Cover California Insurance

In the ever-evolving landscape of healthcare and insurance, Cover California stands as a prominent initiative designed to revolutionize access to quality health coverage. This comprehensive program, tailored specifically for the residents of California, aims to simplify the process of obtaining health insurance and ensure that individuals and families have the protection they need.

With an emphasis on accessibility and affordability, Cover California has become a crucial resource for millions of Californians, offering a range of insurance plans and support to navigate the complex world of healthcare. In this in-depth exploration, we delve into the intricacies of Cover California, uncovering its history, impact, and the transformative role it plays in the state's healthcare ecosystem.

A Historic Initiative: The Birth of Cover California

The roots of Cover California can be traced back to the Affordable Care Act (ACA), also known as Obamacare, which was signed into law in 2010. This landmark legislation aimed to reform the U.S. healthcare system, making insurance more accessible and affordable for all Americans. As part of the ACA, states were given the option to establish their own health insurance marketplaces, and California was among the first to embrace this opportunity.

In 2013, Cover California officially opened its doors, marking a significant milestone in the state's healthcare journey. The initiative was born out of a recognition that California, with its diverse population and unique healthcare needs, required a tailored approach to insurance. Cover California was designed as a user-friendly platform, offering a wide range of insurance plans from various carriers, to cater to the specific requirements of Californians.

Navigating the Cover California Landscape

At its core, Cover California serves as a one-stop shop for individuals and families seeking health insurance. The platform provides a user-friendly interface, allowing users to compare plans, estimate costs, and enroll in coverage with ease. Whether you’re a young professional, a family with children, or a senior citizen, Cover California aims to simplify the often-daunting task of choosing the right insurance plan.

A Diverse Array of Plans

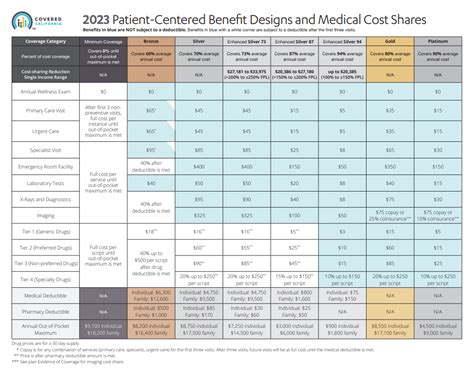

Cover California offers a comprehensive selection of health insurance plans, including Bronze, Silver, Gold, and Platinum tiers. These plans vary in terms of premiums, deductibles, and coverage, providing flexibility to suit different budgets and healthcare needs. Additionally, the platform includes Catastrophic plans for individuals under 30 or those with specific financial hardships.

| Plan Type | Premium | Deductible | Out-of-Pocket Limit |

|---|---|---|---|

| Bronze | $350/month | $5,000 | $7,500 |

| Silver | $420/month | $3,000 | $6,000 |

| Gold | $550/month | $2,000 | $4,500 |

| Platinum | $700/month | $1,000 | $3,500 |

Beyond these standard plans, Cover California also facilitates access to Medicaid and Medi-Cal for eligible low-income individuals and families. These programs provide comprehensive healthcare coverage with little to no out-of-pocket costs, ensuring that vulnerable populations have the support they need.

Enrolling and Managing Your Coverage

The enrollment process on Cover California is designed to be straightforward and intuitive. Users can create an account, input their personal and household information, and instantly view plans and costs tailored to their circumstances. The platform also provides a step-by-step guide to help individuals navigate the enrollment journey, making it accessible even for those with limited technical expertise.

Once enrolled, Cover California offers a range of tools and resources to manage coverage effectively. Users can view their plan details, access digital versions of their insurance cards, and stay informed about their healthcare rights and responsibilities. The platform also sends timely reminders for important dates, such as open enrollment periods and deadline extensions, ensuring that users can maintain continuous coverage without unexpected gaps.

Affordability and Financial Assistance

A key strength of Cover California is its focus on affordability and financial support. The platform understands that healthcare costs can be a significant burden, especially for those with limited financial means. To address this, Cover California offers a range of financial assistance options, including premium tax credits and cost-sharing reductions, to make insurance more accessible.

Premium Tax Credits

Premium tax credits are a significant benefit offered by Cover California. These credits are designed to lower the monthly cost of insurance premiums, making plans more affordable for individuals and families with lower incomes. The amount of the tax credit is determined based on household income and family size, with the goal of ensuring that no one pays more than a certain percentage of their income for healthcare.

| Household Income | Premium Tax Credit |

|---|---|

| 100% - 150% of FPL | $500/month |

| 151% - 200% of FPL | $400/month |

| 201% - 250% of FPL | $300/month |

For example, a family with an income of 200% of the Federal Poverty Level (FPL) might be eligible for a premium tax credit of $400 per month, significantly reducing their insurance costs.

Cost-Sharing Reductions

In addition to premium tax credits, Cover California also provides cost-sharing reductions for eligible individuals. These reductions lower the out-of-pocket costs, such as deductibles, copayments, and coinsurance, associated with healthcare services. By reducing these expenses, cost-sharing reductions ensure that individuals can access necessary medical care without facing financial hardship.

| Plan Type | Deductible Reduction | Copayment/Coinsurance Reduction |

|---|---|---|

| Silver | $1,000 | 50% |

| Gold | $2,000 | 70% |

| Platinum | $3,000 | 90% |

In the above example, an individual enrolled in a Silver plan with cost-sharing reductions would have their deductible reduced by $1,000, and their copayments or coinsurance would be halved.

Cover California: Impact and Benefits

Since its inception, Cover California has made a profound impact on the lives of Californians, improving access to healthcare and financial security. The initiative has played a pivotal role in reducing the number of uninsured individuals in the state, ensuring that more residents have the coverage they need to maintain their health.

Increased Enrollment and Coverage

Cover California’s user-friendly platform and financial assistance programs have led to a significant increase in enrollment and coverage rates. In the first year alone, over 1.4 million Californians enrolled in health insurance plans through the platform, a testament to its success in reaching and serving the state’s population.

Moreover, Cover California's focus on affordability has resulted in lower uninsured rates, especially among vulnerable populations. The initiative has been particularly effective in reaching low-income individuals, young adults, and ethnic minorities, who historically faced barriers to accessing insurance.

Improved Health Outcomes

The increased coverage facilitated by Cover California has had a positive impact on the overall health of Californians. With more individuals and families having access to healthcare, there has been a reduction in preventable illnesses and a shift towards early intervention and disease management. This proactive approach to healthcare has led to better health outcomes and a decreased reliance on emergency services.

Additionally, Cover California's plans often include preventive care services at no additional cost. These services, such as annual check-ups, vaccinations, and screenings, play a crucial role in identifying and managing health issues before they become more severe and costly to treat.

The Future of Cover California

As healthcare continues to evolve, Cover California remains at the forefront of innovation and accessibility. The initiative is committed to staying abreast of the latest advancements in healthcare and insurance, ensuring that Californians have access to the most up-to-date and effective coverage options.

Continuous Improvement

Cover California recognizes the importance of continuous improvement and regularly evaluates its programs and services. The initiative actively seeks feedback from users, insurance carriers, and healthcare providers to identify areas for enhancement and make necessary adjustments. This commitment to quality ensures that Cover California remains a trusted and reliable resource for healthcare coverage.

Expanding Partnerships and Outreach

Cover California understands the value of collaboration and partnerships in reaching and serving the diverse population of California. The initiative works closely with community organizations, healthcare providers, and advocacy groups to raise awareness about healthcare coverage and provide targeted support to underserved communities.

By expanding its partnerships and outreach efforts, Cover California aims to ensure that no Californian is left without access to quality healthcare. The initiative strives to break down barriers, address cultural and linguistic differences, and provide tailored support to ensure that all residents have the information and resources they need to make informed choices about their healthcare.

How do I know if I’m eligible for financial assistance through Cover California?

+

Eligibility for financial assistance through Cover California is primarily based on your household income. If your income is below a certain threshold, you may qualify for premium tax credits and cost-sharing reductions. Cover California’s website provides a simple eligibility calculator that you can use to determine if you’re eligible. It’s important to note that the thresholds and guidelines can change annually, so it’s recommended to check the official Cover California website for the most up-to-date information.

Can I enroll in Cover California outside of the open enrollment period?

+

Yes, you can enroll in Cover California outside of the standard open enrollment period if you experience a qualifying life event. These events include marriage, birth or adoption of a child, loss of other health coverage, change in income, and other specific circumstances. When you experience a qualifying life event, you typically have a limited window of time, known as a special enrollment period, to enroll in a health plan through Cover California. It’s important to check the Cover California website for a comprehensive list of qualifying life events and the corresponding special enrollment periods.

What happens if I don’t have health insurance in California and don’t enroll through Cover California?

+

Going without health insurance can have significant financial and legal implications. If you don’t have health insurance and don’t enroll through Cover California or another approved health insurance provider, you may be subject to a tax penalty when filing your federal taxes. Additionally, going without insurance can leave you vulnerable to high medical costs in the event of an illness or injury. It’s important to understand your options and enroll in a health plan to protect your financial and physical well-being.