Medical Insurance Agent Near Me

In today's world, health is wealth, and having the right medical insurance coverage is an essential aspect of financial planning and overall well-being. Finding a knowledgeable and trustworthy medical insurance agent can be a challenging task, but with the right approach, you can ensure you receive the best guidance and support for your healthcare needs. This article aims to provide an in-depth guide on how to locate and engage with a medical insurance agent near you, ensuring you make informed decisions about your healthcare coverage.

The Importance of a Local Medical Insurance Agent

While the internet has made many services more accessible, finding a medical insurance agent online may not always yield the personalized experience and local expertise you require. A local medical insurance agent can offer several advantages, including:

- Personalized Service: Local agents often provide a more tailored approach, understanding your unique healthcare needs and local market dynamics.

- Face-to-Face Interaction: Meeting with an agent in person can build trust and allow for a more comprehensive understanding of your situation.

- Community Knowledge: Agents with local ties often have a deeper understanding of the healthcare landscape in your area, including local providers and facilities.

- Continued Support: Having an agent nearby ensures ongoing support and guidance, especially during times of need or when reviewing policy changes.

Identifying the Right Medical Insurance Agent

Finding a medical insurance agent who aligns with your needs and expectations is crucial. Here are some steps to help you identify the right professional:

Conduct a Local Search

Start by searching for medical insurance agents in your area. Utilize online directories, business listings, and search engines to create a comprehensive list of potential agents. You can also ask for recommendations from friends, family, or colleagues who have had positive experiences with local agents.

Evaluate Credentials and Experience

Research the qualifications and background of each agent on your list. Look for agents who are licensed and certified to sell medical insurance in your state. Consider their years of experience and specialization in the healthcare insurance field. Agents with a strong track record and positive client reviews are often a good indication of their expertise and reliability.

Assess Specialization and Services

Not all medical insurance agents offer the same services or specialize in the same areas. Determine whether the agent focuses on individual health plans, family coverage, or specific demographics like seniors or young professionals. Consider your unique needs and choose an agent who specializes in the type of coverage you require.

Review Client Testimonials and Reviews

Online reviews and testimonials can provide valuable insights into an agent’s work ethic and customer satisfaction. Look for platforms where clients share their experiences, such as Google Reviews, Yelp, or the agent’s website. Positive reviews and a high rating can indicate a reliable and trustworthy agent.

Schedule a Consultation

Once you’ve narrowed down your list, reach out to the agents and schedule a consultation. A consultation allows you to assess their communication style, expertise, and ability to address your specific concerns. Ask about their process for evaluating your needs, the types of plans they typically recommend, and their availability for ongoing support.

Preparing for Your Meeting with the Agent

To make the most of your time with the medical insurance agent, it’s essential to come prepared. Here are some tips to help you get ready:

- Know Your Budget: Have a clear understanding of your financial capabilities and the amount you're comfortable spending on medical insurance. This will help the agent tailor their recommendations to your budget.

- Gather Relevant Documents: Bring any existing insurance policies, medical records, or financial statements that may be relevant to your discussion. These documents can provide valuable insights into your current coverage and help the agent assess your needs more accurately.

- Prepare Questions: Write down a list of questions you have about medical insurance, coverage options, and the agent's services. This ensures you cover all your concerns and receive the information you need to make an informed decision.

Understanding Medical Insurance Coverage

Before meeting with a medical insurance agent, it’s beneficial to have a basic understanding of medical insurance coverage and its key components. Here’s a simplified breakdown:

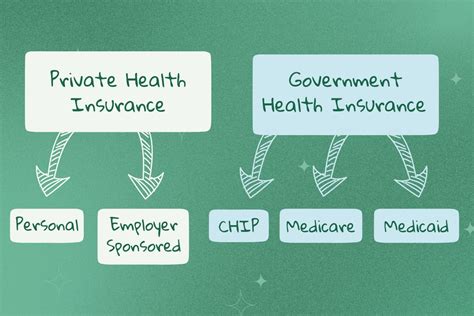

Types of Medical Insurance Plans

- Health Maintenance Organization (HMO): HMOs typically offer lower premiums but have more restrictions on provider choices and require referrals for specialist visits.

- Preferred Provider Organization (PPO): PPOs provide more flexibility in choosing healthcare providers and often cover a wider range of services. However, they may have higher premiums.

- Exclusive Provider Organization (EPO): EPOs are similar to PPOs but do not cover out-of-network care unless it’s an emergency.

- Point-of-Service (POS) Plans: POS plans combine features of both HMOs and PPOs, allowing you to choose between in-network and out-of-network providers.

Key Terms to Understand

- Premium: The amount you pay for your insurance coverage, typically on a monthly basis.

- Deductible: The amount you must pay out of pocket before your insurance coverage kicks in.

- Copayment (Copay): A fixed amount you pay for a covered service, such as a doctor’s visit or prescription medication.

- Coinsurance: Your share of the costs of a covered healthcare service, calculated as a percentage (e.g., you pay 20%, and your insurance covers the remaining 80%).

- Out-of-Pocket Maximum: The most you’ll pay for covered services in a year, excluding your premium.

The Role of a Medical Insurance Agent

A medical insurance agent serves as your trusted advisor, guiding you through the complex world of healthcare insurance. Their primary responsibilities include:

- Policy Evaluation: Agents assess your current coverage and needs to determine the best plan for your situation.

- Plan Comparison: They provide an overview of various insurance plans, helping you understand the differences and benefits of each.

- Application Assistance: Agents guide you through the application process, ensuring you have all the necessary information and documentation.

- Post-Sale Support: Once you've selected a plan, agents continue to provide support, helping you understand your coverage and navigate any changes or claims.

- Advocacy: In the event of a dispute or issue with your insurance provider, agents can advocate on your behalf, ensuring your rights are protected.

Engaging with Your Medical Insurance Agent

Once you’ve found a medical insurance agent you trust, it’s important to establish a positive working relationship. Here are some tips for effective communication and collaboration:

- Set Clear Expectations: Discuss your goals and expectations with the agent. Be open about your budget, coverage needs, and any specific concerns you have.

- Ask Questions: Don't hesitate to ask questions about the insurance plans, coverage details, or any other aspect of healthcare insurance. A good agent will welcome your queries and provide clear explanations.

- Provide Accurate Information: Be transparent and honest about your health status, medical history, and any pre-existing conditions. This ensures the agent can provide accurate recommendations and avoid any potential issues with your coverage.

- Review Your Policy Regularly: Medical insurance policies can change over time, so it's essential to review your coverage annually. Your agent can assist with this process, ensuring your plan remains aligned with your needs.

The Future of Medical Insurance

The healthcare insurance landscape is constantly evolving, with new technologies and innovations shaping the industry. Here’s a glimpse into the future of medical insurance:

Digital Health Solutions

Digital health platforms and apps are revolutionizing the way we manage our healthcare. These tools can help you track your health, manage prescriptions, and even connect with healthcare providers remotely. Medical insurance agents are likely to incorporate these digital solutions into their services, providing a more seamless and efficient experience.

Personalized Medicine

Advancements in genetic testing and precision medicine are paving the way for highly personalized healthcare. Medical insurance plans may adapt to offer more tailored coverage based on individual genetic profiles and health risks. Agents will need to stay updated on these developments to provide accurate advice.

Value-Based Care

The focus on value-based care is shifting the healthcare industry towards outcomes and patient satisfaction. Medical insurance plans may offer incentives for preventive care and healthier lifestyles. Agents can guide you towards plans that prioritize value and encourage proactive health management.

FAQs

How much does a medical insurance agent cost?

+Medical insurance agents are typically compensated through commissions paid by insurance companies. As a result, their services are often free to consumers. However, it’s essential to discuss any potential fees or charges upfront to ensure there are no surprises.

Can I switch medical insurance agents if I’m not satisfied?

+Absolutely! You have the right to choose the agent who best meets your needs. If you feel your current agent is not providing the level of service or expertise you require, you can switch to a different agent at any time. It’s important to ensure a smooth transition by providing all necessary documentation and keeping your insurance company informed.

What should I do if I have a dispute with my insurance company?

+In the event of a dispute, your medical insurance agent can be a valuable advocate. They can assist you in communicating with the insurance company, ensuring your rights are protected, and helping to resolve the issue. If the dispute persists, you may also consider seeking legal advice or contacting your state’s insurance regulatory body for guidance.

Finding the right medical insurance agent near you is an important step towards securing comprehensive and affordable healthcare coverage. By following the steps outlined in this article, you can navigate the process with confidence, ensuring you receive the personalized guidance and support you deserve.