Best Insurance Rates For Home And Auto

When it comes to protecting your home and vehicle, finding the best insurance rates is a crucial step to ensure financial security. The insurance market offers a wide range of options, and navigating through them can be challenging. This comprehensive guide aims to provide valuable insights and expert advice to help you secure the most favorable insurance rates for your home and auto needs.

Understanding the Factors That Influence Insurance Rates

Before diving into the world of insurance quotes, it’s essential to grasp the key factors that insurance providers consider when determining your premium rates. These factors play a significant role in tailoring your insurance policy and pricing.

1. Risk Assessment

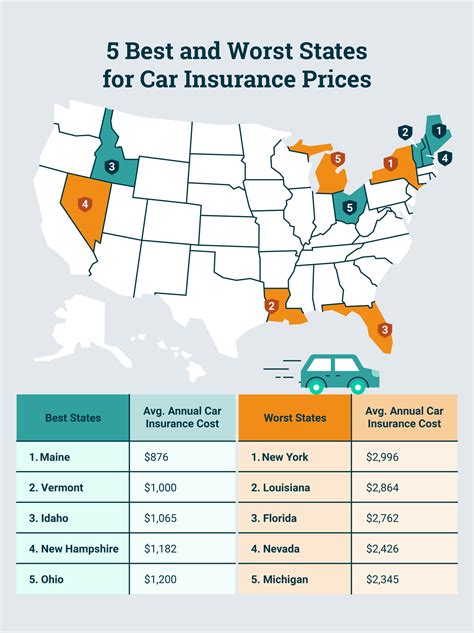

Insurance companies assess the level of risk associated with insuring your home and vehicle. Factors such as your location, the age and condition of your property, and the make and model of your car are taken into account. High-risk areas or older properties may result in higher premiums.

| Risk Factor | Description |

|---|---|

| Natural Disasters | Areas prone to earthquakes, hurricanes, or floods often carry higher insurance costs. |

| Theft and Crime Rates | Higher rates of theft or crime in your neighborhood can impact insurance premiums. |

| Vehicle Statistics | Sports cars or high-performance vehicles are often associated with higher risks and costs. |

2. Personal Profile and History

Your personal information and insurance history are crucial in determining your rates. Factors like age, driving record, and claims history are considered. Younger drivers or those with a history of accidents or claims may face higher premiums.

3. Coverage and Deductibles

The level of coverage you choose directly impacts your insurance rates. Comprehensive coverage options, such as collision and comprehensive insurance for your vehicle or additional coverage for your home, can increase your premiums. Additionally, selecting higher deductibles can lead to lower premiums.

4. Discounts and Bundling

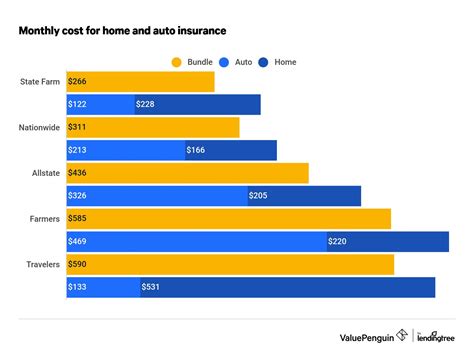

Insurance providers often offer discounts to attract customers. Bundling your home and auto insurance policies with the same company is a common strategy to secure significant savings. Additionally, discounts may be available for safety features, good grades, or loyalty.

Comparing Insurance Providers: A Step-by-Step Guide

To secure the best insurance rates, it’s essential to compare quotes from multiple providers. Here’s a step-by-step process to help you navigate the insurance market effectively.

1. Identify Your Insurance Needs

Start by assessing your specific insurance requirements. Determine the coverage limits, deductibles, and additional features you desire for both your home and auto insurance. This clarity will guide your search and help you make informed decisions.

2. Research Top Insurance Companies

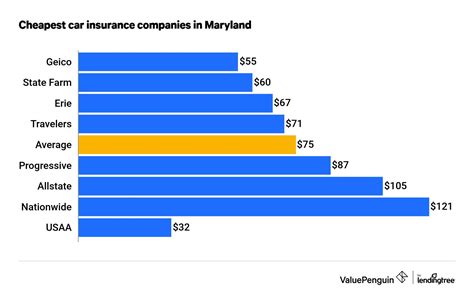

Compile a list of reputable insurance providers known for their reliability and customer satisfaction. Online reviews, industry rankings, and recommendations from trusted sources can assist in this process. Consider both local and national insurers to explore a wide range of options.

3. Gather Quotes and Compare

Reach out to the shortlisted insurance companies and request quotes. Ensure you provide consistent and accurate information to each provider to facilitate an accurate comparison. Compare the quotes based on the coverage, deductibles, and overall cost to identify the most suitable options.

4. Evaluate Additional Benefits and Services

Beyond the quoted premiums, consider the additional benefits and services offered by each insurance provider. Look for features such as 24⁄7 customer support, digital tools for policy management, and claims assistance. These factors can significantly impact your overall insurance experience.

5. Bundle and Negotiate

Bundling your home and auto insurance policies can lead to substantial savings. Many insurance providers offer discounts when you combine multiple policies. Additionally, don’t hesitate to negotiate with insurers. Discuss your specific needs and request customized quotes to find the best deal.

Maximizing Savings: Tips and Strategies

Securing the best insurance rates involves a combination of research, negotiation, and understanding your options. Here are some expert tips to help you maximize your savings:

- Shop around regularly: Insurance rates can vary significantly over time. Regularly review and compare quotes to ensure you're getting the best deal.

- Increase deductibles: Opting for higher deductibles can lower your insurance premiums. However, ensure you can afford the higher deductible in the event of a claim.

- Maintain a clean driving record: A clean driving history with no accidents or violations can lead to lower insurance rates. Safe driving is not only beneficial for your safety but also for your wallet.

- Explore discounts: Insurance providers offer various discounts, such as multi-policy, good student, loyalty, or safety feature discounts. Take advantage of these opportunities to reduce your premiums.

- Consider usage-based insurance: Some insurers offer usage-based insurance programs that track your driving habits. Safe and responsible driving can result in lower premiums.

Expert Insights: Navigating the Complexities of Insurance

Navigating the insurance market can be complex, and seeking expert advice can provide valuable insights. Here are some industry-specific tips to consider when securing the best insurance rates for your home and auto:

1. Work with an Insurance Broker

Insurance brokers can be your trusted allies in finding the best insurance rates. They have access to multiple insurance providers and can negotiate on your behalf. Brokers can offer personalized advice and assist in comparing quotes to find the most suitable policy for your needs.

2. Understand Policy Exclusions

Carefully review the policy exclusions and limitations outlined in your insurance contracts. Understanding what is and isn’t covered can prevent surprises and ensure you have adequate protection.

3. Review and Update Your Policies Regularly

Insurance needs can change over time. Regularly review your policies to ensure they align with your current circumstances. Life events such as marriage, home renovations, or adding a teen driver to your policy may require adjustments to your coverage.

4. Stay Informed about Insurance Trends

Keep yourself updated on insurance industry trends and changes. This knowledge can help you anticipate rate fluctuations and make informed decisions. Stay connected with reputable insurance resources and industry publications to stay ahead of the curve.

Conclusion: Empowering Your Insurance Journey

Securing the best insurance rates for your home and auto is a crucial step towards financial protection and peace of mind. By understanding the factors that influence insurance rates, comparing quotes, and implementing expert tips, you can navigate the insurance market with confidence. Remember, insurance is a long-term commitment, and taking the time to research and make informed decisions will pay off in the long run.

How often should I review my insurance policies?

+It’s recommended to review your insurance policies annually or whenever there are significant changes in your life. Regular reviews ensure your coverage remains adequate and up-to-date.

Can I negotiate insurance rates directly with providers?

+Absolutely! Insurance providers often welcome negotiations, especially when you have a good driving record or are a loyal customer. Don’t hesitate to discuss your needs and request customized quotes.

What are some common discounts offered by insurance companies?

+Insurance companies offer a variety of discounts, including multi-policy discounts, good student discounts, safe driver discounts, and loyalty discounts. Explore these options to maximize your savings.