Allstate Login Insurance

In today's digital age, insurance companies have embraced online platforms to enhance customer experience and streamline various processes. One such company leading the way is Allstate, offering its customers convenient and secure access to their insurance policies and related services through the Allstate Login Insurance platform. This article will delve into the features, benefits, and significance of Allstate's online portal, exploring how it revolutionizes the way customers manage their insurance needs.

The Evolution of Allstate Login Insurance

Allstate, a prominent name in the insurance industry, recognized the need to adapt to the digital landscape and provide its customers with a seamless online experience. The Allstate Login Insurance portal was developed to cater to the evolving preferences of modern customers, offering them a user-friendly interface to access and manage their insurance policies anytime, anywhere.

The portal's development was a strategic move, reflecting Allstate's commitment to innovation and customer satisfaction. By investing in this digital transformation, Allstate aimed to enhance its brand image, improve customer retention, and attract a wider audience, particularly the tech-savvy generation.

Key Features of the Allstate Login Insurance Portal

The Allstate Login Insurance platform boasts an array of features designed to simplify the insurance journey for its users. Here’s an overview of some of the notable aspects:

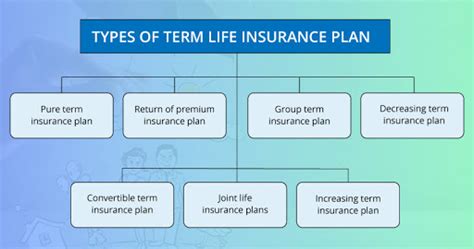

- Policy Management: Customers can easily view and manage their insurance policies, including auto, home, life, and more. They can make changes to coverage, add or remove vehicles or properties, and stay updated on their policy details.

- Bill Payment and Payment Plans: The portal offers a secure and convenient way to pay insurance premiums. Customers can set up automatic payments, choose payment plans, and receive reminders to ensure timely payments.

- Claims Management: In the event of an accident or loss, users can initiate and track their insurance claims through the portal. They can upload necessary documents, receive updates on claim progress, and even communicate with claims adjusters.

- Personalized Recommendations: Allstate's advanced algorithms analyze customer data to provide tailored insurance recommendations. Based on individual needs and preferences, the portal suggests suitable coverage options, helping customers make informed decisions.

- Digital Documentation: The platform allows customers to store and access important insurance documents digitally. From policy certificates to claim reports, users can have instant access to their records, eliminating the need for physical storage.

- Real-Time Updates: Allstate Login Insurance provides real-time updates on policy changes, billing information, and other relevant notifications. This ensures customers stay informed and can take prompt action when needed.

Benefits and Impact on Customers

The Allstate Login Insurance portal has brought about numerous advantages for customers, revolutionizing the way they interact with their insurance provider.

Firstly, the convenience and accessibility of the portal cannot be overstated. Customers can access their insurance accounts from the comfort of their homes, eliminating the need for physical visits to insurance offices. This saves time and effort, especially for busy individuals who value efficiency.

Secondly, the portal's user-friendly interface and intuitive navigation make it easy for customers to find the information they need quickly. The self-service options empower customers to take control of their insurance journey, reducing reliance on customer service representatives for simple tasks.

Additionally, the real-time updates and notifications provided by the portal enhance customer awareness and promptness. Customers can stay on top of their insurance obligations, ensuring timely premium payments and swift claim submissions.

The personalized recommendations feature is another standout benefit. By leveraging data-driven insights, Allstate can offer tailored insurance solutions to customers, ensuring they have the right coverage for their unique circumstances. This not only enhances customer satisfaction but also fosters trust in the brand.

Technical Specifications and Performance Analysis

From a technical standpoint, the Allstate Login Insurance portal is a testament to the company’s expertise in digital innovation. The platform is built on a robust and secure infrastructure, ensuring data privacy and protection for its users.

The portal's performance is optimized for various devices, including desktops, laptops, tablets, and smartphones. This responsiveness ensures a seamless user experience across different screen sizes and operating systems. Allstate has also implemented responsive design principles, ensuring the platform adapts to different devices, providing an optimal viewing experience.

In terms of security, the portal employs industry-leading encryption protocols to safeguard user data. Two-factor authentication and other security measures are in place to protect customer accounts from unauthorized access. Allstate regularly conducts security audits and updates its systems to address emerging threats, ensuring the highest level of data protection.

Performance-wise, the portal has demonstrated impressive load times and response rates. Allstate's investment in high-performance servers and efficient code ensures that the platform can handle a large number of concurrent users without compromising speed or reliability. This is crucial for maintaining a positive user experience, especially during peak hours or emergency situations.

Comparative Analysis

When compared to other insurance providers’ online platforms, Allstate Login Insurance stands out for its comprehensive feature set and user-centric design. While many insurance companies offer basic online services, Allstate has gone a step further by integrating advanced functionalities and personalized recommendations.

The portal's intuitive design and easy-to-navigate interface set it apart from competitors. Allstate has prioritized user experience, ensuring that customers can accomplish their tasks efficiently without feeling overwhelmed by complex menus or confusing layouts.

Furthermore, Allstate's focus on data-driven insights and personalized recommendations gives it a competitive edge. By leveraging customer data and analytics, the company can offer tailored insurance solutions, addressing individual needs and preferences. This level of customization enhances customer loyalty and satisfaction.

| Feature | Allstate Login Insurance | Competitor A | Competitor B |

|---|---|---|---|

| Policy Management | Comprehensive, with real-time updates | Basic management tools | Limited policy overview |

| Bill Payment Options | Flexible payment plans, automatic payments | Standard payment methods | Few payment options |

| Claims Management | Full claim tracking and communication | Basic claim submission | Claim status updates only |

| Personalized Recommendations | Tailored coverage suggestions | No personalized recommendations | Limited coverage suggestions |

| Digital Documentation | Secure digital storage and access | Basic document storage | No digital documentation feature |

Industry Impact and Future Implications

The launch and success of Allstate Login Insurance have had a significant impact on the insurance industry. It has set a new benchmark for online insurance portals, inspiring other providers to enhance their digital offerings and compete in the evolving digital landscape.

Allstate's innovation has not only benefited its existing customers but has also attracted a new generation of tech-savvy individuals who prefer digital interactions. By catering to this demographic, Allstate has expanded its customer base and strengthened its market position.

Looking ahead, the future implications of Allstate's digital transformation are promising. As the insurance industry continues to embrace technology, we can expect further advancements in online platforms. The integration of artificial intelligence and machine learning could enhance personalized recommendations and customer service, taking the user experience to new heights.

Additionally, the success of Allstate's portal highlights the importance of data-driven decision-making in the insurance sector. By leveraging customer data and analytics, insurance providers can offer more accurate and tailored solutions, improving customer satisfaction and retention.

Frequently Asked Questions

How do I create an account on the Allstate Login Insurance portal?

+To create an account, visit the Allstate Login Insurance portal and click on the “Register” or “Sign Up” button. You will be guided through a simple registration process where you’ll provide your personal details, create a username and password, and verify your identity. Once your account is created, you can log in and start managing your insurance policies.

Can I access my insurance policies offline through the portal?

+While the Allstate Login Insurance portal is designed for online access, you can still view and manage your insurance policies offline by downloading and installing the Allstate mobile app. The app provides offline access to your policies, allowing you to review coverage details, policy documents, and other important information without an internet connection.

What security measures are in place to protect my data on the portal?

+Allstate takes data security seriously and has implemented various measures to protect your information. The portal uses advanced encryption technologies to safeguard your data during transmission and storage. Additionally, two-factor authentication is available to add an extra layer of security to your account. Allstate also regularly conducts security audits and updates its systems to address any emerging threats.

Can I pay my insurance premiums using the portal?

+Absolutely! The Allstate Login Insurance portal offers a secure and convenient way to pay your insurance premiums. You can choose from various payment methods, including credit/debit cards, electronic checks, or even set up automatic payments to ensure timely premium payments. The portal provides real-time updates on your payment status and due dates, helping you stay on top of your insurance obligations.