Insurance For Llc Companies

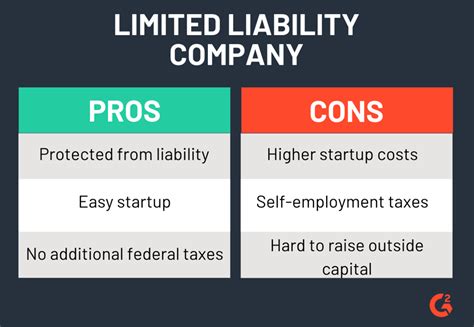

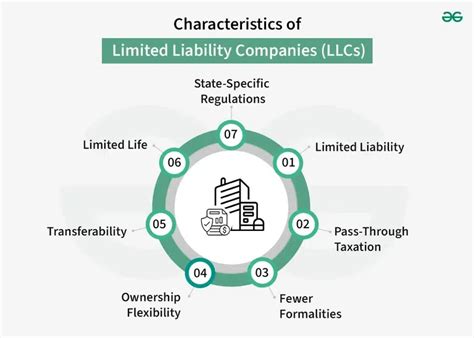

Insurance is a crucial aspect for any business, and Limited Liability Companies (LLCs) are no exception. As an LLC owner, you understand the importance of protecting your business assets and managing potential risks. This comprehensive guide will delve into the world of insurance for LLCs, providing expert insights and strategies to ensure your business is adequately covered.

Understanding the Insurance Landscape for LLCs

The insurance landscape for LLCs can be complex, with various coverage options tailored to meet specific business needs. It’s essential to grasp the fundamentals of insurance to make informed decisions and protect your business effectively.

One of the key considerations for LLCs is liability insurance. This type of coverage safeguards your business against potential lawsuits and claims arising from accidents, injuries, or property damage. It provides a vital layer of protection, ensuring that your personal assets remain separate from business liabilities.

Key Types of Insurance for LLCs

When it comes to insuring your LLC, there are several critical types of coverage to consider:

- General Liability Insurance: This broad coverage protects your LLC against third-party claims, including bodily injury, property damage, and advertising-related injuries. It’s an essential policy for any business that interacts with the public or has employees.

- Professional Liability Insurance (also known as Errors and Omissions Insurance): If your LLC provides professional services or advice, this insurance is crucial. It covers claims arising from mistakes, errors, or negligence in your work, protecting your business from potential financial losses.

- Commercial Property Insurance: This policy safeguards your business property, including buildings, equipment, and inventory, from damage or loss due to events like fire, theft, or natural disasters. It’s particularly important if you own or lease commercial space.

- Business Interruption Insurance: In the event of a covered loss that disrupts your business operations, this insurance provides coverage for lost income and ongoing expenses. It ensures your LLC can continue to pay bills and maintain its financial stability during a temporary shutdown.

- Workers’ Compensation Insurance: If your LLC has employees, this insurance is mandatory in most states. It covers medical expenses and lost wages for employees injured on the job, protecting your business from potential lawsuits and ensuring compliance with labor laws.

Customizing Insurance Coverage for Your LLC

Every LLC is unique, and your insurance needs may vary depending on the nature of your business, industry, and risk factors. Here’s how you can tailor your insurance coverage to fit your specific requirements:

Assessing Your Risks

Start by conducting a thorough risk assessment of your LLC. Identify potential hazards, such as accidents, cyber threats, or industry-specific risks. By understanding your vulnerabilities, you can determine the appropriate insurance coverage needed to mitigate these risks effectively.

Working with Insurance Brokers

Consider engaging the services of an insurance broker who specializes in business insurance. These professionals can provide expert guidance, help you navigate the complex insurance landscape, and find the best coverage options tailored to your LLC’s needs. They can also assist in negotiating policies and ensuring you receive the most competitive rates.

Bundling Insurance Policies

Bundling multiple insurance policies under one carrier can often result in cost savings and streamlined administration. Many insurance companies offer package deals or business owner’s policies (BOPs) that combine essential coverages, such as general liability, commercial property, and business interruption insurance. Discuss bundling options with your insurance provider to explore potential discounts and simplify your insurance portfolio.

Industry-Specific Coverage

Some industries have unique risks and insurance requirements. For example, if you operate in the healthcare or technology sectors, you may need specialized insurance coverage to address industry-specific risks. Consult with industry experts and insurance professionals to ensure you’re adequately covered for the unique challenges of your industry.

Maximizing Insurance Benefits for Your LLC

Beyond the basic coverage, there are strategies you can employ to maximize the benefits of insurance for your LLC:

Loss Prevention and Risk Management

Implementing robust loss prevention and risk management practices can reduce the likelihood of claims and lower your insurance premiums. This may include employee training on safety protocols, implementing cybersecurity measures, or adopting industry-specific best practices to minimize risks.

Policy Review and Updates

Regularly review your insurance policies to ensure they align with your business’s current needs and growth. As your LLC expands or changes its operations, your insurance coverage should adapt accordingly. Stay updated on industry trends and emerging risks to make informed decisions about your coverage.

Utilizing Insurance Claims

When faced with a covered loss, it’s crucial to understand the claims process and maximize the benefits of your insurance coverage. Document the incident thoroughly, report it promptly to your insurance provider, and work closely with your insurer to navigate the claims process efficiently. By doing so, you can ensure your business receives the compensation it needs to recover and continue operations.

The Future of Insurance for LLCs

The insurance industry is evolving, and new trends are shaping the landscape for LLCs. Here’s a glimpse into the future of insurance and how it may impact your business:

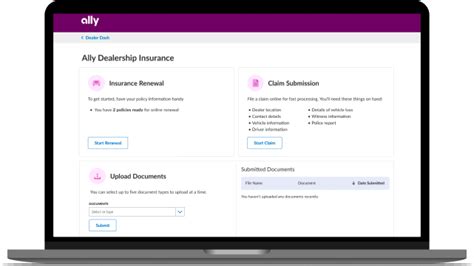

Digital Transformation

The insurance industry is embracing digital technologies, from online policy management and claims processing to the use of artificial intelligence and data analytics. These advancements offer LLCs more efficient and personalized insurance experiences, allowing for better risk assessment and coverage customization.

Insurtech Innovations

Insurtech startups are disrupting the traditional insurance model, offering innovative solutions and new coverage options. These companies leverage technology to provide more affordable and flexible insurance products, often tailored to the unique needs of small businesses like LLCs. Keep an eye on these developments to stay ahead of the curve.

Risk-Sharing Models

Alternative risk transfer mechanisms, such as captive insurance and risk retention groups, are gaining popularity among LLCs. These models allow businesses to share risks collectively, potentially reducing insurance costs and providing more control over coverage. Exploring these options can be a strategic move for LLCs looking to optimize their insurance strategies.

| Insurance Type | Description |

|---|---|

| General Liability Insurance | Broad coverage for third-party claims, including bodily injury and property damage. |

| Professional Liability Insurance | Protects against claims arising from professional services or advice. |

| Commercial Property Insurance | Safeguards business property from damage or loss due to various events. |

| Business Interruption Insurance | Covers lost income and expenses during a temporary business shutdown. |

| Workers' Compensation Insurance | Mandatory coverage for employee injuries, ensuring compliance and financial protection. |

What is the difference between general liability insurance and professional liability insurance for LLCs?

+General liability insurance provides broad coverage for third-party claims, including bodily injury and property damage, which is essential for any business interacting with the public. On the other hand, professional liability insurance (or Errors and Omissions insurance) is specific to businesses that provide professional services or advice. It covers claims arising from mistakes or negligence in your work, protecting your LLC from potential financial losses due to professional errors.

Is workers’ compensation insurance mandatory for LLCs with employees?

+Yes, workers’ compensation insurance is typically mandatory for LLCs with employees. It’s a legal requirement in most states to provide coverage for employee injuries sustained on the job. This insurance protects your business from potential lawsuits and ensures compliance with labor laws. Failure to carry workers’ compensation insurance can result in significant fines and penalties.

How can LLCs save money on insurance premiums?

+LLCs can save on insurance premiums by implementing loss prevention measures, such as employee safety training and cybersecurity protocols. Additionally, bundling multiple insurance policies under one carrier can often result in cost savings. Engaging with insurance brokers who specialize in business insurance can also help negotiate competitive rates and explore potential discounts.