How Much Medical Insurance

Medical insurance is an essential aspect of healthcare, providing financial protection and access to necessary medical services. With the rising costs of healthcare and an ever-evolving healthcare system, understanding how much medical insurance coverage one needs is crucial. This comprehensive guide will delve into the various factors that influence the amount of medical insurance coverage required, offering insights and practical advice to help individuals make informed decisions.

Assessing Individual Needs

The first step in determining the appropriate level of medical insurance coverage is assessing one’s unique needs. This involves evaluating personal and family health histories, considering pre-existing conditions, and understanding the potential risks and health concerns specific to an individual’s lifestyle and age group. For instance, individuals with chronic illnesses or those who engage in high-risk activities may require more extensive coverage.

Personal Health Profile

Creating a detailed personal health profile is essential. This should include a thorough review of medical records, identifying any past surgeries, hospitalizations, or ongoing treatments. By understanding one’s health history, individuals can anticipate potential future needs and ensure their insurance plan covers these adequately.

| Health Concern | Coverage Considerations |

|---|---|

| Chronic Illness | Specialist care, medication coverage, and long-term treatment plans. |

| Age-Related Risks | Vision and hearing tests, preventive care, and age-appropriate screenings. |

| Lifestyle Factors | Sports injuries, travel-related health risks, and mental health support. |

Family Health History

Genetics play a significant role in health. Understanding one’s family health history can provide insights into potential hereditary conditions and help anticipate future healthcare needs. This information is crucial when selecting an insurance plan that offers comprehensive coverage for these specific conditions.

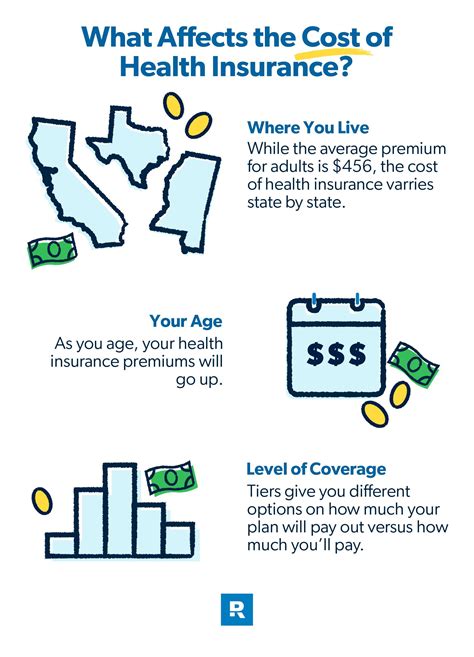

Understanding Healthcare Costs

The cost of healthcare is a critical factor in determining insurance coverage. Healthcare expenses can vary significantly depending on the country, region, and specific healthcare providers. Understanding these costs and how insurance coverage impacts them is essential for making informed decisions.

Common Healthcare Expenses

Healthcare expenses encompass a wide range of services and treatments. These include doctor visits, laboratory tests, prescription medications, hospital stays, surgical procedures, and specialized treatments. The cost of these services can vary based on the provider, location, and complexity of the treatment.

| Healthcare Service | Average Cost (Estimated) |

|---|---|

| Doctor's Visit (Primary Care) | $150 - $300 |

| Specialist Consultation | $250 - $500 |

| Prescription Medication (Monthly) | $50 - $300 |

| Hospitalization (Per Day) | $1,500 - $5,000 |

| Surgical Procedure | $10,000 - $50,000 |

Insurance Coverage and Out-of-Pocket Costs

When selecting a medical insurance plan, it’s essential to understand the concept of out-of-pocket costs. These are the expenses that an individual pays directly, which can include deductibles, copayments, and coinsurance. Deductibles are the amount an insured person must pay out of pocket before the insurance company starts covering costs. Copayments are fixed amounts paid for covered services, while coinsurance is a percentage of the cost of a covered service that the insured person pays.

Evaluating Insurance Plan Options

With a clear understanding of individual needs and healthcare costs, the next step is to evaluate the available insurance plan options. This involves comparing different plans based on coverage, costs, and other important factors.

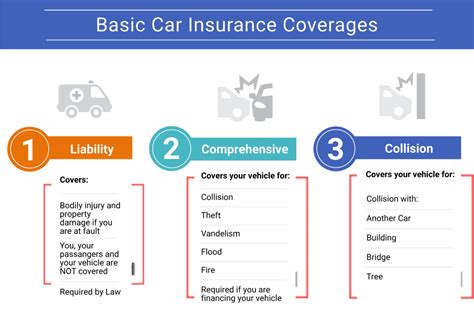

Types of Insurance Plans

There are various types of medical insurance plans, each with its own set of features and benefits. Common types include:

- Health Maintenance Organizations (HMOs): These plans typically have a network of providers and require members to choose a primary care physician. HMOs often have lower premiums but may have more restrictions on out-of-network care.

- Preferred Provider Organizations (PPOs): PPOs offer more flexibility, allowing members to choose any provider within the network without a referral. They often have higher premiums but provide broader coverage options.

- Exclusive Provider Organizations (EPOs): EPOs are similar to PPOs but usually do not cover out-of-network care unless it's an emergency.

- Point-of-Service (POS) Plans: POS plans combine features of HMOs and PPOs, offering flexibility and a broader network.

- High-Deductible Health Plans (HDHPs): These plans have higher deductibles but often come with Health Savings Accounts (HSAs), allowing individuals to save pre-tax dollars for medical expenses.

Comparing Plans

When comparing insurance plans, it’s crucial to consider the following factors:

- Coverage Limits: Check the plan's coverage limits for various services, ensuring they align with your anticipated needs.

- Network of Providers: Verify that your preferred doctors, hospitals, and specialists are within the plan's network to avoid unexpected out-of-network costs.

- Out-of-Pocket Maximum: Understand the plan's out-of-pocket maximum, which is the most you'll pay in a year for covered services.

- Premiums and Deductibles: Compare the monthly premiums and deductibles to find a balance that suits your budget and healthcare needs.

- Additional Benefits: Some plans offer extra benefits like dental, vision, or wellness programs, which can be valuable additions.

Future Considerations

When selecting medical insurance coverage, it’s important to consider future needs and potential changes in healthcare costs and personal circumstances. Here are some key factors to keep in mind:

Inflation and Healthcare Costs

Healthcare costs tend to rise over time due to inflation and advancements in medical technology. When choosing an insurance plan, consider the long-term impact of these rising costs. Opting for a plan with a higher premium but lower out-of-pocket expenses may provide better protection against future cost increases.

Changing Personal Circumstances

Life events such as marriage, the birth of a child, or retirement can significantly impact healthcare needs. It’s crucial to review and update your insurance coverage regularly to ensure it aligns with these changing circumstances. For instance, a family plan may be more suitable after having children, or a Medicare plan may be necessary upon retirement.

Preventive Care and Wellness

Preventive care and wellness programs are essential for maintaining good health and managing healthcare costs. When selecting an insurance plan, look for coverage that includes preventive services like vaccinations, screenings, and wellness programs. These services can help identify and manage health issues early on, potentially reducing future healthcare costs.

Specialized Treatments and Chronic Conditions

If you or a family member have a chronic condition or require specialized treatments, ensure your insurance plan covers these adequately. Some plans offer specific programs or networks for individuals with chronic illnesses, providing better access to specialized care and support.

Conclusion

Determining the right amount of medical insurance coverage is a personalized decision that requires careful consideration of individual needs, healthcare costs, and available insurance plan options. By assessing these factors and staying informed about future considerations, individuals can make informed choices to ensure they have the appropriate level of coverage to protect their health and financial well-being.

How often should I review my insurance coverage?

+It’s recommended to review your insurance coverage annually or whenever there is a significant change in your personal circumstances, such as a new diagnosis, a job change, or a family expansion. Regular reviews ensure your coverage remains adequate and up-to-date.

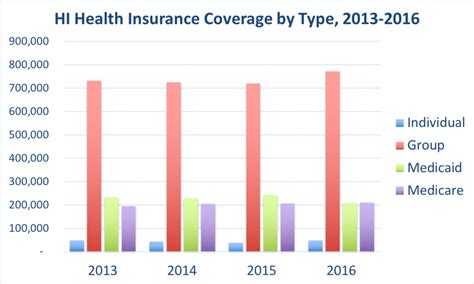

What if I can’t afford the recommended coverage level?

+If financial constraints are an issue, consider exploring government-subsidized plans or programs like Medicaid or CHIP. Additionally, you can look into plans with higher deductibles and lower premiums, but be mindful of the potential out-of-pocket costs.

How can I find the best insurance plan for my needs?

+Research is key. Compare multiple plans, read reviews, and seek advice from healthcare professionals or insurance brokers. Consider your specific healthcare needs and financial situation when making your decision.