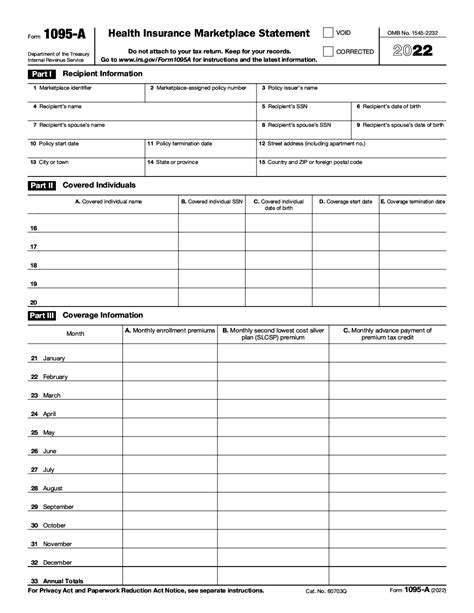

Form 1095A Health Insurance Marketplace

The Form 1095-A, also known as the Health Insurance Marketplace Statement, is a critical document for individuals and families who have obtained health insurance coverage through the Health Insurance Marketplace. This form plays a vital role in the U.S. healthcare system, as it provides essential information for tax purposes and helps individuals understand their coverage and potential eligibility for premium tax credits. In this comprehensive guide, we will delve into the intricacies of Form 1095-A, its purpose, components, and its significance in the context of healthcare and taxation.

Understanding Form 1095-A: An Overview

Form 1095-A is a statement issued by the Health Insurance Marketplace to individuals and families who have enrolled in a qualified health plan. It serves as a record of their healthcare coverage and contains crucial details about the plan’s duration, the individuals covered, and any applicable premium tax credits. This form is a crucial link between the healthcare system and the tax system, ensuring that individuals receive the necessary support for their healthcare expenses and accurately report their insurance status when filing taxes.

The introduction of the Affordable Care Act (ACA), commonly known as Obamacare, brought about significant changes to the U.S. healthcare landscape. One of the key components of the ACA is the establishment of the Health Insurance Marketplace, a platform that allows individuals and small businesses to compare and purchase health insurance plans. Form 1095-A is a direct result of this landmark legislation, designed to streamline the process of obtaining and understanding healthcare coverage.

Key Components of Form 1095-A

Form 1095-A is divided into three parts, each providing specific information about the insured individual’s healthcare coverage and potential tax benefits.

- Part I: Applicant and Coverage Information

This section provides the personal details of the primary applicant, including their name, address, and Social Security number. It also outlines the coverage period, indicating the months during which the individual or family was enrolled in the health plan. Additionally, Part I specifies the type of coverage, such as self-only, family, or spousal coverage, and provides the plan's unique identifier.

- Part II: Household Information and Premium Tax Credits

Part II of the form focuses on the insured individual's household composition and the determination of premium tax credits. It includes details about the number of individuals in the household, their relationship to the primary applicant, and their respective ages. This information is crucial for calculating the premium tax credits, as it helps determine the household's income level and eligibility for financial assistance.

- Part III: Advance Payments of the Premium Tax Credit

The final section of Form 1095-A details the advance payments of the premium tax credit, if applicable. If the insured individual received advance payments to help cover their insurance premiums, this section will provide the amount received and the months for which the payments were made. This information is essential for reconciling the premium tax credit when filing taxes.

The Role of Form 1095-A in Healthcare and Taxation

Form 1095-A serves multiple purposes within the healthcare and taxation systems, each of which is vital to ensuring individuals receive the necessary healthcare coverage and financial support.

Healthcare Coverage Verification

One of the primary functions of Form 1095-A is to verify an individual’s healthcare coverage. It provides a detailed record of the plan’s coverage period, ensuring that individuals have continuous coverage throughout the year. This verification is crucial for avoiding penalties under the ACA’s individual mandate, which requires most individuals to maintain minimum essential coverage or face a tax penalty.

| Coverage Period | Plan Details |

|---|---|

| January - December 2023 | Silver Level Plan with $1,500 annual deductible |

Example of coverage information provided in Form 1095-A

Premium Tax Credit Eligibility

Form 1095-A is also instrumental in determining an individual’s eligibility for premium tax credits. These credits are designed to help individuals and families afford their healthcare coverage by reducing the cost of their insurance premiums. The information provided in Part II of the form, such as household composition and income, is used to calculate the premium tax credit and determine the individual’s advance payment amount.

Tax Filing and Reconciliation

When it comes to tax filing, Form 1095-A plays a crucial role in accurately reporting healthcare coverage and reconciling premium tax credits. Individuals must include this form when filing their taxes to ensure they receive the correct tax credits and avoid any potential penalties for incorrect reporting. The information on the form helps taxpayers understand their insurance status, premium payments, and any applicable tax benefits.

Premium Tax Credit Reconciliation

For individuals who received advance payments of the premium tax credit, Form 1095-A is essential for reconciling these payments. The form provides the amount of advance payments received and allows taxpayers to compare this with their actual premium expenses. This reconciliation process ensures that individuals receive the correct amount of tax credits and helps prevent overpayments or underpayments.

Frequently Asked Questions (FAQ)

What happens if I don’t receive Form 1095-A?

+If you don’t receive Form 1095-A, it’s important to contact your insurance provider or the Health Insurance Marketplace. They can assist you in obtaining a copy of the form or providing the necessary information to ensure you have the details required for tax filing. Keep in mind that you may still be eligible for premium tax credits, even if you don’t receive the form.

How do I know if I’m eligible for premium tax credits?

+Eligibility for premium tax credits depends on your household income and the cost of healthcare coverage in your area. Generally, if your household income is below a certain threshold (determined by the federal poverty level), you may qualify for premium tax credits. It’s recommended to use the Health Insurance Marketplace’s eligibility calculator or consult a tax professional to determine your eligibility.

Can I claim premium tax credits if I didn’t receive advance payments?

+Yes, even if you didn’t receive advance payments of the premium tax credit, you may still be eligible to claim the credit when you file your taxes. This is known as the reconciliation process, where you compare your actual premium expenses with the amount of credit you’re eligible for. The difference, if any, can be claimed as a tax credit.

Conclusion: Navigating Healthcare and Taxes with Form 1095-A

Form 1095-A is a vital document that bridges the gap between healthcare coverage and taxation. It provides individuals with a clear understanding of their healthcare plan, premium tax credit eligibility, and the necessary information for accurate tax filing. By familiarizing themselves with the components of Form 1095-A and its role in the healthcare and taxation systems, individuals can navigate these complex processes with confidence and ensure they receive the full benefits of their healthcare coverage.

As the healthcare landscape continues to evolve, Form 1095-A remains a crucial tool for individuals to stay informed and empowered. Whether it’s verifying coverage, determining tax credits, or reconciling advance payments, this form plays a pivotal role in ensuring individuals have access to affordable healthcare and the financial support they need.