Long Term Care Insurance Rates

In the world of insurance, long-term care (LTC) coverage is a crucial aspect, especially for those planning for their future healthcare needs. LTC insurance rates are a complex topic, influenced by a myriad of factors. Understanding these rates is essential for individuals seeking to protect their financial well-being and ensure access to quality care in their golden years.

Unraveling Long-Term Care Insurance Rates: A Comprehensive Guide

The cost of long-term care insurance can vary significantly, and it’s important to delve into the details to make an informed decision. This guide aims to demystify LTC insurance rates, providing a comprehensive overview of the factors that influence them and offering insights to help you navigate this critical aspect of financial planning.

The Fundamentals of Long-Term Care Insurance Rates

Long-term care insurance is designed to provide financial protection for individuals who require extended care due to age, illness, or disability. It covers various services, including nursing home care, assisted living, home healthcare, and adult day care. The rates for these policies are influenced by a combination of personal factors and broader industry trends.

One of the primary factors that impact LTC insurance rates is age. Premiums are generally lower when individuals purchase coverage at a younger age, as the risk of needing long-term care is reduced. Additionally, the health status of the applicant plays a significant role. Those with pre-existing conditions or a history of chronic illnesses may face higher premiums or even be declined coverage.

| Age | Premium |

|---|---|

| 40-49 years | $1,500 - $2,000 annually |

| 50-59 years | $2,500 - $3,500 annually |

| 60+ years | $4,000+ annually |

The type of policy and its coverage benefits are also crucial determinants. Policies can offer different levels of coverage, from basic to comprehensive, and the premiums reflect these variations. For instance, a policy with a shorter elimination period (the time you must pay out-of-pocket before insurance coverage kicks in) will generally be more expensive than one with a longer period.

Industry Trends and Regulatory Factors

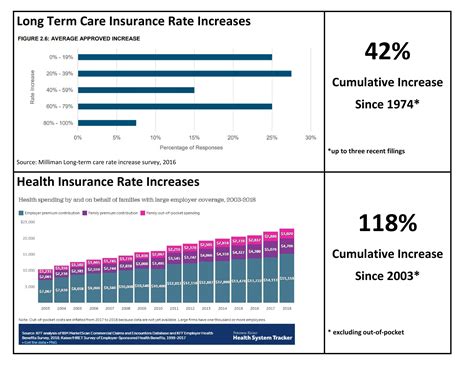

Beyond personal factors, the long-term care insurance industry is influenced by broader trends and regulatory changes. These can significantly impact rates and the availability of coverage.

The financial health of insurance companies is a critical factor. Companies with strong financial stability are more likely to offer competitive rates and maintain the financial viability of their policies over the long term. Regulatory bodies play a role in ensuring this stability by monitoring and overseeing the industry.

The state of the healthcare industry also affects LTC insurance rates. Rising healthcare costs, advancements in medical technology, and changes in healthcare policies can all influence the demand and cost of long-term care services. Insurance companies must adapt their rates to account for these fluctuations.

Personalized Rate Factors: A Deeper Dive

While age and health status are primary determinants, several other personal factors can influence LTC insurance rates. Understanding these nuances can help individuals tailor their policies to their specific needs and circumstances.

The type of care one expects to require can significantly impact premiums. For instance, those who anticipate needing nursing home care may opt for a policy with higher daily benefit limits, which can increase the cost. On the other hand, individuals who foresee primarily home healthcare needs may choose a policy with lower daily limits, potentially resulting in lower premiums.

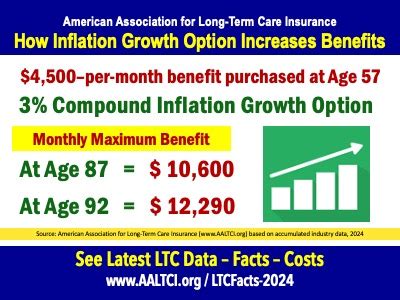

The inflation protection option is another critical factor. This feature allows policyholders to keep pace with rising healthcare costs over time. While it can increase premiums, it ensures that the policy's benefits will maintain their purchasing power, providing valuable financial protection.

The duration of coverage is yet another consideration. Policies can offer coverage for a specific number of years or for the policyholder's lifetime. Lifetime policies are often more expensive but provide peace of mind that coverage will be there when needed, regardless of age or health status.

Long-Term Care Insurance Rates: Future Projections and Implications

Looking ahead, the future of long-term care insurance rates is shaped by a complex interplay of demographic shifts, healthcare advancements, and regulatory changes. Understanding these trends is crucial for individuals and advisors seeking to make informed decisions about LTC insurance.

Demographic Trends and Their Impact

The aging of the population is a significant demographic trend that directly affects the long-term care insurance market. As the Baby Boomer generation enters their retirement years, the demand for LTC services is expected to surge. This increased demand could lead to higher insurance premiums as insurers seek to maintain financial stability.

However, it's not all doom and gloom. The aging population also presents opportunities for innovation and cost-efficiency in long-term care. As more individuals seek LTC services, there is a growing incentive for providers to offer more affordable and accessible care options. This could, in turn, lead to more competitive insurance rates as the market adapts to meet the changing needs of an aging society.

Healthcare Advancements and Technological Innovations

Advancements in healthcare technology and medical treatments are transforming the long-term care landscape. From remote monitoring devices to innovative therapeutic approaches, these advancements have the potential to improve patient outcomes and reduce the overall cost of care.

For example, telemedicine and remote patient monitoring technologies are increasingly being used to provide convenient and cost-effective care to individuals with chronic conditions. These technologies can help identify health issues early on, potentially preventing the need for more intensive and costly care later. As these technologies become more widespread and accessible, they could contribute to stabilizing or even lowering LTC insurance rates.

Additionally, innovative treatments and therapies, such as those focused on dementia and Alzheimer's disease, could significantly improve the quality of life for individuals requiring long-term care. By effectively managing these conditions, insurers may experience lower claims costs, which could positively impact insurance premiums over time.

Regulatory Changes and Their Influence

Regulatory bodies play a crucial role in shaping the long-term care insurance market. Changes in regulations can directly impact insurance rates, policy terms, and the overall availability of coverage.

For instance, in recent years, there has been a push for greater transparency and standardization in the long-term care insurance industry. This has led to the development of more comprehensive and easily comparable policies, making it easier for consumers to understand their options. While these changes may not directly impact insurance rates, they can improve consumer confidence and trust in the market, potentially leading to increased demand for LTC insurance.

Furthermore, regulatory bodies are increasingly focusing on ensuring the financial stability of insurance companies offering LTC coverage. This includes regular financial examinations and the implementation of strict reserve requirements. By maintaining a stable and well-regulated market, these measures can help prevent insurer insolvencies, which could otherwise lead to significant disruptions in coverage and increased rates for consumers.

Conclusion: Navigating the Complexities of LTC Insurance Rates

Understanding the factors that influence long-term care insurance rates is a critical step in making informed decisions about financial planning and healthcare coverage. From personal health and age to broader industry trends and regulatory factors, a multitude of considerations come into play.

As we've explored, the future of LTC insurance rates is intricately tied to demographic shifts, healthcare advancements, and regulatory changes. By staying informed about these trends and working with knowledgeable advisors, individuals can navigate the complexities of LTC insurance and secure the coverage that best meets their needs and circumstances.

What is the average cost of long-term care insurance?

+The average cost of long-term care insurance varies widely depending on factors such as age, health status, coverage benefits, and the inflation protection option. As a rough estimate, premiums can range from 1,500 to 4,000+ annually.

How does age impact long-term care insurance rates?

+Age is a significant factor in LTC insurance rates. Premiums tend to be lower when individuals purchase coverage at a younger age. This is because the risk of needing long-term care is reduced with age.

Can long-term care insurance rates change over time?

+Yes, long-term care insurance rates can change over time due to various factors, including changes in the insured’s health status, increases in the cost of care, and fluctuations in the insurance company’s financial performance.