Insurance Auto Insurance Rates

Understanding auto insurance rates is crucial for anyone seeking to protect their vehicles and themselves on the road. With a vast array of factors influencing these rates, from personal details to vehicle specifics, gaining a comprehensive understanding can help you make informed decisions about your coverage. This guide delves into the intricate world of auto insurance rates, providing you with the insights needed to navigate this complex landscape.

Unraveling the Complexity of Auto Insurance Rates

The journey into the world of auto insurance rates begins with an understanding of the multitude of factors that influence them. These rates are not static; they are dynamic, ever-changing, and unique to each individual and their circumstances. The insurance industry employs sophisticated algorithms and risk assessment models to determine the level of coverage and the associated cost.

Personal Factors: The Human Element in Insurance Rates

When assessing auto insurance rates, insurers consider a range of personal factors that can significantly impact the cost of coverage. These factors include:

- Age and Gender: Younger drivers, particularly those under 25, often face higher insurance rates due to their relative inexperience on the road. Gender can also play a role, with some insurers offering different rates based on statistical risk profiles.

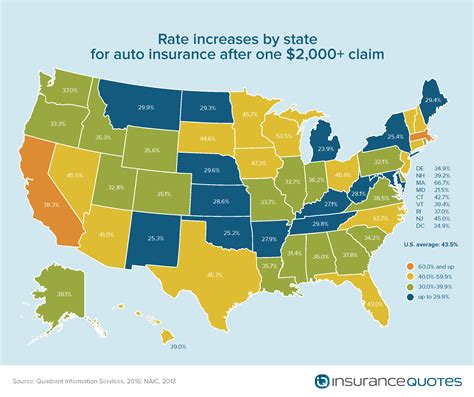

- Driving History: Your record speaks volumes. A clean driving history, free of accidents and traffic violations, can lead to more favorable insurance rates. Conversely, a history marked by accidents or citations can significantly increase your premiums.

- Credit Score: Surprisingly, your credit score can influence your insurance rates. Many insurers use credit-based insurance scores as a factor in determining risk, with lower credit scores often associated with higher premiums.

- Marital Status: Being married can sometimes lead to lower insurance rates, as married individuals are statistically less likely to be involved in accidents.

| Factor | Impact on Rates |

|---|---|

| Age | Higher rates for younger drivers |

| Gender | Varies based on statistical risk profiles |

| Driving History | Clean history leads to lower rates |

| Credit Score | Lower credit scores often mean higher premiums |

| Marital Status | Being married can result in lower rates |

Vehicle-Specific Factors: The Role of Your Ride

The vehicle you drive also plays a significant role in determining your auto insurance rates. Here are some key considerations:

- Vehicle Make and Model: Certain makes and models are statistically more prone to accidents or theft, which can increase insurance rates. Luxury vehicles or sports cars, due to their higher repair costs, may also command higher premiums.

- Vehicle Age and Value: Older vehicles with lower market values often result in lower insurance rates. Conversely, newer, more valuable vehicles can increase the cost of coverage.

- Vehicle Usage: The purpose for which you use your vehicle can impact rates. If you primarily use your car for business or as a rideshare driver, your insurance rates may be higher due to increased exposure to risk.

- Safety Features: Vehicles equipped with advanced safety features like anti-lock brakes, airbags, or collision avoidance systems may qualify for insurance discounts.

| Vehicle Factor | Impact on Rates |

|---|---|

| Make and Model | Statistically riskier vehicles may have higher rates |

| Age and Value | Older, lower-value vehicles often result in lower rates |

| Usage | Business or rideshare use can increase rates |

| Safety Features | Vehicles with advanced safety features may qualify for discounts |

Geographical and Environmental Factors: Where You Live and Drive

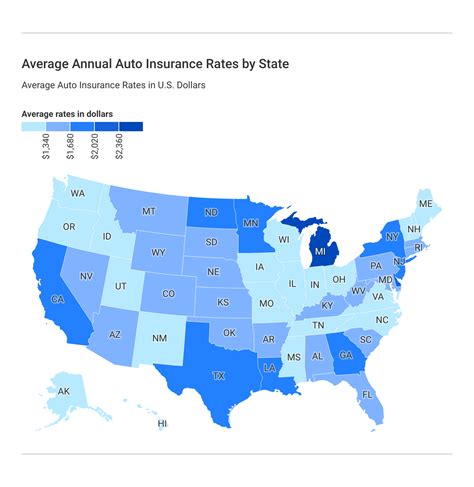

Your geographical location and the environmental factors therein can significantly influence your auto insurance rates. Consider the following:

- Location: Insurance rates can vary greatly depending on the state or even the city in which you reside. Factors such as crime rates, traffic density, and weather conditions can all impact insurance costs.

- Weather Conditions: Areas prone to severe weather events like hurricanes, floods, or blizzards may see higher insurance rates due to the increased risk of damage.

- Traffic Density: Heavily congested areas with a higher likelihood of accidents can result in higher insurance rates.

The Influence of Insurance Coverage and Deductibles

The level of insurance coverage you choose and the associated deductibles can significantly impact your insurance rates. Here’s how:

- Coverage Level: Comprehensive and collision coverage can increase your insurance rates, but they also provide more robust protection in the event of an accident or vehicle damage.

- Deductibles: Choosing a higher deductible can lead to lower insurance rates. However, it’s important to note that a higher deductible means you’ll have to pay more out of pocket if you need to file a claim.

| Coverage Factor | Impact on Rates |

|---|---|

| Coverage Level | Higher coverage often means higher rates |

| Deductibles | Lower rates with higher deductibles |

Discounts and Savings: Maximizing Your Insurance Value

Insurers offer a variety of discounts and savings opportunities to help reduce insurance rates. These can include:

- Multi-Policy Discounts: Bundling your auto insurance with other policies, such as homeowners or renters insurance, can lead to significant savings.

- Safe Driver Discounts: Maintaining a clean driving record for a specified period may qualify you for safe driver discounts.

- Good Student Discounts : Young drivers who maintain good grades in school may be eligible for this discount.

- Loyalty Discounts: Staying with the same insurer for an extended period can result in loyalty discounts.

The Future of Auto Insurance Rates: Technological Advancements and Emerging Trends

The world of auto insurance is constantly evolving, and several emerging trends and technological advancements are poised to influence rates in the future. These include:

- Telematics and Usage-Based Insurance: With the advent of telematics technology, insurers can now track driving behavior in real-time. This data-driven approach to insurance, known as usage-based insurance, allows insurers to offer personalized rates based on an individual’s actual driving habits.

- Artificial Intelligence and Machine Learning: AI and machine learning algorithms are being employed to analyze vast amounts of data, from driving behavior to weather patterns, to more accurately predict risk and set insurance rates.

- Electric and Autonomous Vehicles: The increasing adoption of electric and autonomous vehicles is expected to impact insurance rates. Electric vehicles, due to their lower maintenance costs and reduced risk of certain types of accidents, may lead to lower insurance rates. Autonomous vehicles, while promising safer roads, also present unique liability challenges that could influence insurance costs.

Navigating the Complex Landscape of Auto Insurance Rates: Key Takeaways

Understanding the multitude of factors that influence auto insurance rates is crucial for making informed decisions about your coverage. From personal details like your driving history and credit score to vehicle specifics like make and model, each element plays a role in determining the cost of your insurance. Additionally, geographical and environmental factors, along with your chosen coverage level and deductibles, can further impact your rates.

By staying informed about these factors and keeping abreast of emerging trends and technological advancements, you can better navigate the complex landscape of auto insurance rates. Whether it's leveraging discounts to reduce your premiums or staying aware of how your driving behavior and vehicle choices can impact your rates, being proactive can help you secure the best coverage at the most competitive price.

How often should I review my auto insurance policy and rates?

+It’s a good practice to review your auto insurance policy and rates at least once a year, or whenever your circumstances change significantly. This could include a move to a new location, a change in marital status, or the purchase of a new vehicle. Regular reviews ensure you’re getting the best value and coverage for your specific needs.

Can I negotiate my auto insurance rates with my insurer?

+While insurance rates are primarily based on objective factors, it’s worth discussing your concerns with your insurer. They may be able to offer alternatives or suggest ways to reduce your rates, such as increasing your deductibles or taking advantage of available discounts.

What are some common misconceptions about auto insurance rates?

+One common misconception is that all insurance companies offer the same rates. In reality, rates can vary significantly between insurers, so it’s essential to shop around and compare quotes. Another misconception is that higher-priced insurance always means better coverage. It’s important to carefully review the details of each policy to ensure you’re getting the coverage you need at a competitive price.