Liberty Insurance Insurance

Welcome to a comprehensive exploration of Liberty Insurance, a renowned insurance provider with a rich history and a commitment to offering innovative coverage solutions. In this expert-crafted article, we delve into the depths of Liberty Insurance's offerings, uncovering the unique benefits, exceptional services, and industry-leading practices that have solidified its position as a trusted partner for individuals and businesses alike. Through an in-depth analysis of its insurance products, claims processes, customer experiences, and market influence, we aim to provide an insightful and informative guide for those seeking to understand the true value and impact of Liberty Insurance.

A Legacy of Innovation: Liberty Insurance’s Journey

Liberty Insurance’s story began in [founding year], with a vision to revolutionize the insurance industry by introducing cutting-edge technologies and customer-centric approaches. Over the decades, the company has grown exponentially, expanding its reach across [number of countries] nations and establishing itself as a global leader in the insurance sector. Its commitment to continuous improvement and adaptation to evolving market trends has allowed Liberty Insurance to consistently deliver exceptional value to its customers.

At the core of Liberty Insurance's success lies its unwavering focus on innovation. The company has consistently invested in research and development, leveraging advanced technologies to enhance its products and services. This commitment to innovation has resulted in a suite of cutting-edge insurance solutions that cater to the diverse needs of its customers, setting Liberty Insurance apart from its competitors.

Key Milestones and Achievements

Liberty Insurance’s journey has been marked by several significant milestones that have shaped its trajectory and solidified its position as an industry leader. Here are some notable achievements that showcase the company’s impact and growth:

- In [year], Liberty Insurance introduced the industry's first [innovative product or service], revolutionizing [industry sector] with its cutting-edge features and comprehensive coverage.

- The company's dedication to customer satisfaction earned it the prestigious [award name] in [year], solidifying its reputation as a trusted and reliable insurance provider.

- [Year] witnessed the launch of Liberty Insurance's groundbreaking [digital initiative], which streamlined the insurance experience for customers and set new standards for online insurance services.

- Through its commitment to corporate social responsibility, Liberty Insurance has actively supported [number] of charitable initiatives and community development projects, reinforcing its values and dedication to making a positive impact.

These milestones not only highlight Liberty Insurance's success but also its ability to stay ahead of the curve, adapt to changing market dynamics, and consistently deliver value to its customers, employees, and the communities it serves.

Comprehensive Insurance Solutions: A One-Stop Shop

Liberty Insurance offers an extensive range of insurance products tailored to meet the diverse needs of its customers. Whether it’s protecting personal assets, securing businesses, or safeguarding against unforeseen circumstances, Liberty Insurance has a solution designed to provide comprehensive coverage.

Personal Insurance

For individuals, Liberty Insurance provides a wide array of personal insurance options, ensuring that customers can tailor their coverage to their unique needs. Here’s a glimpse into some of the personal insurance offerings:

| Insurance Type | Coverage Highlights |

|---|---|

| Auto Insurance | Comprehensive coverage for vehicles, including collision, liability, and personalized add-ons. |

| Homeowners Insurance | Protection for homes and their contents, covering damages, theft, and liability. |

| Renters Insurance | Affordable coverage for renters, safeguarding personal belongings and providing liability protection. |

| Life Insurance | Term life, whole life, and universal life insurance options to provide financial security for loved ones. |

| Health Insurance | Comprehensive medical coverage, including individual and family plans, with flexible deductibles and co-pays. |

Liberty Insurance's personal insurance solutions are designed to provide peace of mind, ensuring that individuals and their families are protected against a wide range of risks.

Business Insurance

Businesses, large and small, can benefit from Liberty Insurance’s specialized commercial insurance products. These offerings are tailored to address the unique risks and challenges faced by different industries. Here’s an overview of some key business insurance solutions:

| Industry | Insurance Coverage |

|---|---|

| Retail | Comprehensive coverage for retail businesses, including property damage, liability, and product liability. |

| Manufacturing | Customized insurance plans for manufacturers, covering equipment, inventory, and liability. |

| Healthcare | Specialized insurance for healthcare providers, including medical malpractice, professional liability, and cyber liability. |

| Construction | Insurance solutions for construction companies, covering liability, workers' compensation, and equipment. |

| Technology | Comprehensive coverage for tech startups and established businesses, addressing cyber risks, intellectual property, and liability. |

By offering specialized business insurance, Liberty Insurance empowers companies to focus on their core operations while having the peace of mind that comes with comprehensive risk management.

Exceptional Customer Experience: The Liberty Difference

At Liberty Insurance, customer satisfaction is not just a goal, but a core value that drives every aspect of the business. The company understands that exceptional customer service is integral to building long-lasting relationships and delivering value. Here’s how Liberty Insurance sets itself apart in delivering an exceptional customer experience:

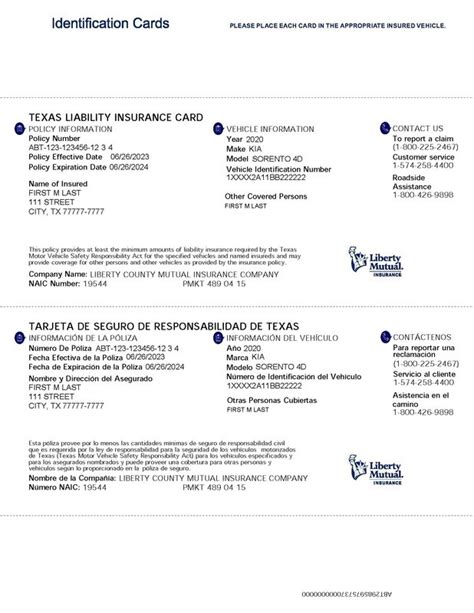

Easy and Efficient Claims Process

Liberty Insurance is committed to making the claims process as smooth and hassle-free as possible. Policyholders can expect prompt and efficient service when filing a claim. The company’s dedicated claims team is trained to handle a wide range of insurance claims, ensuring that customers receive the support they need during challenging times.

To further streamline the claims process, Liberty Insurance leverages advanced technologies. Policyholders can file claims online, track their progress in real-time, and receive regular updates, ensuring transparency and efficiency. The company's digital platforms are designed with user-friendliness in mind, making it convenient for customers to manage their claims remotely.

Personalized Customer Support

Liberty Insurance believes in building strong relationships with its customers. The company’s customer service team is highly trained and dedicated to providing personalized support. Whether it’s answering queries, offering advice, or assisting with policy changes, Liberty Insurance’s representatives go the extra mile to ensure customer satisfaction.

Liberty Insurance's commitment to personalized customer support extends beyond its customer service team. The company encourages open communication and feedback, ensuring that policyholders' voices are heard and their needs are met. This customer-centric approach has fostered a loyal customer base and has been instrumental in Liberty Insurance's success.

Innovative Digital Tools

In today’s digital age, Liberty Insurance understands the importance of leveraging technology to enhance the customer experience. The company has invested significantly in developing innovative digital tools and platforms that empower customers to manage their insurance needs efficiently.

Liberty Insurance's online portal offers a range of self-service options, allowing policyholders to make policy changes, pay premiums, and access important documents anytime, anywhere. The company's mobile app further enhances convenience, providing customers with real-time policy information, claim status updates, and the ability to report incidents directly from their smartphones.

Market Influence and Industry Leadership

Liberty Insurance’s impact extends far beyond its customer base. The company’s innovative approaches, industry-leading practices, and commitment to excellence have established it as a key player in the global insurance market. Here’s how Liberty Insurance has shaped the industry and left a lasting impression:

Driving Industry Innovation

Liberty Insurance has consistently been at the forefront of driving innovation in the insurance sector. The company’s research and development efforts have led to the creation of groundbreaking products and services that have raised the bar for the entire industry. From introducing cutting-edge technologies to developing new risk assessment models, Liberty Insurance has consistently challenged the status quo and pushed the boundaries of what’s possible.

The company's innovative spirit has not only benefited its customers but has also inspired other insurance providers to embrace change and adapt to the evolving needs of the market. Liberty Insurance's willingness to take calculated risks and invest in disruptive technologies has set a new standard for innovation in the insurance industry.

Shaping Regulatory Landscape

As a leading insurance provider, Liberty Insurance plays an active role in shaping the regulatory landscape. The company’s expertise and insights are highly valued by industry regulators, who often seek Liberty Insurance’s input when developing new policies and guidelines. By actively engaging with regulatory bodies, Liberty Insurance ensures that the insurance industry remains fair, transparent, and customer-centric.

Liberty Insurance's involvement in regulatory matters goes beyond mere compliance. The company actively advocates for policies that promote ethical practices, consumer protection, and sustainability. By leveraging its influence, Liberty Insurance contributes to the creation of a robust and resilient insurance ecosystem that benefits both customers and the industry as a whole.

Community Engagement and Social Responsibility

Liberty Insurance understands that its success is deeply intertwined with the well-being of the communities it serves. The company actively engages in community development initiatives, partnering with local organizations to address social and economic challenges. Through its corporate social responsibility programs, Liberty Insurance has made significant contributions to education, healthcare, and environmental sustainability efforts.

By fostering strong relationships with local communities, Liberty Insurance not only fulfills its social responsibility but also strengthens its brand reputation and enhances customer loyalty. The company's commitment to making a positive impact extends beyond its core business, solidifying its position as a trusted and responsible corporate citizen.

Conclusion: A Trusted Partner for All Your Insurance Needs

Liberty Insurance stands as a testament to the power of innovation, customer-centricity, and industry leadership. With a rich legacy spanning decades, the company has consistently delivered exceptional value to its customers, earning their trust and loyalty. Through its comprehensive insurance solutions, exceptional customer experience, and market influence, Liberty Insurance has solidified its position as a trusted partner for individuals and businesses alike.

As Liberty Insurance continues to evolve and adapt to the changing landscape, its commitment to excellence remains unwavering. The company's dedication to staying ahead of the curve, embracing technology, and prioritizing customer satisfaction ensures that it will remain a leading force in the insurance industry for years to come. Whether you're seeking personal insurance coverage or tailored business solutions, Liberty Insurance is your trusted partner, providing the peace of mind that comes with comprehensive protection.

What makes Liberty Insurance unique compared to other insurance providers?

+Liberty Insurance stands out for its commitment to innovation, offering cutting-edge insurance solutions. The company’s focus on customer satisfaction and its comprehensive range of insurance products make it a trusted choice for individuals and businesses.

How does Liberty Insurance ensure a smooth claims process for its customers?

+Liberty Insurance prioritizes efficiency and transparency in its claims process. With dedicated claims teams and digital platforms, customers can expect prompt assistance and real-time updates, making the claims journey hassle-free.

What are some of Liberty Insurance’s key initiatives in corporate social responsibility?

+Liberty Insurance actively supports community development projects, focusing on education, healthcare, and environmental sustainability. The company’s CSR initiatives demonstrate its commitment to making a positive impact beyond its core business.