Average Monthly Auto Insurance

When it comes to auto insurance, one of the most common questions people have is about the average monthly cost. Auto insurance is a necessary expense for any vehicle owner, and understanding the average rates can provide valuable insights into budgeting and financial planning. In this comprehensive guide, we will delve into the world of auto insurance, exploring the factors that influence monthly premiums, providing real-world examples, and offering expert advice to help you navigate the insurance landscape effectively.

Understanding Average Monthly Auto Insurance Rates

The average monthly auto insurance premium varies significantly depending on numerous factors, including your location, driving history, vehicle type, and coverage choices. While it's challenging to pinpoint an exact figure, we can provide a general overview based on industry data and real-life scenarios.

According to recent studies, the national average monthly auto insurance cost for a standard policy ranges between $100 and $200. However, it's crucial to note that this is just an estimate, and your personal circumstances will ultimately determine your specific premium.

Factors Influencing Auto Insurance Rates

Several key factors play a role in determining your auto insurance rates. Understanding these factors can help you make informed decisions when choosing a policy and potentially save money in the long run.

- Location: Where you live or primarily drive your vehicle can significantly impact your insurance rates. Urban areas tend to have higher premiums due to increased traffic, accident rates, and theft risks. Rural areas, on the other hand, often enjoy lower rates.

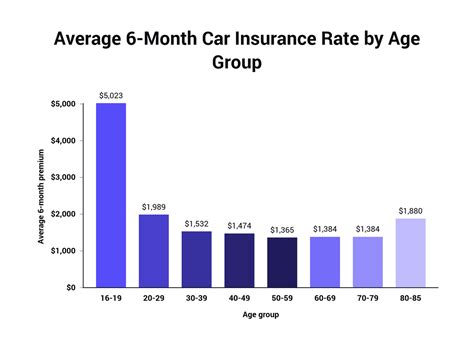

- Age and Gender: Insurance companies consider demographic factors such as age and gender when calculating rates. Young drivers, particularly males under 25, often face higher premiums due to their higher risk profiles. As drivers gain experience and reach certain age milestones, their rates may decrease.

- Driving History: Your driving record is a critical factor in determining insurance costs. A clean driving history with no accidents or violations can lead to lower premiums. Conversely, multiple accidents or traffic violations can result in significantly higher rates or even insurance denials.

- Vehicle Type and Usage: The make, model, and year of your vehicle, as well as its primary usage, influence insurance rates. Sports cars and luxury vehicles generally attract higher premiums due to their higher repair costs and theft risks. Additionally, vehicles used for business or pleasure may have different insurance requirements and costs.

- Coverage Options: The type and level of coverage you choose also impact your monthly premiums. Comprehensive and collision coverage, which protect against various risks, tend to be more expensive than liability-only coverage. Customizing your policy to meet your specific needs is essential, but it's wise to strike a balance between coverage and cost.

Real-World Examples of Average Monthly Premiums

To provide a clearer picture, let's examine some real-world examples of average monthly auto insurance premiums based on different scenarios:

| Scenario | Average Monthly Premium |

|---|---|

| Single 30-year-old male with a clean driving record, driving a 2018 Toyota Camry in a suburban area | $120 |

| Married couple in their 40s with two teenage drivers, owning a 2020 Honda Civic and a 2016 Ford F-150 in a rural area | $180 |

| 22-year-old female student with a minor traffic violation, driving a 2015 Nissan Sentra in an urban area | $150 |

| Retired couple in their 60s with a long history of safe driving, owning a 2019 Tesla Model 3 in a suburban area | $110 |

Maximizing Savings on Auto Insurance

Now that we have a better understanding of average monthly auto insurance rates, let's explore some strategies to help you minimize your insurance costs without compromising on coverage.

Shop Around and Compare Quotes

One of the most effective ways to save on auto insurance is to shop around and compare quotes from multiple providers. Insurance companies use different algorithms and criteria to calculate premiums, so getting quotes from at least three to five insurers can help you find the most competitive rates.

Utilize online comparison tools and insurance marketplaces to streamline the process. These platforms allow you to input your details once and receive multiple quotes, making it easier to identify the best deal.

Bundling Policies

If you have multiple insurance needs, such as auto, home, or renters' insurance, consider bundling your policies with the same provider. Many insurance companies offer discounts when you combine multiple policies, potentially saving you a significant amount on your overall premiums.

Safe Driving Discounts

Insurance companies often reward safe driving behaviors with discounts. If you have a clean driving record and maintain a safe driving habit, you may be eligible for various discounts, such as accident-free, good student, or safe driver discounts. These discounts can significantly reduce your monthly premiums, so be sure to inquire about them when discussing your policy options.

Telematics or Usage-Based Insurance

Some insurance companies offer telematics or usage-based insurance programs that monitor your driving behavior and reward safe driving with lower premiums. These programs typically involve installing a device in your vehicle or using a smartphone app to track your driving habits, such as speeding, hard braking, and time of day driving.

While telematics programs may not be suitable for everyone, they can provide substantial savings for safe drivers. However, it's essential to carefully review the terms and conditions and ensure your privacy is protected.

Raising Deductibles

Increasing your deductible, the amount you pay out of pocket before your insurance coverage kicks in, is another way to lower your monthly premiums. By assuming a higher portion of the risk, you can reduce your insurance costs. However, it's crucial to choose a deductible amount that aligns with your financial capabilities and comfort level.

The Impact of Coverage Choices on Monthly Premiums

Your choice of coverage options significantly influences your monthly auto insurance premiums. Understanding the different types of coverage and their implications can help you make informed decisions when selecting a policy.

Liability Coverage

Liability coverage is the most basic and legally required type of auto insurance in most states. It covers damages and injuries you cause to others in an at-fault accident. Liability coverage typically includes bodily injury liability and property damage liability.

While liability-only coverage is the most affordable option, it may not provide sufficient protection in certain situations. It's essential to carefully assess your risk tolerance and financial capabilities when deciding on liability limits.

Comprehensive and Collision Coverage

Comprehensive and collision coverage are optional but highly recommended types of auto insurance. Comprehensive coverage protects against damages caused by non-accident events, such as theft, vandalism, natural disasters, and animal collisions. Collision coverage, on the other hand, covers damages to your vehicle in an accident, regardless of fault.

Adding comprehensive and collision coverage to your policy can significantly increase your monthly premiums. However, these coverages provide valuable protection against unforeseen events and can save you from costly out-of-pocket expenses.

Medical Payments and Personal Injury Protection (PIP)

Medical payments and Personal Injury Protection (PIP) coverages provide additional protection for medical expenses incurred in an accident, regardless of fault. These coverages can help cover the cost of medical treatments, rehabilitation, and lost wages, ensuring you receive the necessary care without straining your finances.

While medical payments and PIP coverage may increase your monthly premiums, they offer peace of mind and financial security in the event of an accident.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist (UM/UIM) coverage is another important type of auto insurance that provides protection in the event of an accident with a driver who has no insurance or insufficient insurance coverage. UM/UIM coverage can help cover your medical expenses, property damage, and lost wages in such situations.

Although UM/UIM coverage may add to your monthly premiums, it is a wise investment to protect yourself from the financial burden of an accident caused by an uninsured or underinsured driver.

Future Trends and Innovations in Auto Insurance

The auto insurance industry is continuously evolving, and several trends and innovations are shaping the future of insurance coverage. Staying informed about these developments can help you make more informed decisions and potentially benefit from new opportunities.

Telematics and Usage-Based Insurance Expansion

Telematics and usage-based insurance programs are expected to become more prevalent in the coming years. As technology advances and data collection becomes more sophisticated, insurance companies will have access to more accurate driving behavior data, allowing them to offer personalized premiums based on individual driving habits.

AI and Machine Learning Integration

Artificial Intelligence (AI) and machine learning technologies are transforming the insurance industry. Insurers are leveraging these technologies to analyze vast amounts of data, improve risk assessment, and enhance customer experiences. AI-powered chatbots and virtual assistants are already being used to provide instant quotes and answer customer inquiries.

Connected Car Technology

The rise of connected car technology, such as vehicle-to-everything (V2X) communication and advanced driver-assistance systems (ADAS), is set to revolutionize auto insurance. These technologies can provide real-time data on driving behavior, vehicle diagnostics, and accident detection, allowing insurance companies to offer more accurate and personalized coverage.

Blockchain and Smart Contracts

Blockchain technology and smart contracts are being explored to streamline insurance processes and enhance transparency. Blockchain can secure and verify insurance transactions, while smart contracts can automate various insurance functions, such as claims processing and policy issuance, reducing administrative costs and improving efficiency.

Personalized Insurance Policies

With the wealth of data and advanced analytics available, insurance companies are moving towards offering highly personalized insurance policies. These policies will be tailored to individual driving behaviors, vehicle usage patterns, and even lifestyle choices, providing customers with coverage that aligns perfectly with their needs and preferences.

Conclusion

Understanding the average monthly auto insurance rates and the factors that influence them is crucial for effective financial planning and responsible vehicle ownership. By considering your unique circumstances, shopping around for quotes, and making informed coverage choices, you can find the right balance between cost and protection.

Stay informed about the latest trends and innovations in the auto insurance industry to stay ahead of the curve and potentially benefit from new opportunities. Remember, auto insurance is an essential investment to protect your financial well-being and ensure peace of mind on the road.

How often should I review my auto insurance policy and premiums?

+It’s a good practice to review your auto insurance policy and premiums annually or whenever significant life changes occur, such as getting married, having children, or purchasing a new vehicle. Regular reviews ensure your coverage remains adequate and help you identify potential savings opportunities.

What are some common discounts available for auto insurance?

+Common discounts for auto insurance include safe driver discounts, good student discounts, multi-policy discounts (when bundling multiple policies with the same insurer), and loyalty discounts for long-term customers. Additionally, some insurers offer discounts for vehicles equipped with safety features or for policyholders who maintain a good credit score.

How can I lower my auto insurance premiums without sacrificing coverage?

+To lower your auto insurance premiums without compromising coverage, consider increasing your deductible, shopping around for quotes from multiple insurers, and exploring discounts such as safe driver or good student discounts. Additionally, maintaining a clean driving record and avoiding unnecessary coverage options can help keep your premiums in check.