How Much Does It Cost For Business Insurance

Business insurance is a vital aspect of risk management for any company, regardless of its size or industry. It provides a safety net against financial losses and potential liabilities that could arise from various events, such as property damage, legal disputes, or injuries to employees or customers. The cost of business insurance can vary significantly depending on several factors, including the type of business, its location, the level of coverage required, and the insurer's assessment of risk. In this comprehensive guide, we will delve into the factors influencing business insurance costs, explore different coverage options, and provide insights to help business owners make informed decisions when purchasing insurance.

Understanding the Factors that Influence Business Insurance Costs

Several key factors contribute to the overall cost of business insurance. Recognizing and understanding these factors can help business owners anticipate expenses and make strategic choices when selecting insurance coverage.

Type of Business and Industry

The nature of your business and the industry it operates in play a significant role in determining insurance costs. Certain industries, such as construction, manufacturing, or transportation, inherently carry higher risks due to the potential for accidents, property damage, or liability claims. Insurers assess these risks and adjust premiums accordingly. For instance, a construction company will likely face higher insurance costs compared to a software development firm due to the physical risks associated with construction work.

Additionally, specific business activities within an industry can impact insurance rates. For example, a restaurant that serves alcohol may face higher premiums than one that does not, as serving alcohol increases the risk of liability claims related to intoxication.

Business Location

The geographical location of your business is another crucial factor in insurance cost calculations. Areas with higher crime rates, frequent natural disasters, or a dense population may pose increased risks, leading to higher insurance premiums. For instance, a business located in a region prone to hurricanes or earthquakes will likely require specialized coverage and face higher costs due to the potential for extensive property damage.

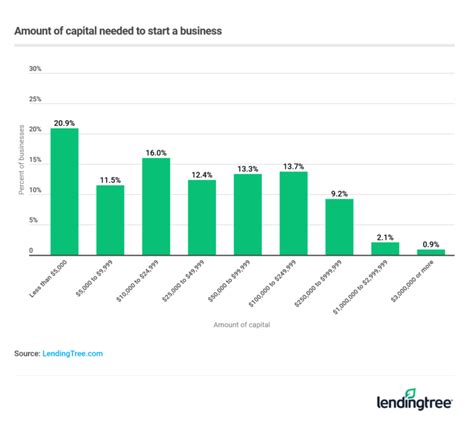

Size and Growth of the Business

The size and growth trajectory of your business can also influence insurance costs. Larger businesses with a greater number of employees, assets, and revenue typically require more extensive coverage. As a business expands, its insurance needs may evolve, and the cost of coverage may increase accordingly. However, economies of scale can sometimes mitigate these costs, as larger businesses may qualify for bulk discounts or have more negotiating power with insurers.

Claims History and Risk Assessment

Insurers carefully evaluate a business's claims history and overall risk profile when determining insurance premiums. A business with a history of frequent claims or high-value claims may be considered a higher risk, leading to increased premiums. On the other hand, a business with a clean claims record may enjoy lower rates as insurers perceive it as a lower-risk entity.

Risk assessment also involves evaluating the business's safety measures, employee training programs, and overall risk management strategies. Businesses that proactively implement safety protocols and reduce potential hazards may be rewarded with more favorable insurance rates.

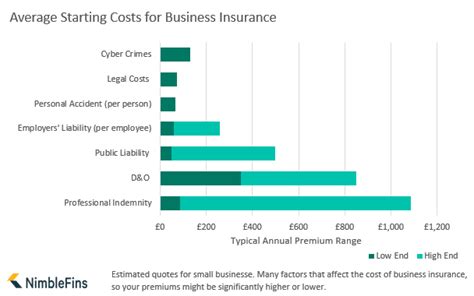

Type and Level of Coverage

The type and level of insurance coverage chosen by a business significantly impact the overall cost. Different types of insurance policies, such as property insurance, liability insurance, workers' compensation, or business interruption insurance, each address specific risks and come with varying premium costs. The more comprehensive the coverage, the higher the premium is likely to be.

Additionally, the level of coverage, determined by the policy limits and deductibles, can affect costs. Higher policy limits and lower deductibles generally result in increased premiums, as they provide more extensive protection against potential losses.

Exploring Different Types of Business Insurance Coverage

Business insurance is not a one-size-fits-all solution. Depending on the nature of your business and the risks it faces, you may require a combination of different insurance policies to ensure comprehensive coverage. Here's an overview of some common types of business insurance coverage.

General Liability Insurance

General liability insurance is a fundamental coverage that every business should consider. It protects against third-party claims arising from bodily injury, property damage, personal injury (such as libel or slander), or advertising injury. This insurance is particularly crucial for businesses that interact directly with customers or the public, as it provides a safety net against potential lawsuits.

| Policy Feature | Description |

|---|---|

| Bodily Injury | Covers medical expenses and legal costs if a customer or visitor is injured on your business premises. |

| Property Damage | Provides coverage for damage to property owned by others, such as a client's building or equipment. |

| Personal and Advertising Injury | Protects against claims of defamation, copyright infringement, or false advertising. |

Property Insurance

Property insurance safeguards a business's physical assets, including buildings, inventory, equipment, and furnishings. It provides coverage for damage or loss due to events like fires, storms, vandalism, or theft. Property insurance is essential for businesses that own or lease physical spaces and assets.

| Policy Feature | Description |

|---|---|

| Building Coverage | Covers the structure of the building, including walls, roofs, and permanent fixtures. |

| Business Personal Property | Protects items such as furniture, machinery, and inventory owned by the business. |

| Loss of Income | Provides compensation for lost revenue if the business is unable to operate due to covered property damage. |

Workers' Compensation Insurance

Workers' compensation insurance is a legal requirement in most states for businesses with employees. It provides coverage for medical expenses and a portion of lost wages if an employee is injured or becomes ill due to work-related causes. This insurance not only protects employees but also shields the business from potential liability lawsuits.

Professional Liability Insurance (Errors and Omissions Insurance)

Professional liability insurance, also known as errors and omissions (E&O) insurance, is essential for businesses providing professional services. It protects against claims of negligence, errors, or omissions in the delivery of those services. This coverage is particularly crucial for industries such as consulting, accounting, legal services, and healthcare, where mistakes can have significant financial implications.

Business Interruption Insurance

Business interruption insurance provides coverage for lost income and ongoing expenses if a business is forced to shut down temporarily due to a covered event, such as a fire or natural disaster. This insurance helps businesses stay afloat during challenging times and can include coverage for expenses like rent, salaries, and loan payments.

Commercial Auto Insurance

Commercial auto insurance is necessary for businesses that own or operate vehicles in the course of their operations. It provides coverage for bodily injury, property damage, and vehicle damage related to business use. This insurance is distinct from personal auto insurance and is tailored to meet the unique needs of commercial vehicles.

Strategies to Reduce Business Insurance Costs

While the cost of business insurance is influenced by various factors, there are strategies business owners can employ to potentially reduce insurance premiums and obtain more favorable coverage.

Shop Around and Compare Quotes

Insurance rates can vary significantly between different providers. By obtaining quotes from multiple insurers, business owners can compare coverage options and premiums to find the most cost-effective solution. It's essential to consider not only the price but also the reputation and financial stability of the insurer.

Bundling Insurance Policies

Bundling multiple insurance policies with the same insurer can often result in cost savings. Many insurers offer discounts when businesses purchase multiple policies, such as combining general liability, property, and business interruption insurance. This strategy not only simplifies insurance management but also potentially reduces overall costs.

Implement Risk Management Strategies

Businesses can take proactive measures to mitigate risks and improve their insurance profiles. Implementing robust safety protocols, employee training programs, and regular maintenance of equipment and facilities can reduce the likelihood of accidents and claims. Insurers often reward businesses with lower premiums for demonstrating a commitment to risk management.

Consider Higher Deductibles

Choosing insurance policies with higher deductibles can result in lower premiums. A deductible is the amount a business pays out of pocket before the insurance coverage kicks in. By opting for higher deductibles, businesses can reduce their insurance costs, but it's essential to ensure that the chosen deductible is manageable in the event of a claim.

Review and Adjust Coverage Regularly

Business needs and risks can evolve over time. Regularly reviewing insurance coverage and making adjustments as necessary is crucial. As a business grows, changes locations, or adds new products or services, its insurance needs may change. By staying proactive and keeping insurance coverage aligned with the business's current state, owners can avoid paying for unnecessary coverage or missing out on essential protections.

Frequently Asked Questions

How much does general liability insurance typically cost for a small business?

+General liability insurance costs for small businesses can vary widely based on factors like industry, location, and coverage limits. On average, small businesses can expect to pay between $300 and $1,000 per year for general liability insurance. However, it's important to note that these are rough estimates, and the actual cost can be higher or lower depending on the specific circumstances of the business.

<div class="faq-item">

<div class="faq-question">

<h3>Can I negotiate business insurance rates with insurers?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, it is possible to negotiate business insurance rates with insurers, especially if you have a strong risk management profile or are a valued customer with multiple policies. Insurers often appreciate proactive risk mitigation efforts and may offer discounts or more favorable terms to businesses that demonstrate a commitment to safety and loss prevention.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What happens if I can't afford the insurance premiums for my business?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>If you're facing financial challenges and cannot afford the insurance premiums for your business, it's crucial to explore alternatives. Consider discussing your situation with your insurance broker or agent to see if there are options for adjusting coverage, increasing deductibles, or spreading out payments. Additionally, seeking advice from financial advisors or industry peers can provide valuable insights into managing insurance costs effectively.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any government programs or subsidies available to help small businesses with insurance costs?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>In some regions, governments may offer programs or subsidies to assist small businesses with insurance costs, particularly in high-risk industries or areas prone to natural disasters. These programs can provide grants, tax incentives, or reduced insurance rates. It's worth researching local, state, or federal initiatives to see if your business qualifies for any such support.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How often should I review and update my business insurance coverage?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>It's recommended to review your business insurance coverage annually or whenever significant changes occur in your business operations, such as expansion, relocation, or introduction of new products or services. Regular reviews ensure that your coverage remains aligned with your business needs and that you're not paying for unnecessary coverage or missing out on essential protections.</p>

</div>

</div>

</div>