Collision Insurance Is...

Collision insurance is an essential component of comprehensive vehicle insurance policies, providing coverage for damages sustained by a vehicle in the event of a collision. This type of insurance plays a crucial role in protecting policyholders from the financial burden of vehicle repairs or replacements, especially when accidents occur. In this article, we will delve into the intricacies of collision insurance, exploring its definition, coverage, and significance in the context of vehicle ownership.

Understanding Collision Insurance

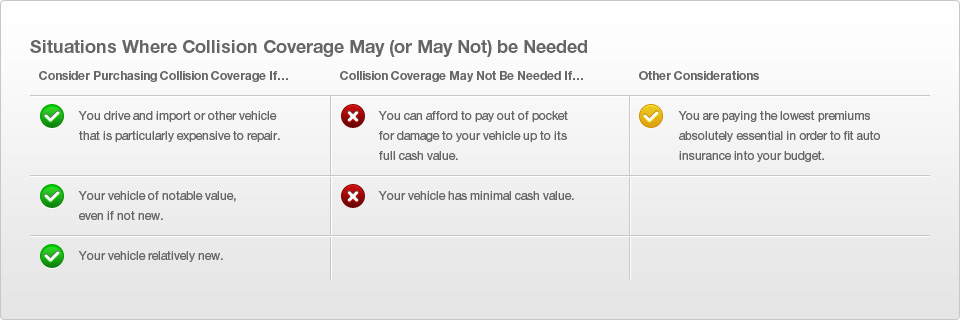

Collision insurance, often referred to as collision coverage, is a specific type of insurance that addresses the financial implications of a vehicle’s involvement in a collision. It covers the costs associated with repairing or replacing a vehicle that sustains damage as a result of a collision with another vehicle, object, or structure.

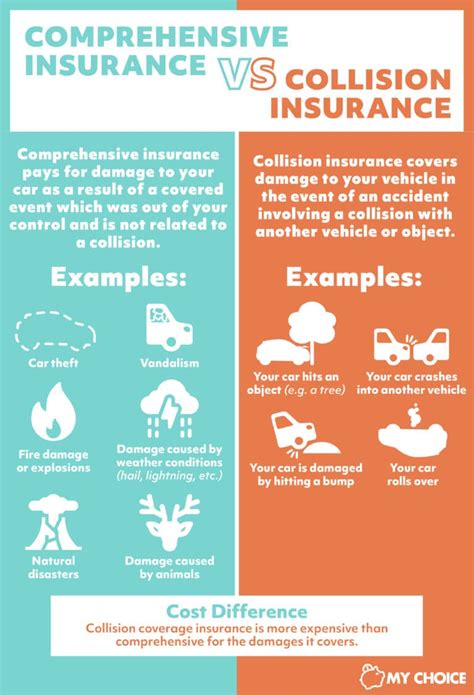

This coverage is distinct from other types of insurance, such as liability insurance, which focuses on the policyholder's responsibility for damages caused to others in an accident. Collision insurance primarily focuses on protecting the insured vehicle, ensuring that the policyholder can manage the financial consequences of an accident effectively.

Key Components of Collision Insurance

Collision insurance typically includes the following key elements:

- Collision Coverage: This is the core aspect of collision insurance, covering damages to the insured vehicle from collisions with other vehicles, fixed objects, or animals. It provides financial protection for repairs or replacements.

- Deductible: A deductible is the amount the policyholder must pay out of pocket before the insurance coverage kicks in. Deductibles can vary based on the policy and the insured's preference, and they can impact the premium cost.

- Limits and Coverage Amounts: Collision insurance policies often have limits, which are the maximum amounts the insurer will pay for covered damages. Policyholders can choose their coverage limits, but higher limits typically result in higher premiums.

- Additional Coverages: Some collision insurance policies may offer additional coverages, such as rental car reimbursement, which can help policyholders cover the cost of a rental car while their vehicle is being repaired.

Collision insurance is designed to provide peace of mind to vehicle owners, ensuring that they can manage the financial impact of accidents without significant strain on their finances.

The Importance of Collision Insurance

Collision insurance plays a vital role in the overall financial protection strategy for vehicle owners. Here are some key reasons why collision insurance is essential:

Financial Protection

The primary purpose of collision insurance is to provide financial protection to policyholders. Vehicle repairs or replacements can be costly, especially for newer or luxury vehicles. Collision insurance helps cover these expenses, ensuring that the policyholder doesn’t face a significant financial burden.

Peace of Mind

Knowing that you have collision insurance in place can provide a sense of security and peace of mind. It alleviates the stress and worry associated with potential accidents, allowing vehicle owners to focus on their daily lives without constant concern about the financial implications of an accident.

Maintaining Vehicle Value

Collision insurance can help maintain the value of a vehicle. By covering repairs and replacements, it ensures that the vehicle remains in good condition, which is essential for resale value. This is particularly beneficial for those who plan to sell or trade in their vehicle in the future.

Comprehensive Coverage

Collision insurance is often paired with other types of insurance, such as comprehensive insurance, to provide a comprehensive protection package. Comprehensive insurance covers non-collision-related damages, such as those caused by theft, vandalism, or natural disasters. Together, these coverages offer a robust financial safety net for vehicle owners.

Collision Insurance Coverage and Claims

Understanding how collision insurance coverage works and the claims process is crucial for policyholders. Here’s an overview:

Collision Coverage and Policy Terms

When purchasing collision insurance, policyholders have the flexibility to choose their coverage limits and deductibles. The coverage limits represent the maximum amount the insurer will pay for covered damages, while the deductible is the amount the policyholder agrees to pay out of pocket.

Policyholders should carefully review their policy terms and conditions to understand the specific details of their coverage, including any exclusions or limitations. Some policies may have specific requirements or procedures for filing claims, which policyholders should be aware of.

Filing a Collision Insurance Claim

In the event of a collision, policyholders should follow these steps to file a collision insurance claim:

- Contact Your Insurance Provider: Immediately notify your insurance company about the accident. Most insurers have a dedicated claims department that can guide you through the process.

- Gather Information: Collect relevant information, including the other driver's details (if applicable), photographs of the damage, and any witness statements. This information will be crucial for the claims process.

- Submit a Claim: Follow the instructions provided by your insurance company to submit a claim. This typically involves completing a claim form and providing the necessary documentation.

- Assessment and Repair: Once the claim is submitted, the insurance company will assess the damage and determine the coverage and repair options. Policyholders may be asked to provide additional information or documentation during this process.

- Repairs or Settlement: Depending on the extent of the damage and the policy terms, the insurer may authorize repairs at a preferred repair shop or provide a settlement amount for the policyholder to manage the repairs independently.

It's important to note that the claims process can vary depending on the insurance company and the specific policy terms. Policyholders should familiarize themselves with their policy details and contact their insurer for guidance if needed.

Collision Insurance and Vehicle Safety

Collision insurance is closely intertwined with vehicle safety and the overall driving experience. While it provides financial protection in the event of an accident, it also encourages safe driving practices and can impact vehicle safety ratings.

Safe Driving Practices

Having collision insurance can motivate drivers to adopt safer driving behaviors. Knowing that they are financially protected in the event of an accident may encourage drivers to be more cautious, follow traffic rules, and practice defensive driving techniques. This can lead to a reduction in accidents and promote a safer driving culture.

Vehicle Safety Features

Collision insurance often plays a role in the decision-making process when it comes to choosing a vehicle. Many modern vehicles are equipped with advanced safety features, such as collision avoidance systems, lane departure warnings, and emergency braking. These features can significantly reduce the risk of accidents and minimize the severity of collisions.

When selecting a vehicle, considering its safety ratings and collision avoidance capabilities can be beneficial. Vehicles with advanced safety features may qualify for insurance discounts or reduced premiums, further incentivizing drivers to prioritize safety.

Discounts and Incentives

Insurance companies often offer discounts and incentives to policyholders who demonstrate safe driving behaviors or own vehicles with advanced safety features. These discounts can lead to significant savings on insurance premiums, making collision insurance more affordable and accessible.

Future Implications and Innovations

The field of collision insurance is continuously evolving, influenced by advancements in technology and changes in the automotive industry. Here are some future implications and potential innovations:

Autonomous Vehicles and Collision Insurance

The rise of autonomous vehicles (AVs) is expected to have a significant impact on collision insurance. As AVs become more prevalent, insurance companies may need to adapt their policies to account for the reduced risk of human error. This could lead to changes in coverage terms and potentially lower premiums for AV owners.

Advanced Safety Technologies

The integration of advanced safety technologies in vehicles is likely to continue, with features such as adaptive cruise control, blind-spot monitoring, and advanced driver-assistance systems becoming more common. These technologies can significantly reduce the risk of accidents, leading to a potential decrease in collision insurance claims.

Usage-Based Insurance (UBI)

Usage-based insurance is a growing trend in the insurance industry, where policy premiums are determined based on a vehicle’s actual usage and driving behavior. UBI policies can provide incentives for safe driving and may offer discounts to policyholders who maintain a good driving record. This approach could revolutionize collision insurance, making it more personalized and rewarding safe driving practices.

Data-Driven Insurance Models

With the advent of big data and analytics, insurance companies are leveraging data-driven models to assess risk and determine premiums. These models can consider a wide range of factors, including driving behavior, vehicle safety ratings, and even weather conditions. By incorporating real-time data, insurance companies can offer more accurate and personalized collision insurance policies.

| Safety Feature | Impact on Collision Insurance |

|---|---|

| Collision Avoidance Systems | Reduces the likelihood of accidents, leading to potential premium discounts. |

| Lane Departure Warnings | Assists drivers in maintaining lane position, minimizing the risk of collisions. |

| Emergency Braking | Automates braking to prevent collisions, especially in critical situations. |

Conclusion

Collision insurance is a vital component of comprehensive vehicle insurance, offering financial protection and peace of mind to vehicle owners. By understanding the coverage, claims process, and the role of collision insurance in promoting vehicle safety, policyholders can make informed decisions to protect their assets and ensure a safer driving experience.

As the automotive industry continues to innovate, collision insurance will adapt to meet the changing needs of drivers, providing a dynamic and responsive financial safety net for vehicle owners.

Is collision insurance mandatory?

+Collision insurance is typically not mandatory, but it is highly recommended for vehicle owners. While it may not be legally required, it provides essential financial protection in the event of an accident, ensuring that policyholders can manage the costs associated with vehicle repairs or replacements.

What is the difference between collision insurance and comprehensive insurance?

+Collision insurance covers damages to the insured vehicle resulting from a collision with another vehicle, object, or animal. Comprehensive insurance, on the other hand, provides coverage for non-collision-related damages, such as those caused by theft, vandalism, natural disasters, or hitting an animal. While collision insurance focuses on physical collisions, comprehensive insurance offers broader protection.

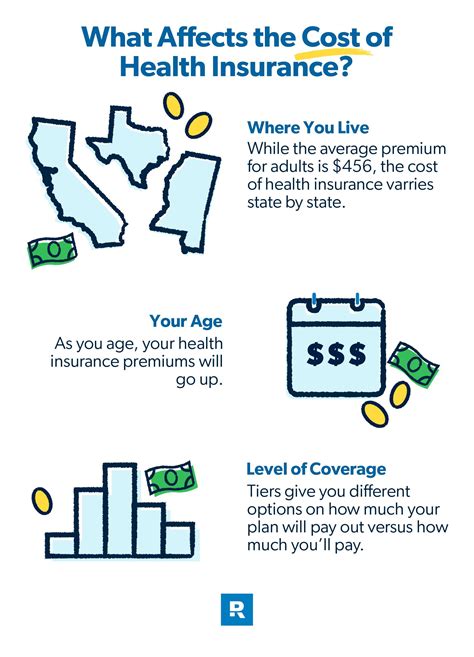

How much does collision insurance cost?

+The cost of collision insurance can vary based on several factors, including the policyholder’s driving record, the value of the vehicle, the chosen coverage limits, and the insurance company. Generally, collision insurance premiums can range from a few hundred to a few thousand dollars annually. It’s recommended to obtain quotes from multiple insurers to find the best coverage and pricing.

Can I choose my own repair shop for collision repairs?

+In most cases, policyholders have the option to choose their preferred repair shop for collision repairs. However, some insurance companies may have a network of preferred repair shops that they recommend or offer incentives for using. It’s important to review your policy terms and discuss your options with your insurance provider to make an informed decision.