Term Life Insurance Versus Whole

When it comes to financial planning and securing your loved ones' future, life insurance is a crucial component. Two common types of life insurance policies are Term Life and Whole Life insurance. Understanding the differences between these policies and their implications is essential for making informed decisions about your financial protection.

In this comprehensive article, we will delve into the nuances of Term Life and Whole Life insurance, exploring their features, benefits, and considerations. By the end, you'll have a clearer understanding of which option might be the best fit for your unique circumstances.

Term Life Insurance: A Temporary Solution with Flexible Options

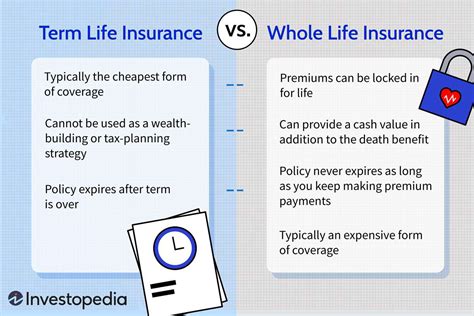

Term Life insurance is a straightforward and cost-effective solution designed to provide financial coverage for a specific period, typically ranging from 10 to 30 years. It is an ideal choice for individuals seeking temporary protection to cover their dependents during critical life stages, such as raising a family or paying off a mortgage.

Key Characteristics of Term Life Insurance

- Coverage Period: As the name suggests, Term Life insurance offers coverage for a defined term. You can choose the duration based on your needs, with common terms being 10, 15, 20, or 30 years.

- Affordability: One of the primary advantages of Term Life is its affordability. Premiums are generally lower compared to Whole Life policies, making it an accessible option for those on a budget.

- Renewability: Many Term Life policies allow you to renew your coverage at the end of the term. However, it’s important to note that premiums may increase with age, and there may be medical underwriting involved.

- Flexibility: Term Life insurance often provides flexibility in terms of coverage amounts. You can adjust the coverage to meet your changing needs over time.

Consider the following real-life example: Sarah, a 30-year-old with two young children, opts for a 20-year Term Life policy with a coverage amount of $500,000. This ensures that if anything happens to her during this period, her family will receive the financial support needed to maintain their lifestyle and cover essential expenses.

| Term Life Insurance Benefits |

|---|

| Cost-effective coverage for a defined period |

| Flexible coverage amounts to adapt to changing needs |

| Renewable options to extend coverage |

| Suitable for temporary financial protection |

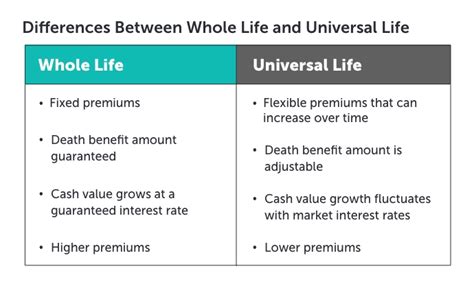

Whole Life Insurance: Permanent Protection with Cash Value

Whole Life insurance, also known as Permanent Life insurance, offers lifelong coverage and provides a death benefit to your beneficiaries. In addition to the traditional death benefit, Whole Life policies accumulate cash value over time, making them a more complex and potentially valuable financial instrument.

Key Features of Whole Life Insurance

- Lifetime Coverage: Unlike Term Life, Whole Life insurance remains in force for your entire life, as long as you continue paying the premiums. This provides peace of mind knowing your loved ones are financially protected regardless of your age.

- Cash Value Accumulation: One of the unique aspects of Whole Life insurance is its cash value component. A portion of your premium goes towards building cash value, which grows tax-deferred over time. This cash value can be accessed through loans or withdrawals during your lifetime.

- Guaranteed Death Benefit: The death benefit amount in a Whole Life policy is guaranteed, meaning it remains fixed throughout the policy’s duration. This provides a predictable financial benefit to your beneficiaries.

- Stable Premium: Whole Life insurance typically offers level premiums, meaning your payments remain the same throughout the policy. This provides stability and predictability in your financial planning.

Imagine John, a 40-year-old business owner, who purchases a Whole Life policy with a $1 million death benefit. Over time, his policy accumulates cash value, which he can use to supplement his retirement income or fund business ventures. The stability of Whole Life insurance provides John with long-term financial security and peace of mind.

| Whole Life Insurance Benefits |

|---|

| Lifetime coverage for long-term financial protection |

| Cash value accumulation for retirement or other financial needs |

| Guaranteed death benefit provides certainty for beneficiaries |

| Stable premiums offer predictable financial planning |

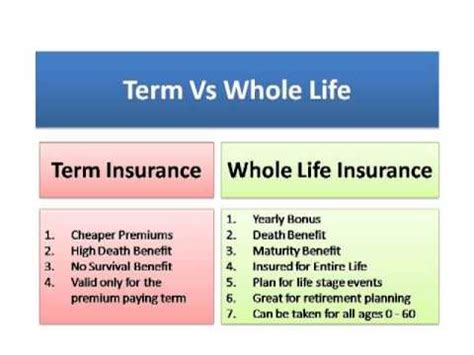

Comparative Analysis: Term Life vs. Whole Life

When deciding between Term Life and Whole Life insurance, it’s essential to consider your unique circumstances and financial goals. Here’s a side-by-side comparison to help you evaluate the key differences:

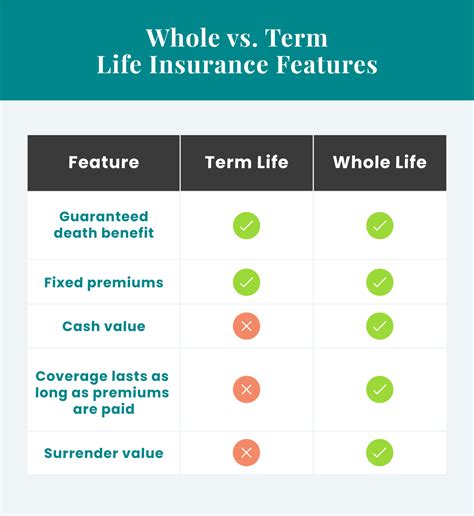

| Criteria | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Coverage Period | Temporary (10-30 years) | Lifetime |

| Cost | Lower premiums | Higher premiums |

| Flexibility | Adjustable coverage amounts | Fixed coverage and cash value |

| Cash Value | None | Accumulates over time |

| Suitability | Temporary financial protection | Long-term financial planning and legacy building |

It's important to note that while Whole Life insurance offers more comprehensive protection and potential financial growth, it comes at a higher cost. Term Life insurance, on the other hand, provides flexibility and affordability for those with more immediate financial concerns.

Performance Analysis: Factors to Consider

When evaluating the performance of Term Life and Whole Life insurance, several factors come into play. These include the insurer’s financial strength, the policy’s guaranteed death benefit, the growth of cash value (for Whole Life), and the overall return on investment.

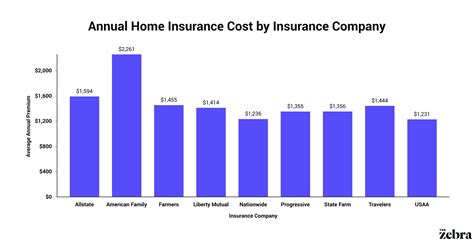

Insurer’s Financial Strength

Both Term Life and Whole Life insurance policies are only as strong as the insurer backing them. It’s crucial to choose an insurance company with a solid financial rating and a proven track record of stability. This ensures that the insurer will be able to fulfill its obligations and pay out benefits when needed.

Guaranteed Death Benefit

The death benefit is a critical aspect of life insurance policies. With Term Life insurance, the death benefit is typically level throughout the term, providing a predictable financial benefit to your beneficiaries. In contrast, Whole Life insurance offers a guaranteed death benefit that remains fixed for the policy’s duration.

Cash Value Growth

Whole Life insurance’s cash value accumulation is a unique feature that sets it apart from Term Life policies. The growth of this cash value is influenced by various factors, including the insurer’s investment strategy, interest rates, and the policy’s performance. It’s important to understand how the cash value grows and whether it meets your financial expectations.

Return on Investment

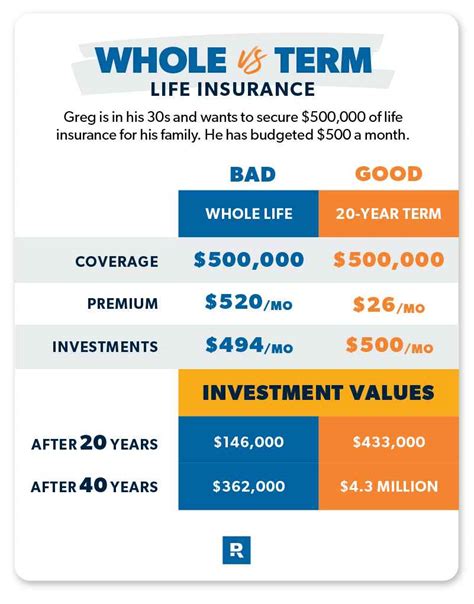

When considering Whole Life insurance, evaluating the return on investment (ROI) is essential. While Whole Life policies offer potential long-term growth, it’s crucial to compare the ROI with other investment options to ensure it aligns with your financial goals. Term Life insurance, on the other hand, focuses primarily on providing affordable protection without the expectation of significant returns.

Evidence-Based Future Implications

The choice between Term Life and Whole Life insurance has long-term implications for your financial security and the well-being of your loved ones. Here’s a look at some of the future considerations:

Financial Security for Dependents

Term Life insurance is an excellent option for providing financial support to dependents during critical life stages. It ensures that your family can maintain their lifestyle and cover essential expenses if something happens to you during the policy term. Whole Life insurance, on the other hand, offers lifelong protection, providing a reliable financial safety net for your loved ones.

Legacy Building and Wealth Transfer

Whole Life insurance’s ability to accumulate cash value over time makes it an attractive option for building wealth and leaving a legacy. The cash value can be used for various purposes, such as funding retirement, paying for a child’s education, or transferring wealth to future generations. Term Life insurance, while not offering cash value accumulation, provides a more affordable way to secure your loved ones’ financial future.

Flexibility and Adaptability

Term Life insurance’s flexibility allows you to adjust coverage amounts as your financial needs change. This is particularly beneficial if your circumstances evolve over time. Whole Life insurance, with its fixed coverage and premiums, provides stability but may not offer the same level of adaptability.

Long-Term Financial Planning

Whole Life insurance’s permanent coverage and cash value accumulation make it a valuable tool for long-term financial planning. It can be an integral part of your retirement strategy, providing a source of income and financial stability. Term Life insurance, while not offering the same level of financial growth, can be a cost-effective way to ensure your family’s financial well-being during specific life stages.

Conclusion: Finding the Right Fit

The decision between Term Life and Whole Life insurance ultimately depends on your individual needs, financial goals, and circumstances. Term Life insurance is an excellent choice for those seeking temporary protection at an affordable cost, while Whole Life insurance provides permanent coverage and the potential for long-term financial growth.

By understanding the features, benefits, and considerations of each type of life insurance, you can make an informed decision that aligns with your financial goals and provides the necessary protection for your loved ones. Remember, it's essential to consult with a qualified financial advisor or insurance professional to ensure you choose the right policy for your unique situation.

What is the main difference between Term Life and Whole Life insurance?

+The key difference lies in the coverage period and financial aspects. Term Life insurance provides temporary coverage for a defined term, typically 10-30 years, and is more affordable. Whole Life insurance offers permanent coverage for your entire life and includes a cash value component, which grows over time.

Is Term Life insurance suitable for everyone?

+Term Life insurance is ideal for individuals seeking temporary financial protection during specific life stages, such as raising a family or paying off a mortgage. It’s a cost-effective option for those with more immediate financial concerns.

What are the advantages of Whole Life insurance over Term Life insurance?

+Whole Life insurance provides lifelong coverage and includes a cash value component. This allows for potential financial growth and flexibility, making it suitable for long-term financial planning and legacy building.

Can I switch from Term Life to Whole Life insurance later in life?

+Yes, it is possible to switch from Term Life to Whole Life insurance. However, it’s important to note that as you age, the cost of Whole Life insurance may increase, and you may need to undergo additional medical underwriting. Consulting with a financial advisor can help guide you through the transition process.