Progressive Insurance Renters Insurance

In today's dynamic housing market, renters make up a significant portion of the population, often seeking flexible and affordable living arrangements. While renting offers convenience and freedom, it also comes with unique risks and responsibilities. That's where Progressive Insurance steps in, offering a tailored solution in the form of their Renters Insurance policy. This comprehensive coverage ensures that renters can safeguard their belongings and personal liability without the worries of unexpected expenses.

Progressive's Renters Insurance is designed to provide peace of mind, protecting renters from a range of potential hazards. From natural disasters to theft and accidental damage, this policy ensures that renters can recover quickly and effectively. In this comprehensive guide, we will delve into the world of Progressive Renters Insurance, exploring its features, benefits, and how it can be a valuable asset for renters across the United States.

Understanding the Need for Renters Insurance

Renters often face unique challenges when it comes to property protection. Unlike homeowners, renters do not own the physical structure of their dwelling, which means they are typically not covered by the landlord's insurance policy. This leaves renters vulnerable to financial losses in the event of damage, theft, or liability claims.

Consider the following scenarios:

- Natural Disasters: A sudden flood or hurricane can cause extensive damage to your rental property, potentially destroying your belongings and forcing you to find alternative accommodation.

- Theft and Burglary: Unfortunately, renters are not immune to theft. Your personal belongings, from electronics to jewelry, can be targeted by burglars, resulting in significant financial loss.

- Accidental Damage: Accidental fires, water leaks, or even guest injuries can occur in your rental space. These incidents can lead to costly repairs and legal liabilities.

These are just a few examples of the risks renters face daily. Without adequate insurance coverage, these events can have a devastating impact on an individual's financial stability and peace of mind.

Progressive Renters Insurance: An Overview

Progressive Insurance's Renters Insurance policy is specifically crafted to address the unique needs of renters. It offers a comprehensive range of coverages, ensuring that policyholders can recover from various mishaps and unforeseen events.

Key Features of Progressive Renters Insurance

Progressive's Renters Insurance policy stands out for its flexibility and comprehensive coverage. Here are some of its key features:

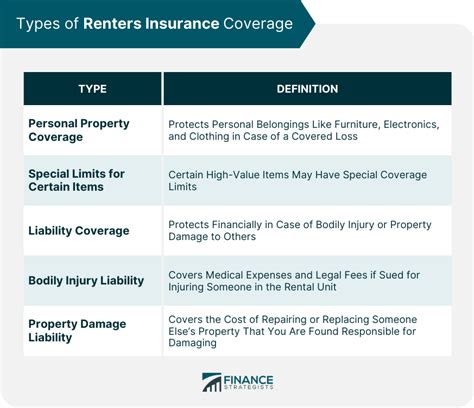

- Personal Property Coverage: This coverage protects your belongings against a wide range of perils, including fire, theft, and vandalism. Progressive even offers optional coverage for high-value items like jewelry and electronics.

- Liability Protection: In the event of an accident or injury on your rental property, this coverage can help pay for medical expenses and legal defense costs. It provides financial protection against potential lawsuits, ensuring you're not left financially vulnerable.

- Additional Living Expenses: If your rental property becomes uninhabitable due to a covered loss, this coverage helps cover the costs of temporary accommodation and additional living expenses, such as meals and transportation.

- Loss of Use Coverage: This coverage compensates for any additional living expenses incurred while you're unable to use your rental property due to a covered loss. It ensures you're not out of pocket during the recovery process.

- Personal Liability: Progressive's Renters Insurance policy includes personal liability coverage, which can protect you from financial losses if you're found legally responsible for bodily injury or property damage to others.

By offering these comprehensive coverages, Progressive Insurance ensures that renters can feel secure and protected in their rental spaces.

The Benefits of Progressive Renters Insurance

Progressive Renters Insurance provides numerous benefits to policyholders, making it a popular choice among renters across the United States. Here are some key advantages:

Comprehensive Coverage

Progressive's policy offers a wide range of coverages, ensuring that renters are protected against various perils. From fire and theft to liability claims, the policy provides a safety net for renters, covering a broad spectrum of potential risks.

Flexible Policy Options

Progressive understands that every renter's needs are unique. That's why they offer flexible policy options, allowing renters to customize their coverage based on their specific requirements. Whether you need higher limits for personal property or additional liability protection, Progressive can tailor a policy to fit your needs.

Affordable Premiums

One of the significant advantages of Progressive Renters Insurance is its affordability. Progressive offers competitive rates, ensuring that renters can access comprehensive coverage without breaking the bank. With flexible payment options and potential discounts, Progressive makes it easy for renters to protect their belongings and personal liability without straining their budgets.

Excellent Customer Service

Progressive is renowned for its exceptional customer service. The company offers 24/7 assistance, ensuring that policyholders can reach out for help whenever they need it. Whether it's a claim inquiry or a simple policy question, Progressive's customer service team is always ready to provide prompt and professional support.

Real-World Examples: Progressive Renters Insurance in Action

Let's explore some real-life scenarios where Progressive Renters Insurance made a significant difference in policyholders' lives.

Scenario 1: Natural Disaster Recovery

Imagine a renter living in a flood-prone area. Despite taking all necessary precautions, a sudden flash flood causes extensive damage to their rental property. The renter's personal belongings, including furniture, electronics, and clothing, are ruined. Without insurance, the financial burden of replacing these items would be overwhelming.

However, with Progressive Renters Insurance, the renter can file a claim and receive compensation for their damaged belongings. Progressive's policy covers a wide range of natural disasters, ensuring that renters can recover and rebuild their lives without facing financial ruin.

Scenario 2: Burglary and Theft

Renters are often targets for theft and burglary due to the transient nature of their living arrangements. In one instance, a renter returned home to find their apartment had been broken into, with valuable items like jewelry, laptops, and cash stolen.

Thanks to Progressive's Renters Insurance policy, which includes coverage for theft and burglary, the renter was able to file a claim and receive compensation for their losses. This allowed them to replace their stolen belongings and continue their lives without the added financial stress.

Scenario 3: Liability Claims

Renters can face liability claims if someone is injured on their rental property. In one case, a guest slipped and fell on a newly mopped floor, resulting in a broken arm. The guest filed a liability claim against the renter, seeking compensation for medical expenses and pain and suffering.

Progressive's Renters Insurance policy includes liability coverage, which protected the renter in this scenario. Progressive handled the claim, providing legal defense and covering the costs associated with the injury, ensuring the renter's financial stability was not compromised.

Performance Analysis: Progressive Renters Insurance

Progressive Insurance is a well-established and highly reputable insurance provider in the United States. Their Renters Insurance policy has consistently received positive reviews and high ratings from industry experts and customer feedback platforms.

One of the key strengths of Progressive's Renters Insurance is its comprehensive coverage. The policy offers a wide range of protections, ensuring that renters are well-prepared for various unforeseen events. From personal property coverage to liability protection, Progressive's policy provides a robust safety net for policyholders.

Additionally, Progressive's claim handling process is efficient and customer-centric. The company has a strong track record of promptly addressing claims and providing fair settlements. This commitment to customer satisfaction has earned Progressive a reputation for reliability and trustworthiness.

| Category | Progressive Renters Insurance |

|---|---|

| Coverage Options | Excellent - Offers a wide range of coverages, including personal property, liability, and additional living expenses. |

| Claim Handling | Exceptional - Known for efficient and fair claim settlements, with a focus on customer satisfaction. |

| Customer Service | Outstanding - Provides 24/7 assistance and prompt response times, ensuring policyholders receive timely support. |

| Pricing | Competitive - Offers affordable premiums with flexible payment options and potential discounts. |

Future Implications and Industry Insights

The demand for renters insurance is expected to continue rising as the rental market expands. With more people opting for renting over owning, the need for comprehensive insurance coverage becomes increasingly vital. Progressive Insurance, with its forward-thinking approach, is well-positioned to meet this growing demand.

Progressive's commitment to innovation and customer satisfaction sets them apart in the insurance industry. Their Renters Insurance policy is a testament to their understanding of the unique needs of renters. By offering flexible coverage options, competitive pricing, and exceptional customer service, Progressive is poised to remain a leading provider in the renters insurance market.

As the housing market evolves, Progressive Insurance is likely to adapt and enhance its Renters Insurance policy to meet the changing needs of renters. This includes potential advancements in digital tools and resources, making it even more convenient for policyholders to manage their coverage and file claims.

Furthermore, Progressive's focus on education and awareness is commendable. By providing resources and guides to help renters understand their insurance needs, Progressive empowers individuals to make informed decisions about their coverage. This proactive approach ensures that renters are well-equipped to protect their belongings and personal liability.

FAQ

What is covered under Progressive’s Renters Insurance policy?

+

Progressive’s Renters Insurance policy covers a wide range of perils, including fire, theft, vandalism, and natural disasters. It also provides liability protection, covering medical expenses and legal defense costs if someone is injured on your rental property. Additionally, it offers additional living expenses coverage, helping you cover the costs of temporary accommodation and additional expenses if your rental becomes uninhabitable due to a covered loss.

How much does Progressive Renters Insurance cost?

+

The cost of Progressive Renters Insurance varies depending on several factors, including the value of your personal property, the coverage limits you choose, and your location. Progressive offers competitive rates and flexible payment options to ensure affordability. You can get a personalized quote by visiting their website or contacting their customer service team.

Can I customize my Progressive Renters Insurance policy?

+

Yes, Progressive offers flexible policy options, allowing you to customize your coverage based on your specific needs. You can choose higher limits for personal property coverage, add optional coverages for high-value items, and adjust your liability limits. This flexibility ensures that your policy aligns with your unique circumstances and provides the protection you require.

How do I file a claim with Progressive Renters Insurance?

+

To file a claim with Progressive Renters Insurance, you can contact their 24⁄7 customer service team by phone or through their online platform. You’ll need to provide details about the incident, including any supporting documentation such as photos or receipts. Progressive will guide you through the claim process, ensuring a smooth and efficient experience.