Average Cost Of Health Insurance For A Family Of 4

The cost of health insurance is a crucial concern for many families, especially when it comes to covering the medical needs of a family of four. Understanding the average expenses and the factors that influence them is essential for effective financial planning and ensuring access to quality healthcare. In this comprehensive guide, we will delve into the intricacies of family health insurance costs, providing a detailed breakdown and expert insights to help you navigate this critical aspect of family life.

Understanding the Landscape: Average Health Insurance Costs for a Family of Four

Health insurance costs can vary significantly based on a multitude of factors, making it challenging to pinpoint an exact average. However, by analyzing industry data and trends, we can gain valuable insights into the typical expenses associated with insuring a family of four.

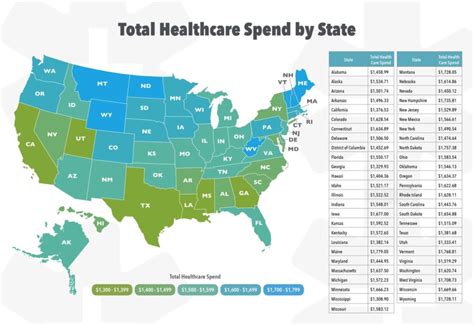

According to recent studies, the average annual premium for family health insurance plans in the United States stands at approximately $21,342. This figure represents the average cost of coverage for employer-sponsored plans, which are the most common form of health insurance for families. It's important to note that this average can vary widely based on geographical location, the specific plan chosen, and the family's healthcare needs.

For instance, in certain states like New York and California, where healthcare costs tend to be higher, the average annual premium can exceed $25,000. On the other hand, in more affordable regions such as the Midwest or rural areas, the average premium may be closer to $18,000 or even lower.

Breaking Down the Costs: A Detailed Analysis

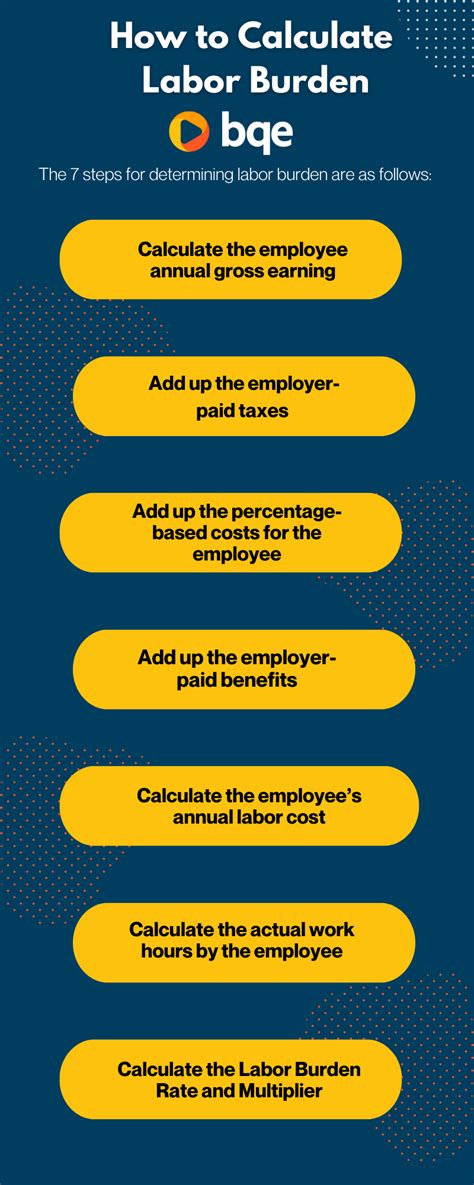

To better understand the composition of these costs, let’s delve into the various components that contribute to the overall premium.

| Cost Category | Average Annual Cost |

|---|---|

| Base Premium | $12,500 |

| Employee Contribution | $4,500 |

| Family Deductible | $3,000 |

| Out-of-Pocket Maximum | $2,500 |

| Co-pays and Co-insurance | $1,842 |

The base premium represents the core cost of the insurance plan, covering the basic healthcare services and benefits. This amount is typically paid by the employer, but some plans may require employee contributions, as indicated in the table.

The family deductible is the amount the family must pay out of pocket before the insurance coverage kicks in. This can range from a few hundred dollars to several thousand, depending on the plan's design. Similarly, the out-of-pocket maximum sets a limit on the family's financial responsibility for healthcare expenses, providing a safety net against catastrophic costs.

Additionally, co-pays and co-insurance represent the portion of healthcare costs that the family pays directly at the time of service. Co-pays are fixed amounts for specific services, while co-insurance is a percentage of the total cost. These costs can vary based on the type of healthcare provider and the services received.

Factors Influencing Health Insurance Costs

Several key factors play a significant role in determining the cost of health insurance for a family of four. Understanding these factors can help families make informed decisions and potentially find more affordable coverage options.

Geographical Location

Healthcare costs can vary dramatically based on where you live. States with higher living costs, such as those on the east and west coasts, generally have higher healthcare expenses. Conversely, more rural or less densely populated areas often have lower healthcare costs.

Plan Type and Coverage Options

The type of health insurance plan chosen can have a substantial impact on costs. Different plans offer varying levels of coverage, deductibles, and out-of-pocket expenses. For instance, HMO plans typically have lower premiums but higher out-of-pocket costs, while PPO plans offer more flexibility but often come with higher premiums.

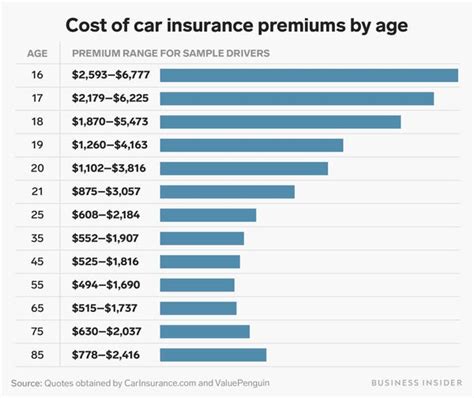

Family Size and Age

The size of your family and the ages of its members are significant factors. Larger families typically pay higher premiums, as more individuals are covered. Additionally, the age of family members can impact costs, with younger families often paying less than those with older adults.

Pre-existing Conditions and Health Status

Pre-existing conditions and the overall health status of family members can significantly influence insurance costs. Insurance companies may charge higher premiums or deny coverage altogether if there are significant health issues present.

Provider Networks and Prescription Drugs

The choice of healthcare providers and the availability of prescription drugs within a plan’s network can impact costs. Out-of-network providers often charge higher fees, which can increase out-of-pocket expenses. Similarly, the cost of prescription drugs can vary based on the plan’s coverage and the specific medications required.

Maximizing Savings: Strategies for Affordable Family Health Insurance

Navigating the complex world of health insurance can be daunting, but there are strategies to help families find more affordable coverage options. Here are some expert tips to consider:

- Shop around and compare plans: Research different insurance providers and their offerings. Compare premiums, deductibles, and coverage options to find the best fit for your family's needs.

- Consider High-Deductible Health Plans (HDHPs): HDHPs often have lower premiums, making them an attractive option for families with lower healthcare needs. These plans can be paired with a Health Savings Account (HSA) to save for future healthcare expenses.

- Utilize employer-sponsored plans: If available, employer-sponsored plans can provide significant cost savings. These plans often offer competitive rates and may include additional benefits or discounts.

- Explore government-sponsored programs: Depending on your income and family size, you may be eligible for government-sponsored programs like Medicaid or the Children's Health Insurance Program (CHIP). These programs offer comprehensive coverage at little to no cost.

- Negotiate with providers: Don't be afraid to negotiate with healthcare providers. Many providers offer discounts or payment plans to help reduce the financial burden of medical expenses.

The Future of Family Health Insurance: Trends and Predictions

The landscape of family health insurance is constantly evolving, influenced by technological advancements, policy changes, and shifts in the healthcare industry. Here are some key trends and predictions to watch for in the coming years:

Telehealth and Virtual Care

The COVID-19 pandemic accelerated the adoption of telehealth services, and this trend is expected to continue. Virtual care offers convenient and cost-effective access to healthcare, reducing the need for in-person visits and potentially lowering insurance costs.

Value-Based Care Models

Value-based care models focus on delivering high-quality healthcare while controlling costs. These models reward healthcare providers for achieving positive health outcomes rather than simply providing more services. This shift could lead to more efficient and affordable healthcare for families.

Emphasis on Preventive Care

Preventive care measures, such as regular check-ups, vaccinations, and lifestyle interventions, are becoming increasingly important. Insurance companies may offer incentives or discounts for families who prioritize preventive care, leading to improved health outcomes and potentially lower long-term costs.

Technological Innovations

Advancements in healthcare technology, such as electronic health records and wearable health devices, are transforming the industry. These innovations can improve efficiency, reduce administrative burdens, and enhance patient engagement, ultimately impacting the cost and quality of healthcare.

Conclusion: Empowering Families with Knowledge

Understanding the average cost of health insurance for a family of four is just the beginning. By delving into the various factors that influence these costs and staying informed about emerging trends, families can make more confident decisions about their healthcare coverage. Remember, the right insurance plan can provide peace of mind and ensure access to the healthcare services your family needs.

Stay tuned for further insights and updates as we continue to explore the dynamic world of family health insurance.

What is the average monthly cost of health insurance for a family of four?

+The average monthly cost for family health insurance can vary significantly based on factors like location, plan type, and family size. However, as a rough estimate, the average monthly premium for a family of four in the United States is around $1,778, according to recent data. This figure can be higher or lower depending on the specific circumstances and coverage needs of each family.

How do I find affordable health insurance for my family?

+Finding affordable health insurance for your family requires careful research and comparison. Start by understanding your options, such as employer-sponsored plans, individual market plans, and government-sponsored programs like Medicaid or CHIP. Compare premiums, deductibles, and coverage details to find the best fit for your family’s needs and budget. Consider factors like your family’s healthcare utilization and any specific medical conditions when making your decision.

Are there any government programs to help with health insurance costs for families?

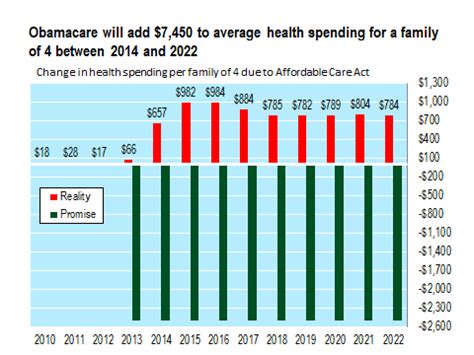

+Yes, there are several government programs designed to assist families with health insurance costs. Medicaid, for example, provides comprehensive health coverage for low-income families and individuals. The Children’s Health Insurance Program (CHIP) offers coverage specifically for children from low-income families. Additionally, the Affordable Care Act (ACA) provides subsidies and tax credits to help families purchase insurance through the Health Insurance Marketplace. These programs can significantly reduce the financial burden of health insurance for eligible families.

What are some tips for reducing out-of-pocket expenses under my family’s health insurance plan?

+Reducing out-of-pocket expenses is crucial for managing your family’s healthcare costs. Here are some tips: Stay in-network for healthcare services to avoid higher out-of-network costs. Compare prices for procedures and medications to find the most cost-effective options. Utilize generic medications whenever possible, as they are often much cheaper than brand-name drugs. Take advantage of preventive care services, which are typically covered at no cost under most plans. By being proactive and informed, you can minimize your out-of-pocket expenses.

How do health insurance costs for a family of four compare to those for an individual or a couple?

+Health insurance costs for a family of four are typically higher compared to those for an individual or a couple. This is primarily due to the increased coverage and benefits required to accommodate the needs of multiple family members. However, the exact cost difference can vary depending on factors like the plan type, location, and the age and health status of family members. It’s essential to compare plans and consider the specific needs of your family to find the most cost-effective coverage.