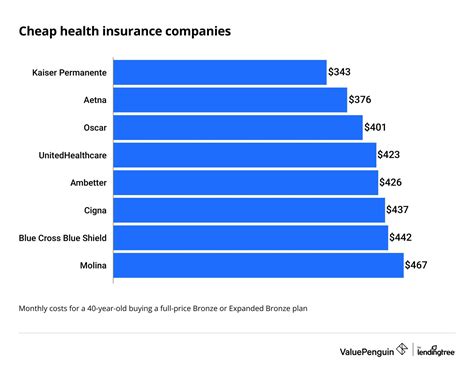

What Is The Cheapest Health Insurance

Finding the cheapest health insurance can be a challenging task, as the cost of coverage can vary greatly depending on several factors. It's important to note that the most affordable option might not always be the best choice for your specific needs. However, understanding the factors that influence insurance costs can help you make an informed decision. This comprehensive guide aims to provide insights into the world of health insurance, offering valuable information to assist you in your search for affordable coverage.

Understanding Health Insurance Costs

The cost of health insurance is influenced by a multitude of factors, including your location, age, health status, and the type of coverage you require. Insurance companies consider these variables to assess the level of risk associated with providing coverage to individuals. Let’s delve into each of these factors to gain a clearer understanding.

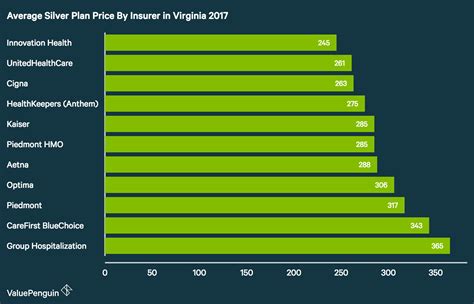

Location

The geographical area in which you reside plays a significant role in determining the cost of your health insurance. Healthcare costs can vary widely across different regions, and insurance providers factor in these regional differences when setting their rates. For instance, the cost of healthcare services in urban areas with specialized medical facilities is generally higher compared to rural areas. This disparity can significantly impact the price of your insurance premium.

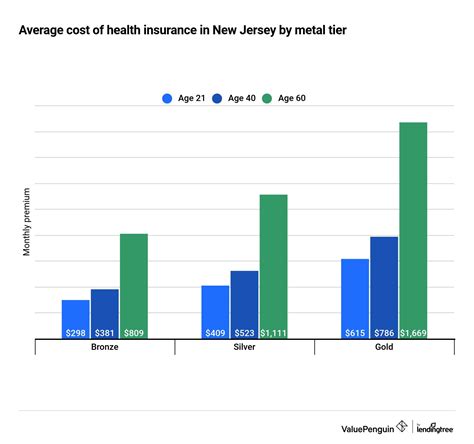

Age

Age is another critical factor that insurance companies consider when calculating premiums. Generally, younger individuals tend to have lower healthcare costs compared to older adults, as they are less likely to require frequent medical attention. Consequently, insurance companies often offer more affordable rates to younger people. As you age, the cost of your health insurance is likely to increase, reflecting the higher probability of needing medical care.

Health Status

Your current health status is a primary determinant of the cost of your health insurance. If you have a history of serious medical conditions or are currently managing a chronic illness, insurance companies may view you as a higher risk and charge higher premiums. Conversely, if you are in good health and have no significant medical issues, you may be eligible for more affordable coverage.

Type of Coverage

The type of health insurance coverage you choose also influences the cost. Different plans offer varying levels of coverage and benefits. For instance, a comprehensive plan that covers a wide range of services and treatments is likely to be more expensive than a basic plan with limited coverage. It’s crucial to assess your healthcare needs and select a plan that provides adequate coverage without exceeding your budget.

Exploring Affordable Health Insurance Options

Now that we’ve discussed the factors that impact the cost of health insurance, let’s explore some strategies to find affordable coverage that suits your needs.

Employer-Sponsored Plans

One of the most common and often most affordable ways to obtain health insurance is through an employer-sponsored plan. Many employers offer healthcare coverage as part of their benefits package, and employees may have the option to enroll in a group plan. Group plans are typically more cost-effective than individual plans because the risk is spread across a larger pool of individuals. Additionally, employers often contribute towards the cost of the premiums, making it even more affordable for employees.

Government-Sponsored Programs

If you are unable to obtain health insurance through your employer or if the cost is still prohibitive, government-sponsored programs can be a valuable option. In the United States, programs like Medicaid and Medicare provide healthcare coverage to eligible individuals. Medicaid is designed for low-income individuals and families, while Medicare primarily serves older adults and individuals with certain disabilities. These programs offer comprehensive healthcare coverage at little to no cost, making them an attractive option for those with limited financial resources.

Marketplace Plans

The Affordable Care Act (ACA) established Health Insurance Marketplaces, also known as Exchanges, where individuals and families can shop for and compare health insurance plans. These Marketplaces offer a range of plans from different insurance companies, allowing you to find the most affordable option that meets your needs. It’s important to note that the cost of Marketplace plans can vary depending on your income, as some individuals may be eligible for subsidies to reduce the cost of their premiums.

Short-Term Plans

If you are in a transitional phase, such as between jobs or awaiting eligibility for another plan, short-term health insurance plans can be a temporary solution. These plans are generally more affordable than comprehensive plans, but they offer limited coverage and may not provide the same level of protection as other options. It’s crucial to carefully review the terms and conditions of short-term plans to ensure they meet your healthcare needs during the coverage period.

Tips for Finding the Cheapest Health Insurance

Here are some additional tips to help you find the most affordable health insurance option:

- Compare Plans: Research and compare different health insurance plans to find the one that offers the best value for your money. Consider the coverage, deductibles, copayments, and out-of-pocket maximums when making your decision.

- Shop During Open Enrollment: In most cases, you can only enroll in or switch health insurance plans during the Open Enrollment Period. Make sure to mark your calendar and take advantage of this opportunity to find the most affordable plan.

- Assess Your Healthcare Needs: Evaluate your healthcare requirements to determine the type of coverage you need. If you are generally healthy and do not require frequent medical attention, a high-deductible plan with lower premiums might be a suitable option.

- Consider Telehealth Options: Telehealth services have become increasingly popular, offering convenient and affordable access to healthcare professionals. Many insurance plans now cover telehealth visits, so consider choosing a plan that includes this benefit.

- Stay Healthy: Maintaining a healthy lifestyle can not only improve your overall well-being but also reduce your healthcare costs. Preventive care and healthy habits can lower the risk of developing serious medical conditions, leading to lower insurance premiums.

Future of Affordable Health Insurance

The landscape of affordable health insurance is constantly evolving, and several trends and initiatives are shaping the future of healthcare coverage. Here are some key developments to watch:

Digital Health Technologies

The integration of digital health technologies, such as telemedicine and wearable health devices, is transforming the way healthcare is delivered and accessed. These technologies offer convenient and cost-effective solutions for managing health conditions and can reduce the need for in-person medical visits. As more insurance providers embrace digital health, we can expect to see more affordable plans that incorporate these innovative technologies.

Value-Based Care Models

Value-based care models are gaining traction in the healthcare industry. These models focus on providing high-quality care while controlling costs. By incentivizing healthcare providers to deliver efficient and effective care, value-based models aim to reduce unnecessary treatments and improve patient outcomes. As these models become more prevalent, we can anticipate the emergence of affordable health insurance plans that reward both patients and providers for achieving positive health outcomes.

Expanded Coverage Options

Efforts to expand healthcare coverage are ongoing, with a focus on ensuring access to affordable insurance for all. The Affordable Care Act (ACA) has played a significant role in increasing the number of insured individuals, and further initiatives are being proposed to enhance coverage. These include expanding Medicaid eligibility, improving access to healthcare services in underserved areas, and exploring innovative models for providing affordable care.

| Insurance Type | Cost Range |

|---|---|

| Employer-Sponsored Plans | $0 - $500/month (varies based on employer contribution) |

| Marketplace Plans | $150 - $1,000/month (subsidies may apply) |

| Government-Sponsored Programs (Medicaid/Medicare) | Free - $150/month (based on eligibility) |

| Short-Term Plans | $50 - $200/month (limited coverage) |

How do I know if I qualify for government-sponsored health insurance programs like Medicaid or Medicare?

+Eligibility for government-sponsored health insurance programs varies based on factors such as age, income, and disability status. You can check your eligibility by visiting the official government websites or by contacting your local health department. They will provide you with the necessary information and guidance to determine if you qualify.

What are the consequences of not having health insurance?

+Not having health insurance can have significant financial and health implications. If you require medical treatment without insurance, you may be responsible for paying the full cost of your care, which can be extremely expensive. Additionally, lacking insurance can lead to delayed or inadequate healthcare, potentially impacting your long-term health and well-being.

Are there any discounts or savings programs available for health insurance premiums?

+Yes, there are several ways to save on health insurance premiums. Some insurance companies offer discounts for healthy lifestyle choices, such as non-smoking or maintaining a healthy weight. Additionally, you may be eligible for premium tax credits or cost-sharing reductions if your income falls within certain thresholds. It’s worth exploring these options to reduce your insurance costs.