Landlord Insurance Quotes

Landlord insurance is an essential aspect of property management, providing protection and peace of mind for rental property owners. In today's dynamic real estate market, understanding the various coverage options and obtaining accurate quotes is crucial for informed decision-making. This comprehensive guide aims to delve into the intricacies of landlord insurance, exploring its significance, coverage types, and the process of securing tailored quotes.

The Significance of Landlord Insurance

Landlord insurance serves as a financial safety net, safeguarding property owners from a myriad of risks and liabilities associated with rental properties. It offers protection against unforeseen events such as property damage, tenant-related issues, and legal liabilities. With the right coverage, landlords can mitigate potential financial losses and ensure the smooth operation of their rental businesses.

In a dynamic real estate landscape, where market fluctuations and unexpected events can impact investment properties, having adequate insurance coverage is paramount. Landlord insurance not only protects the physical structure of the property but also covers aspects such as loss of rental income, legal expenses, and even liability claims arising from tenant injuries or property damage.

Understanding Landlord Insurance Coverage

Landlord insurance policies are designed to cater to the unique needs of rental property owners. Here’s an overview of the key coverage types available:

Property Damage and Liability Coverage

This foundational coverage protects the physical structure of the rental property, including buildings, fixtures, and personal property owned by the landlord. It provides financial relief in the event of damage caused by natural disasters, fires, vandalism, or accidental tenant damage. Additionally, liability coverage safeguards landlords from legal claims arising from tenant injuries or property damage.

For instance, imagine a scenario where a severe storm causes significant roof damage to your rental property. With property damage coverage, you can receive the necessary funds to repair or replace the damaged roof, ensuring the property remains habitable for tenants. Simultaneously, liability coverage steps in to protect you from potential lawsuits if, for example, a tenant slips and falls due to a hazardous condition caused by the storm.

Loss of Rental Income

This coverage is especially crucial for landlords who rely on rental income as a primary source of revenue. It provides compensation for lost rental income in the event the property becomes uninhabitable due to covered perils, such as fire or natural disasters. This ensures landlords can continue to receive income while the property is being repaired or restored.

Consider a case where a fire breaks out in your rental unit, rendering it uninhabitable. With loss of rental income coverage, you can receive compensation for the period during which the property is being repaired, helping you maintain financial stability and continue meeting your obligations, such as mortgage payments and other expenses.

Vacancy and Malicious Damage Coverage

Vacancy coverage protects landlords from financial losses during periods when the rental property is vacant and not generating income. Malicious damage coverage, on the other hand, provides protection against intentional damage caused by tenants or intruders. These coverage types are particularly beneficial for landlords managing properties in high-risk areas or those experiencing frequent tenant turnover.

Suppose you own a rental property in an area prone to vandalism or frequent tenant disputes. Vacancy coverage can provide financial support during periods when the property remains vacant, ensuring you don't incur additional financial burdens. Additionally, malicious damage coverage steps in to cover the costs of repairing or replacing property damaged by tenants or intruders, helping you maintain the integrity of your investment.

Additional Coverages

Landlord insurance policies often offer a range of additional coverages to tailor protection to specific needs. These may include coverage for rental equipment, increased rent due to inflation, or even coverage for tenant screening expenses. Customizing your policy with these additional coverages ensures a comprehensive safety net for your rental business.

Obtaining Accurate Landlord Insurance Quotes

Securing precise landlord insurance quotes is a critical step in selecting the right coverage for your rental properties. Here’s a step-by-step guide to help you navigate the process:

Assess Your Needs

Begin by evaluating the unique risks associated with your rental properties. Consider factors such as the location, type of property, and any specific vulnerabilities it may have. Understanding these risks will help you identify the coverage types that align with your needs.

Research Insurers

Research and compare multiple insurance providers specializing in landlord insurance. Look for reputable companies with a strong track record in the industry. Consider factors such as financial stability, customer satisfaction, and the range of coverage options they offer.

Gather Information

Prepare the necessary information to provide an accurate quote. This typically includes details about the property, such as its location, age, size, and construction materials. Additionally, have information about your rental business, including the number of units, occupancy rates, and any recent claims or incidents.

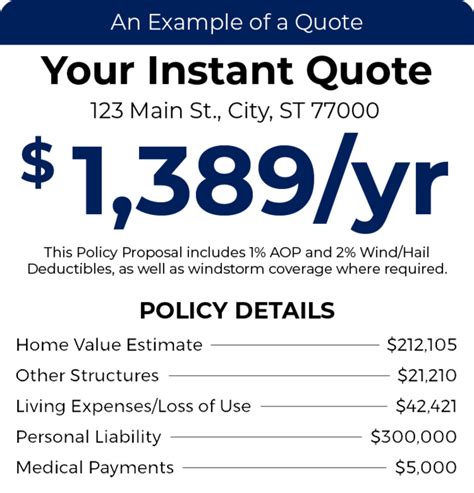

Request Quotes

Contact the selected insurers and request quotes. Provide them with the gathered information to obtain tailored quotes based on your specific needs. Compare the quotes, considering factors such as coverage limits, deductibles, and any additional benefits or exclusions.

Review and Customize

Thoroughly review the quotes received, paying close attention to the coverage details and any potential gaps. Work with the insurance providers to customize the policies to align with your specific requirements. Ensure you understand the terms and conditions, including any exclusions or limitations.

Select the Right Policy

Based on your assessment and research, select the landlord insurance policy that best meets your needs and provides the most comprehensive coverage. Consider factors such as the insurer’s reputation, financial stability, and customer service to ensure a reliable partnership.

The Benefits of Tailored Landlord Insurance

Opting for a tailored landlord insurance policy offers several advantages:

- Customized Protection: A tailored policy ensures your rental properties are adequately protected based on their unique characteristics and risks.

- Cost Efficiency: By customizing your coverage, you can avoid paying for unnecessary add-ons, resulting in a more cost-effective insurance solution.

- Peace of Mind: With a tailored policy, you can rest assured knowing that your rental business is protected against a wide range of potential risks and liabilities.

- Flexibility: Tailored policies allow for adjustments as your rental business evolves, ensuring ongoing protection as your needs change.

Conclusion

Landlord insurance is an indispensable tool for property owners, offering financial protection and peace of mind. By understanding the various coverage options and taking the time to secure accurate quotes, landlords can make informed decisions to safeguard their rental properties and ensure the long-term success of their investment ventures.

What factors influence landlord insurance quotes?

+Several factors influence landlord insurance quotes, including the location and type of property, its age and construction materials, the number of units, occupancy rates, and the insurer’s assessment of risk. Additionally, any prior claims or incidents can impact the quote.

Can I customize my landlord insurance policy to exclude certain coverages I don’t need?

+Absolutely! Landlord insurance policies can be tailored to your specific needs. You can choose to exclude coverages that are not relevant to your situation, helping you save on premiums and create a more cost-effective policy.

How often should I review and update my landlord insurance policy?

+It’s recommended to review your landlord insurance policy annually or whenever significant changes occur in your rental business. This ensures that your coverage remains up-to-date and aligned with your evolving needs.