How Much Does Pet Insurance Cost

Pet insurance is a valuable investment for pet owners, offering financial protection and peace of mind when it comes to unexpected veterinary costs. The cost of pet insurance varies depending on several factors, including the type of coverage, the pet's breed, age, and location, as well as the chosen provider. In this comprehensive guide, we will delve into the various aspects that influence pet insurance pricing and provide you with the knowledge to make an informed decision.

Understanding the Factors Affecting Pet Insurance Costs

When considering pet insurance, it's essential to understand the key factors that impact the cost of coverage. These factors can significantly influence the overall premium you pay, so let's explore them in detail.

Pet's Breed and Age

One of the primary factors influencing pet insurance costs is the breed and age of your furry companion. Different breeds are predisposed to specific health conditions, and younger pets generally have lower premiums due to their lower risk of developing serious health issues. For instance, certain purebred dogs may have a higher risk of genetic disorders, which can lead to increased insurance costs.

Furthermore, as pets age, their healthcare needs tend to increase, resulting in higher insurance premiums. It's important to note that some insurance providers may impose age restrictions or offer limited coverage for older pets.

Coverage Type and Level

The type and level of coverage you choose play a significant role in determining the cost of your pet insurance policy. Pet insurance policies typically fall into two main categories: accident-only and comprehensive coverage.

- Accident-Only Coverage: As the name suggests, this type of policy covers injuries and accidents but excludes illnesses and chronic conditions. It is often more affordable but may not provide sufficient protection for pets with pre-existing conditions or those prone to certain illnesses.

- Comprehensive Coverage: Comprehensive pet insurance policies offer a wider range of benefits, covering both accidents and illnesses. They typically include reimbursement for veterinary expenses, medications, surgeries, and even routine care. While comprehensive coverage provides more extensive protection, it also comes at a higher cost.

Deductibles and Co-pays

Deductibles and co-pays are additional factors that can affect the overall cost of pet insurance. Deductibles refer to the amount you must pay out of pocket before your insurance coverage kicks in, while co-pays are the portion of the bill you pay after insurance coverage has been applied.

Higher deductibles and co-pays generally result in lower monthly premiums, as you are sharing a larger portion of the financial risk with the insurance provider. On the other hand, lower deductibles and co-pays lead to higher monthly premiums but provide greater financial protection in the event of unexpected veterinary expenses.

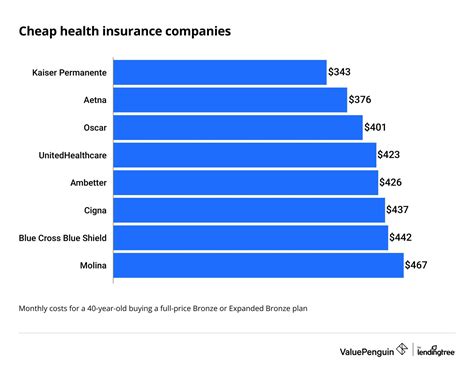

Location and Provider

The location where you reside and the insurance provider you choose can also impact the cost of pet insurance. Veterinary costs and the availability of specialized veterinary services can vary significantly from one region to another. As a result, pet insurance premiums may reflect these regional differences.

Additionally, different insurance providers offer varying levels of coverage, customer service, and claim processing times. It's essential to compare multiple providers and evaluate their reputation, financial stability, and the range of services they offer to find the best value for your pet's needs.

Comparing Pet Insurance Plans and Costs

Now that we've explored the key factors influencing pet insurance costs, let's take a closer look at some real-world examples to better understand the range of prices and coverage options available.

Example 1: Accident-Only Coverage for a Young Cat

Suppose you have a young, healthy domestic shorthair cat named Whiskers. You opt for accident-only coverage, which typically costs less than comprehensive plans. The monthly premium for Whiskers' accident-only insurance could range from $15 to $25, depending on your location and the insurance provider.

This plan would provide coverage for accidents such as injuries from a fall or being hit by a car. It would typically include reimbursement for veterinary fees, medications, and surgery costs related to these accidents.

Example 2: Comprehensive Coverage for an Older Dog

Let's consider another scenario with an older Labrador Retriever named Max. Max is 8 years old and has a history of allergies and occasional ear infections. You decide to opt for comprehensive coverage to ensure his health needs are well-protected.

The monthly premium for Max's comprehensive insurance could range from $40 to $60, taking into account his age and pre-existing conditions. This plan would cover not only accidents but also illnesses, including veterinary visits, medications, and specialized treatments for his allergies and ear infections.

| Plan Type | Whiskers (Cat) | Max (Dog) |

|---|---|---|

| Coverage | Accident-Only | Comprehensive |

| Monthly Premium | $15 - $25 | $40 - $60 |

| Inclusions | Accident-related expenses | Accident and illness coverage |

Maximizing Value and Affordability

When selecting a pet insurance plan, finding a balance between coverage and affordability is essential. Here are some strategies to help you maximize the value of your pet insurance while keeping costs manageable.

Shop Around and Compare Providers

Pet insurance is a competitive market, and prices can vary significantly between providers. Take the time to research and compare multiple insurance companies to find the best coverage at the most competitive rates. Consider factors such as coverage options, claim processing times, and customer reviews when making your decision.

Consider Discounts and Bundles

Many insurance providers offer discounts and bundles that can help reduce the cost of your pet insurance. For example, some companies provide discounts for multiple pets insured under the same policy or offer discounts for enrolling multiple pets from the same household.

Additionally, some providers may offer discounts for enrolling in automatic payment plans or paying your premium annually instead of monthly.

Adjust Deductibles and Co-pays

As mentioned earlier, adjusting your deductibles and co-pays can impact your monthly premium. If you're comfortable sharing more of the financial risk, opting for higher deductibles and co-pays can result in lower monthly payments. However, it's important to choose a deductible and co-pay structure that aligns with your financial capabilities and provides sufficient protection for your pet's healthcare needs.

The Future of Pet Insurance: Trends and Innovations

The pet insurance industry is continuously evolving, with new trends and innovations shaping the way pet owners protect their furry companions. Here's a glimpse into the future of pet insurance and what it may hold.

Telehealth and Virtual Veterinary Care

The rise of telehealth services has extended to the veterinary field, offering pet owners convenient and affordable access to veterinary care. Some insurance providers now cover telehealth consultations, providing pet owners with the option to seek medical advice and guidance remotely. This trend is expected to continue, making veterinary care more accessible and potentially reducing the need for in-person visits for minor issues.

Personalized Coverage Plans

Insurance providers are increasingly adopting personalized coverage plans tailored to the specific needs of individual pets. These plans take into account factors such as breed, age, and pre-existing conditions to offer customized coverage options. By providing personalized plans, insurance companies can better address the unique healthcare requirements of different pets, ensuring more comprehensive and cost-effective coverage.

Wellness and Preventive Care Coverage

The focus on preventive care and wellness is gaining momentum in the pet insurance industry. Many providers now offer coverage for routine care, vaccinations, and preventive treatments, such as flea and tick control. By investing in preventive care, pet owners can potentially avoid more costly illnesses and injuries, ultimately reducing the need for extensive veterinary treatments.

Frequently Asked Questions

Can I get pet insurance for my older pet?

+Yes, many insurance providers offer coverage for older pets. However, it's important to note that premiums may be higher for older pets due to their increased risk of developing health issues. It's recommended to research and compare providers to find the best coverage options for your senior pet.

What is not covered by pet insurance?

+Pet insurance typically excludes pre-existing conditions, meaning any illness or injury that your pet had prior to enrolling in the insurance plan. It's crucial to review the policy's terms and conditions to understand any exclusions and limitations.

Can I switch pet insurance providers if I find a better deal?

+Yes, you have the freedom to switch pet insurance providers if you find a more suitable or cost-effective option. However, it's essential to carefully review the terms and conditions of the new policy to ensure a smooth transition and avoid any gaps in coverage.

Do I need to pay a deductible for every claim?

+It depends on the specific terms of your insurance policy. Some policies require a separate deductible for each claim, while others may have an annual deductible that covers all claims within a policy year. It's important to understand your policy's deductible structure to manage your financial responsibilities effectively.

How do I make a claim with my pet insurance provider?

+The claim process can vary depending on the insurance provider. Generally, you'll need to submit a claim form, provide veterinary invoices, and possibly include additional documentation. It's recommended to familiarize yourself with your provider's claim process and have the necessary information readily available when making a claim.

Pet insurance is an investment in your pet’s health and well-being, offering financial protection and peace of mind. By understanding the factors that influence pet insurance costs and exploring the various coverage options available, you can make an informed decision to ensure your furry companion receives the care they deserve.