Puppy Insurance Comparison

Welcome to the comprehensive guide on puppy insurance, a crucial aspect of responsible pet ownership. In this article, we will delve into the world of puppy insurance policies, exploring the benefits, coverage options, and key considerations to help you make an informed decision. As a pet owner, ensuring the well-being of your furry companion is a top priority, and puppy insurance can provide the financial security and peace of mind you need. Let's embark on this journey to discover the best insurance options for your adorable puppy.

Understanding Puppy Insurance: An Essential Guide

Puppy insurance, also known as pet insurance, is a specialized insurance policy designed to cover the medical expenses and unexpected health issues that may arise during your puppy’s life. It offers financial protection to pet owners, ensuring that their beloved puppies receive the necessary veterinary care without causing a significant strain on their finances.

In the following sections, we will explore the key aspects of puppy insurance, including the different types of policies, coverage options, and the benefits they provide. By understanding these factors, you can make an informed choice that aligns with your puppy's specific needs and your financial capabilities.

Types of Puppy Insurance Policies: A Comprehensive Overview

Puppy insurance policies can be categorized into two main types: accident-only coverage and comprehensive coverage. Each type offers distinct advantages and considerations, catering to the diverse needs of pet owners.

Accident-Only Coverage

Accident-only puppy insurance policies provide coverage specifically for accidental injuries. These policies are ideal for pet owners who want basic protection against unexpected incidents, such as fractures, bites, or other trauma-related injuries. While they offer a more affordable option, it’s important to note that they typically do not cover illnesses or routine care.

Key Features of Accident-Only Coverage:

- Coverage for accidental injuries only.

- Lower premium costs compared to comprehensive plans.

- Suitable for pet owners seeking basic protection.

- Excludes coverage for illnesses and routine veterinary visits.

Comprehensive Coverage

Comprehensive puppy insurance policies, on the other hand, offer a more extensive range of benefits. These policies provide coverage for accidents, illnesses, and even routine veterinary care. They are designed to offer a comprehensive safety net for pet owners, ensuring that their puppies receive the necessary medical attention throughout their lives.

Key Features of Comprehensive Coverage:

- Coverage for accidents, illnesses, and routine care.

- Higher premium costs but comprehensive protection.

- Ideal for pet owners seeking maximum peace of mind.

- Covers a wide range of medical conditions and treatments.

Coverage Options and Benefits: A Detailed Breakdown

Puppy insurance policies offer a variety of coverage options and benefits, allowing pet owners to customize their plans according to their preferences and their puppy's specific needs. Let's explore some of the key coverage options and the advantages they provide.

Accident and Illness Coverage

One of the primary benefits of puppy insurance is the coverage it provides for accidents and illnesses. This includes injuries sustained during playful activities, as well as various medical conditions that may arise. With accident and illness coverage, pet owners can rest assured knowing that their puppies will receive the necessary veterinary treatment without incurring excessive financial burdens.

Key Benefits of Accident and Illness Coverage:

- Protection against unexpected injuries and illnesses.

- Covers diagnostic tests, medications, and treatments.

- Provides financial security during critical health situations.

- Can include coverage for chronic conditions.

Routine Care Coverage

Routine care coverage is an essential aspect of comprehensive puppy insurance policies. It covers the costs associated with regular veterinary check-ups, vaccinations, and preventive treatments. By including routine care coverage, pet owners can ensure that their puppies receive the necessary preventive care to maintain their overall health and well-being.

Key Benefits of Routine Care Coverage:

- Covers annual check-ups, vaccinations, and parasite control.

- Promotes early detection of potential health issues.

- Provides cost savings for routine veterinary procedures.

- Ensures your puppy stays up-to-date with essential preventive measures.

Wellness and Preventive Care

Wellness and preventive care coverage focuses on maintaining your puppy's optimal health and preventing potential health issues. It covers a range of preventive services, such as dental care, spaying or neutering, and certain behavioral training. By investing in wellness and preventive care, pet owners can proactively address health concerns and reduce the risk of more serious conditions later in life.

Key Benefits of Wellness and Preventive Care Coverage:

- Covers dental cleanings, extractions, and oral health treatments.

- Includes spaying or neutering procedures.

- Offers behavioral training and modification support.

- Promotes overall well-being and quality of life for your puppy.

Key Considerations: Choosing the Right Puppy Insurance

When selecting a puppy insurance policy, there are several important factors to consider. These considerations will help you make an informed decision that aligns with your puppy's unique needs and your financial capabilities.

Breed-Specific Concerns

Different breeds of puppies may have specific health concerns or predispositions to certain conditions. It’s crucial to consider these breed-specific factors when choosing an insurance policy. Some insurance providers offer breed-specific coverage options, ensuring that your puppy receives the necessary care for conditions commonly associated with their breed.

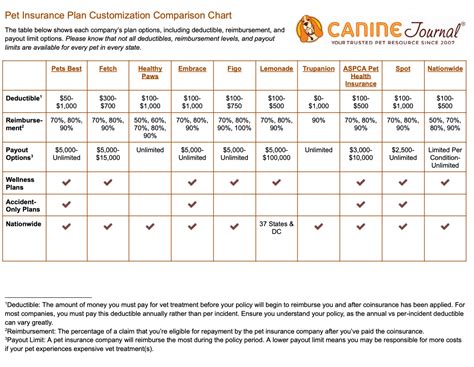

Policy Limits and Deductibles

Understanding the policy limits and deductibles is essential when comparing puppy insurance policies. Policy limits refer to the maximum amount an insurance provider will cover for a specific condition or treatment. Deductibles, on the other hand, are the amount you, as the policyholder, are responsible for paying before the insurance coverage kicks in. It’s important to review these limits and deductibles to ensure they align with your financial expectations.

Waiting Periods and Pre-Existing Conditions

Insurance providers often have waiting periods before certain conditions or treatments are covered. These waiting periods can vary, so it’s crucial to review the policy’s terms and conditions to understand the timeline for coverage. Additionally, pre-existing conditions, which are typically not covered by insurance, can impact the overall policy coverage and premiums. It’s essential to disclose any pre-existing conditions to the insurance provider to avoid any surprises down the line.

Network of Veterinary Clinics

Some puppy insurance policies have preferred networks of veterinary clinics or hospitals. These networks may offer discounted rates or additional benefits for policyholders. It’s beneficial to explore the network of veterinary clinics associated with the insurance provider to ensure that your preferred veterinary clinic is included or to find a suitable alternative.

Customer Support and Claims Process

The quality of customer support and the claims process can significantly impact your overall experience with puppy insurance. It’s important to choose an insurance provider with a reputable customer service team that can assist you with any inquiries or concerns. Additionally, understanding the claims process, including the documentation required and the turnaround time for reimbursements, is crucial to ensure a smooth and efficient experience.

Comparing Top Puppy Insurance Providers: A Detailed Analysis

Now that we’ve explored the key aspects of puppy insurance, let’s delve into a comprehensive comparison of some of the top insurance providers in the market. This analysis will provide you with valuable insights to help you choose the best insurance plan for your adorable puppy.

Provider A: Comprehensive Coverage and Exceptional Benefits

Provider A offers a comprehensive range of coverage options, catering to the diverse needs of pet owners. Their policies include accident and illness coverage, routine care coverage, and even wellness and preventive care. With a strong focus on pet health and well-being, Provider A provides extensive benefits, ensuring that your puppy receives the highest level of care.

Key Features of Provider A:

- Comprehensive coverage for accidents, illnesses, and routine care.

- Includes wellness and preventive care benefits.

- Generous policy limits and flexible deductibles.

- Preferred network of veterinary clinics with discounted rates.

Provider B: Affordable Plans and Personalized Options

Provider B specializes in offering affordable puppy insurance plans without compromising on essential coverage. Their policies are designed to cater to a wide range of budgets, making pet insurance accessible to more pet owners. Additionally, Provider B provides personalized options, allowing you to customize your plan according to your specific needs.

Key Features of Provider B:

- Affordable premium costs without sacrificing coverage.

- Customizable plans to suit your budget and preferences.

- Accident-only and comprehensive coverage options.

- Excellent customer support and efficient claims process.

Provider C: Focus on Breed-Specific Coverage

Provider C understands the unique health concerns associated with different dog breeds. Their insurance policies are tailored to address breed-specific conditions, ensuring that your puppy receives the necessary care for their specific breed-related issues. With a dedicated focus on breed-specific coverage, Provider C provides peace of mind to pet owners.

Key Features of Provider C:

- Comprehensive coverage with a breed-specific focus.

- Offers specialized plans for common breed-related conditions.

- Experienced veterinary team with breed-specific expertise.

- Flexible payment options and competitive pricing.

Performance Analysis: Real-World Benefits of Puppy Insurance

To understand the true value of puppy insurance, let's explore some real-world scenarios and the benefits it provides. These examples will illustrate how puppy insurance can make a significant difference in the lives of pet owners and their furry companions.

Case Study: Accident Coverage in Action

Imagine your energetic puppy accidentally injures their paw while playing fetch in the park. The injury requires immediate veterinary attention, including X-rays and a cast. With accident-only coverage, you can rest assured that the insurance policy will cover the costs associated with the injury, providing financial relief during a stressful situation.

Case Study: Comprehensive Coverage for Chronic Conditions

Let’s consider a scenario where your puppy develops a chronic condition, such as hip dysplasia. This condition requires ongoing veterinary care, including medications, physical therapy, and regular check-ups. With comprehensive coverage, the insurance policy will provide financial support for these treatments, ensuring your puppy receives the necessary care without putting a strain on your finances.

Case Study: Wellness and Preventive Care Benefits

Imagine you’ve enrolled your puppy in a wellness and preventive care plan. This coverage includes annual check-ups, vaccinations, and dental cleanings. By investing in these preventive measures, you can proactively address any potential health issues and ensure your puppy maintains optimal health. The insurance policy covers these routine procedures, making it easier to provide the best possible care for your furry friend.

Future Implications: The Evolving Landscape of Puppy Insurance

As the pet insurance industry continues to evolve, we can expect several exciting developments and innovations in puppy insurance. These future implications will shape the industry and provide even better coverage options for pet owners.

Expansion of Coverage Options

Insurance providers are constantly expanding their coverage options to meet the diverse needs of pet owners. We can anticipate the introduction of more specialized plans, including coverage for specific breeds, genetic conditions, and even behavioral issues. This expansion will ensure that pet owners have access to tailored insurance plans that address their unique concerns.

Integration of Technology and Telemedicine

The integration of technology and telemedicine is revolutionizing the veterinary industry, and it’s likely to have a significant impact on puppy insurance. With the rise of telemedicine, pet owners may have access to remote veterinary consultations, which can be covered by insurance policies. This advancement will improve accessibility to veterinary care and provide convenient options for routine check-ups and minor health concerns.

Enhanced Claims Processing and Customer Experience

Insurance providers are continuously improving their claims processing systems and customer support services. We can expect faster and more efficient claims processes, with reduced paperwork and streamlined reimbursement procedures. Additionally, insurance providers will focus on enhancing the overall customer experience, ensuring that pet owners receive timely assistance and support throughout their policy journey.

FAQ

How do I choose the right puppy insurance policy for my pet?

+When selecting a puppy insurance policy, consider your pet’s breed, any pre-existing conditions, and your budget. Evaluate the coverage options, policy limits, and deductibles to find a plan that suits your needs. Research and compare different providers to ensure you’re getting the best value for your money.

What is the difference between accident-only and comprehensive puppy insurance?

+Accident-only puppy insurance covers accidental injuries, while comprehensive insurance provides coverage for accidents, illnesses, and sometimes routine care. Comprehensive plans offer more extensive protection but typically have higher premiums.

Are there any breed-specific considerations when choosing puppy insurance?

+Yes, certain breeds may be predisposed to specific health conditions. It’s essential to choose a puppy insurance policy that offers breed-specific coverage or has plans tailored to address common breed-related issues. This ensures your pet receives the necessary care for their unique needs.

How do I make a claim with my puppy insurance provider?

+To make a claim, you’ll typically need to provide documentation of your pet’s condition, such as veterinary records and invoices. Contact your insurance provider to initiate the claims process and follow their specific guidelines for submitting the necessary information.