focus on safe driving practices to improve your record over time. Many insurers offer discounts for accident-free periods, so maintaining a clean record can lead to substantial savings.

Exploring Discounts and Bundling Options

Insurers often provide a variety of discounts to attract and retain customers. These can include good student discounts for young drivers with high grades, safe driver discounts, loyalty discounts for long-term customers, or bundling discounts when you insure multiple vehicles or combine car insurance with other policies like homeowners or renters insurance.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is an innovative approach where your premium is based on your actual driving behavior. This can be a great option for safe drivers, as it offers the potential for significant savings. With usage-based insurance, the insurer tracks your driving habits through a device installed in your vehicle or an app on your smartphone, providing data on factors like miles driven, time of day, and braking habits.

Making the Final Decision: Choosing the Right Policy

After careful comparison and consideration, it’s time to select the car insurance policy that best fits your needs and budget. Remember, the cheapest option might not always be the best, and vice versa. Strive for a balance between coverage, cost, and the insurer’s reputation.

Seeking Professional Advice

If you’re still unsure about which policy to choose, consider consulting an insurance agent or broker. These professionals can provide expert advice tailored to your situation and help you navigate the complexities of car insurance. They can also assist in ensuring that you have the appropriate coverage limits and any necessary endorsements to protect your unique circumstances.

Understanding Policy Terms and Conditions

Before finalizing your decision, carefully review the policy documents and terms and conditions. Ensure you understand the coverage exclusions, claim process, and any potential penalties for late payments or policy cancellations. This step is crucial to avoid any unpleasant surprises down the road.

Renewal and Regular Review

Car insurance policies typically have a renewal period, often annually. It’s essential to review your policy regularly to ensure it still meets your needs and to take advantage of any changes in your circumstances that might lead to savings. For example, if you’ve recently moved to a new area or purchased a new vehicle, these changes could impact your insurance rates and coverage requirements.

FAQ

How often should I review my car insurance policy?

+

It’s recommended to review your policy annually, especially around your renewal date. This allows you to assess any changes in your circumstances or the market that could impact your coverage or premiums.

Can I switch insurers mid-policy term if I find a better deal?

+

Yes, you can switch insurers at any time, but be aware of potential cancellation fees or penalties. Some insurers may also require a minimum policy term before allowing cancellations. Always check the terms of your existing policy before making a change.

What should I do if I’m not satisfied with the quotes I receive?

+

If you’re not happy with the quotes, consider refining your search criteria or exploring alternative insurance providers. You can also reach out to an insurance broker who can help you navigate the market and find more suitable options.

Are there any drawbacks to usage-based insurance?

+

Usage-based insurance can be advantageous for safe drivers, but it may not be suitable for everyone. Some drivers may find the tracking aspect intrusive, and the savings aren’t guaranteed. It’s essential to understand the terms and conditions before opting for this type of insurance.

Can I negotiate my car insurance premium with the insurer?

+

While it’s uncommon to directly negotiate premiums with insurers, you can discuss your concerns and explore options with your insurance agent or broker. They may be able to suggest adjustments to your coverage or explore alternative providers to find a more suitable rate.