How Much Is Full Coverage Insurance

Full coverage insurance is a comprehensive insurance policy that offers extensive protection for vehicles and their owners. It combines various types of coverage to provide a robust safeguard against potential financial losses and liabilities arising from accidents, natural disasters, or other unforeseen events. Understanding the cost of full coverage insurance is crucial for vehicle owners seeking to adequately protect their investments.

The Cost of Full Coverage Insurance

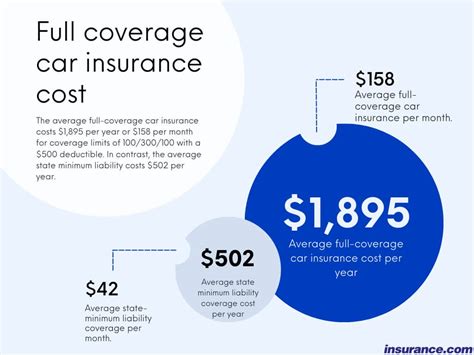

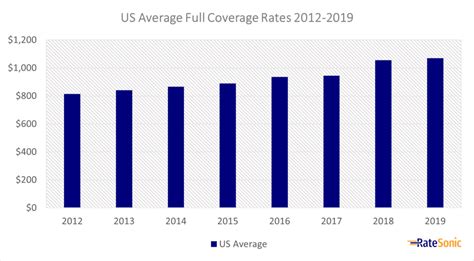

The price of full coverage insurance can vary significantly depending on several factors, including the specific coverage options chosen, the make and model of the vehicle, the driver’s age and driving record, and the location. While it is challenging to provide an exact figure without personalized information, we can delve into the factors influencing the cost and provide a general range to offer a clearer understanding.

Factors Affecting Full Coverage Insurance Costs

Several key elements contribute to the overall cost of full coverage insurance:

- Coverage Options: Full coverage insurance typically includes collision coverage, comprehensive coverage, and liability coverage. The extent of each coverage type and the associated limits directly impact the premium. Higher coverage limits generally result in higher premiums.

- Vehicle Factors: The make, model, and age of the vehicle play a significant role. Newer, more expensive vehicles often have higher insurance costs due to the potential for higher repair or replacement expenses. Additionally, certain vehicle types, such as sports cars or luxury vehicles, may attract higher premiums due to their increased risk profile.

- Driver Profile: The driver's age, driving history, and location are crucial factors. Younger drivers, especially those under 25, often face higher premiums due to their statistically higher risk of accidents. A clean driving record with no accidents or violations can help lower insurance costs. Location-specific factors, such as crime rates, traffic density, and weather conditions, also influence insurance rates.

- Additional Coverages: Full coverage insurance policies can be customized with additional coverages, such as roadside assistance, rental car reimbursement, or gap insurance. These optional coverages add to the overall cost of the policy.

- Deductibles: Choosing a higher deductible can lower insurance premiums. A deductible is the amount the policyholder pays out of pocket before the insurance coverage kicks in. By selecting a higher deductible, policyholders can reduce their monthly or annual premiums.

Given these factors, it is evident that the cost of full coverage insurance can vary widely. While it is challenging to provide an exact range without specific details, we can estimate that the annual cost of full coverage insurance can range from a few hundred dollars to several thousand dollars. The wide variation highlights the importance of obtaining personalized quotes to understand the precise cost for an individual's circumstances.

Tips for Managing Full Coverage Insurance Costs

While full coverage insurance offers essential protection, there are strategies to manage the costs effectively:

- Shop Around: Obtain quotes from multiple insurance providers to compare rates and coverage options. Shopping around can help identify the most cost-effective option for your specific needs.

- Bundle Policies: Many insurance companies offer discounts when you bundle multiple policies, such as auto insurance with homeowners or renters insurance. Bundling can lead to significant savings.

- Maintain a Clean Driving Record: A clean driving record with no accidents or violations is essential to keeping insurance costs low. Safe driving habits and a positive driving history demonstrate responsibility and can result in lower premiums.

- Consider Higher Deductibles: While a higher deductible means paying more out of pocket in the event of a claim, it can lead to lower monthly or annual premiums. Assess your financial situation and comfort level with potential out-of-pocket expenses before choosing a deductible.

- Explore Discounts: Many insurance companies offer discounts for various reasons, such as safe driving, good student status, or vehicle safety features. Ask your insurance provider about available discounts and ensure you are taking advantage of all applicable discounts.

- Review Coverage Annually: Regularly review your insurance policy and coverage limits to ensure they align with your current needs. As your circumstances change, you may be able to adjust coverage or deductibles to optimize costs without compromising protection.

The Importance of Full Coverage Insurance

Despite the cost considerations, full coverage insurance is essential for vehicle owners. It provides financial protection in the event of accidents, vandalism, natural disasters, or other unforeseen circumstances. With full coverage insurance, policyholders can have peace of mind knowing that their vehicle and their financial well-being are adequately safeguarded.

Full coverage insurance offers several key benefits, including:

- Comprehensive Protection: It covers a wide range of potential risks, including collisions, vandalism, theft, and natural disasters. This comprehensive protection ensures that policyholders are not left financially burdened in the event of an unforeseen incident.

- Liability Coverage: Full coverage insurance includes liability coverage, which is crucial for protecting against claims arising from accidents where the policyholder is at fault. This coverage safeguards the policyholder's assets and financial stability.

- Peace of Mind: Knowing that your vehicle and financial interests are protected can provide significant peace of mind. Full coverage insurance allows you to drive with confidence, knowing that you are prepared for the unexpected.

Case Study: The Benefits of Full Coverage Insurance

To illustrate the importance and benefits of full coverage insurance, let’s consider a hypothetical scenario:

John, a 30-year-old professional, recently purchased a new car. He opted for full coverage insurance, including collision, comprehensive, and liability coverage. While driving one evening, an unexpected hailstorm damaged his vehicle's exterior and shattered the windshield. The cost of repairs was estimated at $3,500.

With full coverage insurance, John was able to file a claim and have his vehicle repaired without incurring significant out-of-pocket expenses. The insurance company covered the cost of repairs, allowing John to continue using his vehicle without financial strain. Additionally, the liability coverage provided peace of mind, knowing that he was protected against potential lawsuits or financial liabilities if he had been at fault in an accident.

The Future of Full Coverage Insurance

As technology advances and the insurance industry adapts, the landscape of full coverage insurance is likely to evolve. Here are some potential future implications and trends:

- Telematics and Usage-Based Insurance: Telematics technology, which tracks driving behavior and vehicle performance, is gaining traction. Usage-based insurance policies that offer discounts based on safe driving habits may become more prevalent, incentivizing responsible driving and potentially reducing insurance costs.

- Autonomous Vehicles: The rise of autonomous vehicles could have a significant impact on insurance. As self-driving cars become more common, insurance providers may adjust coverage options and premiums based on the reduced risk profile associated with these vehicles.

- Digitalization and Convenience: Insurance companies are increasingly embracing digital platforms and technologies to enhance the customer experience. Online quotes, mobile apps for policy management, and streamlined claims processes are likely to become even more prevalent, making it easier for policyholders to manage their insurance needs.

- Data-Driven Personalization: Advanced analytics and data-driven insights may allow insurance providers to offer more personalized coverage options and pricing. By analyzing individual driving patterns and risk profiles, insurance companies can tailor policies to specific needs, potentially reducing costs for low-risk drivers.

Conclusion

Full coverage insurance is a valuable investment for vehicle owners, providing comprehensive protection against a wide range of risks. While the cost of full coverage insurance can vary significantly based on various factors, understanding these influences and implementing cost-management strategies can help ensure affordable coverage. By staying informed, comparing options, and maintaining safe driving habits, policyholders can obtain the protection they need without straining their finances.

As the insurance industry continues to evolve, embracing technological advancements and data-driven insights, the future of full coverage insurance looks promising. Policyholders can expect more personalized coverage options, enhanced convenience, and potentially lower costs as insurance providers adapt to changing dynamics.

What is the average cost of full coverage insurance per month?

+The average cost of full coverage insurance per month can vary widely based on individual circumstances. As a general estimate, monthly premiums can range from 100 to 300 or more. It’s important to obtain personalized quotes to get an accurate estimate for your specific situation.

Can I customize my full coverage insurance policy?

+Yes, full coverage insurance policies can be customized to meet your specific needs. You can choose the coverage limits, deductibles, and optional coverages that best suit your preferences and budget. It’s recommended to discuss your options with an insurance agent to ensure you have the right coverage.

Are there any discounts available for full coverage insurance?

+Yes, many insurance companies offer discounts for full coverage insurance policies. Common discounts include safe driver discounts, multi-policy discounts (bundling auto insurance with other policies), good student discounts, and vehicle safety feature discounts. It’s worth inquiring about available discounts when obtaining quotes.