What Does Comprehensive Auto Insurance Cover

Comprehensive auto insurance, often referred to as full coverage insurance, is a type of vehicle insurance policy that provides an extensive range of protections for car owners. This type of coverage goes beyond the basic liability insurance, offering financial protection for a variety of incidents and circumstances that can affect a vehicle. In this comprehensive guide, we will delve into the specifics of what comprehensive auto insurance covers, exploring the different scenarios and damages it can help policyholders navigate.

Understanding Comprehensive Auto Insurance

Comprehensive auto insurance is designed to protect vehicle owners from a wide array of risks, including those that are not typically covered by standard liability insurance. It aims to provide financial security and peace of mind by offering coverage for various unforeseen events that can lead to vehicle damage or loss.

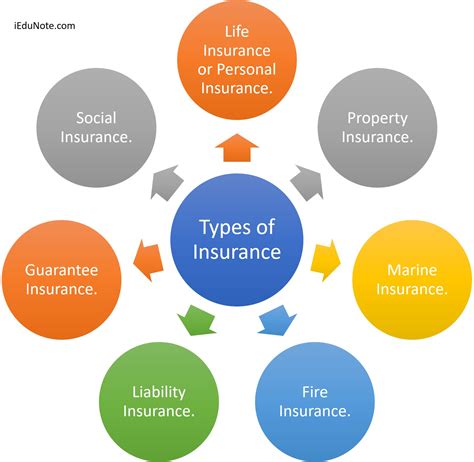

Key Components of Comprehensive Coverage

Comprehensive insurance typically includes the following essential coverages:

- Collision Coverage: This pays for damages to your vehicle if you’re involved in a collision, regardless of who is at fault.

- Comprehensive Coverage: As the name suggests, this aspect of the policy covers damages caused by incidents other than collisions. This includes events like theft, vandalism, natural disasters, falling objects, and more.

- Uninsured/Underinsured Motorist Coverage: Provides protection in case you’re involved in an accident with a driver who doesn’t have sufficient insurance coverage.

- Personal Injury Protection (PIP): PIP covers medical expenses and lost wages for you and your passengers, regardless of who is at fault in an accident.

- Medical Payments Coverage: Similar to PIP, this coverage pays for medical expenses for you and your passengers, but it may have different limits and coverages depending on your state’s laws.

Scenarios Where Comprehensive Insurance Provides Coverage

Comprehensive auto insurance is designed to cover a broad spectrum of situations. Here are some specific scenarios where having this type of insurance can be beneficial:

1. Natural Disasters

Whether it’s a hurricane, tornado, flood, earthquake, or hail storm, natural disasters can cause significant damage to vehicles. Comprehensive insurance typically covers damages caused by these events, providing financial relief to policyholders.

| Natural Disaster | Coverage Provided |

|---|---|

| Hurricane | Wind and water damage |

| Tornado | Damage caused by high winds and flying debris |

| Flood | Water damage, including submersion |

| Earthquake | Damage from shaking, falling objects, and debris |

| Hail Storm | Dents, cracks, and other damage caused by hail |

2. Theft and Vandalism

Vehicle theft and vandalism are unfortunately common occurrences. Comprehensive insurance covers the cost of repairing or replacing your vehicle if it’s stolen or damaged by vandals.

| Incident | Coverage |

|---|---|

| Theft | Reimbursement for the value of the stolen vehicle |

| Vandalism | Repairs for damages like broken windows, scratches, or spray paint |

3. Falling Objects and Animal Collisions

Comprehensive insurance also covers damages caused by falling objects, such as tree branches or debris from construction sites. Additionally, if your vehicle collides with an animal, like a deer, comprehensive coverage can help with the repair costs.

4. Glass Damage

Comprehensive insurance typically includes coverage for glass damage, such as cracked or shattered windshields. This coverage often has its own deductible, separate from the comprehensive deductible.

5. Fire and Explosions

In the unfortunate event of a fire or explosion, comprehensive insurance can provide coverage for the damages caused to your vehicle. This includes both accidental fires and those caused by external sources.

6. Civil Unrest and Riots

During civil unrest or riots, vehicles can be damaged or destroyed. Comprehensive insurance can offer protection in these situations, covering the cost of repairs or replacement.

Limitations and Exclusions of Comprehensive Coverage

While comprehensive insurance offers a wide range of protections, it’s essential to understand its limitations and exclusions. Here are some common scenarios where comprehensive insurance may not provide coverage:

1. Normal Wear and Tear

Comprehensive insurance does not cover the regular wear and tear that a vehicle experiences over time. This includes things like fading paint, rust, or mechanical breakdowns due to age or lack of maintenance.

2. Intentional Damage

If you intentionally damage your vehicle, comprehensive insurance will not provide coverage. This also applies to damage caused by others if it’s determined to be intentional.

3. Mechanical Breakdowns

Comprehensive insurance does not cover mechanical breakdowns or failures that are not directly related to a covered incident. For example, if your engine fails due to a manufacturing defect, it’s not typically covered by comprehensive insurance.

4. Government Action

If your vehicle is damaged or destroyed as a result of government action, such as during a road construction project or as a result of civil forfeiture, comprehensive insurance may not provide coverage.

5. Nuclear Hazards

Comprehensive insurance often excludes coverage for damages caused by nuclear hazards, such as nuclear reaction, radiation, or radioactive contamination.

Choosing the Right Comprehensive Coverage

When selecting comprehensive auto insurance, it’s crucial to choose a policy that aligns with your specific needs and circumstances. Consider the following factors:

- Deductible Amount: Comprehensive insurance typically has a separate deductible from your collision coverage. Choose a deductible amount that you're comfortable paying out-of-pocket in case of a claim.

- Policy Limits: Understand the limits of your coverage, including the maximum amount the insurance company will pay for certain types of damages.

- Additional Coverages: Some insurers offer optional add-ons to your comprehensive policy, such as rental car coverage or custom parts coverage. Evaluate these options based on your needs.

- Discounts: Look for insurers that offer discounts for safe driving, multiple vehicles, or other qualifying factors. These discounts can significantly reduce your premium costs.

FAQ

Does comprehensive insurance cover accidents caused by my own negligence?

+Yes, comprehensive insurance covers a wide range of incidents, including those caused by your own negligence. For example, if you back into a pole or hit a deer, comprehensive coverage can help with the repairs.

Can I get comprehensive insurance if I only have liability coverage currently?

+Yes, you can upgrade your existing liability-only coverage to include comprehensive insurance. Contact your insurance provider to discuss your options and obtain a quote.

How does comprehensive insurance differ from collision insurance?

+Collision insurance covers damages to your vehicle if you’re involved in a collision, regardless of fault. Comprehensive insurance, on the other hand, covers a broader range of incidents, including theft, vandalism, and natural disasters.