Dental Insurances

Dental health is an essential aspect of overall well-being, and having access to quality dental care is crucial for maintaining healthy teeth and gums. In many countries, dental insurance plays a significant role in providing individuals and families with affordable and comprehensive dental coverage. This comprehensive guide aims to delve into the world of dental insurances, exploring their intricacies, benefits, and how they contribute to improving oral health.

Understanding Dental Insurance: A Necessary Investment

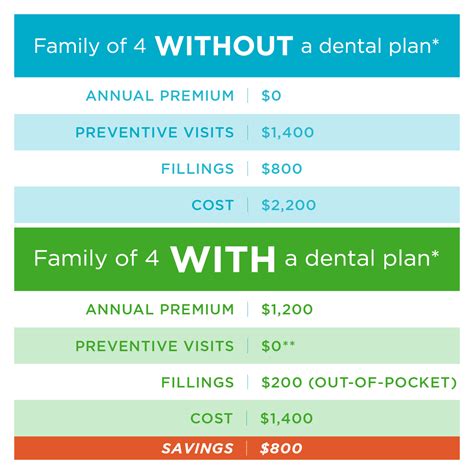

Dental insurance is a type of health coverage specifically designed to offset the costs associated with dental treatments and procedures. It acts as a financial safeguard, ensuring that individuals can access necessary dental care without incurring excessive out-of-pocket expenses. Unlike general health insurance, which often covers a wide range of medical services, dental insurance primarily focuses on oral health-related procedures and treatments.

The importance of dental insurance lies in its ability to encourage regular dental check-ups and preventive care. By covering the costs of routine examinations, cleanings, and early interventions, dental insurance promotes proactive oral health management. This not only helps identify potential issues before they become major problems but also contributes to overall health and well-being.

Key Components of Dental Insurance Plans

Dental insurance plans typically consist of several core components that define their coverage and benefits. These include:

- Annual Maximum: The maximum amount that the insurance plan will cover within a year. This limit varies between plans and can significantly impact the overall cost of dental care.

- Deductible: The amount an individual must pay out of pocket before the insurance coverage kicks in. Higher deductibles often result in lower monthly premiums.

- Co-Insurance or Co-Payment: The percentage or fixed amount that the insured individual pays for covered services after meeting the deductible. For instance, a 20% co-insurance means the insured pays 20% of the treatment cost, while the insurance covers the remaining 80%.

- Waiting Periods: Certain dental procedures, especially major ones, may have waiting periods before they are covered. This ensures that individuals don’t rush into costly procedures and allows time for preventive care to take effect.

- Network Providers: Dental insurance plans often have a network of preferred dentists and specialists. Choosing an in-network provider can result in lower out-of-pocket costs.

Understanding these components is crucial when evaluating and choosing a dental insurance plan that best suits one's needs and financial situation.

The Benefits of Dental Insurance: Improving Oral Health and Financial Security

Dental insurance offers a multitude of benefits that extend beyond the financial aspect. Here’s a deeper look at how dental insurance positively impacts oral health and overall well-being:

1. Preventive Care and Early Detection

One of the primary advantages of dental insurance is its emphasis on preventive care. Most plans cover routine check-ups, dental cleanings, and X-rays, which are vital for maintaining oral hygiene and identifying potential issues early on. Regular visits to the dentist can help catch problems like cavities, gum disease, or oral infections before they escalate, leading to more complex and costly treatments.

For instance, a simple filling for a cavity can cost around $100-$200, while a root canal procedure, which may be necessary if the cavity is left untreated, can range from $500 to over $1,000. Dental insurance often covers a significant portion of these costs, making it more affordable to address issues promptly.

| Treatment | Average Cost |

|---|---|

| Dental Filling (composite) | $100 - $200 |

| Root Canal | $500 - $1,000 |

| Dental Crown | $800 - $1,500 |

2. Coverage for Essential Procedures

Dental insurance plans typically offer coverage for a wide range of essential procedures, ensuring that individuals can access necessary treatments without financial strain. These procedures can include:

- Restorative Treatments: Covering the cost of fillings, crowns, bridges, and other procedures to restore damaged teeth.

- Periodontal Care: Providing coverage for treatments related to gum disease, such as deep cleanings and periodontal maintenance.

- Endodontic Procedures: Including root canal treatments and related endodontic services.

- Oral Surgery: Covering extractions, dental implants, and other surgical procedures.

For example, a dental crown, often needed after a root canal or to restore a severely damaged tooth, can cost upwards of $800 to $1,500. With dental insurance, a significant portion of this cost is covered, making it more feasible to undergo necessary treatments.

3. Orthodontic Coverage and Cosmetic Procedures

Some dental insurance plans also offer coverage for orthodontic treatments, which can be a significant financial relief for individuals seeking braces or other orthodontic devices. While orthodontic care is often associated with cosmetic enhancements, it also plays a crucial role in correcting misaligned teeth and jaws, which can lead to improved oral health and overall quality of life.

Additionally, certain plans may provide coverage for cosmetic procedures like teeth whitening or veneers, though this is less common and often comes with restrictions or limitations.

Choosing the Right Dental Insurance Plan: Factors to Consider

Selecting a dental insurance plan that aligns with one’s needs and financial situation is crucial. Here are some key factors to consider:

1. Coverage and Benefits

Review the plan’s coverage details, including the annual maximum, deductible, and co-insurance rates. Ensure that the plan covers the specific procedures you may require, such as fillings, root canals, or orthodontic care. Also, check for any waiting periods and limitations on certain treatments.

2. Network Providers

Check if your preferred dentist or specialists are in the plan’s network. Out-of-network providers may result in higher out-of-pocket costs, so it’s essential to verify their network status.

3. Cost and Affordability

Consider the monthly premiums, deductibles, and co-insurance rates. While a plan with lower premiums may seem attractive, it might have higher out-of-pocket costs or limited coverage. Strike a balance between cost and the benefits you expect to utilize.

4. Additional Benefits and Perks

Some plans offer additional benefits like vision care, prescription discounts, or discounts on dental products. These added perks can enhance the overall value of the plan.

The Impact of Dental Insurance on Oral Health: Real-World Examples

To illustrate the tangible benefits of dental insurance, let’s explore a few real-world scenarios:

Case Study 1: Regular Check-ups and Early Detection

Ms. Johnson, a diligent dental insurance holder, visits her dentist twice a year for check-ups and cleanings. During one such visit, her dentist detects early signs of gum disease. With her insurance coverage, she is able to undergo a deep cleaning procedure, known as scaling and root planing, which helps reverse the gum disease and prevent further complications. The insurance covers a significant portion of the treatment cost, ensuring Ms. Johnson can maintain her oral health without financial burden.

Case Study 2: Major Dental Procedures and Financial Relief

Mr. Garcia, a father of two, experiences severe tooth pain and visits his dentist. The dentist diagnoses a badly damaged tooth requiring a root canal and a dental crown. Without insurance, the combined cost of these procedures could be financially devastating. However, with his dental insurance plan, Mr. Garcia is relieved to find that the insurance covers a substantial part of the treatment, making it more manageable to address his dental issue promptly.

Case Study 3: Orthodontic Care and Improved Quality of Life

Sarah, a teenager, has always been self-conscious about her crooked teeth. With her family’s dental insurance plan, which includes orthodontic coverage, she is able to undergo braces treatment. Over the course of a few years, her teeth straighten, boosting her confidence and improving her overall well-being. The insurance coverage makes this transformative treatment accessible and affordable for her family.

Future Trends and Innovations in Dental Insurance

The field of dental insurance is evolving, with ongoing efforts to improve accessibility, affordability, and coverage. Here are some trends and innovations to watch for:

1. Expanded Coverage for Preventive Care

Many dental insurance providers are recognizing the long-term benefits of preventive care and are expanding their coverage to include more frequent check-ups, comprehensive oral exams, and advanced diagnostic tools like digital imaging and oral cancer screenings.

2. Integration with Digital Health Technologies

The integration of dental insurance with digital health platforms and apps is on the rise. This allows for more efficient claim processing, real-time benefit verification, and personalized oral health plans. Additionally, some insurers are offering incentives and discounts for using digital tools to track and improve oral hygiene habits.

3. Focus on Value-Based Care

Value-based care models in dentistry aim to provide high-quality care while controlling costs. Dental insurers are increasingly partnering with dental providers to offer bundled payment models for certain procedures, encouraging efficient and effective treatment while reducing overall costs.

4. Emphasis on Oral Health Education

Dental insurance companies are investing in oral health education initiatives to empower individuals to take control of their oral health. This includes providing resources and tools to help patients understand their oral health needs, the importance of preventive care, and how to navigate their insurance benefits effectively.

What is the average cost of dental insurance per month?

+The cost of dental insurance can vary significantly based on factors like age, location, and the specific plan chosen. On average, individual dental insurance plans range from $30 to $50 per month, while family plans can cost between $100 and $200 per month. However, these averages can fluctuate, and it's essential to review specific plans and their premiums.

Do all dental insurance plans cover orthodontic treatment?

+Orthodontic coverage varies widely among dental insurance plans. While some plans offer comprehensive orthodontic coverage, others may have limited benefits or exclude orthodontic treatment altogether. It's crucial to review the plan's details carefully to understand the coverage for orthodontic procedures.

Can I use my dental insurance to cover emergency dental procedures?

+Yes, dental insurance typically covers emergency dental procedures. However, the specific coverage and benefits may vary depending on the plan. Some plans may have separate provisions or limits for emergency care, so it's important to review the policy's emergency coverage details.

Are there any alternatives to traditional dental insurance plans?

+Yes, there are alternatives to traditional dental insurance plans, such as dental discount plans and dental savings plans. These options provide access to discounted dental services without the need for insurance coverage. While they may not offer the same comprehensive benefits as insurance, they can be more affordable and flexible for some individuals.

Dental insurance plays a pivotal role in promoting oral health and providing financial security for individuals and families. By understanding the benefits and choosing the right plan, one can ensure access to necessary dental care while managing costs effectively. As the field continues to evolve, the focus on preventive care, integration with digital technologies, and value-based models promises to enhance the overall dental insurance experience, making oral health more accessible and affordable for all.