Insurance Planner

Insurance is a vital aspect of financial planning, offering individuals and businesses protection against unforeseen events and risks. With a multitude of insurance types and policies available, understanding the nuances and implications of each can be daunting. This article aims to provide an in-depth exploration of the role of an Insurance Planner, shedding light on their expertise, responsibilities, and the impact they have on securing financial stability and peace of mind for their clients.

The Comprehensive Role of an Insurance Planner

An Insurance Planner, also known as a financial advisor or insurance consultant, is a professional who specializes in guiding individuals and businesses through the complex world of insurance. They are not merely sales agents but trusted advisors who take a holistic approach to their clients’ financial well-being. Here’s an insight into the multifaceted role of an Insurance Planner:

Personalized Risk Assessment

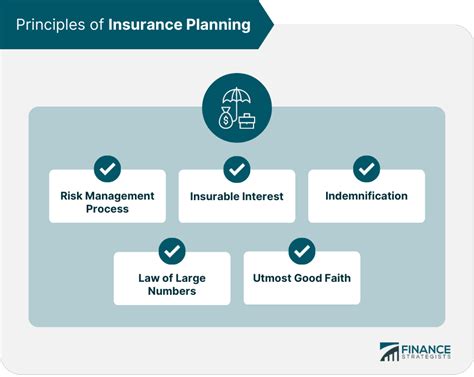

The primary responsibility of an Insurance Planner is to conduct a thorough assessment of their client’s unique risk profile. This involves understanding the client’s current financial situation, goals, and aspirations. By analyzing factors such as income, assets, liabilities, and family dynamics, the planner can identify potential risks and vulnerabilities.

For instance, a young professional with a growing family might require life insurance and disability coverage to protect their loved ones’ financial future. In contrast, a business owner may need liability insurance and business interruption coverage to safeguard their enterprise.

Tailored Insurance Solutions

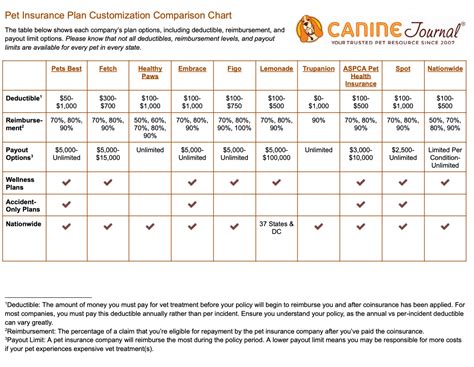

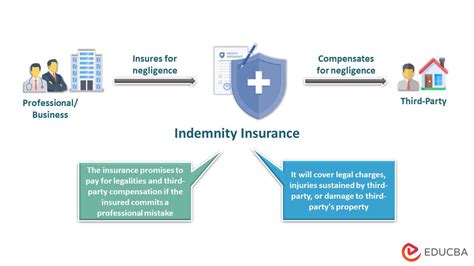

Based on the risk assessment, an Insurance Planner develops customized insurance strategies. They draw from a wide range of insurance products, including life, health, property, liability, and business insurance, to create a comprehensive plan that aligns with the client’s needs. This might involve recommending specific policies, riders, or add-ons to enhance coverage.

Consider a retiree who seeks financial security. An Insurance Planner might suggest an annuity plan to provide a steady income stream, along with long-term care insurance to cover potential healthcare expenses.

Policy Procurement and Management

Once the insurance strategy is defined, the planner assists in the procurement process. They guide clients through the often complex application and underwriting procedures, ensuring all necessary documentation is in order. Additionally, they maintain regular communication with insurance companies to advocate for their clients’ interests and negotiate favorable terms.

Throughout the policy lifecycle, the Insurance Planner remains involved. They review and update policies as needed, ensuring coverage remains adequate as life circumstances change. This might involve adjusting coverage limits, adding beneficiaries, or making other necessary modifications.

Education and Advocacy

An Insurance Planner serves as an educator, demystifying the often confusing world of insurance. They explain policy terms, conditions, and exclusions in plain language, ensuring clients fully understand their coverage. This transparency fosters trust and empowers clients to make informed decisions.

Furthermore, Insurance Planners advocate for their clients’ rights. They navigate the claims process, ensuring clients receive the benefits they are entitled to. In the event of a dispute, they work diligently to resolve issues, often leveraging their industry connections and expertise.

The Impact of Insurance Planning

The work of an Insurance Planner has far-reaching implications for individuals and businesses. By implementing effective insurance strategies, clients can:

- Protect Financial Stability: Insurance provides a safety net against unexpected events, ensuring financial obligations can be met even in the face of adversity.

- Preserve Wealth: Adequate insurance coverage helps safeguard assets and wealth, preventing depletion due to unforeseen circumstances.

- Enhance Peace of Mind: Knowing that risks are mitigated and financial protection is in place allows individuals and businesses to focus on their goals and pursuits with confidence.

- Ensure Business Continuity: For businesses, insurance planning is crucial for survival. It covers potential liabilities and interruptions, allowing companies to weather storms and emerge resilient.

The Expertise and Qualifications of Insurance Planners

Becoming an Insurance Planner requires a unique blend of financial knowledge, analytical skills, and empathy. Many professionals in this field hold advanced degrees in finance, economics, or related disciplines. Additionally, they undergo specialized training and obtain certifications such as the Chartered Financial Consultant (ChFC) or Certified Financial Planner (CFP) to demonstrate their expertise.

Industry Knowledge and Experience

Insurance Planners stay abreast of industry trends, regulatory changes, and new insurance products. Their experience allows them to anticipate potential risks and recommend innovative solutions. They understand the intricacies of insurance contracts and can guide clients through the often-complex terminology.

Client-Centric Approach

At the heart of an Insurance Planner’s role is a deep commitment to their clients’ best interests. They prioritize building long-term relationships based on trust and transparency. By understanding their clients’ values, priorities, and concerns, they can provide personalized advice and support.

The Future of Insurance Planning

The field of insurance planning is evolving rapidly, driven by technological advancements and changing consumer expectations. Here’s a glimpse into the future:

Digital Transformation

Insurance Planners are increasingly leveraging technology to enhance their services. Online platforms and digital tools enable more efficient risk assessment, policy procurement, and claims management. Additionally, digital resources empower clients to access information and make informed decisions.

Personalized Insurance Solutions

Advancements in data analytics and artificial intelligence are paving the way for highly personalized insurance solutions. By analyzing vast datasets, Insurance Planners can identify unique risk factors and tailor policies to individual needs. This precision-based approach ensures clients receive the coverage they require without unnecessary expenses.

Embracing Sustainability

With a growing focus on sustainability and environmental responsibility, Insurance Planners are exploring ways to integrate these values into insurance strategies. This might involve recommending eco-friendly coverage options or advocating for sustainable business practices among clients.

Conclusion: The Value of Expert Insurance Planning

In a world filled with uncertainty, the role of an Insurance Planner is invaluable. These professionals provide a critical service, guiding individuals and businesses through the complexities of insurance to secure their financial future. By leveraging their expertise, clients can navigate risks with confidence, knowing they have the protection they need.

As the insurance landscape continues to evolve, the role of Insurance Planners will remain essential. Their ability to adapt, innovate, and provide personalized solutions will continue to make a significant impact on the financial well-being of their clients.

What qualifications do Insurance Planners typically hold?

+Insurance Planners often hold advanced degrees in finance, economics, or related fields. Additionally, they obtain specialized certifications such as the Chartered Financial Consultant (ChFC) or Certified Financial Planner (CFP) to demonstrate their expertise.

How does an Insurance Planner stay updated with industry changes?

+Insurance Planners attend industry conferences, participate in continuing education programs, and stay connected with professional networks to stay abreast of the latest trends, products, and regulatory changes.

What are some common challenges faced by Insurance Planners?

+Insurance Planners often navigate complex regulatory environments, manage client expectations, and stay updated with ever-evolving insurance products. Additionally, they must advocate for their clients’ interests during the claims process, which can be challenging.