Auto Insurance For 3 Month

Finding affordable auto insurance for a three-month period can be a challenging task, especially if you're looking for comprehensive coverage. However, with the right knowledge and strategies, it is possible to secure adequate insurance for a short-term period. This comprehensive guide will delve into the world of short-term auto insurance, offering expert insights and practical tips to help you navigate this unique insurance scenario.

Understanding Short-Term Auto Insurance

Short-term auto insurance, often referred to as temporary car insurance, is a flexible insurance option designed for those who need coverage for a limited period, typically ranging from one day to six months. It is an ideal solution for various situations, such as borrowing a friend’s car for a road trip, renting a vehicle for a short duration, or even covering a gap between insurance policies.

One of the key advantages of short-term auto insurance is its flexibility. You can tailor the coverage to your specific needs, choosing the duration and the level of protection required. This makes it an attractive option for those who don't want to commit to a long-term policy or for situations where standard insurance might not apply.

Coverage Options for Three Months

When seeking auto insurance for a three-month period, it’s essential to understand the different coverage options available. Most insurers offer a range of policies, including liability-only coverage, comprehensive plans, and customized packages. Here’s a breakdown of these options:

- Liability-Only Coverage: This is the most basic form of auto insurance, providing protection against bodily injury and property damage claims made against you. It is suitable for those on a tight budget or for vehicles that are not regularly used.

- Comprehensive Coverage: A more extensive option, comprehensive coverage includes liability protection, as well as coverage for theft, fire, vandalism, and other non-collision-related incidents. It is ideal for those who want comprehensive protection for their vehicles.

- Customized Packages: Many insurers offer tailored packages that allow you to choose specific coverage elements, such as medical payments, uninsured/underinsured motorist coverage, or rental car reimbursement. This flexibility lets you create a plan that suits your unique needs.

It's crucial to carefully review the policy details to ensure you understand the coverage limits, deductibles, and any exclusions that may apply. Short-term policies often come with specific restrictions, so it's essential to read the fine print to avoid any surprises.

Factors Affecting Short-Term Auto Insurance Rates

The cost of short-term auto insurance can vary significantly depending on several factors. Understanding these factors can help you make informed decisions and potentially save money on your insurance premium.

Vehicle Type and Usage

The type of vehicle you’re insuring and how you use it can have a significant impact on your insurance rates. High-performance cars, luxury vehicles, and sports cars are typically more expensive to insure due to their higher repair costs and increased risk of theft. Additionally, if you’re using the vehicle for business purposes or as part of a rideshare service, your rates may be higher.

Driver Profile and History

Your driving record and personal profile are key considerations for insurers. Factors such as your age, gender, driving experience, and claims history can influence your premium. Younger drivers and those with a history of accidents or traffic violations may face higher rates. It’s also worth noting that some insurers offer discounts for certain professions or for completing defensive driving courses.

Coverage Duration and Level

The duration of your coverage and the level of protection you choose will directly affect your insurance cost. Longer coverage periods and more comprehensive plans generally result in higher premiums. However, it’s important to strike a balance between cost and adequate coverage to ensure you’re not underinsured.

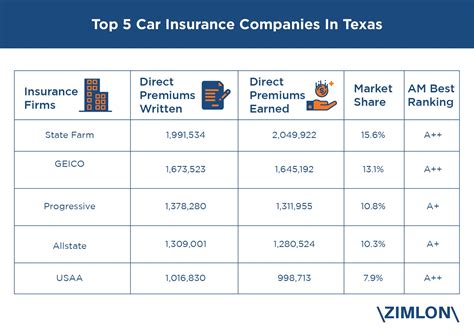

| Coverage Level | Description | Estimated Premium (Monthly) |

|---|---|---|

| Liability-Only | Basic coverage for bodily injury and property damage | $100 - $150 |

| Comprehensive | Includes liability and coverage for theft, fire, etc. | $150 - $250 |

| Customized Package | Tailored coverage with specific add-ons | $200 - $350 |

Note: These premium estimates are for illustrative purposes only and may vary based on individual circumstances and insurer rates.

Tips for Securing Affordable Short-Term Auto Insurance

Finding affordable short-term auto insurance requires a strategic approach. Here are some expert tips to help you get the best coverage at the most competitive rates:

- Compare Multiple Quotes: Obtain quotes from several insurers to compare rates and coverage options. Online comparison tools can be a great way to quickly assess different offers.

- Consider Package Deals: Some insurers offer package deals that combine short-term auto insurance with other forms of insurance, such as home or rental insurance. These bundles can provide cost savings.

- Choose a Higher Deductible: Opting for a higher deductible can reduce your premium, but it's important to ensure you can afford the deductible in the event of a claim.

- Review Coverage Needs: Assess your specific coverage requirements. If you're only using the vehicle occasionally, you may not need comprehensive coverage, which can save you money.

- Check for Discounts: Many insurers offer discounts for various reasons, such as good driving records, loyalty, or safety features in your vehicle. Ask about available discounts to potentially lower your premium.

- Shop Around Regularly: Auto insurance rates can vary significantly between insurers, and they may change over time. Regularly shopping around for quotes can help you stay up-to-date with the most competitive rates.

The Future of Short-Term Auto Insurance

The short-term auto insurance market is evolving, driven by changing consumer needs and technological advancements. Here are some trends and future implications to consider:

Digitalization and Convenience

The rise of digital insurance platforms and apps has made it easier and faster to purchase short-term auto insurance. Insurers are investing in technology to streamline the purchasing process, offering instant quotes and seamless online or mobile applications. This trend is expected to continue, making short-term insurance even more accessible and convenient.

Flexible Payment Options

Insurers are recognizing the demand for flexible payment plans, especially for short-term policies. Some companies now offer monthly or even weekly payment options, providing greater affordability and flexibility for consumers. This trend is likely to expand, catering to a wider range of financial situations.

Personalized Coverage

With the advancement of data analytics, insurers are able to offer more personalized coverage options. By analyzing driving behavior and risk profiles, insurers can tailor policies to individual needs, potentially reducing costs for lower-risk drivers. This trend could make short-term insurance more affordable and attractive for a broader range of consumers.

Collaborative Insurance Models

The insurance industry is exploring collaborative models, such as peer-to-peer insurance and community-based insurance, which could disrupt traditional insurance models. These models leverage technology and shared risk to offer more affordable coverage options. While still in their infancy, these innovative approaches have the potential to transform the short-term insurance landscape.

Regulatory Changes

Regulatory bodies are continually reviewing and updating insurance guidelines. Changes in regulations can impact the availability and cost of short-term auto insurance. It’s important to stay informed about any updates that may affect your insurance options and costs.

Conclusion

Securing auto insurance for a three-month period is a viable option for those with temporary insurance needs. By understanding the coverage options, factors affecting rates, and implementing strategic tips, you can navigate the short-term insurance market with confidence. As the industry continues to evolve, staying informed about the latest trends and innovations will ensure you make informed decisions about your insurance coverage.

Can I get short-term auto insurance if I have a poor driving record?

+Yes, short-term auto insurance is available for drivers with a poor driving record. However, your premium is likely to be higher due to the increased risk. It’s important to shop around and compare quotes to find the most competitive rates.

What if I need to extend my short-term auto insurance beyond three months?

+If you find that you need to extend your short-term insurance beyond the initial period, most insurers offer the option to renew or convert your policy into a longer-term plan. Contact your insurer to discuss your options and ensure seamless coverage.

Are there any restrictions on the type of vehicles that can be insured for short-term periods?

+In general, most vehicles can be insured for short-term periods. However, some insurers may have restrictions or additional requirements for certain types of vehicles, such as classic cars or high-performance sports cars. Always check with your insurer to ensure your vehicle is eligible.