Pip Auto Insurance

In the rapidly evolving landscape of insurance services, innovative companies are revolutionizing the way we protect our assets. Pip Auto Insurance stands out as a forward-thinking brand that offers a unique and personalized approach to automotive coverage. This article delves into the intricacies of Pip Auto Insurance, exploring its innovative features, benefits, and the impact it has on the insurance industry as a whole.

The Evolution of Auto Insurance: Introducing Pip

The traditional model of auto insurance has long been a necessity for vehicle owners, but it often comes with complexities and a lack of personalization. Pip Auto Insurance emerges as a game-changer, offering a fresh perspective on automotive coverage. By leveraging advanced technologies and a customer-centric approach, Pip aims to simplify the insurance process, providing tailored solutions that meet the unique needs of each policyholder.

Founded by a team of industry experts with a vision for a more efficient and client-friendly insurance experience, Pip has quickly gained recognition for its innovative strategies. The company's mission is to revolutionize the auto insurance sector by making coverage accessible, affordable, and tailored to individual driving behaviors and preferences.

Key Features and Benefits of Pip Auto Insurance

Pip Auto Insurance boasts a range of features that set it apart from traditional insurance providers. Here’s a closer look at some of its standout offerings:

- Personalized Premium Calculations: Pip utilizes advanced algorithms to analyze driving behaviors and patterns. By assessing factors such as mileage, driving style, and road conditions, the company offers customized premium rates that accurately reflect an individual's risk profile. This ensures that policyholders pay premiums that align with their actual driving habits.

- Real-Time Claims Processing: In the event of an accident or incident, Pip's digital platform streamlines the claims process. Policyholders can initiate claims instantly through the mobile app, providing real-time updates and facilitating a swift resolution. This technology reduces the traditional delays and complexities associated with filing claims, offering a more efficient and stress-free experience.

- Discounts and Rewards: Pip encourages safe driving behaviors by implementing a reward system. Policyholders who maintain a consistent record of safe driving can earn discounts on their premiums. Additionally, the company offers incentives for environmentally conscious choices, such as driving electric vehicles or adopting eco-friendly driving practices.

- Telematics Integration: Pip's advanced telematics technology allows for real-time monitoring of driving behaviors. This data is used to provide accurate risk assessments and personalized feedback to drivers. By promoting safer driving habits, Pip not only reduces the likelihood of accidents but also contributes to a more sustainable and responsible driving culture.

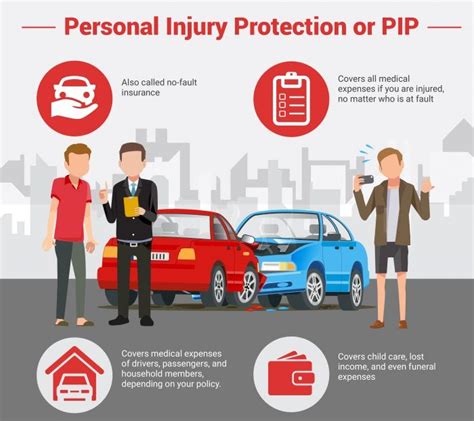

- Comprehensive Coverage Options: While Pip's focus is on innovation and personalization, it doesn't compromise on the breadth of coverage. Policyholders can choose from a range of comprehensive coverage options, including liability, collision, comprehensive, and personal injury protection. Pip ensures that its clients have the necessary protection for their unique circumstances.

With its innovative approach, Pip Auto Insurance not only benefits individual policyholders but also has a positive impact on the wider insurance industry. By challenging traditional models, Pip encourages a shift towards more customer-centric practices, driving competition and improvement across the sector.

The Impact of Pip on the Insurance Industry

Pip’s influence extends beyond its direct clients, shaping the future of the insurance landscape. Here’s how Pip is contributing to industry evolution:

Enhancing Customer Experience

Pip’s emphasis on personalization and digital integration has set a new standard for customer experience in the insurance sector. By offering tailored coverage and efficient claim processes, Pip has raised the bar for client satisfaction. Other insurance providers are now compelled to adopt similar strategies, leading to an overall improvement in the quality of services offered.

Promoting Sustainable Practices

Through its telematics technology and reward system, Pip actively promotes sustainable and safe driving behaviors. By incentivizing eco-friendly choices and safe driving habits, Pip contributes to a reduction in environmental impact and accident rates. This not only benefits individual policyholders but also has a positive ripple effect on society as a whole.

Driving Industry Innovation

Pip’s success has sparked a wave of innovation within the insurance industry. Other companies are now investing in technology and data analytics to compete with Pip’s personalized offerings. This competitive environment encourages continuous improvement, leading to the development of more efficient and customer-friendly insurance products and services.

The insurance industry is undergoing a transformative phase, and Pip Auto Insurance stands at the forefront of this revolution. By prioritizing customer needs, leveraging technology, and fostering a culture of sustainability, Pip has not only created a successful business model but has also set the stage for a brighter and more sustainable future for the insurance sector.

| Feature | Description |

|---|---|

| Personalized Premiums | Pip analyzes driving behaviors to offer tailored premium rates. |

| Real-Time Claims | Digital platform enables instant claim initiation and updates. |

| Safe Driving Rewards | Policyholders earn discounts for maintaining a safe driving record. |

| Telematics Integration | Real-time monitoring of driving behaviors for accurate risk assessments. |

| Comprehensive Coverage | Wide range of coverage options to suit individual needs. |

How does Pip Auto Insurance calculate personalized premiums?

+Pip utilizes advanced algorithms to analyze driving behaviors, including mileage, driving style, and road conditions. This data-driven approach allows for a more accurate assessment of an individual’s risk profile, resulting in personalized premium rates.

What makes Pip’s claims process more efficient than traditional methods?

+Pip’s digital platform enables policyholders to initiate claims instantly through a mobile app. Real-time updates and streamlined processes ensure a faster and more convenient claims experience compared to traditional paper-based methods.

How does Pip encourage sustainable driving practices?

+Pip’s telematics technology and reward system incentivize eco-friendly choices and safe driving behaviors. Policyholders can earn discounts by adopting sustainable practices, such as driving electric vehicles or practicing eco-conscious driving habits.