What Happens If Your Insurance Gets Cancelled For Non Payment

When it comes to insurance policies, timely payments are crucial to maintaining coverage. However, life can sometimes present financial challenges, leading to missed or delayed payments. In such scenarios, insurance companies have protocols in place to address non-payment, which may ultimately result in policy cancellation. Understanding the implications and potential consequences of a cancelled insurance policy is essential for policyholders.

The Impact of Non-Payment

When an insurance policyholder fails to make the required premium payments, the insurance company typically initiates a series of actions to recover the outstanding amount. These actions can vary depending on the insurance provider and the terms of the policy.

Grace Periods and Late Fees

Many insurance companies offer a grace period after the due date for premium payments. This grace period allows policyholders a few extra days to make their payments without facing immediate consequences. During this period, the policy remains active, and the policyholder can make the payment without incurring any penalties. The length of the grace period can vary, but it is often around 30 days.

If the premium remains unpaid after the grace period, the insurance company may assess a late fee to cover administrative costs and to discourage late payments. Late fees can vary, but they are usually a percentage of the premium or a fixed amount. It's important to note that some insurance providers may waive the late fee for the first missed payment or offer payment plans to help policyholders catch up.

| Insurance Type | Average Grace Period (Days) | Late Fee Range |

|---|---|---|

| Auto Insurance | 20-30 | $5-$25 |

| Homeowners Insurance | 25-35 | $10-$30 |

| Health Insurance | 25-45 | 1% - 2% of Premium |

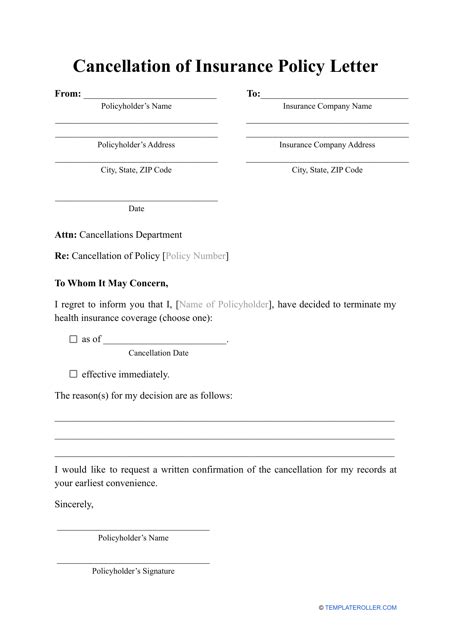

Notice of Cancellation

If the premium remains unpaid after the grace period and late fees have been applied, the insurance company will typically send a Notice of Cancellation to the policyholder. This notice serves as a formal warning that the policy is at risk of cancellation due to non-payment.

The Notice of Cancellation will outline the amount owed, the deadline for payment, and the consequences of non-compliance. It will also provide information on how to reinstate the policy if the payment is made before the cancellation date.

It's crucial for policyholders to carefully review this notice and take immediate action to avoid policy cancellation. Missing this deadline could result in the policy being terminated, leading to significant implications.

Consequences of Policy Cancellation

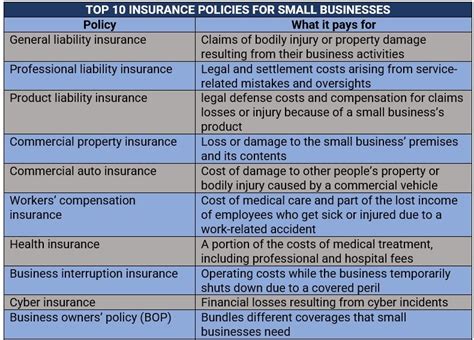

When an insurance policy is cancelled for non-payment, the policyholder faces a range of consequences, each with potential long-term impacts. These consequences can vary depending on the type of insurance and the specific circumstances surrounding the cancellation.

Loss of Coverage

The most immediate and obvious consequence of a cancelled insurance policy is the loss of coverage. This means that the policyholder is no longer protected by the insurance policy, and any claims or incidents that occur after the cancellation date will not be covered.

For example, if an auto insurance policy is cancelled and the policyholder gets into an accident, they will be responsible for all the costs associated with the accident, including repairs, medical bills, and any legal expenses. Similarly, a cancelled homeowners insurance policy leaves the policyholder vulnerable to financial losses in the event of a fire, theft, or natural disaster.

Financial Penalties and Fees

In addition to losing coverage, policyholders may face financial penalties and fees as a result of policy cancellation. These fees can include:

- Cancellation Fees: Some insurance companies charge a fee for cancelling a policy, regardless of the reason. This fee is often a percentage of the remaining premium or a fixed amount.

- Unpaid Premium Balance: If the policy was cancelled during the policy term, the policyholder may still owe the remaining premium balance. The insurance company may pursue collection efforts to recover this amount, which can lead to additional fees and negative impacts on the policyholder's credit score.

- Increased Future Premiums: A history of cancelled policies due to non-payment can impact future insurance premiums. Insurance companies may view such policyholders as high-risk and charge higher rates to compensate for the increased risk.

Legal and Regulatory Implications

In certain cases, the cancellation of an insurance policy can have legal and regulatory implications, especially if the policy is mandated by law or required by a contract.

For example, most states require drivers to carry auto insurance. If a driver's auto insurance policy is cancelled for non-payment, they may face legal consequences, including fines, license suspension, or even criminal charges. Similarly, homeowners with mortgages often have a contractual obligation to maintain homeowners insurance, and failure to do so can result in legal action by the mortgage lender.

Difficulty in Obtaining Future Insurance

A history of cancelled insurance policies can make it more challenging to obtain future insurance coverage. Insurance companies review an applicant’s insurance history, including any cancellations, when determining eligibility and setting premiums.

Policyholders with a history of cancellations may be viewed as high-risk, and insurance companies may be hesitant to offer them coverage. If coverage is granted, it may come with higher premiums, stricter terms, or even exclusions. This can make it difficult for policyholders to find affordable and comprehensive insurance in the future.

Options for Policyholders

If a policyholder finds themselves facing policy cancellation due to non-payment, there are several options they can explore to avoid the consequences outlined above.

Make the Payment

The simplest and most effective option is to make the overdue payment as soon as possible. This will prevent the policy from being cancelled and avoid the financial and legal consequences associated with cancellation.

Policyholders should contact their insurance company to discuss payment options and ensure that the payment is made within the grace period or before the cancellation date. Many insurance companies offer flexible payment plans or allow policyholders to pay online or over the phone.

Seek Financial Assistance

If financial hardship is the reason for non-payment, policyholders should consider seeking financial assistance to help them catch up on their insurance premiums.

This could involve exploring government assistance programs, reaching out to community organizations, or discussing payment plans with their insurance provider. Some insurance companies may be willing to work with policyholders to find a solution that fits their financial situation.

Reinstatement of the Policy

If a policy has been cancelled due to non-payment, policyholders may have the option to reinstate the policy if they make the overdue payment within a certain timeframe.

The reinstatement process and timelines vary depending on the insurance company and the specific policy. Policyholders should contact their insurance provider to inquire about the reinstatement process and any associated fees or requirements.

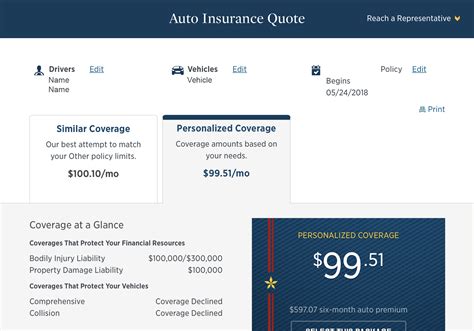

Shop for New Insurance

In some cases, it may be necessary for policyholders to shop for new insurance if their current policy is cancelled or if they are unable to reinstate it.

This process can be challenging, especially with a history of cancelled policies, but it is not impossible. Policyholders should compare quotes from multiple insurance companies and be transparent about their past cancellations to find the best coverage at a reasonable rate.

Tips for Avoiding Policy Cancellation

Preventing policy cancellation due to non-payment is always the best course of action. Here are some tips to help policyholders avoid this situation:

- Set up automatic payments or payment reminders to ensure premiums are paid on time.

- Review your insurance coverage and premiums regularly to ensure they align with your financial situation and needs. Consider reducing coverage or shopping for more affordable options if necessary.

- If you anticipate financial difficulties, contact your insurance provider to discuss your situation and explore payment plan options or coverage adjustments.

- Build an emergency fund specifically for insurance premiums to cover unexpected costs or periods of financial strain.

Conclusion

Insurance policy cancellation due to non-payment can have significant and long-lasting consequences. From losing coverage to facing financial penalties and legal issues, the impact of a cancelled policy can be far-reaching. However, by understanding the process, being proactive about payments, and seeking assistance when needed, policyholders can avoid these consequences and maintain their insurance coverage.

What happens if I miss a payment but make it before the cancellation date?

+

If you make the overdue payment before the cancellation date, your policy will typically remain active. However, you may still be charged a late fee, and it’s important to ensure future payments are made on time to avoid further issues.

Can I get my policy reinstated after cancellation due to non-payment?

+

Yes, you may have the option to reinstate your policy by making the overdue payment within a certain timeframe. Contact your insurance provider to inquire about the reinstatement process and any associated fees.

Will a cancelled policy due to non-payment impact my credit score?

+

Yes, a cancelled policy due to non-payment can negatively impact your credit score. Insurance companies may report the cancellation to credit bureaus, which can affect your creditworthiness in the future.

Are there any government programs to help with insurance premiums for those facing financial hardship?

+

Yes, some states and municipalities offer programs to assist low-income individuals and families with insurance premiums. These programs vary, so it’s important to research and reach out to your local government or community organizations for more information.