Humma Insurance

Introduction

Welcome to the world of Humma Insurance, a revolutionary force in the insurance sector that is reshaping the traditional landscape with its cutting-edge approach. In an industry known for its slow-paced, bureaucratic nature, Humma Insurance stands out as a beacon of innovation, leveraging data and technology to offer customers a seamless and personalized experience. This article delves into the heart of Humma’s journey, exploring its unique value proposition, the technologies driving its success, and the profound impact it is having on the insurance industry as a whole.

Unlocking the Power of Data-Driven Insurance

At the core of Humma Insurance’s philosophy lies a deep commitment to harnessing the potential of data. By leveraging advanced analytics, machine learning, and artificial intelligence, Humma has transformed the way insurance is understood, underwritten, and delivered. This data-centric approach enables Humma to offer highly tailored insurance products and services that are not only efficient but also incredibly precise in meeting customer needs.

One of Humma’s key strengths is its ability to gather and analyze vast amounts of data from diverse sources. This includes traditional customer information, such as age, gender, and occupation, as well as more innovative data points like driving behavior, health metrics, and even social media activity. By integrating and interpreting this data, Humma can make more informed decisions, leading to more accurate risk assessments and, ultimately, better insurance coverage for its customers.

The Technology Behind Humma’s Success

Humma Insurance’s technological prowess is the driving force behind its innovative products and services. The company has invested heavily in developing a robust, proprietary technology platform that serves as the backbone of its operations. This platform, built on a foundation of cloud computing and distributed systems, ensures scalability, security, and efficiency.

At the heart of Humma’s technology stack is its advanced analytics engine. This powerful tool enables the company to process and analyze massive datasets in real-time, generating valuable insights that inform its decision-making processes. By utilizing predictive modeling and machine learning algorithms, Humma can anticipate customer needs, identify emerging risks, and develop proactive insurance solutions.

Furthermore, Humma Insurance has embraced the potential of the Internet of Things (IoT) and connected devices. By integrating IoT sensors and devices into its insurance offerings, Humma can gather real-time data on a range of factors, from driving behavior to home security systems. This data provides a richer, more dynamic understanding of customer needs and enables Humma to offer highly personalized insurance products and services.

Personalized Insurance: A Game-Changer for Customers

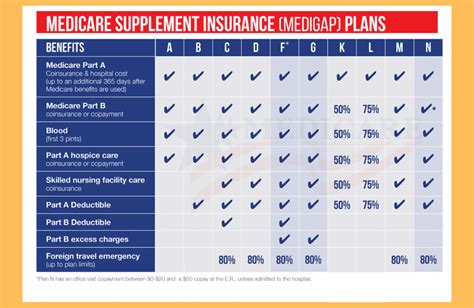

One of the most significant impacts of Humma Insurance’s data-driven approach is the ability to offer highly personalized insurance products. Unlike traditional insurance providers, which often offer one-size-fits-all policies, Humma tailors its insurance offerings to the unique needs and circumstances of each customer.

For example, Humma’s auto insurance policies can be customized based on an individual’s driving behavior, with premiums adjusted based on factors like miles driven, time of day, and even the safety of the routes taken. Similarly, Humma’s health insurance plans can be personalized to an individual’s health metrics and lifestyle choices, offering incentives and rewards for maintaining a healthy lifestyle.

This level of personalization not only enhances the customer experience but also encourages more responsible behavior. By aligning insurance costs with individual risk factors, Humma Insurance incentivizes customers to make smarter, safer choices, ultimately leading to a more sustainable and efficient insurance ecosystem.

Empowering Customers with Digital Tools

In addition to its data-driven insurance offerings, Humma Insurance has developed a suite of digital tools and platforms that empower customers to take control of their insurance journey. These tools, accessible via mobile apps and web portals, enable customers to easily manage their insurance policies, view coverage details, and make adjustments as needed.

One standout feature of Humma’s digital platform is its real-time claims processing. By leveraging advanced imaging and data analytics, Humma can quickly assess and approve claims, often within minutes of submission. This not only reduces the stress and uncertainty associated with traditional claims processes but also demonstrates Humma’s commitment to providing an exceptional customer experience.

Impact on the Insurance Industry

The success of Humma Insurance has had a profound impact on the broader insurance industry. By demonstrating the power of data-driven innovation, Humma has inspired a wave of digital transformation across the sector. Traditional insurance providers, once slow to adopt new technologies, are now racing to catch up with Humma’s cutting-edge approach.

Furthermore, Humma’s success has paved the way for a new generation of insurance startups and disruptors, many of which are leveraging the same data-centric strategies to challenge the status quo. This increased competition and innovation are driving down insurance costs, improving customer experiences, and fostering a more dynamic and responsive insurance ecosystem.

The Future of Insurance with Humma

As Humma Insurance continues to innovate and grow, its impact on the insurance industry is only expected to increase. With its focus on data-driven decision-making and customer-centric products, Humma is well-positioned to lead the way in shaping the future of insurance.

Looking ahead, Humma plans to expand its product offerings, leveraging its advanced analytics and machine learning capabilities to enter new insurance markets. From specialty insurance for high-risk industries to innovative health and wellness plans, Humma is poised to offer a comprehensive suite of insurance solutions that cater to a diverse range of customer needs.

Conclusion

Humma Insurance stands as a shining example of the transformative power of data-driven innovation in the insurance industry. By leveraging advanced technologies and a deep commitment to understanding customer needs, Humma has revolutionized the way insurance is delivered, offering a highly personalized and efficient experience. As the insurance landscape continues to evolve, Humma’s leadership and vision will undoubtedly continue to shape the future of this critical industry.

FAQ

How does Humma Insurance ensure data security and privacy?

+

Humma Insurance prioritizes data security and privacy by implementing robust encryption protocols, access controls, and regular security audits. Our systems are designed with privacy by design principles, ensuring that customer data is protected at every stage of the insurance process.

What are the benefits of personalized insurance policies offered by Humma?

+

Personalized insurance policies from Humma offer several advantages, including tailored coverage that aligns with individual needs, incentives for responsible behavior, and cost savings by eliminating unnecessary coverage. These policies provide a more efficient and accurate reflection of an individual’s risk profile.

How does Humma’s digital platform enhance the customer experience?

+

Humma’s digital platform empowers customers by providing easy access to their insurance policies, allowing them to manage and adjust coverage as needed. The platform’s real-time claims processing feature further enhances the experience by reducing the time and uncertainty associated with traditional claims processes.