Vehicle Insurance Claim

Vehicle insurance claims are an integral part of the automotive industry, providing financial protection and peace of mind to drivers and vehicle owners. When an accident or unforeseen event occurs, the process of filing an insurance claim becomes crucial to ensure timely repairs, cover medical expenses, and mitigate potential losses. In this comprehensive guide, we delve into the intricacies of vehicle insurance claims, exploring the steps involved, the factors that influence claim outcomes, and the best practices to navigate this complex process.

Understanding Vehicle Insurance Claims

Vehicle insurance claims are formal requests made by policyholders to their insurance providers to cover expenses resulting from accidents, theft, natural disasters, or other covered events. These claims serve as a safety net, offering financial support to repair or replace vehicles, compensate for property damage, and cover medical bills for injuries sustained during an accident. The process involves careful documentation, thorough assessment, and negotiation to reach a settlement that satisfies both the policyholder and the insurance company.

The Claims Process: A Step-by-Step Guide

Filing a vehicle insurance claim is a detailed and structured process. Here’s a comprehensive breakdown of the steps involved:

1. Report the Incident

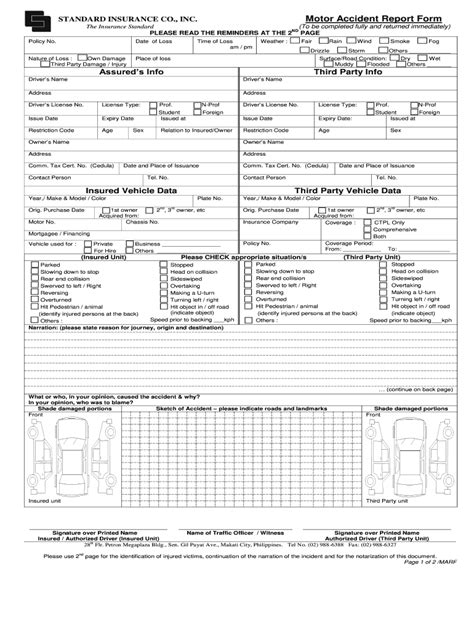

As soon as an accident or loss occurs, it’s essential to promptly report the incident to your insurance provider. Most insurance companies have dedicated claims hotlines or online portals to facilitate this process. Provide detailed information about the event, including the date, time, location, and circumstances surrounding the accident. Accurate and timely reporting is crucial to initiate the claims process efficiently.

2. Collect Evidence

Evidence plays a pivotal role in vehicle insurance claims. Gather as much evidence as possible, including photographs of the damage, witness statements, police reports, and any relevant documentation. If there are visible signs of damage, capture clear and detailed images from multiple angles. Witness statements can provide valuable insights into the incident, especially in cases of disputes.

3. Contact Your Insurance Provider

After reporting the incident and gathering evidence, contact your insurance provider to discuss the claim. They will guide you through the specific steps required for your policy. Provide them with all the relevant information and documentation to expedite the claims process. Your insurance company will assign a claims adjuster to handle your case, who will assess the damage and determine the scope of coverage.

4. Assessment and Estimation

The claims adjuster will thoroughly inspect the vehicle and assess the extent of the damage. They will consider factors such as the vehicle’s make, model, age, and condition. Based on their assessment, they will provide an estimate for the repairs or replacement costs. It’s crucial to review the estimate carefully and discuss any discrepancies with your insurance provider.

5. Negotiation and Settlement

Once the estimate is finalized, the negotiation process begins. You have the right to negotiate the settlement amount if you believe it doesn’t adequately cover the damage or if there are additional expenses incurred. Be prepared to provide supporting evidence and justify your claim. Open communication and collaboration with your insurance provider can lead to a fair and satisfactory settlement.

6. Repairs and Replacement

After reaching a settlement, the next step is to initiate the repairs or replacement process. Your insurance company may have preferred repair shops or dealerships, but you have the option to choose your own repair facility. Ensure that the chosen repair shop provides quality work and uses genuine parts to maintain the vehicle’s integrity. If the vehicle is deemed a total loss, the insurance company will provide a settlement based on the vehicle’s fair market value.

7. Claim Resolution

Throughout the claims process, it’s essential to keep track of all communications and documentation. Maintain a record of all interactions with your insurance provider, repair shop, and any other relevant parties. Once the repairs are complete or the settlement is received, review the final outcome to ensure it aligns with the agreed-upon terms. If there are any discrepancies, address them promptly with your insurance provider.

Factors Influencing Claim Outcomes

Several factors can impact the outcome of a vehicle insurance claim. Understanding these factors can help policyholders navigate the process more effectively:

1. Policy Coverage

The scope of coverage under your insurance policy plays a crucial role in determining claim outcomes. Different policies offer varying levels of coverage, including comprehensive, collision, liability, and additional add-ons. Understanding the specific terms and conditions of your policy is essential to know what expenses are covered and what may be excluded.

2. Deductibles and Out-of-Pocket Costs

Deductibles are the amounts policyholders must pay out of pocket before their insurance coverage kicks in. Higher deductibles often result in lower insurance premiums, but they also mean higher out-of-pocket expenses in the event of a claim. It’s essential to consider the balance between premiums and deductibles when selecting an insurance policy.

3. Accident History and Claim Frequency

Insurance companies consider a policyholder’s accident history and claim frequency when assessing claims. Multiple claims within a short period can raise red flags and potentially lead to higher premiums or even policy cancellations. Maintaining a clean driving record and practicing safe driving habits can positively impact claim outcomes.

4. State Regulations and Laws

Vehicle insurance claims are subject to state-specific regulations and laws. These regulations govern factors such as mandatory coverage requirements, no-fault vs. at-fault systems, and dispute resolution processes. Familiarizing yourself with the insurance laws in your state can help you navigate the claims process more effectively.

5. Repair Shop Selection

Choosing the right repair shop can impact the quality of repairs and the overall claim experience. While insurance companies may have preferred repair shops, policyholders have the freedom to select their own trusted repair facilities. Researching and selecting a reputable shop with a track record of quality work and customer satisfaction can ensure a smoother claims process.

Best Practices for a Successful Claim

Navigating the vehicle insurance claims process can be challenging, but following these best practices can increase your chances of a successful and satisfactory outcome:

1. Prompt Reporting and Documentation

Report accidents or losses to your insurance provider as soon as possible. The sooner you report, the faster the claims process can begin. Additionally, collect and maintain thorough documentation, including photographs, witness statements, and any relevant reports or forms. This evidence will strengthen your claim and expedite the assessment process.

2. Understand Your Policy

Take the time to thoroughly review and understand your insurance policy. Familiarize yourself with the coverage limits, deductibles, and any exclusions or limitations. Knowing your policy inside and out will help you navigate the claims process with confidence and ensure you receive the benefits you’re entitled to.

3. Collaborate with Your Insurance Provider

Maintain open and transparent communication with your insurance provider throughout the claims process. Be responsive to their requests for information and documentation. Collaborating with your insurance company can lead to faster claim resolutions and a more positive experience.

4. Seek Legal Advice (if Needed)

In complex or disputed claims, seeking legal advice can be beneficial. Attorneys specializing in insurance law can provide guidance and representation to ensure your rights are protected. They can help navigate the legal intricacies of insurance policies and advocate for fair claim settlements.

5. Maintain a Safe Driving Record

Practicing safe driving habits is not only essential for personal safety but also for maintaining a positive insurance record. A clean driving record can lead to lower insurance premiums and better claim outcomes. Avoid reckless driving, obey traffic laws, and regularly maintain your vehicle to reduce the likelihood of accidents.

Common Challenges and How to Overcome Them

Vehicle insurance claims can present various challenges. Here’s how to tackle some common obstacles:

1. Disputed Claims

In cases where there are disputes over fault or the extent of damage, it’s crucial to gather as much evidence as possible. Witness statements, dashcam footage, and expert opinions can strengthen your case. If the dispute persists, consider mediation or arbitration as alternatives to litigation.

2. Delayed Repairs or Settlements

Delays in repairs or settlement payments can be frustrating. Stay in regular communication with your insurance provider and the repair shop to track the progress. If delays persist, escalate the issue to a higher authority within the insurance company or seek assistance from consumer protection agencies.

3. Underestimation of Damages

Sometimes, the initial estimate provided by the insurance company may not cover all the damages. Review the estimate carefully and provide additional evidence or documentation to support your claim. Negotiate with the insurance provider to ensure a fair and comprehensive settlement.

4. Dealing with Multiple Insurance Companies

In cases involving multiple vehicles or drivers, dealing with multiple insurance companies can be complex. Maintain organized records and communicate with all relevant parties. Seek guidance from an insurance professional or legal expert to navigate the multi-party claims process effectively.

Future Trends and Innovations in Vehicle Insurance Claims

The landscape of vehicle insurance claims is evolving, driven by technological advancements and changing industry practices. Here’s a glimpse into the future of vehicle insurance claims:

1. Telematics and Usage-Based Insurance

Telematics technology, which collects and analyzes driving data, is gaining traction in the insurance industry. Usage-based insurance policies offer personalized premiums based on driving behavior. This technology can provide accurate data for claim assessments and encourage safe driving practices.

2. AI and Machine Learning

Artificial intelligence and machine learning are transforming the claims process. These technologies can automate claim assessments, detect fraud, and provide accurate damage estimates. AI-powered chatbots and virtual assistants can also enhance customer service and streamline claim inquiries.

3. Digital Claims Management

The shift towards digital claims management is streamlining the process for both policyholders and insurance providers. Online portals, mobile apps, and digital documentation are making it easier to report claims, upload evidence, and track the progress of settlements. Digital claims management improves efficiency and reduces paperwork.

4. Enhanced Fraud Detection

Insurance companies are investing in advanced fraud detection technologies to combat insurance fraud. These systems use data analytics and machine learning to identify suspicious patterns and potential fraud attempts. Enhanced fraud detection ensures fair claim settlements and protects honest policyholders.

5. Integration of Autonomous Vehicles

As autonomous vehicles become more prevalent, the insurance industry is adapting to this new reality. Insurance providers are developing policies specifically tailored for autonomous vehicles, addressing unique liability and coverage concerns. The integration of autonomous vehicles into the insurance landscape presents both challenges and opportunities.

Conclusion

Vehicle insurance claims are a vital aspect of the automotive industry, providing financial protection and peace of mind to vehicle owners. By understanding the claims process, factors influencing outcomes, and adopting best practices, policyholders can navigate this complex journey with confidence. As the industry evolves, technological advancements and innovative practices will continue to shape the future of vehicle insurance claims, offering enhanced efficiency, accuracy, and customer satisfaction.

How long does it typically take to process a vehicle insurance claim?

+The processing time for vehicle insurance claims can vary depending on several factors, including the complexity of the claim, the insurance provider’s workload, and the availability of necessary documentation. On average, simple claims with minimal damage and clear liability can be resolved within a few weeks. However, more complex claims involving extensive repairs, multiple parties, or disputes may take several months to reach a resolution.

Can I choose my own repair shop for vehicle insurance claims?

+Yes, policyholders generally have the freedom to choose their preferred repair shop for vehicle insurance claims. While insurance companies may have partnerships with specific repair facilities, you have the right to select a repair shop that you trust and that provides quality work. However, it’s important to check your policy for any specific requirements or restrictions regarding repair shop selection.

What happens if my vehicle is a total loss in an accident?

+If your vehicle is deemed a total loss in an accident, the insurance company will provide a settlement based on the vehicle’s fair market value. The insurance adjuster will assess the extent of the damage and determine if the cost of repairs exceeds the vehicle’s value. In such cases, the insurance company will offer a settlement amount, which you can use to purchase a replacement vehicle.

Can I negotiate the settlement amount for my vehicle insurance claim?

+Yes, policyholders have the right to negotiate the settlement amount for their vehicle insurance claim. If you believe the initial estimate provided by the insurance company does not adequately cover the damage or additional expenses incurred, you can present supporting evidence and justification for a higher settlement. Open communication and collaboration with your insurance provider can lead to a fair and satisfactory resolution.