Private Car Insurance Companies

The world of private car insurance is a vast and intricate landscape, offering a myriad of options for vehicle owners seeking protection and peace of mind. With an ever-evolving industry, it's crucial to stay informed about the latest trends, policies, and best practices to make well-informed decisions regarding your automotive insurance.

This comprehensive guide aims to delve into the intricacies of private car insurance companies, exploring their operations, policies, and the impact they have on the lives of countless vehicle owners worldwide. By understanding the nuances of this industry, you'll be better equipped to navigate the often-confusing realm of car insurance, making choices that align with your specific needs and circumstances.

Understanding the Private Car Insurance Landscape

The private car insurance sector is a competitive market, with numerous companies vying for the attention of vehicle owners. These companies offer a range of policies tailored to meet diverse needs, from comprehensive coverage to more specialized options. Understanding the landscape involves recognizing the key players, their unique offerings, and the factors that influence their popularity and success.

Key Players and Their Policies

Some of the leading private car insurance companies include State Farm, Geico, Progressive, and Allstate, each with a unique approach to coverage and customer service. State Farm, for instance, boasts a vast network of agents, offering personalized service and a range of discounts. Geico, on the other hand, focuses on digital convenience, providing an extensive online platform for policy management and claims.

Progressive and Allstate offer innovative features, such as usage-based insurance and accident forgiveness, appealing to those seeking more flexible coverage options. Understanding the policies and unique selling points of these companies is essential for making informed choices.

| Insurance Company | Key Features |

|---|---|

| State Farm | Extensive agent network, personalized service, various discounts |

| Geico | Digital convenience, online policy management, extensive claims support |

| Progressive | Usage-based insurance, snapshot program, flexible coverage options |

| Allstate | Accident forgiveness, teen smart driver program, innovative digital tools |

Factors Influencing Popularity

The popularity of private car insurance companies is influenced by various factors, including financial stability, customer satisfaction, and the range of coverage options offered. Financial stability is a critical aspect, as it ensures the company’s ability to pay out claims, providing security for policyholders. Customer satisfaction, often measured through surveys and reviews, reflects the overall experience with the company, including claim processes, customer service, and policy offerings.

Additionally, the range of coverage options and their flexibility play a significant role. Some companies excel in providing comprehensive coverage for a wide range of vehicles and drivers, while others specialize in more niche markets, such as classic car insurance or coverage for high-risk drivers. Understanding these factors can help vehicle owners make choices that align with their specific needs and priorities.

Comparing Policies and Coverage Options

Private car insurance policies vary significantly, offering a range of coverage options to suit different needs and budgets. Understanding these policies and their nuances is essential for making informed decisions about your automotive insurance.

Policy Types and Their Benefits

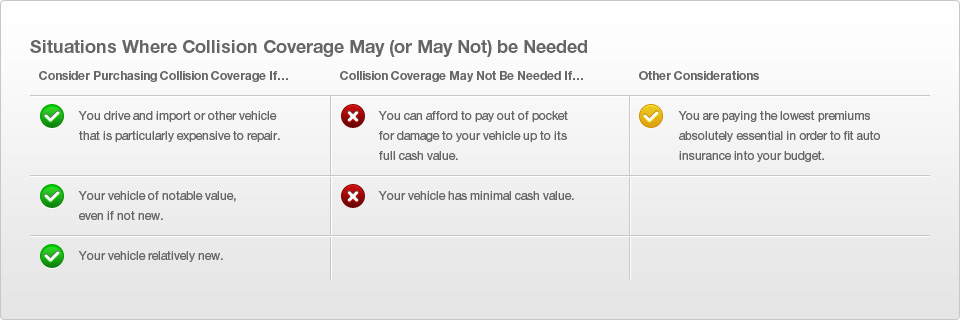

Private car insurance policies generally fall into two main categories: comprehensive coverage and liability-only coverage. Comprehensive coverage, as the name suggests, provides a wide range of protections, including collision, comprehensive (for non-accident damages like theft or natural disasters), personal injury protection (PIP), and uninsured/underinsured motorist coverage. This type of policy offers the most protection but typically comes with a higher premium.

Liability-only coverage, on the other hand, is more basic, providing protection only for damages you cause to others' property or injuries you cause to others. This type of policy is typically more affordable but offers limited protection, making it suitable for those on a tight budget or those with older vehicles.

| Policy Type | Coverage |

|---|---|

| Comprehensive | Collision, comprehensive, PIP, uninsured/underinsured motorist |

| Liability-only | Coverage for damages caused to others |

Specialized Coverage Options

Beyond the standard policy types, private car insurance companies offer a variety of specialized coverage options to cater to unique needs. These can include:

- Usage-based Insurance: Policies that adjust premiums based on your actual driving behavior, often determined through a telematics device. This can be beneficial for safe drivers, offering potential discounts.

- Accident Forgiveness: A feature that ensures your premiums won't increase after your first at-fault accident, providing a layer of protection against rate hikes.

- Rental Car Coverage: Additional coverage to provide rental car reimbursement in case your vehicle is in the shop due to an insured incident.

- Gap Insurance: Coverage that pays the difference between what your insurance company pays and the balance you owe on your lease or loan if your vehicle is totaled or stolen.

Specialized coverage options can provide added protection and peace of mind, but they often come at an additional cost. It's essential to carefully consider your needs and assess the value these options bring to your specific situation.

The Impact of Private Car Insurance

Private car insurance companies play a pivotal role in the lives of vehicle owners, offering financial protection and peace of mind. Beyond the immediate benefits of coverage, these companies have a broader impact on society and the economy.

Financial Protection and Peace of Mind

At its core, private car insurance provides financial protection in the event of an accident or other vehicle-related incident. This protection can be critical, ensuring that vehicle owners can cover the costs of repairs, medical expenses, and legal fees without devastating financial consequences. The peace of mind that comes with this protection is invaluable, allowing drivers to focus on the road and their daily lives without constant worry.

Social and Economic Impact

The influence of private car insurance extends beyond individual vehicle owners. On a societal level, car insurance plays a role in promoting safe driving practices. With the knowledge that accidents can lead to significant financial liabilities, drivers are incentivized to drive more cautiously, reducing the overall number of accidents and their severity. This, in turn, leads to fewer injuries and fatalities on the road, improving public safety.

Economically, the car insurance industry is a significant contributor. It provides employment opportunities, from agents and adjusters to underwriters and claims specialists. The industry also stimulates economic growth through its vast network of partnerships, including relationships with auto repair shops, medical professionals, and legal services. Additionally, the data and insights generated by the industry contribute to research and development, driving innovation in automotive safety and technology.

Future Implications and Innovations

Looking ahead, the private car insurance industry is poised for significant changes and innovations. The rise of autonomous vehicles and electric cars, for instance, will require new coverage models and policies. Additionally, advancements in technology, such as telematics and data analytics, are already transforming the industry, offering more precise risk assessments and personalized coverage options.

The future of private car insurance also involves a shift towards a more customer-centric approach, with companies leveraging technology to provide seamless digital experiences and more tailored policies. This evolution promises to make car insurance more accessible, flexible, and responsive to the diverse needs of vehicle owners.

FAQs

How do I choose the right private car insurance company for me?

+Choosing the right private car insurance company involves assessing your specific needs and circumstances. Consider factors such as the type of vehicle you own, your driving record, and any unique requirements you may have. Research the companies’ policies, coverage options, and customer satisfaction ratings. Get quotes from multiple insurers to compare prices and coverage. Remember, the cheapest option might not always be the best, so balance cost with the level of coverage and service you require.

What are some common discounts offered by private car insurance companies?

+Private car insurance companies offer a variety of discounts to attract and retain customers. These can include multi-policy discounts (for bundling car insurance with other policies like home or life insurance), good student discounts (for young drivers with good grades), safe driver discounts (for accident-free driving records), and loyalty discounts (for long-term customers). Some insurers also offer usage-based discounts, where your driving behavior is tracked and safe driving habits can lead to lower premiums.

What should I do if I’m involved in an accident and need to make an insurance claim?

+If you’re involved in an accident, the first step is to ensure your safety and the safety of others involved. Call the police to report the accident and get a police report, which can be useful for your insurance claim. Take photos of the accident scene and damage to all vehicles involved. Gather contact information from the other drivers and any witnesses. Then, contact your insurance company as soon as possible to start the claims process. Follow their instructions and provide all necessary documentation to ensure a smooth claims experience.

Can I switch private car insurance companies if I’m not satisfied with my current provider?

+Absolutely! You have the right to switch private car insurance companies at any time if you’re not satisfied with your current provider. Research other insurers, get quotes, and compare coverage and prices. Ensure that you understand the terms and conditions of the new policy before making the switch. Some companies may offer incentives to new customers, so it’s worth shopping around to find the best deal and the most suitable coverage for your needs.