Best Insurance Plans

When it comes to securing your future and protecting your assets, having a reliable insurance plan is paramount. In today's dynamic and uncertain world, the need for comprehensive insurance coverage is more evident than ever. This article aims to guide you through the intricate process of selecting the best insurance plans that cater to your unique needs, offering peace of mind and financial security.

Understanding Your Insurance Needs

Insurance is a broad term encompassing various types of coverage, each designed to address specific risks and concerns. To navigate the complex world of insurance, it’s essential to understand your unique requirements and priorities. Here’s a comprehensive breakdown of different insurance categories and what they entail.

Health Insurance

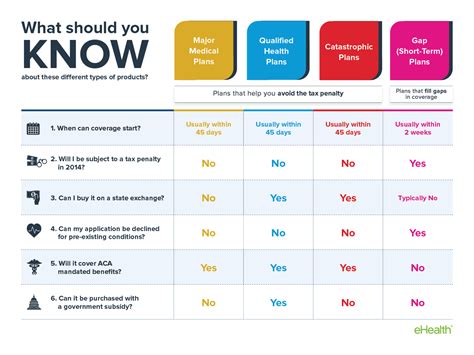

Health insurance is arguably one of the most crucial types of coverage, providing financial protection against unexpected medical expenses. It covers a range of healthcare services, including doctor visits, hospital stays, prescription medications, and preventive care. With the rising costs of healthcare, having adequate health insurance is essential to ensure you can access necessary medical treatments without incurring overwhelming financial burdens.

When choosing a health insurance plan, consider factors such as the scope of coverage, including the range of services and treatments covered, the network of healthcare providers available, and the out-of-pocket costs like deductibles, copayments, and coinsurance. Additionally, evaluate the plan’s flexibility to accommodate any specific healthcare needs you may have, such as coverage for pre-existing conditions or access to specialized treatments.

Life Insurance

Life insurance provides financial security for your loved ones in the event of your untimely death. It offers a lump-sum payment, known as a death benefit, to your beneficiaries, helping them cover expenses such as funeral costs, outstanding debts, and ongoing living expenses. Life insurance is particularly crucial for individuals with financial dependents, such as spouses, children, or elderly parents, as it ensures their financial stability even in the absence of the primary income earner.

There are two primary types of life insurance: term life and permanent life. Term life insurance provides coverage for a specified period, typically ranging from 10 to 30 years, and is often more affordable than permanent life insurance. On the other hand, permanent life insurance, such as whole life or universal life, offers coverage for the insured’s entire life and accumulates cash value over time, which can be borrowed against or withdrawn.

Auto Insurance

Auto insurance is mandatory in most countries and provides financial protection against accidents, theft, and other damages related to your vehicle. It covers a range of scenarios, including liability for bodily injury and property damage to others, as well as damage to your own vehicle. Having adequate auto insurance is essential to protect your financial well-being and ensure you can cover the costs associated with vehicle-related incidents.

When selecting an auto insurance plan, consider factors such as the level of coverage (liability, collision, comprehensive), the deductibles and premiums, and any additional coverages you may require, such as rental car reimbursement or roadside assistance. Additionally, evaluate the insurer’s reputation for prompt claim processing and customer satisfaction to ensure a smooth experience in the event of an accident.

Home Insurance

Home insurance, also known as homeowners insurance, is designed to protect your residence and personal belongings against various risks, including fire, theft, vandalism, and natural disasters. It provides financial coverage for the cost of repairing or replacing your home and its contents, as well as liability protection if someone is injured on your property.

When choosing a home insurance plan, assess the value of your home and the replacement cost of your belongings to ensure adequate coverage. Consider factors such as the policy limits, deductibles, and any specific coverage endorsements you may need, such as flood or earthquake coverage. Additionally, evaluate the insurer’s claims handling process and customer service reputation to ensure a positive experience in the event of a claim.

Other Types of Insurance

In addition to the aforementioned insurance categories, there are numerous other types of coverage available to address specific needs and risks. These include:

- Disability Insurance: Provides income replacement if you’re unable to work due to illness or injury.

- Long-Term Care Insurance: Covers the costs of long-term care, such as nursing home stays or home healthcare services.

- Travel Insurance: Offers protection against trip cancellations, medical emergencies, and lost or delayed luggage while traveling.

- Pet Insurance: Helps cover veterinary costs for unexpected illnesses or injuries sustained by your pets.

- Umbrella Insurance: Provides additional liability coverage beyond your existing policies, offering protection against major lawsuits.

Key Considerations When Choosing an Insurance Plan

With a plethora of insurance options available, selecting the best plan that aligns with your needs can be daunting. Here are some key considerations to guide your decision-making process:

Assess Your Needs and Priorities

Begin by evaluating your unique circumstances and priorities. Consider factors such as your age, health status, financial obligations, and dependents. For instance, if you have a family to support, life insurance and health insurance become paramount. On the other hand, if you’re a young professional with few financial commitments, you may prioritize auto insurance and disability insurance.

Research and Compare Insurers

Take the time to research and compare different insurance providers. Evaluate their financial stability, customer satisfaction ratings, and claims handling processes. Look for insurers with a strong track record of prompt claim payments and positive customer experiences. Online reviews and industry rankings can provide valuable insights into an insurer’s reputation.

Understand the Policy Terms and Conditions

Before committing to an insurance plan, carefully review the policy’s terms and conditions. Pay attention to the coverage limits, deductibles, and any exclusions or limitations. Ensure you understand the renewal process, any potential rate increases, and the cancellation policy. Don’t hesitate to seek clarification from the insurer if any aspect of the policy is unclear.

Seek Professional Advice

Consider consulting with an insurance broker or financial advisor who can provide personalized guidance based on your specific needs and circumstances. These professionals can help you navigate the complex world of insurance, offering insights into the best plans available and ensuring you’re adequately covered.

Monitor and Review Your Coverage Regularly

Your insurance needs may evolve over time as your life circumstances change. Regularly review your coverage to ensure it remains aligned with your current needs. Factors such as marriage, the birth of a child, a new job, or a significant life event may warrant adjustments to your insurance portfolio. Stay proactive and ensure your coverage remains comprehensive and up-to-date.

Maximizing the Benefits of Your Insurance Plan

Once you’ve selected the best insurance plan for your needs, it’s essential to make the most of your coverage. Here are some tips to optimize your insurance experience:

Understand Your Coverage Limits

Familiarize yourself with the coverage limits of your insurance plan. This includes understanding the maximum amount the insurer will pay out for a specific claim, as well as any sub-limits or exclusions. By understanding your coverage limits, you can better manage your expectations and take appropriate actions to mitigate potential financial risks.

Review and Update Your Policy Regularly

Insurance policies are not static; they should be reviewed and updated periodically to reflect changes in your life and financial circumstances. For instance, if you’ve made significant home improvements or purchased new assets, ensure your home insurance coverage reflects their current value. Similarly, if your health status has changed or you’ve started a new business, review your health and liability insurance coverage accordingly.

Take Advantage of Discounts and Bundles

Many insurance providers offer discounts and bundled policies to encourage customer loyalty and reduce administrative costs. Look for opportunities to save money by bundling multiple insurance policies, such as auto and home insurance, with the same insurer. Additionally, inquire about discounts for safe driving records, loyalty rewards, or policy add-ons that can enhance your coverage without significantly increasing your premiums.

File Claims Promptly and Accurately

In the event of an insured loss, it’s crucial to file your claim promptly and accurately. Provide all the necessary documentation and information to your insurer to facilitate a smooth claims process. Be prepared to answer any questions or provide additional details as requested by the insurer. By staying proactive and cooperative, you can ensure a timely resolution and minimize any potential delays or complications.

Utilize Preventive Measures and Safety Features

Insurance is not only about managing risks but also about preventing them. Take advantage of preventive measures and safety features to reduce the likelihood of incidents that could trigger an insurance claim. For instance, install smoke detectors and fire extinguishers in your home, practice defensive driving techniques, and invest in home security systems to deter potential burglaries. By proactively mitigating risks, you can not only reduce the likelihood of claims but also potentially qualify for insurance discounts.

Conclusion: Navigating the Complex World of Insurance

Choosing the best insurance plan is a critical step towards safeguarding your financial well-being and protecting your loved ones. By understanding your unique needs, researching different insurers, and carefully reviewing policy terms, you can make informed decisions and select coverage that provides the peace of mind and security you deserve.

Remember, insurance is a dynamic field, and your needs may change over time. Stay proactive, monitor your coverage regularly, and don’t hesitate to seek professional advice when needed. By staying informed and taking a proactive approach to insurance, you can navigate the complex world of insurance with confidence and ensure a secure future for yourself and your loved ones.

What is the difference between term life insurance and permanent life insurance?

+Term life insurance provides coverage for a specified period, typically ranging from 10 to 30 years, and is often more affordable than permanent life insurance. On the other hand, permanent life insurance, such as whole life or universal life, offers coverage for the insured’s entire life and accumulates cash value over time, which can be borrowed against or withdrawn.

How do I choose the right health insurance plan for my needs?

+When selecting a health insurance plan, consider factors such as the scope of coverage, including the range of services and treatments covered, the network of healthcare providers available, and the out-of-pocket costs like deductibles, copayments, and coinsurance. Additionally, evaluate the plan’s flexibility to accommodate any specific healthcare needs you may have.

What additional coverages should I consider for my auto insurance plan?

+When choosing an auto insurance plan, consider additional coverages such as rental car reimbursement, roadside assistance, or uninsured/underinsured motorist coverage. These add-ons can provide enhanced protection and peace of mind in the event of an accident or vehicle-related incident.

How often should I review and update my insurance coverage?

+It’s recommended to review and update your insurance coverage annually or whenever there are significant changes in your life circumstances. Factors such as marriage, the birth of a child, a new job, or a major life event may warrant adjustments to your insurance portfolio to ensure adequate coverage.

What preventive measures can I take to reduce my insurance premiums?

+Taking proactive measures to mitigate risks can help reduce your insurance premiums. For instance, installing smoke detectors, practicing defensive driving techniques, and investing in home security systems can not only reduce the likelihood of claims but also potentially qualify you for insurance discounts.