How Do Insurance Claims Work

The Complex Process of Insurance Claims: An In-Depth Exploration

Navigating the intricate world of insurance claims can be a daunting task, often shrouded in a maze of complex procedures and technicalities. This comprehensive guide aims to demystify the process, offering a detailed breakdown of each step, along with expert insights and real-world examples to enhance your understanding.

Understanding the Fundamentals of Insurance Claims

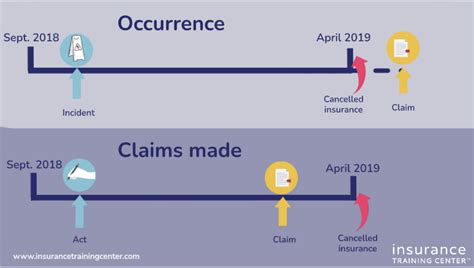

Insurance claims represent the formal request made by a policyholder to an insurance company for coverage or reimbursement of a loss, which could be due to various events such as accidents, theft, natural disasters, or medical emergencies. The claims process is a critical aspect of any insurance policy, ensuring that policyholders receive the financial protection and support they've paid for.

The insurance claims process is not a one-size-fits-all scenario; it varies based on the type of insurance, the nature of the claim, and the specific terms and conditions outlined in the policy. This section provides a general overview, which we'll delve deeper into in subsequent sections.

The Initial Steps: Filing a Claim

Initiating an insurance claim typically involves notifying the insurance company about the incident and providing preliminary details. This step is often time-sensitive, as most policies have specific timeframes within which a claim must be filed. For instance, in the case of a car accident, it's essential to report the incident to your insurer promptly to avoid any potential delays or complications.

At this stage, the insurer will assign a claims adjuster or representative to handle your case. This individual will be your primary point of contact throughout the claims process, guiding you through the necessary steps and answering any queries you may have.

| Step | Action |

|---|---|

| 1 | Contact your insurer within the specified time frame. |

| 2 | Provide initial details of the incident. |

| 3 | Receive assignment of a claims adjuster. |

Assessing the Claim: A Detailed Examination

Once your claim is filed, the insurer embarks on a thorough assessment process to evaluate the validity and extent of the claim. This assessment involves several key steps:

- Verification of Policy Coverage: The insurer scrutinizes your policy to ensure that the specific incident or loss is covered. This step is crucial as it forms the basis for any potential payout.

- Gathering Evidence: The claims adjuster will request documentation and evidence to support your claim. This may include police reports, medical records, repair estimates, or photographs of the damage.

- Determining Liability: In cases where the claim involves an accident or negligence, the insurer will assess who is at fault. This determination can impact the outcome of the claim, especially if it affects the distribution of liability among multiple parties.

- Evaluating the Extent of Loss: The insurer will carefully examine the extent of the loss to determine the appropriate compensation amount. This evaluation considers factors like the original value of the item, its depreciation, and any additional costs incurred as a result of the incident.

The Claims Decision: Acceptance or Denial

Following the assessment, the insurer will make a decision regarding your claim. This decision could lead to one of the following outcomes:

- Claim Acceptance: If the insurer deems your claim valid and covered by your policy, they will proceed with the payout. The amount of compensation depends on the policy terms and the extent of the loss. In some cases, the insurer may offer a settlement, which is a one-time payment to resolve the claim.

- Claim Denial: Claims can be denied for various reasons, including lack of coverage for the specific incident, late reporting, or fraudulent claims. If your claim is denied, the insurer will provide a detailed explanation of the reasons for the denial.

The Claims Payout: Receiving Compensation

In the event of a successful claim, the insurer will proceed with the payout process. This involves calculating the exact amount of compensation based on the policy terms and the assessed loss. The insurer will then issue a payment, which can be done through various methods such as checks, direct deposits, or specialized payment platforms.

It's important to note that the claims payout process can vary based on the type of insurance and the complexity of the claim. In some cases, especially for larger claims, the payout process may take longer due to the need for additional documentation or legal proceedings.

Real-World Scenarios: Case Studies

A Homeowner's Insurance Claim

Imagine a scenario where a homeowner's property sustains damage due to a severe storm. The homeowner promptly files a claim with their insurance company, providing details of the incident and any available evidence. The insurer's claims adjuster visits the property to assess the damage and determine the extent of the loss.

After a thorough evaluation, the adjuster concludes that the damage is covered by the homeowner's policy and calculates the compensation amount. The insurer then issues a check to the homeowner, covering the cost of repairs and any additional living expenses incurred due to the damage.

A Car Accident Claim

In another scenario, a driver is involved in a car accident. They report the incident to their insurer and provide a police report detailing the accident. The insurer's claims adjuster reviews the report and assesses the liability of the drivers involved. If the insured driver is found to be at fault, the insurer may cover the cost of repairs to the other vehicle, as well as any medical expenses incurred by the other driver.

Expert Insights and Industry Trends

In recent years, the insurance industry has undergone significant technological advancements, leading to more efficient claims processes. Many insurers now utilize digital platforms and mobile apps to streamline the claims process, allowing policyholders to file claims, upload documents, and track the progress of their claims in real-time.

Additionally, the use of advanced analytics and machine learning has enhanced the accuracy and speed of claims assessments. These technologies enable insurers to quickly analyze large volumes of data, improving the overall efficiency of the claims process.

Future Implications and Industry Evolution

Looking ahead, the insurance industry is poised for further transformation. The integration of emerging technologies like blockchain and artificial intelligence is expected to revolutionize the claims process, offering even more efficient and secure solutions. These advancements will likely lead to faster claim settlements, enhanced fraud detection, and improved customer experiences.

Moreover, the increasing focus on sustainability and environmental concerns is driving a shift towards more sustainable insurance practices. This includes the development of green insurance policies that offer coverage for sustainable practices and technologies, as well as initiatives to reduce the environmental impact of insurance operations.

As the insurance industry continues to evolve, it's crucial for insurers to adapt to these changes and stay ahead of the curve. By embracing technological advancements and sustainability initiatives, insurers can enhance their services, improve customer satisfaction, and remain competitive in a rapidly changing market.

Conclusion

Understanding the intricate process of insurance claims is crucial for policyholders, ensuring they can navigate the claims journey effectively. By familiarizing yourself with the steps involved, from filing a claim to receiving compensation, you can better prepare for any unforeseen circumstances and make informed decisions throughout the process.

Remember, while the insurance claims process can be complex, it's designed to provide financial protection and support when you need it most. With the right knowledge and preparation, you can ensure a smoother and more successful claims experience.

How long does the insurance claims process typically take?

+

The duration of the claims process can vary significantly based on the type of insurance, the complexity of the claim, and the insurer’s workload. Simple claims may be resolved within a few days to a week, while more complex claims can take several weeks or even months. It’s important to stay in touch with your insurer and provide any necessary documentation promptly to expedite the process.

What happens if my claim is denied?

+

If your claim is denied, you’ll receive a detailed explanation from the insurer outlining the reasons for the denial. In such cases, it’s crucial to review the policy terms and conditions carefully to understand the grounds for the denial. If you believe the denial is unjustified, you may have the right to appeal the decision or seek legal advice.

Can I negotiate the amount of my insurance claim payout?

+

In some cases, it may be possible to negotiate the amount of your insurance claim payout, especially if there are disagreements over the assessed value of the loss or the extent of coverage. However, it’s important to approach such negotiations with a clear understanding of your policy terms and the evidence supporting your claim. It’s also advisable to seek professional advice before engaging in any negotiations.