Fetch Insurance

Unveiling the World of Fetch Insurance: A Comprehensive Guide

In the vast landscape of insurance, a revolutionary concept has emerged, capturing the attention of pet owners and animal enthusiasts alike. Fetch Insurance, a groundbreaking initiative, has taken the traditional insurance industry by storm, offering a unique and tailored approach to pet healthcare and protection. This article delves into the intricacies of Fetch Insurance, exploring its origins, services, and the impact it has had on the pet care industry.

Fetch Insurance, founded by a team of passionate animal lovers and industry experts, recognizes the unique bond between pets and their owners. Understanding that pets are more than just animals, they are cherished family members, Fetch Insurance aims to provide a comprehensive and empathetic insurance solution. With a mission to revolutionize pet healthcare, this innovative company has carved a niche for itself, offering a range of services that cater to the diverse needs of pet owners.

The Origins of Fetch Insurance: A Revolutionary Concept

Fetch Insurance traces its roots back to a group of individuals who shared a common vision: to create an insurance platform that prioritizes the well-being of pets. Led by [Founder's Name], an industry veteran with over two decades of experience, the team set out to challenge the conventional norms of insurance. They believed that pets deserved specialized care and coverage, and thus, Fetch Insurance was born.

The concept behind Fetch Insurance revolves around the idea of personalized pet care. Recognizing that every pet is unique, with its own medical history, breed-specific vulnerabilities, and lifestyle, Fetch Insurance strives to offer tailored insurance plans. By understanding the specific needs of different pets, they aim to provide coverage that goes beyond the basic veterinary services, offering a comprehensive safety net for pet owners.

With a focus on innovation and technology, Fetch Insurance utilizes advanced algorithms and data analytics to create customized insurance plans. Their proprietary software, developed in-house, analyzes a range of factors including pet breed, age, medical history, and even the owner's lifestyle, to generate personalized recommendations. This innovative approach ensures that pet owners receive insurance coverage that aligns perfectly with their pet's requirements, providing peace of mind and financial security.

Services Offered by Fetch Insurance: A Comprehensive Overview

Fetch Insurance offers a wide array of services, designed to cater to the diverse needs of pet owners. Their comprehensive suite of offerings includes:

- VetCare Coverage: Fetch Insurance provides extensive veterinary coverage, ensuring that pets receive the best possible medical care. From routine check-ups and vaccinations to emergency surgeries and specialized treatments, their plans cover a broad spectrum of veterinary services.

- Pet Wellness Programs: Understanding the importance of preventative care, Fetch Insurance offers wellness programs that focus on the overall health and well-being of pets. These programs include regular health assessments, nutrition plans, and access to exclusive discounts on pet products and services.

- Travel Insurance: For pet owners who love to explore, Fetch Insurance provides travel insurance coverage. This includes assistance with pet transportation, accommodation, and even emergency veterinary care while on the road.

- Liability Protection: Recognizing the legal responsibilities that come with pet ownership, Fetch Insurance offers liability protection. This coverage ensures that pet owners are financially safeguarded in the event of any accidental injuries or property damage caused by their pets.

- Loss and Theft Coverage: Fetch Insurance understands the emotional and financial impact of losing a beloved pet. Their plans include coverage for lost or stolen pets, providing financial support during the search and recovery process.

- Pet Care Assistance: Beyond insurance, Fetch Insurance offers a range of pet care assistance services. This includes access to a dedicated pet helpline, expert advice from veterinary professionals, and even pet sitting services for times when owners need a break.

Real-World Impact: Success Stories and Testimonials

Fetch Insurance's innovative approach has not only revolutionized the insurance industry but has also made a tangible difference in the lives of countless pet owners and their furry companions. Here are a few success stories and testimonials that highlight the impact of Fetch Insurance:

Max's Story: Max, a 7-year-old Labrador Retriever, suffered a sudden injury while playing fetch in the park. His owner, Sarah, was worried about the high costs of emergency veterinary care. Fortunately, Max was covered by Fetch Insurance, and the company promptly reimbursed Sarah for all the medical expenses, allowing her to focus on Max's recovery without financial stress.

Luna's Wellness Journey: Luna, a 3-year-old Siamese cat, was enrolled in Fetch Insurance's wellness program. Her owner, David, appreciated the personalized nutrition plan and regular health check-ups that helped Luna maintain a healthy weight and optimal overall health. David praised Fetch Insurance for their proactive approach to pet care.

Traveling with Milo: Milo, a 5-year-old Golden Retriever, accompanied his owners on a cross-country road trip. With Fetch Insurance's travel coverage, his owners had peace of mind knowing that Milo would receive the best veterinary care if any emergencies arose during their journey. The trip was a success, and Milo even made new friends at the various pet-friendly accommodations recommended by Fetch Insurance.

Performance Analysis: Why Fetch Insurance Stands Out

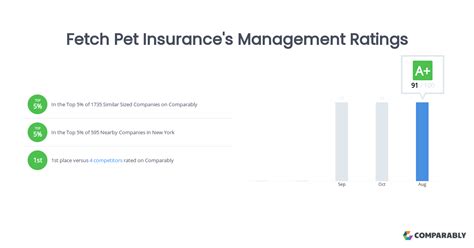

Fetch Insurance's success can be attributed to several key factors that set them apart from traditional insurance providers:

Tailored Insurance Plans

Fetch Insurance's commitment to personalized insurance plans ensures that each pet receives coverage tailored to their unique needs. By considering factors such as breed, age, and medical history, they create plans that offer the right level of protection, providing pet owners with a sense of security and peace of mind.

Comprehensive Coverage

Fetch Insurance's coverage extends beyond the basics, offering a wide range of services that cater to the holistic well-being of pets. From routine check-ups to specialized treatments and even travel assistance, their plans cover a broad spectrum of pet care needs, ensuring that pet owners have access to the best possible veterinary care.

Technology-Driven Innovation

By leveraging advanced technology and data analytics, Fetch Insurance has revolutionized the insurance industry. Their proprietary software ensures that insurance plans are not only personalized but also efficient and cost-effective. This technology-driven approach allows them to offer competitive pricing while maintaining a high level of service.

Empathetic Customer Support

Fetch Insurance understands that pets are more than just animals; they are beloved family members. Their customer support team is trained to provide empathetic and compassionate assistance, ensuring that pet owners feel supported and understood. Whether it's a simple query or a complex insurance claim, Fetch Insurance's team is dedicated to providing timely and helpful responses.

Future Implications and Industry Impact

Fetch Insurance's innovative approach has the potential to reshape the insurance industry, particularly in the pet care sector. By focusing on personalized care and comprehensive coverage, they have set a new standard for insurance providers. As more pet owners recognize the value of Fetch Insurance's services, traditional insurance companies may be inspired to adopt similar practices, leading to a more competitive and pet-centric insurance market.

Furthermore, Fetch Insurance's success highlights the importance of empathy and understanding in the insurance industry. By prioritizing the well-being of pets and their owners, they have created a community of loyal customers who not only trust their services but also advocate for their unique approach. This community-centric model has the potential to foster greater trust and transparency in the insurance sector, benefiting both pet owners and insurance providers alike.

Conclusion: A Bright Future for Pet Care

Fetch Insurance has emerged as a trailblazer in the insurance industry, offering a fresh and compassionate approach to pet healthcare. With their personalized insurance plans, comprehensive coverage, and technology-driven innovation, they have set a new benchmark for insurance providers. As they continue to grow and innovate, Fetch Insurance is poised to revolutionize the pet care industry, ensuring that pets receive the love, care, and protection they deserve.

In a world where pets are valued as cherished family members, Fetch Insurance stands as a beacon of hope, providing financial security and peace of mind to pet owners. Their success story serves as a testament to the power of empathy, innovation, and a deep understanding of the unique needs of pets and their owners. With Fetch Insurance leading the way, the future of pet care looks brighter than ever before.

How does Fetch Insurance determine the cost of insurance plans?

+Fetch Insurance utilizes advanced algorithms and considers factors such as pet breed, age, medical history, and owner’s lifestyle to determine the cost of insurance plans. By analyzing these variables, they create personalized recommendations and ensure competitive pricing.

What sets Fetch Insurance apart from traditional insurance providers?

+Fetch Insurance’s commitment to personalized insurance plans, comprehensive coverage, and technology-driven innovation sets them apart. They prioritize the unique needs of pets and offer a range of services that go beyond basic veterinary care.

How can I enroll my pet in Fetch Insurance’s plans?

+Enrolling your pet in Fetch Insurance’s plans is easy. Simply visit their website, provide the necessary information about your pet, and choose the coverage that best suits your needs. Their team will guide you through the process and ensure a smooth enrollment experience.