Usaa Home And Auto Insurance

When it comes to protecting your home and vehicles, choosing the right insurance provider is crucial. USAA, a well-known name in the insurance industry, offers a comprehensive range of coverage options specifically tailored for military members, veterans, and their families. In this article, we will delve into the world of USAA's home and auto insurance, exploring its unique features, benefits, and why it might be the perfect choice for your insurance needs.

Understanding USAA Home Insurance

USAA’s home insurance policies are designed to provide comprehensive protection for military homeowners. With a focus on military-specific risks and needs, USAA offers a range of coverage options to cater to different housing situations.

Coverage Options

USAA’s home insurance policies offer standard coverage for most homeowners, including protection against damages caused by fire, theft, wind, and other perils. Additionally, they provide unique coverages tailored to military life, such as:

- Deployment Coverage: This coverage offers additional protection for military members deployed overseas. It includes increased coverage limits for personal property and can extend to cover additional living expenses if a deployment results in an extended stay away from home.

- Military Equipment Coverage: Recognizing the unique possessions of military members, USAA provides coverage for military equipment and gear, ensuring that items like uniforms, weapons, and specialized tools are protected.

- Base Housing Coverage: For military members living on base, USAA offers coverage for personal belongings and liability while residing in base housing. This coverage can be especially valuable for those frequently relocating due to military orders.

Discounts and Savings

USAA is known for its commitment to providing affordable insurance options. Here are some of the discounts and savings available to policyholders:

- Multi-Policy Discount: By bundling your home and auto insurance policies with USAA, you can save up to 10% on your overall insurance costs.

- Loyalty Discount: USAA rewards long-term members with a loyalty discount, offering savings of up to 10% for every five years you remain a policyholder.

- Safe Driver Discount: Safe and responsible driving can lead to significant savings. USAA offers discounts for accident-free driving, with potential savings of up to 20%.

- Home Safety Discounts: Installing security systems, smoke detectors, and other safety measures can result in further discounts, encouraging policyholders to prioritize home safety.

Claims Process

USAA understands the importance of a smooth and efficient claims process, especially for military members who may be deployed or relocated. Their claims process is designed with military life in mind, offering:

- 24⁄7 Claims Support: USAA provides round-the-clock claims support, ensuring that policyholders can reach out at any time, from anywhere, to report and manage claims.

- Military-Trained Claims Adjusters: USAA’s claims adjusters are trained to understand the unique circumstances and challenges faced by military members, ensuring a more personalized and efficient claims experience.

- Mobile App Claims Management: USAA’s mobile app allows policyholders to manage their claims digitally, providing real-time updates and streamlining the entire claims process.

USAA Auto Insurance: Protecting Your Vehicles

USAA’s auto insurance policies are designed to offer comprehensive protection for military vehicle owners. With a focus on military-specific needs and risks, USAA provides a range of coverage options to cater to different driving situations.

Coverage Options

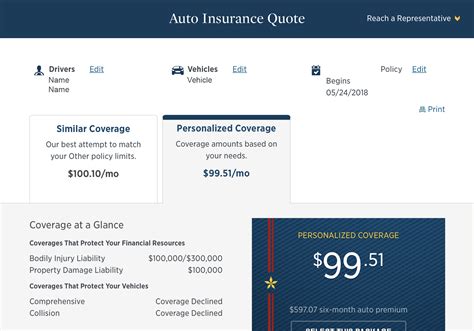

USAA’s auto insurance policies offer standard coverage for most drivers, including liability, collision, and comprehensive coverage. Additionally, they provide unique coverages tailored to military life, such as:

- Deployment Coverage: Similar to home insurance, USAA’s auto insurance policies offer additional protection for deployed military members. This coverage can include increased coverage limits for rental cars and can extend to cover additional expenses incurred due to deployment.

- Military Equipment Transportation: Recognizing the need to transport military equipment and gear, USAA provides coverage for trailers and specialized vehicles used for this purpose.

- Base Housing Vehicle Coverage: For military members living on base, USAA offers coverage for vehicles parked on base housing premises, ensuring peace of mind for those frequently relocating.

Discounts and Savings

USAA’s auto insurance policies offer a range of discounts and savings opportunities, including:

- Multi-Policy Discount: As mentioned earlier, bundling your home and auto insurance policies with USAA can lead to significant savings, with potential discounts of up to 10%.

- Safe Driver Discount: USAA rewards safe and responsible driving with discounts of up to 20%, encouraging policyholders to maintain a clean driving record.

- Military Discounts: USAA offers exclusive discounts to military members, recognizing their unique contributions. These discounts can vary based on rank, length of service, and other factors.

- Vehicle Safety Discounts: Installing safety features like anti-theft devices, airbags, and advanced driver-assistance systems can lead to further discounts, encouraging policyholders to prioritize vehicle safety.

Claims Process

USAA’s auto insurance claims process is designed with military life in mind, offering:

- 24⁄7 Claims Support: Similar to home insurance, USAA provides round-the-clock claims support for auto insurance policyholders, ensuring prompt assistance regardless of the time or location.

- Military-Trained Claims Adjusters: USAA’s auto insurance claims adjusters are trained to understand the unique challenges faced by military members, providing a more personalized and efficient claims experience.

- Rental Car Coverage: In the event of a covered loss, USAA offers rental car coverage, ensuring policyholders have a temporary vehicle while their own car is being repaired or replaced.

FAQ

Can I get home insurance with USAA if I’m not a military member or veteran?

+While USAA’s primary focus is on serving military members, veterans, and their families, they do offer certain insurance products to the general public. However, their home insurance policies are primarily designed for military homeowners.

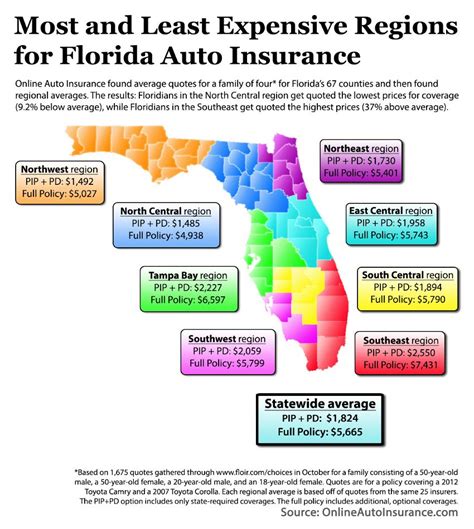

How does USAA determine insurance rates for auto insurance policies?

+USAA takes into account various factors when determining insurance rates, including the make and model of the vehicle, the driver’s age and driving record, the location of the vehicle, and the coverage options chosen. They also offer discounts based on military rank and length of service.

What is the process for filing a claim with USAA’s home insurance?

+To file a claim with USAA’s home insurance, policyholders can contact USAA’s 24⁄7 claims support line, use the mobile app, or visit their online claims center. USAA’s claims adjusters will guide policyholders through the process, ensuring a smooth and efficient resolution.

Are there any limitations or exclusions in USAA’s auto insurance policies?

+Like any insurance policy, USAA’s auto insurance policies have certain limitations and exclusions. These may include damages caused by wear and tear, mechanical breakdowns, intentional acts, or damages resulting from illegal activities. It’s important to carefully review the policy documents to understand the specific exclusions.