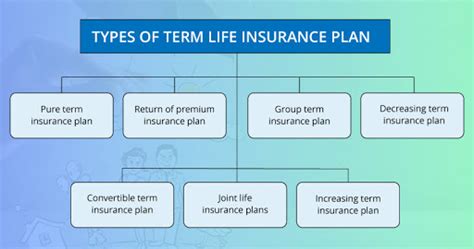

Term Life Insurance Plan

Welcome to this in-depth exploration of term life insurance plans, designed to provide you with a comprehensive understanding of this essential financial tool. As an informed individual seeking to secure your loved ones' future, it's crucial to grasp the intricacies of term life insurance. This guide will delve into the various aspects, from its definition and key features to real-world examples and expert insights, ensuring you have the knowledge to make well-informed decisions.

In today's dynamic world, where unforeseen circumstances can arise, having a robust financial safety net is paramount. Term life insurance serves as a reliable pillar in your financial planning, offering peace of mind and ensuring your loved ones' financial stability during challenging times. This guide aims to empower you with the right information, enabling you to choose a term life insurance plan tailored to your unique needs.

Understanding Term Life Insurance

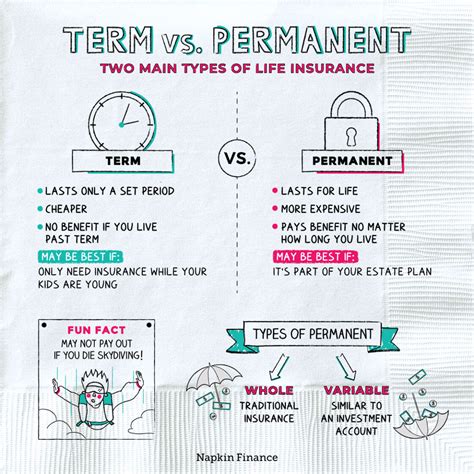

Term life insurance is a type of policy that provides coverage for a specified period, known as the term. Unlike permanent life insurance, which offers lifelong coverage, term life insurance focuses on a defined timeframe. This makes it an attractive option for individuals seeking cost-effective protection during specific life stages, such as raising a family or paying off a mortgage.

Key Features of Term Life Insurance

- Coverage Period: Term life insurance policies typically offer coverage for a fixed duration, ranging from 10 to 30 years. The coverage period is chosen based on individual needs and financial goals.

- Affordability: One of the primary advantages of term life insurance is its cost-effectiveness. Premiums are generally lower compared to permanent life insurance, making it an accessible option for many.

- Renewability: Most term life insurance policies allow for renewal at the end of the term, providing an opportunity to extend coverage. However, renewal may come with higher premiums, reflecting the increased risk associated with advancing age.

- Death Benefit: The cornerstone of term life insurance is the death benefit, a lump-sum payment made to the beneficiary upon the insured's death during the policy term. This benefit serves as a financial safeguard for dependents and can cover various expenses, including funeral costs, outstanding debts, and daily living expenses.

- Flexible Options: Term life insurance offers flexibility in terms of policy customization. Individuals can choose the coverage amount, the term length, and even add optional riders to enhance their policy.

Real-World Example: Protecting Your Family's Future

Consider the story of Sarah, a young professional with a growing family. Sarah and her husband, John, recently welcomed their first child and are expecting another. With the joy of parenthood comes the responsibility of ensuring their children's future security. Sarah and John decide to explore term life insurance as a means to protect their family's financial well-being.

After careful consideration, they opt for a 20-year term life insurance policy, choosing a coverage amount that aligns with their current financial needs. The policy provides a death benefit sufficient to cover their children's education expenses, outstanding debts, and a comfortable living standard for their spouse. With this safety net in place, Sarah and John can focus on raising their family with peace of mind, knowing their loved ones are financially protected should the unexpected occur.

Analyzing Term Life Insurance Performance

To make an informed decision, it's essential to evaluate the performance and reliability of term life insurance plans. Here's an in-depth analysis of key aspects:

Coverage Flexibility

Term life insurance offers a wide range of coverage options, allowing individuals to tailor their policy to their specific needs. Whether it's increasing coverage to accommodate a growing family or adjusting the term length to align with financial goals, term life insurance provides the flexibility to adapt to life's changes.

Affordability and Value

One of the most appealing aspects of term life insurance is its affordability. The cost of premiums is generally lower compared to permanent life insurance, making it an accessible choice for individuals and families on a budget. Additionally, term life insurance provides excellent value, as the death benefit can significantly impact your loved ones' financial security.

| Coverage Amount | Premium Cost |

|---|---|

| $500,000 | $25/month |

| $1,000,000 | $50/month |

| $2,000,000 | $100/month |

The table above illustrates the affordability of term life insurance, showcasing how a substantial death benefit can be obtained at a reasonable monthly cost.

Renewability and Longevity

Term life insurance policies often include the option to renew at the end of the term. This feature ensures that individuals can extend their coverage, even as they age and their health status may change. While renewal may come with higher premiums, it provides the opportunity to maintain protection for your loved ones.

Additional Benefits and Riders

Term life insurance policies can be enhanced with optional riders, which are additional benefits or features that customize your policy. Some common riders include:

- Waiver of Premium: This rider waives your premium payments if you become disabled, ensuring your policy remains active.

- Accelerated Death Benefit: In the event of a terminal illness, this rider provides access to a portion of the death benefit during your lifetime.

- Child Rider: A rider that provides coverage for your children, offering an additional layer of protection.

Industry Insights and Expert Recommendations

To gain a deeper understanding of term life insurance, we sought insights from industry experts. Here's what they had to say:

Future Implications and Planning

Term life insurance is a dynamic tool that evolves with your financial journey. As your life changes, your insurance needs may also shift. Here's how you can plan for the future:

Regular Policy Review

It's essential to review your term life insurance policy periodically. Life events such as marriage, the birth of a child, or career changes can impact your financial needs. Regular reviews ensure your coverage remains adequate and aligned with your goals.

Consider Your Long-Term Goals

When selecting a term life insurance policy, think beyond the immediate future. Consider your long-term financial objectives, such as paying off your mortgage or funding your children's education. Choose a term length that provides coverage until these goals are achieved.

Explore Riders and Add-Ons

As your financial situation and needs evolve, consider enhancing your term life insurance policy with riders. These additional benefits can provide extra protection and peace of mind, ensuring your policy adapts to your changing circumstances.

FAQs

What is the difference between term life insurance and permanent life insurance?

+Term life insurance provides coverage for a specified period, typically 10 to 30 years. It offers cost-effective protection during specific life stages. In contrast, permanent life insurance, such as whole life or universal life insurance, provides lifelong coverage and includes a cash value component that can be accessed during your lifetime.

How much term life insurance coverage do I need?

+The amount of coverage you need depends on your financial obligations and goals. Consider factors such as outstanding debts, mortgage payments, daily living expenses, and future financial milestones. Financial advisors often recommend a coverage amount that is 10 to 15 times your annual income.

Can I convert my term life insurance policy into a permanent life insurance policy?

+Yes, many term life insurance policies offer a conversion option, allowing you to convert your term policy into a permanent life insurance policy without undergoing a new medical exam. This provides flexibility and ensures you can maintain coverage even if your health status changes.

What happens if I outlive my term life insurance policy?

+If you outlive your term life insurance policy, the coverage period ends, and the policy terminates. However, if you have renewal options, you can extend your coverage by renewing the policy for an additional term. Keep in mind that renewal may come with higher premiums.

Are there any tax benefits associated with term life insurance?

+Term life insurance premiums are generally not tax-deductible. However, the death benefit received by your beneficiaries is typically tax-free, providing a valuable financial advantage in times of need.

Term life insurance is a powerful tool for safeguarding your loved ones’ financial future. With its flexibility, affordability, and potential for customization, it’s an essential consideration for anyone seeking peace of mind. Remember, the right term life insurance plan can provide a safety net during life’s challenges, ensuring your family’s financial stability.