Auto Insurance In Fl

When it comes to auto insurance, Florida residents have a unique set of considerations due to the state's specific regulations and unique driving environment. Auto insurance in Florida is a complex topic that warrants a detailed exploration, as it impacts millions of drivers and their financial well-being. In this comprehensive guide, we will delve into the intricacies of auto insurance in Florida, offering valuable insights and expert advice to help Floridians make informed decisions about their coverage.

Understanding Florida’s Auto Insurance Requirements

Florida stands out as one of the few states that does not mandate drivers to carry liability insurance for bodily injury. However, this does not mean that drivers are exempt from financial responsibility. Instead, Florida requires proof of financial responsibility in various situations, such as when registering a vehicle or facing a traffic violation. This proof can be demonstrated through several methods, including:

- A valid auto insurance policy.

- A cash deposit of $50,000 with the Department of Highway Safety and Motor Vehicles (DHSMV).

- A surety bond of at least $50,000 issued by an authorized insurance company.

- A certificate of self-insurance for those who own multiple vehicles.

It's important to note that while Florida's insurance requirements may seem less stringent compared to other states, the consequences of driving without proper financial responsibility can be severe. Drivers caught without proof of financial responsibility may face penalties, including license suspension and registration revocation.

The Florida No-Fault System

Florida operates under a no-fault insurance system, which means that regardless of who is at fault in an accident, each driver’s insurance policy covers their own medical expenses and lost wages up to a certain limit. This system aims to streamline the claims process and reduce litigation. Under Florida’s Personal Injury Protection (PIP) law, drivers are required to carry at least $10,000 in PIP coverage, which provides compensation for medical bills and lost wages after an accident.

However, it's crucial to understand that the no-fault system has limitations. In certain situations, such as severe injuries or damages exceeding policy limits, drivers may need to file a liability claim against the at-fault party. This is where comprehensive understanding of one's insurance policy and Florida's legal framework becomes essential.

Choosing the Right Auto Insurance Coverage in Florida

While Florida’s insurance requirements provide a basic framework, drivers have the flexibility to choose additional coverage options to tailor their policy to their specific needs. Here are some key considerations when selecting auto insurance coverage in Florida:

Liability Coverage

Although not mandatory, liability coverage is highly recommended. It provides protection against claims for bodily injury and property damage caused to others in an accident for which you are at fault. Experts suggest carrying liability limits higher than the state minimum to ensure adequate protection in case of severe accidents.

| Coverage Type | Recommended Limit |

|---|---|

| Bodily Injury Liability (per person) | $100,000 |

| Bodily Injury Liability (per accident) | $300,000 |

| Property Damage Liability | $100,000 |

Uninsured/Underinsured Motorist Coverage

Given that Florida does not require liability insurance, carrying Uninsured Motorist (UM) and Underinsured Motorist (UIM) coverage is crucial. This coverage protects you in the event of an accident with a driver who has no insurance or insufficient insurance to cover the damages. UM/UIM coverage pays for your medical expenses, lost wages, and other damages up to your policy limits.

Experts recommend carrying UM/UIM coverage limits equal to or higher than your liability coverage limits to ensure maximum protection.

Collision and Comprehensive Coverage

Collision coverage pays for repairs or replacement of your vehicle after an accident, regardless of fault. Comprehensive coverage, on the other hand, covers damage to your vehicle caused by non-accident events, such as theft, vandalism, natural disasters, or collisions with animals. While these coverages are optional, they provide valuable protection for your vehicle’s value.

Medical Payments Coverage (MedPay)

MedPay is an optional coverage that provides additional medical expense coverage for you and your passengers after an accident. It can help cover deductibles, co-pays, and other out-of-pocket expenses not covered by your health insurance or PIP policy. MedPay can be a valuable addition to your policy, especially if you have high deductibles or limited health insurance coverage.

Factors Affecting Auto Insurance Rates in Florida

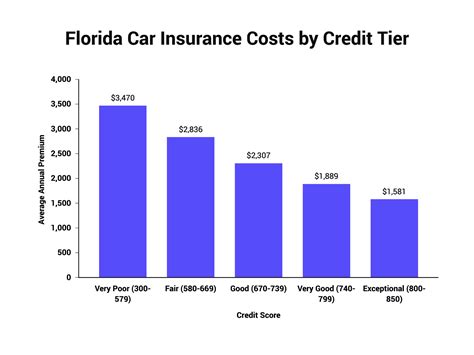

Like in any state, auto insurance rates in Florida are influenced by a multitude of factors. Understanding these factors can help drivers make informed choices and potentially reduce their insurance costs. Here are some key considerations:

Driving History

Your driving record is a significant factor in determining your insurance rates. A clean driving history with no at-fault accidents or moving violations can lead to lower premiums. Conversely, a history of accidents or traffic violations can result in higher rates or even difficulty finding an insurer willing to cover you.

Vehicle Type and Usage

The make, model, and year of your vehicle play a role in determining your insurance rates. Factors such as the vehicle’s safety ratings, repair costs, and theft frequency can impact the cost of coverage. Additionally, the primary use of your vehicle, whether for commuting, business, or pleasure, can also affect your rates.

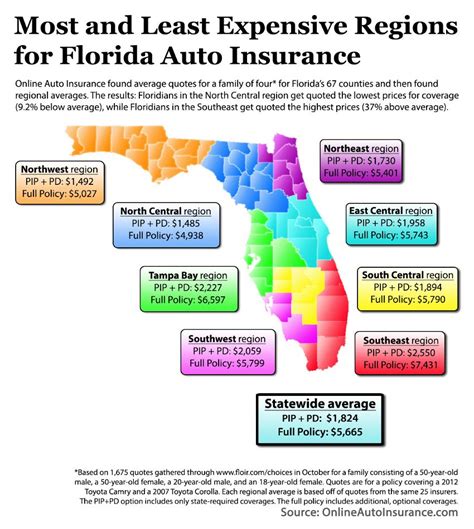

Location and Mileage

Your address and annual mileage are crucial factors in determining insurance rates. Urban areas often have higher rates due to increased traffic congestion and the higher likelihood of accidents and theft. Similarly, driving more miles annually may result in higher rates, as it increases the risk of accidents.

Insurance Company and Policy Features

Different insurance companies offer varying policy features and pricing structures. Shopping around and comparing quotes from multiple insurers can help you find the best coverage at the most competitive rates. Additionally, the features and discounts offered by insurers, such as multi-policy discounts or safe driver incentives, can significantly impact your overall cost.

Navigating Claims and Disputes in Florida

Understanding the claims process and your rights as a policyholder is crucial when dealing with auto insurance in Florida. Here’s what you need to know:

Filing a Claim

In the event of an accident or vehicle damage, it’s important to promptly report the incident to your insurance company. Most insurers provide online or mobile app options for reporting claims, making the process more convenient. Be sure to gather all necessary information, including photos of the damage, witness statements, and contact information for involved parties.

Dealing with Disputes

In some cases, disputes may arise between policyholders and insurance companies. This could be due to disagreements over the value of a claim, the extent of damages, or the interpretation of policy terms. If a dispute cannot be resolved through direct communication with your insurer, Florida provides several avenues for resolving insurance-related conflicts, including mediation and arbitration services.

Florida’s Consumer Protection Laws

Florida has consumer protection laws in place to ensure that insurance companies act fairly and in good faith. These laws outline the rights and responsibilities of both policyholders and insurers, providing a framework for resolving disputes. Familiarizing yourself with these laws can empower you to advocate for your rights effectively.

Future Trends and Innovations in Florida’s Auto Insurance Landscape

The auto insurance industry in Florida, like elsewhere, is evolving rapidly due to technological advancements and changing consumer preferences. Here are some trends and innovations to watch for:

Telematics and Usage-Based Insurance (UBI)

Telematics devices and UBI programs are gaining traction in Florida. These technologies track driving behavior, such as acceleration, braking, and mileage, to offer personalized insurance rates based on actual driving habits. For safe drivers, UBI can result in significant premium discounts.

Digital Transformation

The digital revolution is transforming the insurance industry, with more insurers offering online and mobile app services for policy management, claims reporting, and customer support. This shift towards digital platforms enhances convenience and efficiency for policyholders.

Automated Vehicles and Safety Innovations

The increasing adoption of automated vehicle technologies and advanced safety features is expected to have a significant impact on auto insurance. As these technologies become more prevalent, they may lead to a reduction in accidents and, consequently, insurance claims. This could potentially result in lower insurance rates over time.

What is the average cost of auto insurance in Florida?

+The average cost of auto insurance in Florida varies based on numerous factors, including driving history, vehicle type, location, and coverage options. According to recent data, the average annual premium in Florida is around $1,600. However, it’s important to note that rates can vary significantly depending on individual circumstances.

How can I lower my auto insurance rates in Florida?

+There are several strategies to potentially reduce your auto insurance rates in Florida. These include maintaining a clean driving record, shopping around for the best rates, considering higher deductibles, and exploring discounts such as multi-policy or safe driver discounts. Additionally, opting for telematics or UBI programs, if available, can reward safe driving with lower premiums.

What happens if I drive without insurance in Florida?

+Driving without insurance in Florida can result in severe penalties. You may face fines, license suspension, and even criminal charges. Additionally, if you’re involved in an accident, you’ll be personally responsible for all damages and injuries, which can lead to significant financial burdens. It’s crucial to maintain proper insurance coverage to avoid these consequences.

Can I get auto insurance without a license in Florida?

+Obtaining auto insurance without a valid driver’s license can be challenging. Most insurance companies require a valid license as part of their underwriting process. However, if you have a valid license from another state or country, some insurers may still provide coverage. It’s advisable to consult with insurance agents or brokers to explore your options in such cases.