Renters Insurance Liability Coverage

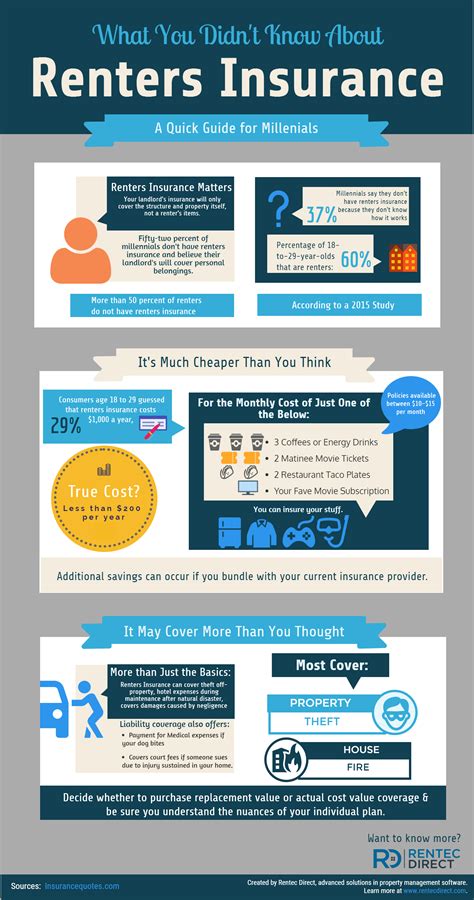

Renters insurance is a vital aspect of financial planning for anyone living in a rented property. It provides essential protection against a range of risks, including liability coverage, which is often an overlooked but crucial component of a comprehensive insurance policy. This article aims to delve into the intricacies of renters insurance liability coverage, exploring its significance, what it entails, and how it can protect individuals from potential financial pitfalls.

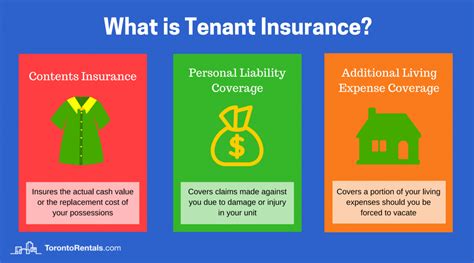

Understanding Renters Insurance Liability Coverage

Liability coverage within a renters insurance policy is designed to protect policyholders from legal and financial responsibilities that may arise from accidents or incidents that occur on their rented premises. It offers a safety net, ensuring that individuals are not left financially burdened should they be held responsible for causing bodily injury or property damage to others.

In essence, liability coverage acts as a shield, providing financial support for legal defense costs, medical expenses, and potential compensation payments if a claim is made against the policyholder. This coverage is particularly important for renters, as it extends beyond the four walls of their apartment, covering any area within the rented property's boundaries, including the yard or any common areas.

Real-Life Scenarios and the Importance of Liability Coverage

Consider a hypothetical situation where a guest at a rented apartment slips and falls due to a wet floor, resulting in a broken arm. In such a case, the injured guest may seek compensation for their medical bills and any associated costs. Without adequate liability coverage, the renter could be held personally liable for these expenses, which could potentially run into thousands of dollars.

Another scenario could involve a pet-related incident. For instance, if a renter's dog bites a visitor, causing serious injury, the renter could face substantial legal and medical costs. Liability coverage steps in to cover these expenses, mitigating the financial impact on the policyholder.

| Scenario | Potential Liability |

|---|---|

| Slip and Fall | $10,000 - $20,000 for medical bills and legal fees |

| Dog Bite | $25,000 - $50,000 or more, depending on severity |

These examples highlight the critical role of liability coverage in renters insurance. By providing financial protection, it ensures that policyholders can focus on their recovery or defense without the added stress of managing unexpected costs.

Coverage Limits and Policy Customization

Renters insurance liability coverage typically comes with a specified limit, which is the maximum amount the insurance provider will pay out for a single claim. This limit can vary significantly, depending on the policy and the renter’s specific needs and budget.

For instance, a standard renters insurance policy might offer liability coverage with a limit of $100,000. However, for those who own high-value assets or have a greater risk of liability claims, increasing the coverage limit to $300,000 or more might be advisable. This ensures that the policyholder is adequately protected, even in the event of a significant claim.

Policyholders should carefully consider their coverage limits, taking into account factors such as the value of their personal property, the likelihood of liability incidents, and their financial ability to withstand a large claim. It's a delicate balance, and consulting with an insurance professional can help renters make informed decisions about their liability coverage.

Tailoring Coverage for Unique Circumstances

Renters insurance policies are not one-size-fits-all. They can be customized to suit the specific needs and circumstances of the policyholder. For example, individuals with high-risk hobbies or occupations might require additional liability coverage to ensure they are adequately protected.

Consider a renter who is an avid snowboarder. The potential for liability incidents is higher in this scenario, as the renter could be responsible for accidents or injuries that occur during their snowboarding activities, even if they are off the rented premises. By adding an endorsement to their renters insurance policy, they can extend their liability coverage to include these specific risks.

| Policy Feature | Description |

|---|---|

| Personal Liability | Covers bodily injury or property damage caused by the policyholder or their family members. |

| Medical Payments to Others | Provides coverage for medical expenses for injuries sustained by others on the rented premises, regardless of fault. |

| Guest Medical Coverage | Offers additional medical coverage for guests who are injured on the rented property, even if the injury is the guest's fault. |

These additional coverages and endorsements ensure that renters can tailor their insurance to match their lifestyle and potential risks, providing a comprehensive safety net.

The Process of a Liability Claim

Understanding the process of a liability claim is essential for renters, as it allows them to navigate potential incidents with confidence and take appropriate actions.

In the event of an incident that may result in a liability claim, the first step is to assess the situation and ensure the safety and well-being of all involved parties. This could involve calling emergency services if necessary, such as in the case of a severe injury.

Next, the policyholder should promptly notify their insurance provider about the incident. Providing detailed information about what occurred, any potential injuries or damages, and any relevant witness statements or evidence is crucial. This helps the insurance company assess the claim and determine the appropriate course of action.

Legal Representation and Defense Costs

In situations where a liability claim results in legal action, renters insurance liability coverage steps in to provide financial support for legal defense costs. This includes hiring an attorney, covering court fees, and any other associated legal expenses.

It's important for policyholders to understand that while liability coverage can provide substantial financial relief, it does not guarantee a successful defense or the dismissal of a claim. The outcome of legal proceedings depends on various factors, including the specifics of the incident, the evidence presented, and the jurisdiction's laws and regulations.

Having a clear understanding of the potential legal implications and being proactive in managing any liability claims is essential. This may involve cooperating with the insurance provider, providing necessary documentation, and seeking legal advice if needed.

Future Implications and the Evolving Landscape of Liability Coverage

The landscape of liability coverage in renters insurance is continually evolving, influenced by changing societal dynamics, technological advancements, and emerging risks. As such, staying informed about these developments is crucial for renters to ensure their insurance policies remain relevant and effective.

One notable trend is the increasing focus on cyber liability coverage. With the rise of digital technologies and the prevalence of cyber threats, renters are now exposed to new risks, such as data breaches, identity theft, and online defamation. Many insurance providers are recognizing this and offering endorsements or separate policies to cover these emerging risks.

Additionally, the increasing popularity of short-term rental platforms like Airbnb and VRBO has prompted insurance providers to adapt their renters insurance policies. These platforms present unique liability risks, such as guest injuries or property damage, which traditional renters insurance policies may not adequately cover. As a result, specialized insurance products are being developed to address these specific concerns.

Staying Ahead of the Curve: Evolving Risks and Insurance Solutions

Renters must stay vigilant and proactive in monitoring emerging risks and ensuring their insurance coverage keeps pace with these changes. This involves regularly reviewing their insurance policies, staying informed about industry developments, and consulting with insurance professionals to ensure their coverage remains comprehensive and up-to-date.

For instance, if a renter plans to list their property on a short-term rental platform, they should carefully assess their insurance needs and consider adding appropriate endorsements or separate policies to cover the unique risks associated with this type of rental arrangement.

Similarly, as cyber threats continue to evolve, renters should consider whether their current liability coverage is sufficient to protect them from potential online risks. If not, adding cyber liability coverage or seeking out insurance providers that offer robust cyber protection can be a prudent step.

In conclusion, renters insurance liability coverage is a critical component of a renter's financial safety net, offering protection against a wide range of potential liability incidents. By understanding the scope and limits of their coverage, customizing their policies to match their unique circumstances, and staying informed about emerging risks and insurance solutions, renters can ensure they are well-prepared for the unforeseen.

What is the average cost of renters insurance liability coverage?

+The cost of renters insurance liability coverage can vary depending on several factors, including the policy limits, the location of the rental property, and the renter’s personal circumstances. On average, liability coverage in a renters insurance policy can range from 100,000 to 300,000, with premiums typically falling between 15 to 30 per month. However, these figures can vary significantly, and it’s recommended to obtain multiple quotes to find the best coverage and price for your specific needs.

Does renters insurance liability coverage include legal defense costs?

+Yes, liability coverage in renters insurance policies typically includes legal defense costs. This means that if a claim is made against you, your insurance provider will cover the expenses associated with hiring an attorney, court fees, and other legal costs. However, it’s important to review your policy carefully, as some providers may have specific limits or exclusions regarding legal defense coverage.

Can I increase my liability coverage limits if needed?

+Absolutely. Renters insurance policies often allow policyholders to increase their liability coverage limits to better protect themselves from potential financial liabilities. This can be especially important for individuals with high-value assets or those who face a greater risk of liability claims. Consult with your insurance provider to understand the options available and the associated costs of increasing your coverage limits.