Cost Car Insurance

Car insurance is a vital aspect of vehicle ownership, providing financial protection and peace of mind to drivers worldwide. However, the cost of car insurance can vary significantly, influenced by numerous factors. Understanding these factors and their impact is crucial for making informed decisions about your insurance coverage and managing your automotive expenses effectively. In this comprehensive article, we will delve into the world of car insurance costs, exploring the key determinants, regional variations, and strategies to obtain the best value for your insurance needs.

Understanding the Factors That Influence Car Insurance Costs

The cost of car insurance is influenced by a multitude of factors, each playing a unique role in determining the premium you pay. These factors can be broadly categorized into two main groups: personal characteristics and vehicle-related factors.

Personal Characteristics

Your personal circumstances and driving history significantly impact your car insurance rates. Here are some key personal factors that insurance companies consider:

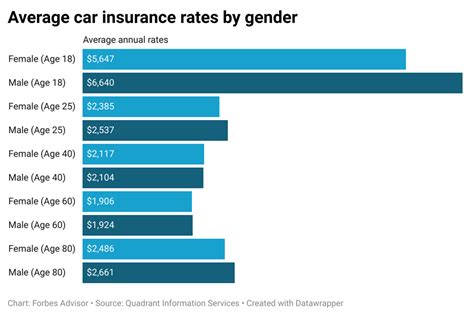

- Age: Younger drivers, especially those under 25, often face higher insurance premiums due to their perceived higher risk of accidents. As you age and gain more driving experience, insurance rates tend to decrease.

- Driving Record: A clean driving record with no accidents or violations is a major factor in keeping insurance costs down. Insurance companies reward safe driving habits by offering lower premiums.

- Credit Score: In many cases, your credit score can affect your insurance rates. Insurance providers may view a higher credit score as an indicator of financial responsibility, leading to lower premiums.

- Marital Status: Being married can sometimes result in lower insurance rates, as married individuals are often seen as more financially stable and responsible.

- Location: The area where you live and drive plays a significant role. Urban areas with higher populations and more traffic accidents typically have higher insurance rates.

Vehicle-Related Factors

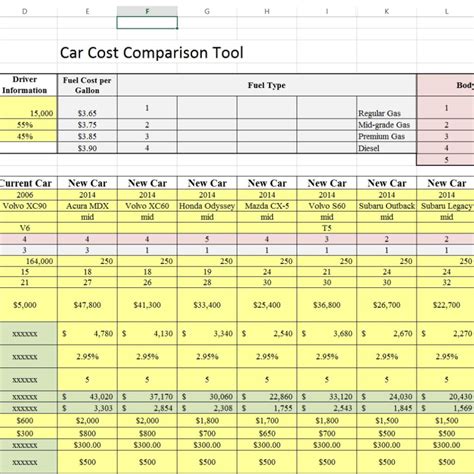

The type of vehicle you drive and its specific characteristics can also impact your insurance costs. Consider the following vehicle-related factors:

- Vehicle Type: The make, model, and year of your car matter. Sports cars, luxury vehicles, and high-performance cars generally have higher insurance premiums due to their costlier repairs and higher risk of theft.

- Vehicle Usage: How you use your vehicle makes a difference. If you primarily drive for pleasure or commute short distances, your insurance rates may be lower compared to someone who uses their car for business or long-distance travel.

- Safety Features: Vehicles equipped with advanced safety features like anti-lock brakes, airbags, and collision avoidance systems often qualify for insurance discounts, as they reduce the risk of accidents and potential injuries.

- Vehicle Age: Older vehicles tend to have lower insurance costs, as they are generally less valuable and may not require as extensive or expensive repairs.

- Coverage Options: The type and extent of coverage you choose also affect your insurance costs. Comprehensive coverage, collision coverage, and liability insurance all come at different price points, so it's essential to find the right balance for your needs.

Regional Variations in Car Insurance Costs

Car insurance costs can vary significantly from one region to another, even within the same country. These regional variations are influenced by a combination of factors, including:

- Traffic Density and Accident Rates: Areas with higher traffic volumes and accident rates often have higher insurance premiums, as the risk of accidents and claims is greater.

- Crime Rates: Regions with higher crime rates, especially those with frequent car thefts or vandalism, tend to have higher insurance costs due to the increased risk of claims.

- Weather Conditions: Areas prone to severe weather conditions, such as hurricanes, floods, or frequent hailstorms, may have higher insurance rates due to the potential for weather-related damage to vehicles.

- Population Density: Urban areas with high population density often have higher insurance costs, as there is a greater likelihood of accidents and claims.

- State-Specific Laws: Different states have varying laws and regulations regarding car insurance, which can impact the cost of coverage. For example, states with no-fault insurance laws may have higher premiums to cover medical expenses and property damage.

Comparative Analysis: Regional Insurance Costs

To illustrate the regional variations in car insurance costs, let’s consider a comparative analysis of insurance rates in different U.S. states. The following table presents average annual insurance premiums for a standard policy in various states:

| State | Average Annual Premium |

|---|---|

| California | $1,500 |

| Texas | $1,200 |

| New York | $1,800 |

| Florida | $1,300 |

| Illinois | $1,100 |

| Ohio | $850 |

This table showcases the significant differences in insurance costs across states. Factors such as traffic density, accident rates, and state-specific laws contribute to these variations.

Strategies for Managing Car Insurance Costs

While car insurance costs are influenced by various factors beyond your control, there are several strategies you can employ to manage and potentially reduce your insurance premiums. Here are some effective approaches:

Shopping Around and Comparing Quotes

One of the most effective ways to find the best car insurance rates is to shop around and compare quotes from multiple providers. Insurance companies use different rating systems and offer various discounts, so getting multiple quotes can help you identify the most cost-effective option for your needs.

Bundling Policies

Many insurance companies offer discounts when you bundle multiple policies, such as car insurance with homeowners or renters insurance. By combining your policies, you can often save money and streamline your insurance management.

Increasing Deductibles

Consider increasing your deductible, which is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible can result in lower monthly premiums, but it’s essential to choose a deductible that you can afford in the event of an accident or claim.

Maintaining a Good Driving Record

A clean driving record is one of the best ways to keep your insurance costs down. Avoid accidents, violations, and speeding tickets, as these can lead to higher premiums or even policy cancellations. Safe driving habits not only keep you and others safe but also help you save money on insurance.

Taking Advantage of Discounts

Insurance companies offer a variety of discounts to attract and retain customers. These discounts can include:

- Safe Driver Discounts: Rewards for maintaining a clean driving record.

- Multi-Policy Discounts: Savings for bundling multiple policies.

- Good Student Discounts: Discounts for students with good grades.

- Low Mileage Discounts: Reduced rates for drivers who drive fewer miles annually.

- Safety Feature Discounts: Discounts for vehicles equipped with advanced safety features.

Understanding Coverage Options

Review your coverage options carefully to ensure you have the right balance of protection and affordability. Consider your specific needs and risks, and adjust your coverage accordingly. Avoid paying for coverage you don’t need, but also ensure you have adequate protection for your vehicle and liabilities.

The Future of Car Insurance: Trends and Innovations

The car insurance industry is evolving, and several trends and innovations are shaping the future of automotive insurance. Here’s a glimpse into what lies ahead:

Telematics and Usage-Based Insurance

Telematics technology, which includes devices that track driving behavior, is gaining traction in the insurance industry. Usage-based insurance (UBI) policies offer discounts to drivers who exhibit safe driving habits, as determined by telematics data. This trend is expected to continue, providing incentives for safe driving and personalized insurance rates.

AI and Machine Learning

Artificial Intelligence (AI) and machine learning are transforming the insurance industry by improving claim processing, risk assessment, and fraud detection. These technologies enable insurance companies to make more accurate predictions and offer tailored insurance products to customers.

Connected Car Technology

The integration of connected car technology, such as advanced driver-assistance systems (ADAS) and vehicle-to-everything (V2X) communication, is enhancing vehicle safety and reducing the risk of accidents. This technology can also provide valuable data for insurance companies, potentially leading to more precise risk assessments and insurance rates.

Blockchain Technology

Blockchain technology has the potential to revolutionize the insurance industry by improving data security, streamlining claim processing, and enhancing transparency. It can also facilitate the sharing of vehicle data between insurance companies and vehicle manufacturers, leading to more accurate risk assessments.

Electric and Autonomous Vehicles

The rise of electric and autonomous vehicles is expected to have a significant impact on car insurance. Electric vehicles may have lower insurance costs due to their advanced safety features and reduced risk of certain types of accidents. Autonomous vehicles, while still in development, are expected to bring about a paradigm shift in insurance, potentially reducing the need for traditional liability coverage.

Conclusion: Navigating the Cost of Car Insurance

Understanding the factors that influence car insurance costs and employing effective strategies to manage those costs are essential for every vehicle owner. By staying informed about regional variations, shopping around for the best rates, and taking advantage of discounts and technological innovations, you can navigate the complex world of car insurance with confidence. Remember, finding the right balance between coverage and affordability is key to ensuring your automotive journey is both safe and financially sound.

How can I lower my car insurance costs if I have a poor driving record?

+If you have a poor driving record, you can still take steps to lower your insurance costs. Consider enrolling in a defensive driving course, as completing such a course may result in a reduction of points on your driving record and potentially lower insurance rates. Additionally, maintain a clean driving record going forward to gradually improve your insurance standing. Shopping around for quotes from different insurance providers can also help you find more competitive rates, even with a less-than-perfect driving history.

Are there any ways to save on car insurance if I own an older vehicle?

+Absolutely! If you own an older vehicle, you may be able to save on insurance by adjusting your coverage. For instance, you can consider dropping comprehensive and collision coverage if your vehicle is older and has low resale value. This is because these coverages primarily protect the value of your vehicle, which may not be significant for an older car. Instead, you can focus on liability coverage to protect yourself financially in the event of an accident. Additionally, maintaining a good driving record and taking advantage of any available discounts can help keep your insurance costs down.

What are some common car insurance discounts, and how can I qualify for them?

+Common car insurance discounts include safe driver discounts, multi-policy discounts, good student discounts, and low mileage discounts. To qualify for these discounts, you typically need to maintain a clean driving record, bundle multiple policies with the same insurer, maintain good grades (for students), and drive fewer miles annually. Some insurance companies also offer discounts for vehicles equipped with advanced safety features or for customers who pay their premiums in full upfront. It’s always a good idea to inquire about available discounts when shopping for insurance and to ask your insurer about potential discounts you may qualify for.