Secondary Health Insurance Plans

In the complex world of healthcare, understanding insurance coverage is crucial for navigating the often-confusing medical landscape. Among the various insurance options, secondary health insurance plans stand out as an essential component, providing an additional layer of protection and financial support. This article aims to delve into the intricacies of secondary health insurance, exploring its purpose, benefits, and real-world applications.

The Role of Secondary Health Insurance

Secondary health insurance plans, as the name suggests, are designed to act as a secondary source of coverage, stepping in where a primary insurance plan leaves off. While primary insurance typically covers the majority of healthcare costs, it often comes with certain limitations and exclusions. This is where secondary insurance steps in to bridge the gap, ensuring that individuals and families have comprehensive coverage for their medical needs.

Consider the case of Ms. Johnson, a working professional with a primary insurance plan through her employer. Ms. Johnson's primary plan has a high deductible and covers only a portion of her prescription medication costs. Here, a secondary insurance plan can be a lifesaver, providing additional coverage for the remaining medication expenses and potentially waiving the deductible, thus reducing her out-of-pocket costs.

Key Benefits of Secondary Health Insurance

Secondary health insurance plans offer a range of advantages, making them an attractive option for individuals and families seeking comprehensive healthcare coverage. Here are some key benefits:

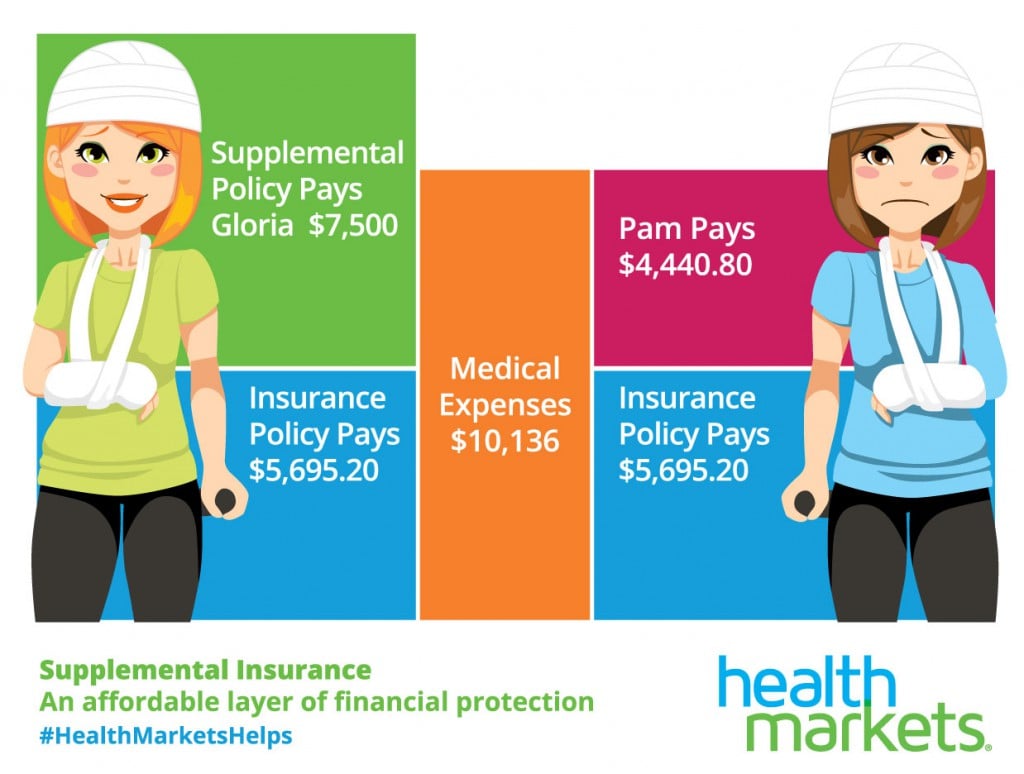

- Gap Coverage: As mentioned, secondary insurance fills the gaps left by primary plans. It ensures that individuals are not left with unexpected or excessive medical bills, providing financial peace of mind.

- Lower Out-of-Pocket Costs: By covering deductibles, copayments, and coinsurance, secondary insurance plans can significantly reduce the financial burden on policyholders. This is especially beneficial for those with high-deductible primary plans.

- Broad Coverage: Secondary insurance often provides coverage for a wide range of medical services, including prescription medications, dental care, vision care, and even alternative therapies. This comprehensive approach ensures that policyholders have access to a diverse range of healthcare options.

- Flexibility: Many secondary insurance plans offer customizable options, allowing policyholders to choose coverage levels and benefits that align with their specific needs and budget. This flexibility ensures that individuals can tailor their insurance to their unique circumstances.

- Peace of Mind: With secondary insurance, individuals can rest assured knowing that they have an extra layer of protection. This peace of mind is invaluable, especially for those with pre-existing conditions or complex medical histories.

Understanding Secondary Health Insurance Plans

Secondary health insurance plans come in various forms, each designed to cater to specific needs and circumstances. Here’s an overview of some common types of secondary insurance plans:

1. Medigap Plans

Medigap, or Medicare Supplement Insurance, is a type of secondary insurance specifically designed for individuals enrolled in Medicare Part A and Part B. These plans fill the gaps in original Medicare coverage, covering expenses such as copayments, deductibles, and even foreign travel emergencies. Medigap plans are offered by private insurance companies and are regulated by the Centers for Medicare and Medicaid Services (CMS).

| Medigap Plan | Coverage Highlights |

|---|---|

| Plan A | Covers basic Medicare gaps, including Part A hospital coinsurance and Part B copayments. |

| Plan F | Provides comprehensive coverage, including Medicare Part B deductible and Part A hospital stays beyond Medicare coverage. |

| Plan G | Similar to Plan F, but with a small Part B deductible. |

2. TRICARE for Life

TRICARE for Life is a secondary insurance plan offered to eligible military retirees and their families. It works in conjunction with Medicare to provide comprehensive healthcare coverage. TRICARE for Life covers expenses not covered by Medicare, such as Medicare Part B deductible and coinsurance, making it an invaluable resource for military retirees.

3. Veteran’s Administration (VA) Health Care

The VA Health Care system provides secondary insurance coverage to eligible veterans. This system offers a range of medical services, including primary care, specialty care, and even long-term care. VA health care aims to provide quality healthcare to veterans, often at little to no cost.

4. Employer-Sponsored Secondary Plans

Many employers offer secondary health insurance plans as part of their benefits package. These plans can vary widely, but they often provide additional coverage for expenses such as prescription medications, dental care, and vision care. Employer-sponsored secondary plans are a valuable benefit, ensuring employees have comprehensive healthcare options.

Performance Analysis and Real-World Impact

The impact of secondary health insurance plans is evident in the lives of countless individuals and families. Let’s explore a few real-world examples of how these plans make a difference:

Case Study: Mr. and Mrs. Anderson

Mr. and Mrs. Anderson, a retired couple, rely on Medicare as their primary insurance. However, they found that Medicare’s coverage gaps left them with significant out-of-pocket expenses. By enrolling in a Medigap Plan F, they were able to reduce their financial burden, with the secondary insurance plan covering their Medicare Part B deductible and copayments.

Impact on Veterans

For veterans, VA health care and TRICARE for Life serve as vital secondary insurance options. These plans ensure that veterans have access to quality healthcare, often without the financial strain associated with private insurance. The VA Health Care system, in particular, provides a wide range of services, from mental health support to specialized medical treatments, ensuring that veterans receive the care they deserve.

Employer-Sponsored Plans: A Win-Win

Employer-sponsored secondary health insurance plans are a win-win for both employees and businesses. Employees benefit from comprehensive healthcare coverage, often at a discounted rate, while businesses attract and retain talented individuals. These plans also promote a healthier workforce, leading to increased productivity and reduced absenteeism.

Future Implications and Industry Insights

As healthcare continues to evolve, the role of secondary health insurance plans becomes increasingly important. Here are some key future implications and industry insights:

- Growing Demand: With the rising cost of healthcare, the demand for secondary insurance plans is expected to increase. As individuals seek ways to manage their healthcare expenses, secondary insurance will become an essential tool for financial planning.

- Customization and Innovation: The secondary insurance industry is evolving, with insurers offering more customizable plans and innovative features. This trend allows policyholders to tailor their coverage to their specific needs, ensuring a more personalized approach to healthcare.

- Integration with Technology: The integration of technology, such as telemedicine and digital health records, is transforming the insurance landscape. Secondary insurance plans are likely to leverage these advancements, offering convenient digital solutions for policyholders.

- Industry Collaboration: To provide comprehensive coverage, insurance companies are collaborating more closely with healthcare providers and pharmaceutical companies. This collaboration ensures that policyholders have access to the best possible care, with reduced administrative burdens.

Conclusion

Secondary health insurance plans are a crucial component of the healthcare ecosystem, providing an essential safety net for individuals and families. By understanding the benefits and real-world impact of these plans, individuals can make informed decisions about their healthcare coverage. As the industry evolves, secondary insurance will continue to play a pivotal role in ensuring access to quality, affordable healthcare.

How do I choose the right secondary health insurance plan for me?

+Choosing the right secondary plan involves assessing your specific needs and budget. Consider factors such as coverage gaps in your primary plan, your prescription medication needs, and any additional healthcare services you require. It’s also important to compare plans from different providers to find the best fit for your circumstances.

Can I have multiple secondary health insurance plans?

+Yes, it is possible to have multiple secondary insurance plans. For example, you may have a Medigap plan and also be eligible for VA health care or TRICARE for Life. However, it’s essential to review the coordination of benefits provisions in each plan to ensure there are no conflicts or duplicate coverage.

Are secondary health insurance plans expensive?

+The cost of secondary health insurance plans can vary widely depending on the type of plan, your location, and your specific coverage needs. Some plans, like Medigap, have standardized rates, while others may offer more customizable options with varying premiums. It’s important to shop around and compare plans to find the most affordable option for your situation.