How Much Is Car Insurance

The cost of car insurance is a common concern for vehicle owners and prospective buyers alike. With various factors influencing the price, understanding the average rates and the key determinants can help individuals make informed decisions about their coverage. In this article, we delve into the world of car insurance costs, exploring the average rates, the variables that affect them, and the strategies to secure the best coverage at an affordable price.

Understanding the Average Car Insurance Rates

Car insurance rates vary significantly across different regions, insurance providers, and policy types. The average cost of car insurance in the United States, for instance, is approximately 1,674 per year</strong> or <strong>139.50 per month as of 2023, according to the Insurance Information Institute (III). However, this average can be highly misleading, as rates can differ greatly depending on individual circumstances and the state of residence.

For a more personalized estimate, individuals can consider using online car insurance calculators. These tools allow users to input their specific details, such as their age, gender, driving history, and vehicle make and model, to receive a more accurate quote. For example, the average annual cost for a 25-year-old male driver with a clean driving record and a 2020 Toyota Camry is approximately $1,500, while a 35-year-old female driver with the same vehicle and record might pay around $1,300.

Regional Variations

Car insurance rates also exhibit significant regional differences. States with higher populations, more congested roads, and a history of frequent accidents or insurance fraud tend to have higher average rates. For instance, the average annual premium in California is 1,818</strong>, while in <strong>Maine</strong>, it's <strong>966.

| State | Average Annual Premium |

|---|---|

| California | $1,818 |

| Maine | $966 |

| Texas | $1,481 |

| Florida | $2,038 |

| Illinois | $1,296 |

Factors Influencing Car Insurance Costs

Several factors contribute to the variability in car insurance rates. Insurance companies use these factors to assess the risk associated with insuring a particular individual and to set their premiums accordingly.

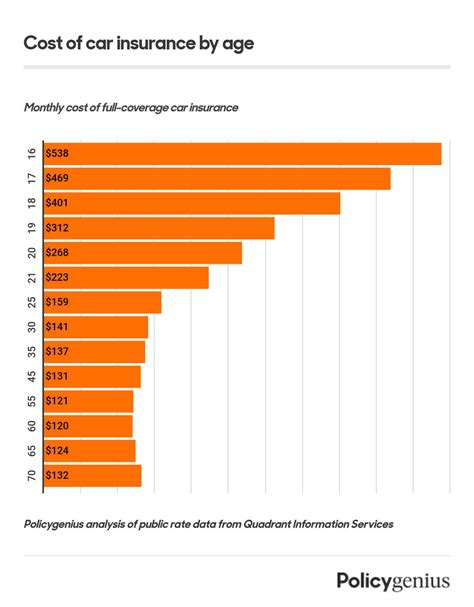

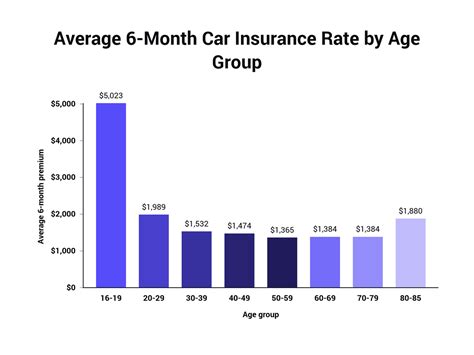

Age and Gender

Age and gender are two of the most significant factors in determining car insurance rates. Statistically, younger drivers, particularly those under the age of 25, are involved in more accidents and tend to have higher insurance rates. Similarly, male drivers are often associated with higher rates due to their perceived higher risk-taking behavior.

For instance, a 20-year-old male driver might pay an average of $2,200 per year for insurance, while a 20-year-old female driver might pay around $1,800. As individuals age, their rates generally decrease, with drivers over the age of 50 often enjoying the lowest rates.

Driving History

Your driving history is a critical factor in determining your insurance rates. A clean driving record with no accidents or violations can lead to lower premiums, while a history of accidents, DUI convictions, or traffic violations can significantly increase your insurance costs.

For example, a driver with a single at-fault accident in the past three years might see their insurance rates increase by 20-50%, depending on the severity of the accident and their state's regulations. Similarly, a DUI conviction can lead to a 100% or higher increase in insurance rates.

Vehicle Type and Usage

The type of vehicle you drive and how you use it also influence your insurance rates. Generally, more expensive vehicles, high-performance cars, and vehicles prone to theft or accidents will have higher insurance costs. Additionally, the purpose for which you use your vehicle can affect your rates. For instance, using your car for business purposes or as a rideshare driver can lead to higher premiums.

Consider the example of a 2022 Ford F-150, a popular pickup truck. The average annual insurance cost for this vehicle is approximately $1,400. However, if the same truck is used for commercial purposes, the insurance rates could increase by 20-30% or more.

Location and Mileage

Your location and the number of miles you drive each year also impact your insurance rates. As mentioned earlier, insurance rates vary by state, and even within a state, rates can differ based on the specific region or city. Additionally, the more you drive, the higher your insurance rates are likely to be, as the risk of being involved in an accident increases with mileage.

For instance, a driver in New York City might pay an average of $2,000 per year for insurance, while a driver in a rural area of the same state might pay closer to $1,200. Similarly, a driver who logs 15,000 miles per year might pay a higher premium than someone who only drives 5,000 miles annually.

Credit Score

Your credit score is another factor that can influence your insurance rates. Many insurance companies use credit-based insurance scores to assess the risk of insuring a particular individual. Generally, individuals with higher credit scores are seen as less risky and may qualify for lower insurance rates.

For example, a driver with an excellent credit score (800+) might pay an average of $1,200 per year for insurance, while a driver with a poor credit score (550-600) might pay closer to $2,000 or more.

Strategies to Reduce Car Insurance Costs

While car insurance is a necessary expense for vehicle owners, there are strategies to reduce the costs without compromising coverage. Here are some effective approaches to consider:

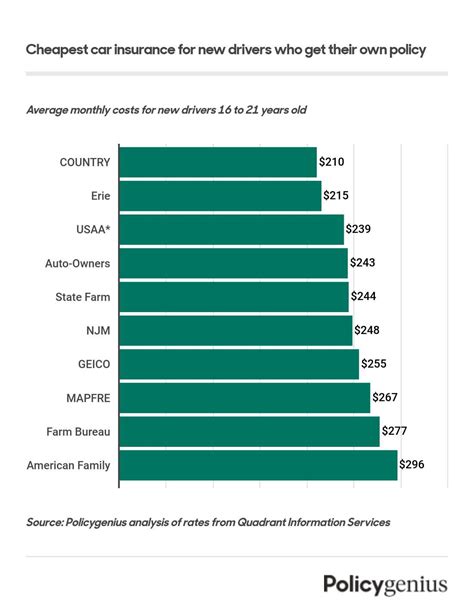

Shop Around and Compare Rates

Insurance rates can vary significantly between providers, so it’s essential to shop around and compare quotes. Online insurance marketplaces and comparison tools can make this process easier, allowing you to quickly gather quotes from multiple insurers. Additionally, don’t be afraid to negotiate with your current insurer; they may be willing to match or beat a competitor’s offer to retain your business.

Bundle Policies and Maintain a Good Credit Score

Bundling your insurance policies, such as combining auto and home insurance, can often lead to significant savings. Many insurers offer multi-policy discounts, so consider this option if you’re in the market for multiple types of insurance.

Furthermore, maintaining a good credit score can help reduce your insurance rates. Insurers often use credit-based insurance scores to assess risk, so improving your credit score can lead to lower premiums. This is especially true for younger drivers, who often have lower credit scores and higher insurance rates.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is a newer option that allows insurers to monitor your driving behavior in real-time. By installing a device or using an app to track your driving habits, insurers can offer personalized rates based on your actual driving patterns.

For example, if you're a safe driver who rarely uses your vehicle, you might qualify for lower rates with a usage-based insurance policy. On the other hand, if you're a high-mileage driver who frequently engages in risky behaviors like speeding, your rates may increase.

Take Advantage of Discounts

Many insurers offer discounts for a variety of reasons. Common discounts include safe driver discounts, good student discounts, multi-car discounts, and even discounts for belonging to certain professional organizations or alumni associations.

It's worth exploring these options with your insurer to see if you qualify for any additional savings. Some discounts may require specific actions, such as completing a defensive driving course or maintaining a certain grade point average as a student, so be sure to understand the requirements before pursuing a particular discount.

Choose the Right Coverage Levels

While it’s essential to have adequate car insurance coverage, overinsuring your vehicle can lead to unnecessary expenses. Review your policy regularly to ensure you’re not paying for coverage you don’t need. For example, if you drive an older vehicle with a low resale value, you may not need comprehensive or collision coverage, as these coverages primarily protect the value of your vehicle.

Additionally, consider raising your deductible. A higher deductible means you'll pay more out of pocket in the event of a claim, but it can also lead to lower monthly premiums. Be sure to choose a deductible amount that you're comfortable paying if the need arises.

Conclusion

Car insurance is an essential expense for vehicle owners, but understanding the factors that influence rates and employing strategic approaches can help keep costs manageable. From shopping around for the best rates to taking advantage of discounts and choosing the right coverage levels, there are numerous ways to reduce car insurance costs without compromising protection.

Remember, car insurance is a necessary investment to protect yourself and others on the road. By staying informed and proactive, you can find the right coverage at a price that fits your budget.

What is the average cost of car insurance in the United States?

+The average cost of car insurance in the United States is approximately 1,674 per year or 139.50 per month as of 2023, according to the Insurance Information Institute (III). However, this average can vary significantly based on individual circumstances and the state of residence.

How do age and gender impact car insurance rates?

+Age and gender are significant factors in determining car insurance rates. Younger drivers, particularly those under 25, and male drivers are often associated with higher rates due to their perceived higher risk-taking behavior and involvement in accidents. As individuals age, their rates generally decrease, with drivers over 50 often enjoying the lowest rates.

Can my driving history affect my insurance rates?

+Absolutely. Your driving history is a critical factor in determining your insurance rates. A clean driving record with no accidents or violations can lead to lower premiums, while a history of accidents, DUI convictions, or traffic violations can significantly increase your insurance costs.

How does the type of vehicle I drive affect my insurance rates?

+The type of vehicle you drive can impact your insurance rates. More expensive vehicles, high-performance cars, and vehicles prone to theft or accidents will generally have higher insurance costs. Additionally, the purpose for which you use your vehicle can affect your rates, with commercial or business use often resulting in higher premiums.

Are there ways to reduce my car insurance costs?

+Yes, there are several strategies to reduce car insurance costs. These include shopping around for the best rates, bundling policies, maintaining a good credit score, considering usage-based insurance, taking advantage of discounts, and choosing the right coverage levels.