Best Auto Insurance Cheap

Navigating the world of auto insurance can be a daunting task, especially when you're on the hunt for the best coverage at an affordable price. With numerous providers offering a wide range of policies, it's crucial to make an informed decision that not only meets your needs but also fits within your budget. In this comprehensive guide, we'll delve into the intricacies of auto insurance, exploring the factors that influence cost, the coverage options available, and the steps you can take to secure the best insurance for your vehicle without breaking the bank.

Understanding the Factors that Impact Auto Insurance Costs

The cost of auto insurance is influenced by a multitude of factors, each playing a unique role in determining the price you’ll pay for coverage. Here’s a breakdown of some of the key elements that impact your insurance premiums:

Your Driving History

One of the most significant factors in determining your auto insurance rates is your driving record. Insurance providers carefully scrutinize your driving history, taking into account any accidents, traffic violations, or claims you’ve made in the past. A clean driving record typically leads to lower premiums, while a history of accidents or violations can result in higher costs.

Vehicle Type and Usage

The type of vehicle you drive and how you use it also play a vital role in determining your insurance rates. Sports cars, luxury vehicles, and high-performance models often come with higher insurance costs due to their higher repair and replacement expenses. Additionally, the frequency and purpose of your driving can impact your rates. If you use your vehicle for business purposes or commute long distances daily, your insurance premiums may be higher.

Location and Demographics

Your geographical location and demographic factors can significantly influence your insurance rates. Insurance providers consider the crime rates, traffic density, and accident statistics in your area when determining your premiums. Moreover, demographic factors such as age, gender, and marital status can also impact your insurance costs. For instance, younger drivers are often considered higher risk and may face higher insurance premiums.

Credit Score and Insurance Score

Your credit score and insurance score are also taken into account when calculating your insurance premiums. Insurance providers use these scores to assess your financial responsibility and predict your likelihood of filing a claim. A higher credit score and insurance score can lead to lower insurance costs, as they indicate a lower risk profile.

Exploring Coverage Options and Choosing the Right Policy

Now that we’ve established the factors that impact auto insurance costs, let’s delve into the world of coverage options and how to choose the right policy for your needs and budget.

Liability Coverage

Liability coverage is a fundamental component of any auto insurance policy. It protects you financially in the event that you’re found at fault for an accident, covering the costs of bodily injury and property damage claims made against you. Most states require a minimum level of liability coverage, but it’s essential to consider your specific needs and opt for higher limits if necessary.

Collision and Comprehensive Coverage

Collision and comprehensive coverage are optional add-ons to your auto insurance policy, but they can provide valuable protection in specific situations. Collision coverage pays for repairs or replacements to your vehicle if you’re involved in an accident, regardless of fault. Comprehensive coverage, on the other hand, covers damage to your vehicle resulting from non-accident events, such as theft, vandalism, natural disasters, or collisions with animals.

Personal Injury Protection (PIP) and Medical Payments Coverage

Personal Injury Protection (PIP) and Medical Payments coverage are designed to cover your medical expenses and those of your passengers in the event of an accident. While PIP coverage is mandatory in some states, it’s often an optional add-on in others. Medical Payments coverage, on the other hand, provides additional coverage for medical expenses not covered by your health insurance or PIP.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist coverage is another important consideration when choosing your auto insurance policy. This coverage protects you financially if you’re involved in an accident with a driver who has no insurance or insufficient insurance to cover the costs of the accident. It ensures that you’re not left financially vulnerable in such situations.

Choosing the Right Coverage and Provider

When selecting your auto insurance coverage, it’s crucial to consider your unique needs and budget. Evaluate the different coverage options and choose the ones that provide adequate protection without exceeding your financial means. Additionally, researching and comparing insurance providers is essential to finding the best rates and coverage options. Look for providers with a strong reputation, excellent customer service, and a range of discounts to help reduce your premiums.

Strategies to Secure the Best Auto Insurance at a Discounted Price

Finding affordable auto insurance doesn’t have to be a daunting task. With the right strategies and a bit of research, you can secure the best coverage at a discounted price. Here are some tips to help you save on your auto insurance premiums:

Shop Around and Compare Quotes

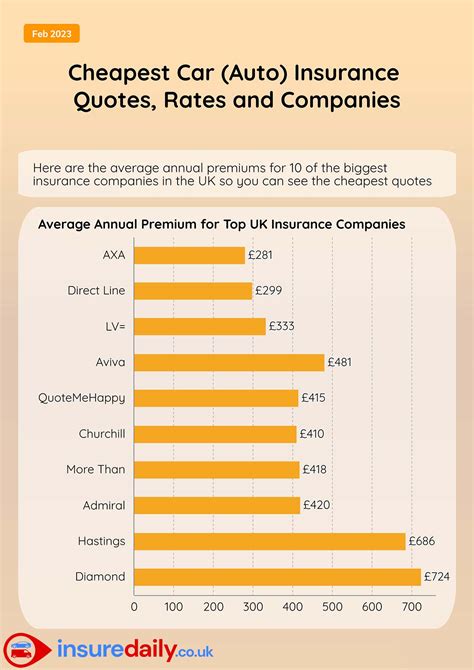

One of the most effective ways to find affordable auto insurance is to shop around and compare quotes from multiple providers. Each insurance company has its own pricing structure and discounts, so obtaining quotes from at least three providers can help you identify the most competitive rates. Online quote comparison tools can simplify this process, allowing you to quickly assess different options.

Bundle Your Policies

Bundling your auto insurance with other types of insurance, such as homeowners or renters insurance, can lead to significant savings. Many insurance providers offer multi-policy discounts, rewarding customers who choose to consolidate their insurance needs with a single provider. By bundling your policies, you can often secure a discounted rate on your auto insurance.

Utilize Discounts

Insurance providers offer a variety of discounts to help reduce your premiums. Some common discounts include safe driver discounts, good student discounts, loyalty discounts, and discounts for completing defensive driving courses. Research the discounts available from different providers and ensure you’re taking advantage of all the discounts for which you’re eligible.

Consider Higher Deductibles

Opting for a higher deductible on your auto insurance policy can lead to lower premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By increasing your deductible, you assume more financial responsibility in the event of an accident, which can result in reduced insurance costs. However, it’s important to choose a deductible amount that you can comfortably afford.

Maintain a Clean Driving Record

As mentioned earlier, your driving record is a significant factor in determining your auto insurance rates. Maintaining a clean driving record by avoiding accidents, traffic violations, and claims can lead to lower insurance premiums. Safe driving not only reduces your risk of accidents but also demonstrates your responsibility as a driver, which is often rewarded with lower insurance costs.

Review Your Policy Regularly

It’s essential to regularly review your auto insurance policy to ensure you’re getting the best coverage at the most competitive price. Insurance rates can change over time, and your personal circumstances may also evolve. By reviewing your policy annually or whenever your life circumstances change, you can ensure that your coverage remains adequate and that you’re not overpaying for unnecessary features.

The Future of Auto Insurance: Emerging Trends and Technologies

The auto insurance industry is constantly evolving, with new trends and technologies shaping the way insurance is provided and priced. Here’s a glimpse into the future of auto insurance and the potential impact on consumers:

Telematics and Usage-Based Insurance

Telematics technology, which involves the use of sensors and data analytics, is transforming the way auto insurance is priced. Usage-based insurance, also known as pay-as-you-drive insurance, uses telematics to track driving behavior and calculate insurance premiums based on actual usage. This approach can benefit safe drivers by offering more accurate and personalized insurance rates.

Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning are being increasingly adopted by insurance providers to streamline processes and enhance accuracy. These technologies can analyze vast amounts of data to identify patterns and predict risks more effectively. As a result, insurance providers can offer more precise pricing and coverage options, benefiting consumers with tailored insurance plans.

Connected Cars and Data-Driven Insurance

The rise of connected cars, equipped with advanced sensors and communication technologies, is paving the way for data-driven insurance. These vehicles generate a wealth of data, providing insurance providers with real-time insights into driving behavior, vehicle performance, and road conditions. By leveraging this data, insurance providers can offer more dynamic and personalized insurance plans, potentially reducing costs for safe drivers.

Blockchain and Smart Contracts

Blockchain technology and smart contracts have the potential to revolutionize the auto insurance industry. Blockchain can provide a secure and transparent platform for storing and sharing insurance data, reducing the risk of fraud and enhancing efficiency. Smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, can automate various insurance processes, such as claims handling and policy administration, leading to faster and more efficient operations.

The Impact of Electric and Autonomous Vehicles

The transition to electric and autonomous vehicles is set to bring significant changes to the auto insurance landscape. Electric vehicles (EVs) are generally considered safer and more environmentally friendly, which could lead to lower insurance premiums. Autonomous vehicles, with their advanced safety features and reduced risk of human error, could further drive down insurance costs. However, the widespread adoption of these technologies may also present new challenges and risks that insurance providers will need to address.

Conclusion: Navigating the Road Ahead

Securing the best auto insurance at a cheap price requires a comprehensive understanding of the factors that influence cost, a careful evaluation of coverage options, and a strategic approach to policy selection. By staying informed, comparing quotes, and utilizing discounts, you can find affordable insurance that meets your needs. As the auto insurance industry continues to evolve with emerging trends and technologies, consumers can expect more personalized and data-driven insurance plans, potentially leading to further savings.

How much does auto insurance typically cost per month?

+The cost of auto insurance varies widely depending on factors such as your location, driving record, and the type of vehicle you drive. On average, you can expect to pay anywhere from 50 to 200 per month for auto insurance, but premiums can be significantly higher or lower depending on your individual circumstances.

Are there any ways to lower my auto insurance premiums without compromising coverage?

+Yes, there are several strategies you can employ to lower your auto insurance premiums without sacrificing coverage. These include shopping around for quotes, bundling your policies, maintaining a clean driving record, and increasing your deductible. Additionally, taking advantage of discounts for safe driving, good student status, or loyalty can help reduce your premiums.

What factors influence the cost of my auto insurance policy?

+The cost of your auto insurance policy is influenced by various factors, including your driving record, the type of vehicle you drive, your location, and your demographic factors such as age and gender. Additionally, your credit score and insurance score can impact your premiums. It’s important to consider these factors when shopping for auto insurance to ensure you’re getting the best rate.